Breaking Down The Cost of MARPOL

Since January 8, 2009, United States (U.S.) and foreign flagged ships operating in the waters of the U.S. have been subject to MARPOL Annex VI. The Marine Environmental Protection Committee (MEPC) of the International Maritime Organization (IMO) adopted amendments to Annex VI and the nitrogen oxides (NOx) Technical Code, collectively referred to as Annex VI (Revised). Annex VI (Revised) entered into force on July 1, 2010. These amendments include significant and progressive limits for sulfur oxide (SOx) and NOx emissions from marine engines and for the first time addressed emissions of Particulate Matter (PM). The amendments replaced the SOx Emissions Control Areas (SECA) by introducing the concept of Emission Control Areas (ECA) for SOx, NOx, and PM.

On March 26, 2010, MEPC at its 60th session adopted amendments to MARPOL Annex VI to designate the new North American ECA and at its 62nd session, July 2011, to designate the U.S. Caribbean Sea ECA. The North American ECA entered into force on August 1, 2011 and took full effect on August 1, 2012; the U.S. Caribbean Sea ECA entered into force on January 1, 2013 and shall take full effect on January 1, 2014. The boundaries of the North American and the U.S. Caribbean Sea ECA are defined in Table 1.

Annex VI (revised) implements a three-tier structure for new engines.

• Tier I applied to a diesel engine that was installed on a ship constructed on or after January 1, 2000, and prior to January 1, 2011, and represents the 17 g/kWh standard, as stipulated in the existing Annex VI.

• For Tier II, NOx emission levels for a diesel engine installed on a ship constructed on or after January 1, 2011, would be reduced to 14.4 g/kWh.

• For Tier III, NOx emission levels for a diesel engine installed on a ship constructed on or after January 1, 2016, would be reduced to 3.4 g/kWh, when the ship is operating in a designated ECA. Outside a designated ECA, Tier II limits apply.

The Coast Guard has entered into a Memorandum of Understanding (MOU) with the Environmental Protection Agency (EPA) dated June 27, 2011, to set forth the terms by which the USCG and EPA will mutually cooperate in the implementation and enforcement of Annex VI to MARPOL as implemented by the Act to Prevent Pollution from Ships (APPS).

The EPA has conducted an analysis of the expected economic impacts of Annex VI (Revised) on the markets for marine diesel engines, ocean-going vessels, and the marine transportation service sector. The EPA examined the impacts of all components of the markets for marine diesel engines, ocean-going vessels, marine fuels and international marine transportation services. This included the cost of the Clean Air Act emission control program marine diesel engines for U.S. vessel owners and the costs of complying with the emission and fuel sulfur controls for all ships operating in the area proposed by the U.S. Government to be designated as an Emission Control Area (ECA) under MARPOL Annex VI. This analysis looked at two aspects of the economic impacts: estimated social costs and how they are shared across stakeholders, and estimated market impacts in terms of changes in prices and quantities produced for directly affected markets.

Annex VI (Revised) requires each party to take all reasonable steps to promote the availability of compliant fuel in its ports and terminals. For ships using low sulfur fuel oil, separate fuel supplies may be carried for use while operating worldwide and within the ECA’s. Table 1 below provides the fuel oil sulfur limits referred to in Annex VI (Revised).

With limited exceptions, including for certain public vessels, all vessels that operate in the North American ECA are required to be in compliance with the Annex VI (Revised) ECA fuel oil sulfur standard. Most vessels under 400 gross tonnage are likely already in compliance with the standard as the majority of these vessels operate using solely distillate fuel oil that meets the Annex VI (Revised) ECA fuel oil sulfur limit.

The total estimated costs in 2030 are approximately $3.1 billion. These costs are expected to accrue initially to the owners and operators of affected vessels when they purchase engines, vessels and fuel. These owners and operators are expected to pass their increased costs on to the entities that purchase international marine transportation services, in the form of higher freight rates. Ultimately, these costs will be borne by the final consumers of goods transported by affected vessels in the form of higher prices for those goods.

With regard to market-level impacts, the EPA estimates that compliance would increase the price of a new vessel by 0.5 to 2%, depending on the vessel type. The price impact on the marine transportation services sector would vary, depending on the route and the amount of time spent in waterways covered by the engine and fuel controls. For example, the EPA estimated that the cost of operating a ship in liner service between Singapore, Seattle, and Los Angeles/Long Beach, which includes about 1,700 NM of operation in waterways covered the EMC, would increase by about 3 percent. For a container ship, this represents a price increase of about $18 per container, assuming the total increase in operating costs is passed on to the purchaser of marine transportation services. The per passenger price of a seven-day Alaska cruise on a vessel operating entirely within waterways covered by the EMC is expected to increase about $7 per day. Ships that spend less time in covered areas would experience relatively smaller increases in their operating costs and the impact on freight prices is expected to be smaller.

This analysis of the economic impacts relies on the estimated engineering compliance costs for engines and fuels. These costs include hardware costs for new U.S. vessels, to comply with the Tier 2 and Tier 3 engine standards, and for existing U.S. vessels to comply with the MARPOL Annex VI requirements for existing engines. There are also hardware costs for fuel switching equipment on new and existing U.S. vessels to comply with the 1.0% fuel sulfur limit; the cost analysis assumes that 32% of all vessels require fuel-switching equipment to be added (new vessels) or retrofit (existing vessels). Also included are expected increases in operating costs for U.S. and foreign vessels operating in the U.S. ECA and U.S. internal waters. These increased operating costs include changes in fuel consumption rates and increases in fuel costs.

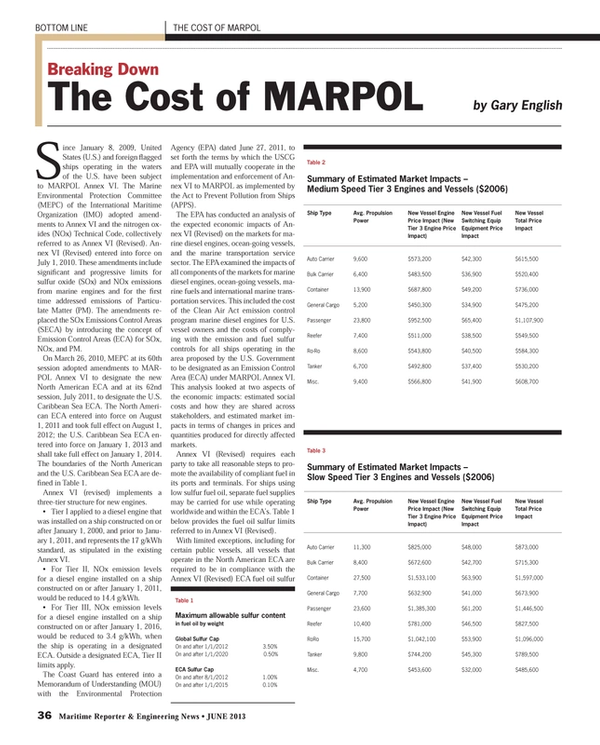

Estimated price impacts for a sample of engine-vessel combinations are set out in Table 2 (see previous page), for medium speed engines, and Table 3 (see previous page), for slow speed engines. These are the estimated price impacts associated with the Tier 3 engine standards on a vessel that will switch fuels to comply with the fuel sulfur requirements while operating in the waterways covered by EMC, for all years, beginning in 2016.

The estimated price impacts for Tier 2 vessels is substantially lower, given the technology that will be used to meet the Tier 2 standards is much less expensive. Because the standards do not phase in, the estimated price impacts are the same for all years the Tier 2 standards are required, 2011 through 2015.

The EPA maintains that these estimated price impacts for Tier 2 and Tier 3 vessels are relatively small when compared to the price of a new vessel. A selection of new vessel prices is provided in Table 4; these range from about $40-$480 million. The program price increases range from about $600,000 - $1.5 million. A price increase of $600,000 to comply with the Tier 3 standards and fuel switching requirements would be an increase of approximately 2% for a $40 million vessel. The largest vessel price increase is for a Tier 3 passenger vessel or about $1.5 million; this is a price increase of less than 1% for a $478 million passenger vessel. The EPA concludes that price increases of this magnitude would be expected to have little, if any, effect on the sales of new vessels, all other economic conditions held constant.

The market impacts for the fuel markets were estimated through the World Oil Refining Logistics and Demand (WORLD) model. The expected price impacts are set out in Table 5. Note that on a mass basis, less distillate than residual fuel is needed to go the same distance (5 % less). The prices in Table 5 are adjusted for this impact. Table 5 shows that the regulatory scheme is expected to result in an increase in the price of marine distillate fuel, about 1.3%. The price of residual fuel is expected to decrease slightly, by less than one percent, due to a reduction in demand for that fuel.

Because of the need to shift from residual fuel to distillate for ships while operating in the waterways covered by the engine and fuel controls (the U.S. ECA and U.S. internal waters), shipowners are expected to see an increase in their total cost of fuel. This increase is because distillate fuel is more expensive than residual fuel. Factoring in the higher energy content of distillate fuel relative to residual fuel, the fuel cost increase would be about 39%.

The EPA used the above estimates of engine, vessel and fuel price impacts to estimate the impacts on the prices of marine transportation services. This analysis is limited to the impacts of increases in operating costs due to the fuel and emission requirements. Operating costs would increase due to the increase in the price of fuel, the need to switch to fuel with a sulfur content not to exceed 1.0% while operating in the waterways covered by the engine and fuel controls and due to the need to dose the after treatment system to meet the Tier 3 standards. Table 6 summarizes these price impacts for selected transportation markets. Table 6 also lists the vessel and engine parameters that were used in the calculations.

The total social costs of the coordinated strategy are based on both fixed and variable costs. Fixed costs are a cost to society; they displace other product development activities that may improve the quality or performance of engines and vessels. In this economic impact analysis, fixed costs are accounted for in the year in which they occur, with the fixed costs associated with the Tier 2 engine standards accounted for in 2010 and the fixed costs associated with the Tier 3 engine standards and the fuel sulfur controls for vessels operating on the waterways covered by the coordinated strategy are accounted for in the five-year period beginning prior to their effective dates.

These estimated social costs for all years are presented in Table 7. For 2030, the costs are estimated to be about $3.1 billion. It is expected that consumers of the marine transportation services will pay for these costs. Additionally, consumers will pay prices for the goods transported by sea.

The EPA estimated annual monetized health benefits of Annex VI (Revised) in 2030 will be between $110 - $270 billion, assuming a 3% discount rate (or between $99 - $240 billion at 7% discount rate). EPA believes by 2030 emission reductions associated with the ECA will annually prevent: between 12,000 - 31,000 premature deaths, about 1,400,000 work days lost: and about 9,600,000 minor restricted-activity days. Furthermore, the EPA predicts the following important ecosystem benefits: NOx, SOx and direct PM reductions reduce deposition in many sensitive ecosystems, improve visibility – especially in Class I federal areas; and reduce ozone damage to many ecosystems throughout the U.S.

The bottom line is every consumer will be paying more for the goods used in everyday life and more in taxes for governmental regulatory enforcement in order reduce NOx, SOx, and PM in the atmosphere. Finally, under the law of unintended consequences, will this cause a consolidation in the industry? The larger carriers could absorb some of these additional costs, potentially squeeze out smaller carriers and then purchases these assets and make up profits on the back end. We are seeing a similar scenario playing out in the airline industry.

Gary English is President of Marine Forensic & Investigation Group, LLC. Mr. English focuses on Marine Accident Investigation, Forensic Analysis, Risk Assessment & Management, Regulatory Compliance, Expert Testimony, Consulting and Mediation Services. Mr. English graduated from the United States Naval Academy with a Bachelor of Science in Applied Science, the Naval Postgraduate School with a Master of Science degree in Applied Science and the Charleston School of Law—Cum Laude.

(As published in the June 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

Read Breaking Down The Cost of MARPOL in Pdf, Flash or Html5 edition of June 2013 Maritime Reporter

Other stories from June 2013 issue

Content

- “Lies, Damned Lies & Statistics” page: 6

- Maersk Rate Hikes Hitting the High Notes page: 8

- Does Svitzer Dominate the Indian Salvage Scene? page: 8

- What You Need to Know to Operate Offshore Brazil page: 10

- Why TWIC? page: 14

- Cargo Morphs in New Directions page: 16

- Annual Economic Sanctions Update page: 18

- Infrastructure for Alaska’s LNG and Other Resources page: 22

- Non-Tankers Next on OPA 90 List page: 26

- Sail Safe BC Ferries’ Safety Initiative page: 30

- Simulation Trends of Tomorrow page: 32

- Economic Impacts of STCW 2010 page: 34

- Breaking Down The Cost of MARPOL page: 36

- The Year in Review page: 40

- Dr. Shashi Kumar page: 44

- Boxed In page: 46

- Contamination Controlled page: 48

- If in Doubt, Ask the Doctor: Is it Time to Buy? page: 52

- Finnish Shipbuilding and Arctic Operations page: 54

- Irving Plans for the Future page: 55

- German Shipbuilding Prospects are Fair & Partly Cloudy page: 58

- Hull Medic: Keep Coats Efficient page: 72

- Diesel-Electric Units Prepared for Navy’s AGOR Project page: 73

- Integrated Bridge Shaping the Future page: 74