Page 38: of Maritime Reporter Magazine (September 2014)

Marine Propulsion Edition

Read this page in Pdf, Flash or Html5 edition of September 2014 Maritime Reporter Magazine

38 Maritime Reporter & Engineering News • SEPTEMBER 2014

T oday there are 324 oil/gas fl oating production units are now in service, on order or available for reuse on another fi eld. FPSOs account for 64% of the existing systems, 79% of systems on or- der. Production semis, barges, spars and

TLPs comprise the balance.

The oil/gas production fl oater inven- tory has increased by four units since last month. Three FPSOs were ordered in August. We also reinstated a partially completed production semi, Octobuoy, which we earlier deleted from the list of orders when the contract was terminated.

This unit was being built for use by ATP in the North Sea. The builder, Cosco

Nantong, took ownership of the partially fi nished semi after ATP defaulted. Cos- co is now marketing the unit for comple- tion as a production facility.

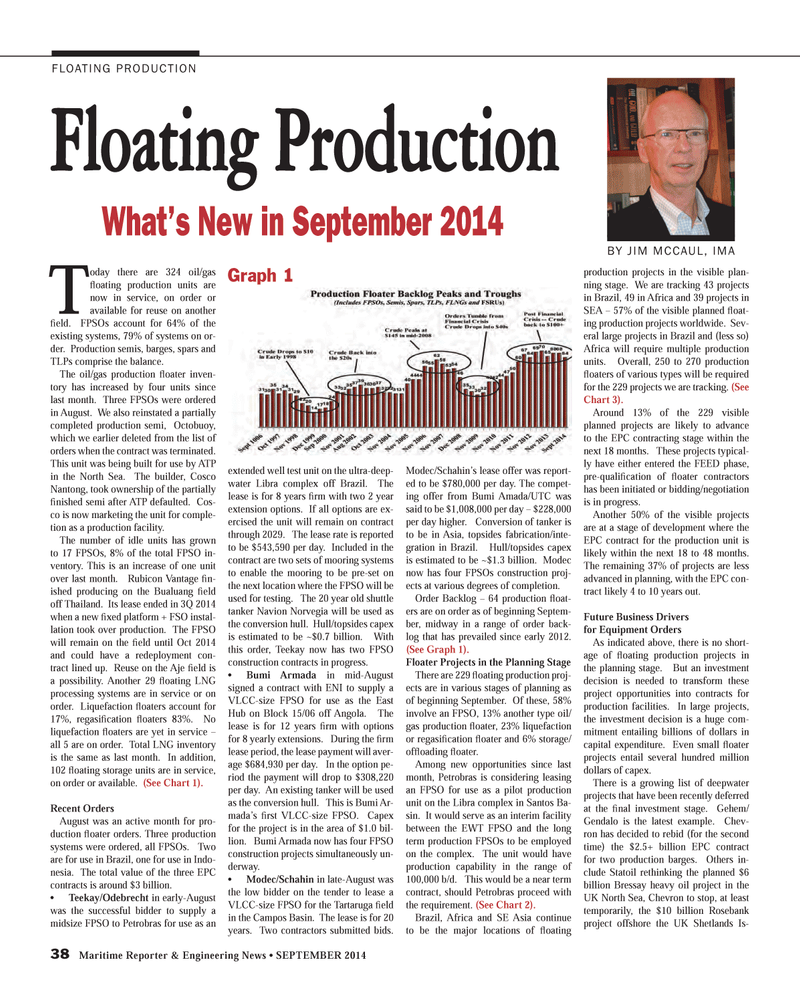

The number of idle units has grown to 17 FPSOs, 8% of the total FPSO in- ventory. This is an increase of one unit over last month. Rubicon Vantage fi n- ished producing on the Bualuang fi eld off Thailand. Its lease ended in 3Q 2014 when a new fi xed platform + FSO instal- lation took over production. The FPSO will remain on the fi eld until Oct 2014 and could have a redeployment con- tract lined up. Reuse on the Aje fi eld is a possibility. Another 29 fl oating LNG processing systems are in service or on order. Liquefaction fl oaters account for 17%, regasifi cation fl oaters 83%. No liquefaction fl oaters are yet in service – all 5 are on order. Total LNG inventory is the same as last month. In addition, 102 fl oating storage units are in service, on order or available. (See Chart 1).

Recent Orders

August was an active month for pro- duction fl oater orders. Three production systems were ordered, all FPSOs. Two are for use in Brazil, one for use in Indo- nesia. The total value of the three EPC contracts is around $3 billion. • Teekay/Odebrecht in early-August was the successful bidder to supply a midsize FPSO to Petrobras for use as an extended well test unit on the ultra-deep- water Libra complex off Brazil. The lease is for 8 years fi rm with two 2 year extension options. If all options are ex- ercised the unit will remain on contract through 2029. The lease rate is reported to be $543,590 per day. Included in the contract are two sets of mooring systems to enable the mooring to be pre-set on the next location where the FPSO will be used for testing. The 20 year old shuttle tanker Navion Norvegia will be used as the conversion hull. Hull/topsides capex is estimated to be ~$0.7 billion. With this order, Teekay now has two FPSO construction contracts in progress. • Bumi Armada in mid-August signed a contract with ENI to supply a

VLCC-size FPSO for use as the East

Hub on Block 15/06 off Angola. The lease is for 12 years fi rm with options for 8 yearly extensions. During the fi rm lease period, the lease payment will aver- age $684,930 per day. In the option pe- riod the payment will drop to $308,220 per day. An existing tanker will be used as the conversion hull. This is Bumi Ar- mada’s fi rst VLCC-size FPSO. Capex for the project is in the area of $1.0 bil- lion. Bumi Armada now has four FPSO construction projects simultaneously un- derway. • Modec/Schahin in late-August was the low bidder on the tender to lease a

VLCC-size FPSO for the Tartaruga fi eld in the Campos Basin. The lease is for 20 years. Two contractors submitted bids.

Modec/Schahin’s lease offer was report- ed to be $780,000 per day. The compet- ing offer from Bumi Amada/UTC was said to be $1,008,000 per day – $228,000 per day higher. Conversion of tanker is to be in Asia, topsides fabrication/inte- gration in Brazil. Hull/topsides capex is estimated to be ~$1.3 billion. Modec now has four FPSOs construction proj- ects at various degrees of completion.

Order Backlog – 64 production fl oat- ers are on order as of beginning Septem- ber, midway in a range of order back- log that has prevailed since early 2012. (See Graph 1).

Floater Projects in the Planning Stage

There are 229 fl oating production proj- ects are in various stages of planning as of beginning September. Of these, 58% involve an FPSO, 13% another type oil/ gas production fl oater, 23% liquefaction or regasifi cation fl oater and 6% storage/ offl oading fl oater.

Among new opportunities since last month, Petrobras is considering leasing an FPSO for use as a pilot production unit on the Libra complex in Santos Ba- sin. It would serve as an interim facility between the EWT FPSO and the long term production FPSOs to be employed on the complex. The unit would have production capability in the range of 100,000 b/d. This would be a near term contract, should Petrobras proceed with the requirement. (See Chart 2).

Brazil, Africa and SE Asia continue to be the major locations of fl oating production projects in the visible plan- ning stage. We are tracking 43 projects in Brazil, 49 in Africa and 39 projects in

SEA – 57% of the visible planned fl oat- ing production projects worldwide. Sev- eral large projects in Brazil and (less so)

Africa will require multiple production units. Overall, 250 to 270 production fl oaters of various types will be required for the 229 projects we are tracking. (See

Chart 3).

Around 13% of the 229 visible planned projects are likely to advance to the EPC contracting stage within the next 18 months. These projects typical- ly have either entered the FEED phase, pre-qualifi cation of fl oater contractors has been initiated or bidding/negotiation is in progress.

Another 50% of the visible projects are at a stage of development where the

EPC contract for the production unit is likely within the next 18 to 48 months.

The remaining 37% of projects are less advanced in planning, with the EPC con- tract likely 4 to 10 years out.

Future Business Drivers for Equipment Orders

As indicated above, there is no short- age of fl oating production projects in the planning stage. But an investment decision is needed to transform these project opportunities into contracts for production facilities. In large projects, the investment decision is a huge com- mitment entailing billions of dollars in capital expenditure. Even small fl oater projects entail several hundred million dollars of capex.

There is a growing list of deepwater projects that have been recently deferred at the fi nal investment stage. Gehem/

Gendalo is the latest example. Chev- ron has decided to rebid (for the second time) the $2.5+ billion EPC contract for two production barges. Others in- clude Statoil rethinking the planned $6 billion Bressay heavy oil project in the

UK North Sea, Chevron to stop, at least temporarily, the $10 billion Rosebank project offshore the UK Shetlands Is-

FLOATING PRODUCTION

BY JIM MCCAUL, IMA

Floating Production

What’s New in September 2014

Graph 1

MR #9 (34-39).indd 38 9/4/2014 10:43:04 AM

37

37

39

39