Page 25: of Maritime Reporter Magazine (May 2022)

Green Ship Technologies

Read this page in Pdf, Flash or Html5 edition of May 2022 Maritime Reporter Magazine

FUTURE FUELS “What happened in 2020 is that after a couple of months,

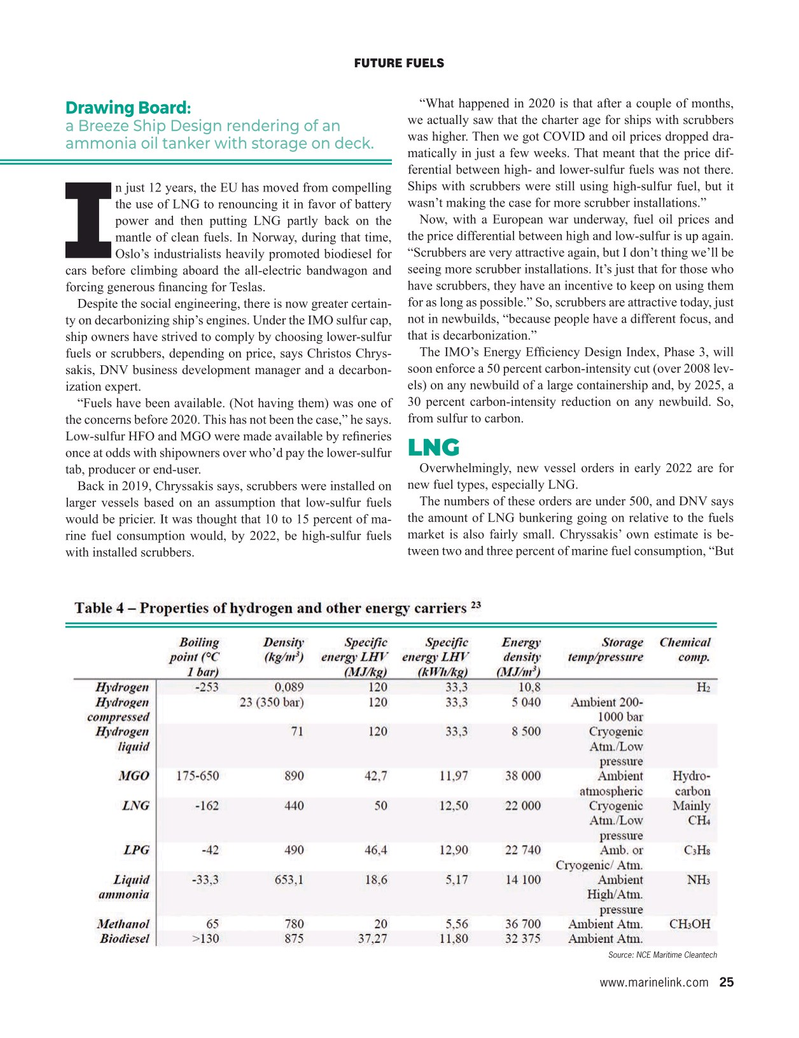

Drawing Board: we actually saw that the charter age for ships with scrubbers a Breeze Ship Design rendering of an was higher. Then we got COVID and oil prices dropped dra- ammonia oil tanker with storage on deck. matically in just a few weeks. That meant that the price dif- ferential between high- and lower-sulfur fuels was not there. n just 12 years, the EU has moved from compelling Ships with scrubbers were still using high-sulfur fuel, but it the use of LNG to renouncing it in favor of battery wasn’t making the case for more scrubber installations.”

Now, with a European war underway, fuel oil prices and power and then putting LNG partly back on the mantle of clean fuels. In Norway, during that time, the price differential between high and low-sulfur is up again.

IOslo’s industrialists heavily promoted biodiesel for “Scrubbers are very attractive again, but I don’t thing we’ll be cars before climbing aboard the all-electric bandwagon and seeing more scrubber installations. It’s just that for those who have scrubbers, they have an incentive to keep on using them forcing generous ? nancing for Teslas. for as long as possible.” So, scrubbers are attractive today, just

Despite the social engineering, there is now greater certain- ty on decarbonizing ship’s engines. Under the IMO sulfur cap, not in newbuilds, “because people have a different focus, and ship owners have strived to comply by choosing lower-sulfur that is decarbonization.”

The IMO’s Energy Ef? ciency Design Index, Phase 3, will fuels or scrubbers, depending on price, says Christos Chrys- soon enforce a 50 percent carbon-intensity cut (over 2008 lev- sakis, DNV business development manager and a decarbon- els) on any newbuild of a large containership and, by 2025, a ization expert. “Fuels have been available. (Not having them) was one of 30 percent carbon-intensity reduction on any newbuild. So, the concerns before 2020. This has not been the case,” he says. from sulfur to carbon.

Low-sulfur HFO and MGO were made available by re? neries

LNG once at odds with shipowners over who’d pay the lower-sulfur

Overwhelmingly, new vessel orders in early 2022 are for tab, producer or end-user.

Back in 2019, Chryssakis says, scrubbers were installed on new fuel types, especially LNG.

The numbers of these orders are under 500, and DNV says larger vessels based on an assumption that low-sulfur fuels the amount of LNG bunkering going on relative to the fuels would be pricier. It was thought that 10 to 15 percent of ma- rine fuel consumption would, by 2022, be high-sulfur fuels market is also fairly small. Chryssakis’ own estimate is be- tween two and three percent of marine fuel consumption, “But with installed scrubbers.

Source: NCE Maritime Cleantech www.marinelink.com 25

MR #5 (18-33).indd 25 5/3/2022 9:13:18 AM

24

24

26

26