Page 23: of Offshore Engineer Magazine (Jul/Aug 2021)

The Robotics Revolution

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2021 Offshore Engineer Magazine

Summary of Market Size, Local Content Offshore Wind Turbine and Installation

Preference and Development Type and Maintenance Fleet by 2030 international market through 2030 and over 8,000 in China. WIND FARM CONSTRUCTION AND

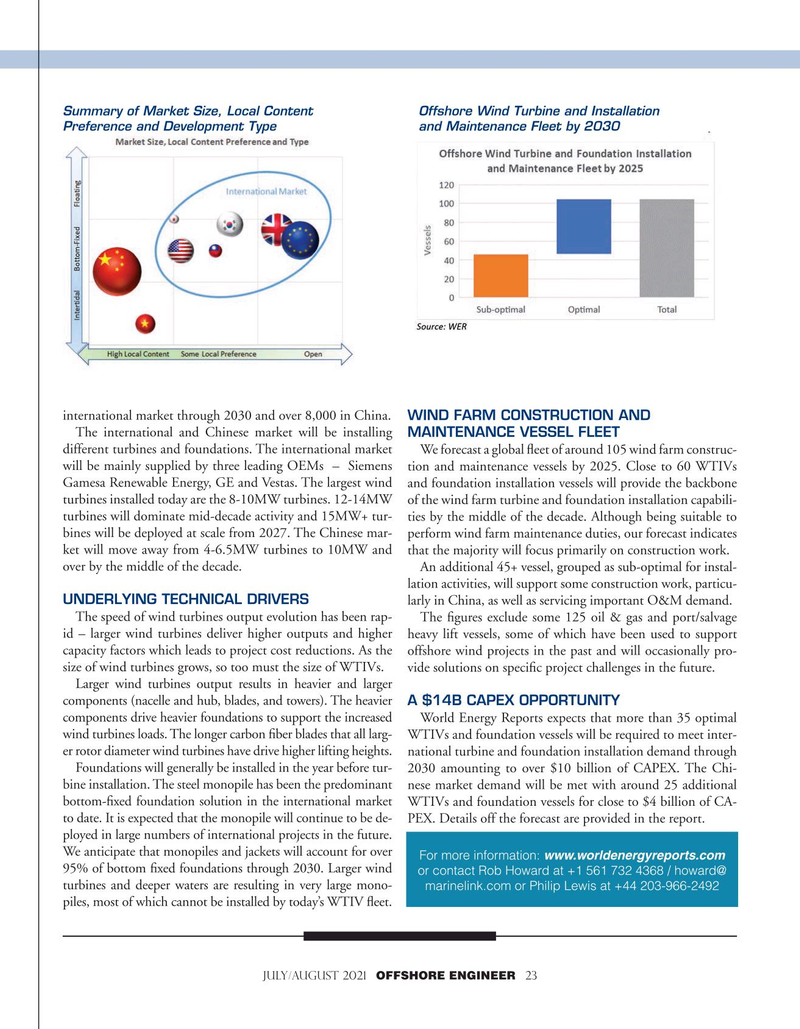

The international and Chinese market will be installing MAINTENANCE VESSEL FLEET different turbines and foundations. The international market We forecast a global feet of around 105 wind farm construc- will be mainly supplied by three leading OEMs – Siemens tion and maintenance vessels by 2025. Close to 60 WTIVs

Gamesa Renewable Energy, GE and Vestas. The largest wind and foundation installation vessels will provide the backbone turbines installed today are the 8-10MW turbines. 12-14MW of the wind farm turbine and foundation installation capabili- turbines will dominate mid-decade activity and 15MW+ tur- ties by the middle of the decade. Although being suitable to bines will be deployed at scale from 2027. The Chinese mar- perform wind farm maintenance duties, our forecast indicates ket will move away from 4-6.5MW turbines to 10MW and that the majority will focus primarily on construction work.

over by the middle of the decade. An additional 45+ vessel, grouped as sub-optimal for instal- lation activities, will support some construction work, particu-

UNDERLYING TECHNICAL DRIVERS larly in China, as well as servicing important O&M demand.

The speed of wind turbines output evolution has been rap- The fgures exclude some 125 oil & gas and port/salvage id – larger wind turbines deliver higher outputs and higher heavy lift vessels, some of which have been used to support capacity factors which leads to project cost reductions. As the offshore wind projects in the past and will occasionally pro- size of wind turbines grows, so too must the size of WTIVs. vide solutions on specifc project challenges in the future.

Larger wind turbines output results in heavier and larger components (nacelle and hub, blades, and towers). The heavier A $14B CAPEX OPPORTUNITY components drive heavier foundations to support the increased World Energy Reports expects that more than 35 optimal wind turbines loads. The longer carbon fber blades that all larg- WTIVs and foundation vessels will be required to meet inter- er rotor diameter wind turbines have drive higher lifting heights. national turbine and foundation installation demand through

Foundations will generally be installed in the year before tur- 2030 amounting to over $10 billion of CAPEX. The Chi- bine installation. The steel monopile has been the predominant nese market demand will be met with around 25 additional bottom-fxed foundation solution in the international market WTIVs and foundation vessels for close to $4 billion of CA- to date. It is expected that the monopile will continue to be de- PEX. Details off the forecast are provided in the report.

ployed in large numbers of international projects in the future.

We anticipate that monopiles and jackets will account for over

For more information: www.worldenergyreports.com 95% of bottom fxed foundations through 2030. Larger wind or contact Rob Howard at +1 561 732 4368 / howard@ turbines and deeper waters are resulting in very large mono- marinelink.com or Philip Lewis at +44 203-966-2492 piles, most of which cannot be installed by today’s WTIV feet.

JULY/AUGUST 2021 OFFSHORE ENGINEER 23

22

22

24

24