Gc Rieber Shipping

-

- Safety the Focus as Heavy Lifting Picks Up Maritime Reporter, Apr 2014 #78

Modern heavy lift capabilities are crucial for safe, efficient operations offshore

Heavy lift operations offshore are an awe-inspiring feat, but an operation that requires consistent monitoring of man, machine and procedure to ensure they are conducted in as an efficient and safe manner as possible. Due to a growing focus on safety related to subsea lifting operations, DNV GL recently established a Joint Industry Project (JIP) to develop practical methods for reducing the risks and lifetime cost of steel wire ropes for subsea lifting applications, using an integrated systems approach. In all, 14 industry players have already signed up and more partners are welcomed, said Inger-Lise Tangen, project manager, DNV GL.

“Frontier areas have emerged as serious attractions for oil and gas operators in recent years,” said Elisabeth Tørstad, CEO of DNV GL Oil & Gas. “Over half of the industry executives we interviewed for our industry outlook report Challenging Climates said they expect subsea technologies to absorb the strongest investment this year, to support exploration into new or challenging environments. Operating in these areas requires leading-edge technologies and new knowledge. Industry collaboration is even more important here where the technical challenges are complex and the risk exposure may be higher. This JIP is therefore very timely.”

The growing number of subsea field developments worldwide is demanding greater focus on safe execution of subsea lifting operations, both in the installation phase and throughout the lifetime of the field. High safety levels will be even more important going into deeper and ultra-deep waters, lifting larger and heavier equipment and more complex and expensive structures.

However, there are limited rules, regulations and standards suitable for ensuring and assessing the integrity of steel wire ropes for subsea lifting, especially for larger diameter ropes. A number of different factors can influence the integrity of a steel wire rope, but the knowledge about their effect and interaction, and how to assess them, is unfortunately limited currently.

“Industry players have expressed concerns related to today’s knowledge levels, competence and technology related to assessment of the condition and integrity of wire ropes. This is why DNV GL in cooperation with the industry has established a JIP with the aim of developing a Recommended Practice (RP) for integrity management of steel wire ropes used for subsea lifting applications,” explains Inger-Lise Tangen, Project Manager, DNV GL.

The new methods for integrity management of steel wire ropes will form the basis for documentation of the safety and reliability of integrated systems according to DNV-OS-E407, throughout the service life of the rope until it is duly discarded. The project will include relevant issues related to system integration, monitoring, condition assessment, inspection, maintenance, lubrication, production, etc.

Partners are: Bridon, DMT GmbH & Co. KG, DOF Management, Farstad Shipping AS, GC Rieber Shipping ASA, Heerema Marine Contractors Nederland SE, Huisman Equipment BV, National Oilwell Varco (NOV), Redaelli, Rolls Royce Marine AS, Saipem, Technip UK Limited, TEUFELBERGER Seil Ges.m.b.H. and W. Giertsen Services AS.

While the DNV GL Joint Project focuses on matters surrounding the safety of wire rope, Samson continues to be a pioneer in delivering solutions and gaining acceptance of synthetic rope various industries and applications. The company recently debuted Manitowoc Cranes’ Grove RT770E rough-terrain crane using Samson’s KZ100, the first synthetic hoist rope designed specifically for mobile cranes. KZ100 is a product of joint application development between Samson and Manitowoc, supported by fiber supplier DSM Dyneema, and ushers Samson into the crane industry.

KZ100 is a lightweight alternative to traditional steel wire rope and provides multiple benefits for safe and easy handling. According to Samson, with the same load pull and load chart as wire, KZ100 can be used with a 5:1 safety factor. It is 80% lighter than the wire it replaces, making for easy handling/reaving and installation. Synthetic KZ100 does not rust and requires no lubing, and the unique construction eliminates kinking, bird caging, and damage caused by diving on the winch drum. Because of its torque-neutral construction, KZ100 eliminates load spin and cabling.

Manitowoc and Samson conducted an extensive lab testing and field trial program to prove the viability of using synthetic rope as a crane hoist line. KZ100 was tested in the lab to characterize tensile strength, tension fatigue, bend fatigue, and the effects of temperature on the rope’s performance. These tests were performed at four different testing labs—two Samson labs and two third-party labs. The testing plan required more than 4,000 hours of machine and sample preparation time to complete. The total length of rope manufactured for testing and field trials pursued over the course of this project came to 24,500 ft., or more than 4.6 miles of rope. In addition to Samson’s tests, Manitowoc conducted reliability tests over more than 280 hours and 14,000 cycles.

Lankhorst Ropes supplied Arctic vessel builder Arctech Helsinki Shipyard with steel wire towing ropes for three new icebreaking supply and emergency operations ships operating in seas off Far East Russia and the Gulf of Finland. The emergency and rescue vessel, NB 508 Baltika, is being built for the Russian Ministry of Transport. While the NB 506 Vitus Bering and NB 507 Aleksey Chirikov, high capability multifunctional icebreaking supply vessels are for Russian shipping company Sovcomflot.

Lankhorst has supplied each of the NB 506 Vitus Bering and NB 507 Aleksey Chirikov with 1,000m of 66mm diameter steel wire rope; the ropes have a minimum breaking load (MBL) of 310Mt. The NB 508 Baltika will use 700m of 58mm diameter rope with 240Mt MBL. The steel wire ropes feature an independent wire rope core, providing greater strength and stability to the rope than a fiber core. As well as towing, the galvanized rope can also be used for multiple other offshore applications.

Two of the vessels, NB 506 Vitus Bering and NB 507 Aleksey Chirikov, will support the Sakhalin-1 Arkutun-Dagi oil and gas field in the Sea of Okhotsk, Far East Russia. The ships’ main tasks will be to protect the oil and gas rigs from ice accumulation, provide supplies and transport crews, as well as, oil spill recovery, firefighting, ocean towing, stand-by and rescue. The ships and their equipment will have to perform in temperatures of minus 35 °C, waves up to 18m in height and wind speeds exceeding 140 km per hour.

Lankhorst Ropes also won a contract by Aberdeen based Dana Petroleum to provide Gama 98 polyester mooring lines for the Western Isles Development FPSO vessel (Floating Production Storage and Offloading). Given the weather conditions in the North Sea, and relatively shallow water depth, the cylindrically shaped FPSO will use a semi-taut leg mooring system. It will be moored with 14 polyester mooring lines in three clusters of 4, 4 and 6 lines at 250m water depth. Two clusters will have longer lines to the prevailing weather that, together with seabed chain, will provide the lateral restoring force needed to keep the production vessel on station.

The Gama 98 polyester rope tethers are made from parallel laid sub-rope cores within an outer braided jacket. The Western Isles Project (Dana 77% and Cieco 23%) will develop two discovered oil fields called Harris and Barra in the Northern North Sea, 160km east of the Shetlands and 12km west of Tern field. It involves a subsea development of at least five production and four water injection wells plus two exploration wells tied back to a new build floating production, storage and offloading vessel (FPSO) with oil export using shuttle tankers.

Lankhorst Ropes also won a contract by NOV Flexibles, Denmark, to supply Lankoforce riser tethers for the Knarr field development, located in 410m of water in the North Tampen region of the Norwegian Sector of the Northern North Sea. The riser tethers will be the first to use Dyneema DM 20, a high modulus polyethylene (HMPE) rope, for permanent subsea anchoring of flexible risers. Lankoforce riser tethers are designed to hold risers and umbilicals in position, connected to subsea production systems such as well manifolds, wellheads, Christmas trees and well jumpers. Each of the Knarr development riser tethers comprises two HMPE tethers connecting a hold-down clamp with an anchor, allowing rotation around two axes.

The riser tether has a Lankoforce rope construction with a 12 strand braided rope core made from Dyneema DM20. The high modulus polyethylene core provides the strength and mechanical performance expected of these long-term tethers. The entire rope core is protected by a braided polyester jacket and polyurethane coating, and includes ROV handling points for ease of installation.

Caley Ocean Systems supplied a high performance, A-frame handling system to Boskalis Offshore for launching trenching vehicles and ploughs from the company’s first ‘N Class’ cable-laying vessel Ndurance. Mounted on the stern of the Ndurance, the Caley A-frame is capable of handling loads of 70 ton with a maximum lift and reach of 21m up to Seastate-5. The A Frame structure is manufactured in three sections, two leg sections and a top crossbeam. The crossbeam includes the pivot mountings for A-frame’s telescopic swinging beam assembly mounted on a dampening frame, allowing the lifting system to handle a wide range of equipment.

The A-frame includes an anti-pitch system incorporating two double acting hydraulic cylinders trunnion mounted to the crossbeam, together with hydraulic power unit (HPU) and winch, for maximum operational flexibility. In addition to cable-laying, the Ndurance’s A-frame will be used for a range of other tasks, including launch and recovery of tools and equipment associated with offshore construction projects.

The Caley A-frame is widely used in offshore and ocean science applications where several systems have been in continuous service for over 30 years with many thousands of successful deployments.(As published in the April 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)

-

)

March 2024 - Marine Technology Reporter page: 45

)

March 2024 - Marine Technology Reporter page: 45ronments. The new agreement will address speci? c techni- cal gaps in the UUV defense and offshore energy markets especially for long duration, multi-payload mission opera- tions where communications are often denied or restricted. As part of the new alliance, Metron’s Resilient Mission Autonomy portfolio

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36LANDER LAB #10 Of special interest for marine applications, LiPo batteries are Shipping any kind of lithium battery can be a challenge, and offered in a “pouch” design, with a soft, ? at body. The pouch IATA regs vary with the batteries inside or outside an instru- is vacuum-sealed, with all voids ?

-

)

March 2024 - Marine Technology Reporter page: 11

)

March 2024 - Marine Technology Reporter page: 11assist in identifying mines and act as a neutralization device. About the Author Bottom mines pose even greater chal- David R. Strachan is a defense analyst and founder of lenges. Unlike contact mines, bottom Strikepod Systems, a research and strategic advisory mines utilize a range of sensors to

-

)

March 2024 - Marine Technology Reporter page: 7

)

March 2024 - Marine Technology Reporter page: 7Set a Course for your Career Become a NOAA professional mariner! Sail with NOAA’s fleet of research marinerhiring.noaa.gov 1-833-SAIL-USA (724-5872) and survey ships! - Detects all iron and steel Get your next salvage - Locate pipelines, anchors and job done faster chains with a JW Fishers

-

)

April 2024 - Maritime Reporter and Engineering News page: 46

)

April 2024 - Maritime Reporter and Engineering News page: 46MARKETPLACE Professional www.MaritimeProfessional.com GILBERT ASSOCIATES, INC.GILBERT ASSOCIATES, INC. Naval Architects and Marine Engineers SHIP DESIGN & ENGINEERING SERVICES Join the industry’s #1 Linkedin group )NNOVATION

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43“The industry is an ecosystem which includes owners, managers, mariners, shipyards, equipment makers, designers, research institutes and class societies: all of them are crucial,” – Eero Lehtovaara, Head of Regulatory & Public Affairs, ABB Marine & Ports All images courtesy ABB Marine and Ports provi

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42OPINION: The Final Word Seeing the Ship as a System Shipping must engage with the decarbonization realities that lie ahead by changing the way it crafts maritime legislation to re? ect its place in the interconnected, interdependent world economy, said Eero Lehtovaara, ABB Marine & Ports. ABB Marine &

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41Nautel provides innovative, industry-leading solutions speci? cally designed for use in harsh maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications

-

)

April 2024 - Maritime Reporter and Engineering News page: 40

)

April 2024 - Maritime Reporter and Engineering News page: 40TECH FEATURE SITUATIONAL AWARENESS SITUATIONAL AWARENESS SYSTEM BATTLES COGNITIVE FATIGUE IN WATCHKEEPERS All images courtesy Groke Technologies Today’s evolving maritime security risks pose all-too-familiar threats to international shipping, and as just one of the many causes of fatigue, they add

-

)

April 2024 - Maritime Reporter and Engineering News page: 39

)

April 2024 - Maritime Reporter and Engineering News page: 39Tech Files Latest Products, Systems and Ship Designs “Wall Climbing Robot” Danish Pilot calls gets ClassNK Nod LEGO Model "A tribute build to a work life at sea" Image courtesy MOL, Sumitomo Heavy Industries lassNK granted its Innovation Endorse- Image courtesy Espen Andersen/DanPilot ment for

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38Tech Files Latest Products, Systems and Ship Designs Zero-Emission Mooring Service of a Tanker Consulmar achieved a milestone by executing what it calls ing boat Castalia, which operates on full electric propulsion. the world's ? rst zero-emissions mooring service for a tanker. Equipped with two 150 kW

-

)

April 2024 - Maritime Reporter and Engineering News page: 37

)

April 2024 - Maritime Reporter and Engineering News page: 37SIMULATION "A simulated vessel ? ooding can help teams work together to solve the challenge using different systems on the bridge." – Jussi Siltanen, Lead, "The gami? cation of Product Marketing, learning makes it fun." Safety Solutions at NAPA – Captain Pradeep Chawla, Founder, MarinePALS Image

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35SIMULATION e have a close relationship with tech- Realism is prized beyond immersive, photo-realistic visu- nology, evidenced by, for example, als, and providers are introducing increasingly accurate func- the phones we are estimated to un- tionality. FORCE Technology’s upcoming DEN-Mark2 math- lock around

-

)

April 2024 - Maritime Reporter and Engineering News page: 34

)

April 2024 - Maritime Reporter and Engineering News page: 34FEATURE Image courtesy Kongsberg Digital Simulators Track our Changing Relationship with Technology Simulation-based training has its whole-of-ship/ whole-of-team scenarios, but zooming in, the industry is now working on more speci? c targets. By Wendy Laursen Image above: Kongsberg Digital has integrated

-

)

April 2024 - Maritime Reporter and Engineering News page: 29

)

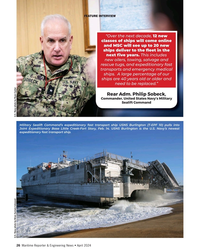

April 2024 - Maritime Reporter and Engineering News page: 29RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND U.S. Navy photo by Bill Mesta/released U.S. Navy photo by Ryan Carter Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command, visits USNS Patuxent (T-AO 201) for a tour of the ship at Naval Station Norfolk, Va., November 20, 2023.

-

)

April 2024 - Maritime Reporter and Engineering News page: 28

)

April 2024 - Maritime Reporter and Engineering News page: 28FEATURE INTERVIEW track missiles and warheads for the Mis- sile Defense Agency, and it travels with its support ship, the MV Hercules. For our Service Support ships, we have the two hospital ships, USNS Mer- cy and Comfort; two rescue and salvage ships; two submarine tenders; and the Sixth Fleet ?

-

)

April 2024 - Maritime Reporter and Engineering News page: 27

)

April 2024 - Maritime Reporter and Engineering News page: 27RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND With COVID, we had to make some hard choices for our Do your CIVMARs have upward mobility? mariners because we couldn’t rotate. Many of our mariners The Navy has Sailors who become “Mustangs,” and work found other employment, and were able to use their skills

-

)

April 2024 - Maritime Reporter and Engineering News page: 26

)

April 2024 - Maritime Reporter and Engineering News page: 26FEATURE INTERVIEW “Over the next decade, 12 new classes of ships will come online and MSC will see up to 20 new ships deliver to the ? eet in the next ? ve years. This includes new oilers, towing, salvage and rescue tugs, and expeditionary fast transports and emergency medical ships. A large

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND Photo by Brian Suriani USN Military Sealift Command From a global supply chain perspective, What makes MSC so vital to the we’ve learned a lot about dealing with Navy’s ? eet and our military disruptions. COVID delivered a big forces around the world? wake-up

-

)

April 2024 - Maritime Reporter and Engineering News page: 24

)

April 2024 - Maritime Reporter and Engineering News page: 24FEATURE INTERVIEW U.S. Navy photograph by Brian Suriani/Released Rear Adm. Philip Sobeck (right) Commander of U.S. Military Sealift Command (MSC) explains the tradition of the Navy ‘looping ceremony’. Lt. Robert P. Ellison assumes the title of MSC’s Flag Aide during the ceremony. NEEDS MILITARY MORE

-

)

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22INTERVIEW WE ARE ENGAGED WITH MULTIPLE US OSW WIND DEVELOPMENTS AND SEEING AN UP-TICK FOR CVA, TECHNOLOGY REVIEW AND RISK REDUCTION SERVICES IN EARLY DEVELOPMENT PHASES. WITH NEW LEASE ROUNDS COMING AND NEW OPPORTUNITIES, WE DO NOT SEE A BIG SLOWDOWN FOR OSW DEVELOPMENTS APART FROM THE OBVIOUS

-

)

April 2024 - Maritime Reporter and Engineering News page: 20

)

April 2024 - Maritime Reporter and Engineering News page: 20INTERVIEW One-on-One with ROB LANGFORD, VP, GLOBAL OFFSHORE WIND As the U.S. offshore wind industry endures a predictable number of stops and starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas

-

)

April 2024 - Maritime Reporter and Engineering News page: 19

)

April 2024 - Maritime Reporter and Engineering News page: 19SOVs Source: Intelatus Global Partners built vessel fell from ~25% in early 2021 to ~12% today. Visit Us The biggest new building premium is found in the USA, for at OTC Houston, TX a variety of reasons, where the three tier one SOVs are being Booth 2121 built for ~€87-168 million. VARD is a leader in

-

)

April 2024 - Maritime Reporter and Engineering News page: 15

)

April 2024 - Maritime Reporter and Engineering News page: 15hydro-acoustic design of a propulsor that delays cavitation meets its underwater noise limits. This will require specialized inception and cavitating area. The third approach should be test sites or specialized mobile underwater testing equipment. isolation mounting of a vibro-active equipment and