Liquefied Gas Carriers

-

- WORLD SHIPBUILDING Maritime Reporter, Jun 1983 #60

The events of 1982 clearly indicated that the improvement in the world order book, which began in 1979, was only a shortlived respite from the problems which have beset the shipbuilding industry since the mid '70s.

The total volume of new orders placed fell sharply by over 30 percent from 17.2 million gt in 1981 to 11.9 million gt in 1982, the lowest figure since 1978, Tables 1 and 2 and Chart 1. An important factor contributing to this decrease was the slowing up in new ordering for bulk carriers, coupled with continuing lack of demand for new tankers.

The economic outlook continues to be poor, with little change in a low industrial growth rate, an oil surplus arising from a fall off in demand, low freight rates and over tonnaging. The extremely competitive second-hand prices for ships are tempting some shipowners to consider very seriously this option, rather than to order new tonnage, when the occasion arises.

The total order book at the end of the year stood at 29.2 million gt and is comparable to the order book at the beginning of 1980; 79 percent of this tonnage is due to be completed during 1983, Table 3 and Chart 2. Japan acquired nearly 50 percent of the 1982 orders, western Europe's percentage decreased, while the rest of the world showed an increase of five percent on the previous year. This has largely been due to South Korea's increased order book, the continuing growth in export orders from the People's Republic of China, and a substantial order book for Brazil, Poland and the Democratic Republic of Germany.

With the decline in bulk carrier and tanker ordering, there is now a greater emphasis towards more specialized ships; it is noticeable that the containership order book has risen 1.6 million gt at the end of 1981 to 2.9 million gt at the end of 1982.

However, a large percentage of these orders is accounted for by four major owners. Further, there have been moves by some owners to increase capacity by lengthening existing containerships and to achieve operational economies by converting to diesel propulsion or by adopting slow steaming. A steady demand for ro-ro types is illustrated by comparing the 1982 order book figure of 1.05 million gt with that of 1981 (0.82 million gt).

General cargo ships account for 20 percent of the order book, with a switch to building multipurpose ships incorporating limited ro-ro and container facilities.

Fully refrigerated ships show a strong order book, but over-tonnaging could be develop- ing. The optimum capacities appear to be around 4,250, 7,080 and 11,300 cubic meters, although 15,600 cubic meters is in evidence in a few cases.

At the end of 1982 10 cruise ships were on order. A continuing requirement for ferries is evident, with the order book having 115 ships of 403,000 gt as against 95 ferries of 344,000 gt at the end of 1981. Again, the smaller offshore supply ships provide much needed work, there currently being 350 on order. Of this total, 135 units are to be constructed in the U.S.A. South Korea and the People's Republic of China have entered this market, which will bring increased competition for new orders. The overall trend is for bigger and more versatile vessels.

Fifty percent of the order book comprises bulk carriers, including bulk oil carriers, with over 500 ships of 15 million gt currently on order or under construction.

Since last year's report it has been evident that while there have been few cancellations, there has been a move to extend delivery dates, and the rate of ordering is slowing down.

The number of new orders placed in 1982 was 176 bulk carriers of 4.6 million gt. The 18-40,000-dwt bulk carrier has been most favored in 1982. Total completions were 287 ships of 8.4 million gt.

The in-service bulk carrier fleet stands at 119.2 million gt, or 28 percent of the world fleet.

Nearly 54 percent of bulk carriers are under 10 years in age.

Mainly depending on the rate of scrappings and casualties, this percentage will be considerably increased by the addition of 10 million gt, as the estimated 1983 completions come into service.

A five-year analysis, commencing in 1977, on bulk-carrier scrappings shows that the gross tonnaee disposed of in 1978 was 1.5 million but by 1981 this had fallen to just over a quarter of a million.

Although o v e r - t o n n a g i n g is strongly evident for bulk carriers, there is a degree of optimism that there will be enough trade to employ the majority of the fleet over the coming years, particularly in the coal and grain trades.

The work provided to shipyards by tanker new construction continues to decline and tanker orders now only represent 16.5 percent of the order book compared with 30 percent in 1979, Chart 3. In December 1982, there were only four tankers of 100,000 gt or above in the order book. The in-service tanker fleet at the end of June 1982 stood at 166.8 million gt. There are 450 tankers of 34 million gt laid up.

A considerable number of the ships laid up require retrofitting to bring them up to MARPOL 73 requirements. In view of discouraging forecasts for this mar- ket it is questionable whether such ships will re-enter commercial service. Scrap prices for tankers are low, due largely to considerable overcapacity in world steel production. The tanker section is also affected by changing patterns of oil transportation as more supplies come from the North Sea, Alaska, etc., with a corresponding decrease in VLCC sailings from the Gulf. As a result, a number of VLCCs and ULCCs are no longer economically viable but, unfortunately, there continues to be limited shipbreaking capacty to deal with them.

New orders for liquefied gas carriers in 1982 amounted to 17 ships of 0.3 million gt. Of these, two of 200,000 gt were for the carriage of LNG, and the order book now stands at 43 ships of 1.4 million gt (1.9 million cubic meters).

Of this figure 10 ships totaling 900,000 gt are for the car- riage of LNG. Japan has 0.8 million gt of this order book and France 0.2 million gt. Delays in the development of shore facilities to handle this commodity are aggravating the situation, and some of the completions have gone into short-term lay-up.

In 1982 there were no orders for coal-fired ships. Only two are building in Italy and one each in Japan and the U.S.A. In addition there are two tankers being converted to bulk carriers in Spain, and two uncompleted liquefied gas carriers being converted to ore/ bulk/oil carriers in South Korea.

Table 4 compares the performance of the main areas of shipbuilding around the world, Table 5 and Chart 4 present the historical record.

JAPAN Japan clearly dominates the shipbuilding scene as she has done for the last 20 years. Her order book stands at 10 million gt—a third of the world tonnage on order. Seventy percent, or 7 million gt, of this country's order book is due for completion in 1983. Bulk carriers comprise 62 percent (6.2 million gt) of the work in hand. Tankers have declined to 11 percent compared with 32 percent in 1978. The order book is diverse, with a variety of ship types for 38 countries.

The tonnage being constructed for the domestic market has remained nearly constant, while export tonnage has decreased from just over 10 million to less than eight million gt. Flexibility is still the major attribute of the Japanese shipbuilding industry and this is made easier by the fact that the large shipyards tend to be extensions of conglomerates, with other major business outlets.

The yards in western Japan accounted for 1.2 million gt of the completions, comprising bulk carriers, oil tankers, chemical tankers, cargo ships and tugs.

Especially noteworthy among the 1982 completions was the bauxite carrier River Boyne, 80,469 dwt, the first of the new generation of coal-burning ships.

SOUTH KOREA South Korea has, in a difficult year, increased its share of the total order book for the fifth consecutive year. New orders in 1982 amounted to 73 ships of 1.1 million gt. Bulk carriers dominated the total order book with 44 percent (1.1 million gt). General cargo ships, at 1.2 million gt, represent 45 percent of the South Korea order book as against the Japanese 13 percent.

It could become increasingly difficult to fully utilize South Korea's developing shipbuilding facilities if the world order book continues to decline. Incentives in the form of government grants and cheap and abundant labor could be dominant features, but the wide variety of ship types available to clients will also be important.

The principal area for marine activity continued to be Ulsam at the Hyundai and Donghae shipyards where there were 39 ships on order or building.

UNITED KINGDOM The United Kingdom's order book remains virtually unchanged at one million gt, with the major proportion being scheduled for completion within the next 12 months. New orders obtained were 52 ships of 286,000 gt, with completions of 0.4 million gt. Bulk carriers have slightly increased their share of the order book and stand at 57 percent. Work for the offshore industry showed an increase in all parts of the U.K.

FRANCE Over 40 percent of the French order book (717,896 gt) is accounted for by LNG, LPG and.

containerships. Most of the remainder is made up of passenger and general cargo ships.

Great efforts are being made by the French shipbuilding industry to improve its competitiveness in export markets, and mergers are planned which will leave only two major shipbuilding groups in France.

The Finnish shipbuilding industry is of interest as it managed to avoid the worst of the recession in shipbuilding. From an order book of 75 ships (600,000 gt), 58 are for registration in the USSR. It is of interest too that no bulk carriers are on order or building in Finland; the predominant ship types are ro-ro, passenger, tugs and supply ships.

Brazil continues to be among the world leaders in shipbuilding.

The outlook for shipbuilding orders looks more hopeful with several important orders being received by various yards. During 1982 the largest offshore structure ever built in South America, the steel jacket for the Namorado II platform, was towed from

-

- B r o g a n A n d Sundaresan P r o m o t e d At MTL Maritime Reporter, Apr 15, 1984 #6

commodities. MTL's fleet includes crude oil tankers, petroleum product tankers, chemical tankers, dry bulk carriers, molten sulphur tankers and liquefied gas carriers operating in both U.S. domestic and international trades. MTL provides a variety of marine services to the oil, petrochemical, agricultural

-

- A.L. Burbank Forms Shipcentral, Limited —Tsao Named To Board Maritime Reporter, Mar 1974 #40

and Europe. Included, have been numerous types of specialized bulkcarriers, super, very large (VLGC) and ultra large (ULCC) tankers, large liquefied gas carriers, and products carriers for which, in most cases, customized charters were arranged. Shipcentral will further emphasize the above services

-

- THE WORLD ORDERBOOK Maritime Reporter, Sep 1994 #98

bulk carriers represent 34 percent and general cargo 18 percent (container tonnage constitutes 71 percent of the general cargo total orderbook). Liquefied gas carriers account for 2.8 million gt of the total orderbook. Japan is the country making the largest contribution in this area, with 47.5 percent

-

- MTL Announces Promotions Maritime Reporter, Apr 15, 1984 #18

transportation. MTL's fleet includes crude oil tankers, petroleum product tankers, chemical tankers, dry bulk carriers, molten sulphur tankers and liquefied gas carriers operating in both U.S. domestic and international trades

-

- Gas Ship Design Challenges Maritime Reporter, Nov 2000 #66

sophisticated LNG, LPG and ethylene carriers fleet. About the Author Naval architect and marine surveyor Syd Harris has been involved with liquefied gas carriers for over 25 years. An independent consultant since 1978, he invites you to visit his web page at www.fsharris.co.uk

-

- ABS Reports Increase In Classifications Maritime Reporter, Oct 15, 1977 #44

capacity." As of July 1, he said, 1,946 vessels totaling 28,827,000 dwt, or 17,522,000 gt, were on order to ABS classication. ABS involvement with liquefied gas carriers is increasing, Mr. Young reported. As of July 1, there were five LPG vessels building or on order to ABS classification, including

-

- World Shipping And Shipbuilding Maritime Reporter, Jun 1986 #65

the Federal Republic of Germany, where yards have been successful in obtaining a number of high-value orders for passenger ships, ferries, and liquefied gas carriers for both domestic and export markets. Negotiations for an $864- million order for three frigates for the Portuguese Navy have been under way

-

- SNAME Annual Meeting Maritime Reporter, Nov 1978 #12

Mansour, Edward Price and A. Thayamballi. Synopsis—The use of prestressed concrete for constructing storage/ processing vessels and oceangoing liquefied gas carriers may have certain advantages. The technical feasibility and safety of a 300- meter-long prestressed concrete vessel c a r r y i n g LPG

-

- Responding to “The Articulated Tug Barge (ATB) Quandary” Marine News, Mar 2013 #60

Gases 46 CFR 162 Engineering Equipment 46 CFR 172 Special Rules Pertaining to Bulk Cargoes ABS Guide for Building and Classing Liquefied Gas Carriers With Independent Tanks ABS Rules for Building and Classing Steel Barges ABS Rules for Building and Classing Steel Vessels Under 90M

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36LANDER LAB #10 Of special interest for marine applications, LiPo batteries are Shipping any kind of lithium battery can be a challenge, and offered in a “pouch” design, with a soft, ? at body. The pouch IATA regs vary with the batteries inside or outside an instru- is vacuum-sealed, with all voids ?

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42OPINION: The Final Word Seeing the Ship as a System Shipping must engage with the decarbonization realities that lie ahead by changing the way it crafts maritime legislation to re? ect its place in the interconnected, interdependent world economy, said Eero Lehtovaara, ABB Marine & Ports. ABB Marine &

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38Tech Files Latest Products, Systems and Ship Designs Zero-Emission Mooring Service of a Tanker Consulmar achieved a milestone by executing what it calls ing boat Castalia, which operates on full electric propulsion. the world's ? rst zero-emissions mooring service for a tanker. Equipped with two 150 kW

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35SIMULATION e have a close relationship with tech- Realism is prized beyond immersive, photo-realistic visu- nology, evidenced by, for example, als, and providers are introducing increasingly accurate func- the phones we are estimated to un- tionality. FORCE Technology’s upcoming DEN-Mark2 math- lock around

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32FEATURE A closeup of a blade installation process taken via drone. A blade handling system is apparent (in yellow). Images courtesy of Mammoet requirement for the development of these cranes, particularly ling area. This would result in a major time and fuel saving. in ? oating offshore wind,” says

-

)

April 2024 - Maritime Reporter and Engineering News page: 27

)

April 2024 - Maritime Reporter and Engineering News page: 27RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND With COVID, we had to make some hard choices for our Do your CIVMARs have upward mobility? mariners because we couldn’t rotate. Many of our mariners The Navy has Sailors who become “Mustangs,” and work found other employment, and were able to use their skills

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND Photo by Brian Suriani USN Military Sealift Command From a global supply chain perspective, What makes MSC so vital to the we’ve learned a lot about dealing with Navy’s ? eet and our military disruptions. COVID delivered a big forces around the world? wake-up

-

)

April 2024 - Maritime Reporter and Engineering News page: 21

)

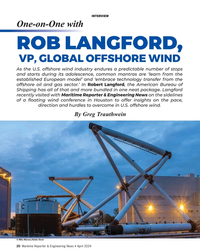

April 2024 - Maritime Reporter and Engineering News page: 21ROB LANGFORD, VP, GLOBAL OFFSHORE WIND ob Langford has worked in the offshore industry ABS. “We are growing and evolving our services across all for more than three decades, ‘cutting his teeth’ offshore infrastructure along with our continued support to the in a UK design ? rm working in the North Sea

-

)

April 2024 - Maritime Reporter and Engineering News page: 20

)

April 2024 - Maritime Reporter and Engineering News page: 20INTERVIEW One-on-One with ROB LANGFORD, VP, GLOBAL OFFSHORE WIND As the U.S. offshore wind industry endures a predictable number of stops and starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas

-

)

April 2024 - Maritime Reporter and Engineering News page: 19

)

April 2024 - Maritime Reporter and Engineering News page: 19SOVs Source: Intelatus Global Partners built vessel fell from ~25% in early 2021 to ~12% today. Visit Us The biggest new building premium is found in the USA, for at OTC Houston, TX a variety of reasons, where the three tier one SOVs are being Booth 2121 built for ~€87-168 million. VARD is a leader in

-

)

April 2024 - Maritime Reporter and Engineering News page: 18

)

April 2024 - Maritime Reporter and Engineering News page: 18MARKETS & gas activity returns, we anticipate that supply of the vessels The Question of Emissions to offshore wind projects will reduce, driving demand for ad- Given that SOVs and CSOVs operate in a segment target- ditional CSOVs. ing reduced emissions, and many operate in the North Eu- Outside of China

-

)

April 2024 - Maritime Reporter and Engineering News page: 16

)

April 2024 - Maritime Reporter and Engineering News page: 16MARKETS SOVs – Analyzing Current, Future Demand Drivers By Philip Lewis, Director of Research, Intelatus © Björn Wylezich/AdobeStock t a high-level, there are three solutions to transferring Lower day rate CTVs are often used for daily transfer of technicians from shore bases to offshore wind farms

-

)

April 2024 - Maritime Reporter and Engineering News page: 11

)

April 2024 - Maritime Reporter and Engineering News page: 11ing will be more accurate in determining trends and aspects of SIRE 2.0 seeks to unify the maritime community in its ap- improvement or safety concerns. proach to safety and compliance, enhancing transparency and The introduction of core and rotational questions in SIRE 2.0 operational ef? ciency by

-

)

April 2024 - Maritime Reporter and Engineering News page: 4

)

April 2024 - Maritime Reporter and Engineering News page: 4Authors & Contributors MARITIME REPORTER AND ENGINEERING NEWS M A R I N E L I N K . C O M ISSN-0025-3448 USPS-016-750 No. 4 Vol. 86 Maritime Reporter/Engineering News (ISSN # 0025-3448) is published monthly Cooper Fischer Goldberg except for March, July, and October by Maritime Activity Reports, Inc.

-

)

April 2024 - Marine News page: 40

)

April 2024 - Marine News page: 40Vessels General Arnold Chasse, La. The 32-inch CSD will immediately begin work on Phase Four of the Corpus Christi Ship Channel Improvement Project. The project will bene? cially reuse 100% of the dredged material removed from the channel deepening and widening. The General Arnold is the newest,

-

)

April 2024 - Marine News page: 36

)

April 2024 - Marine News page: 36Feature Electric Tugs the construction of which has fallen behind schedule. “When you’re out on the leading edge of these technolo- gies, everything has to catch up,” Manzi said. “Permitting has to catch up, regulation has to catch up, standards have to catch up. And we’ve faced all three of those challenge

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27Feature Shipbuilding Loumania Stewart / U.S. Coast Guard focus), which require very different business systems to be in place. “We’ve been able to do both,” he said, noting that having systems in place for government jobs makes East- ern Shipbuilding “move-in ready for the Navy and other DOD agencies

-

)

February 2024 - Maritime Reporter and Engineering News page: 44

)

February 2024 - Maritime Reporter and Engineering News page: 44Tech Files Latest Products & Technologies MarineShaft Yanmar Hydrogen MarineShaft specializes in urgent re- Fuel Cell AIP pair/replacement of damaged rudder and Yanmar Power Technology Co., Ltd. propeller equipment along with many (Yanmar PT), a subsidiary of Yanmar on-site repair services. MarineShaft

-

)

February 2024 - Maritime Reporter and Engineering News page: 38

)

February 2024 - Maritime Reporter and Engineering News page: 38TECH FEATURE Ammonia and the 15,00 A project initiated by Seaspan Corporation and the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMMCZCS) has set out to develop a design for a large 15,000-TEU ammonia-fueled container vessel. Image Seaspan Corporation/Foreship By Greg Trauthwein orking with

-

)

February 2024 - Maritime Reporter and Engineering News page: 37

)

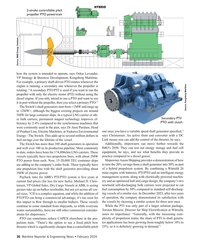

February 2024 - Maritime Reporter and Engineering News page: 37PTI/PTO "In a typical LNG carrier, permanent magnet technology improves ef? ciency by 2-4% compared to synchronous machines." – Dr. Jussi Puranen, Head of Product Line, Electric Machines, at Yaskawa Environmental Energy / The Switch The Switch’s shaft generators start from <1MW and range up to 12MW+.

-

)

February 2024 - Maritime Reporter and Engineering News page: 36

)

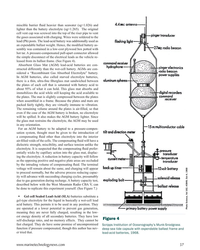

February 2024 - Maritime Reporter and Engineering News page: 36HYBRID 2-stroke controllable pitch propeller PTO powertrain Source: MAN Energy Solutions how the system is intended to operate, says Oskar Levander, VP Strategy & Business Development, Kongsberg Maritime. For example, a primary shaft-driven PTO rotates whenever the engine is running; a secondary one

-

)

February 2024 - Maritime Reporter and Engineering News page: 35

)

February 2024 - Maritime Reporter and Engineering News page: 35PTI/PTO 30 years ago shaft generators with PTI capability kept container ships sailing at top speed. That purpose gone, PTI/PTO is making a new comeback in more cargo shipping segments, this time for reducing emissions. By Wendy Laursen etro? tting a shaft generator is not an insigni? - the ef? ciency