Oil And Gas Investments

-

- Floating Production Inventory Continues to Grow Maritime Reporter, Mar 2014 #10

The number of floating production systems continues to grow; 349 floating production units are now in service, on order or off-field/being remarketed. This inventory is 5% higher than a year ago, 27% higher than five years ago.

Current Inventory: Of the total, 320 units are used for oil/gas production. Included in this figure are 211 FPSOs. They are the most common type system, comprising 65% of the existing systems and 72% of the systems on order. The remaining consists of 10 production barges, 48 semis, 23 spars and 28 TLPs.

Another 29 units are floating LNG processing systems. This figure includes four liquefaction floaters (FLNGs), all of which are on order, and 25 regasification terminals (FSRUs) . Several of the 11 active FSRUs are interim regas units being used until the long term unit is delivered. In addition, 102 floating storage units are in service, on order or available. (See Chart Below).

FPSO Owners

There are 66 owners of FPSOs, but this overall figure disguises a relatively high concentration within a few companies. The top six FPSO owners own 95 units, or 45% of the FPSOs in service, available or on order. The remaining 55% is spread over 60 owners, more than half of which own only one FPSO. Field operators own 52% of the FPSOs. Petrobras is clearly the dominant player. It owns 28 units, 13% of the total FPSO inventory. Other field operators with large FPSO ownership are CNOOC (14 units), ExxonMobil and Total (each seven units), and BP, Chevron and Shell (5 units each).

Leasing operators own the remaining 48% of the FPSOs. SBM is the largest leasing company. It owns 17 units, 8% of the inventory. Next in line are BW Offshore and Modec (each 13 units), Teekay (10 units), Bumi Armada (7 units) and Bluewater (5 units). In terms of control of FPSOs, Petrobras is the gorilla in the sector. Counting both owned and leased units, Petrobras has 52 FPSOs under its control – 25% of the FPSOs inventory.

A list of the top FPSO owners is, right. The full list on www.imastudies.com.

Production Floater Orders

Sixty-eight production floaters are currently on order. The figure includes 36 FPSOs, 14 other oil/gas production units and 18 LNG processing units. In the later are four floating liquefaction plants and 14 regasification terminals. The order backlog has remained around 70 units since mid-2012. But the composition of orders has changed. In the current order backlog are significantly fewer FPSOs (49 on order in mid-2012 vs. 36 now) and more regasification floaters (9 on order in mid-2012 vs. 14 now).

Fewer FPSOs on order reflects the slowdown in FPSO contracts during the past year. Only 11 FPSOs were ordered in 2013, down 20% from the average ordering pace over the past 10 years. FSRUs on the other hand have been hot items. The current backlog of FSRU orders is more than 50% higher than in mid-2012. Included in the current order backlog are six speculative FSRUs being built without a use contract, reflecting the bullish market for regasification terminals.

The market over the first two months of 2014 has picked up a bit. Three production floater orders were placed in January/February.

• Petronas ordered a second FLNG for use on the Rotan field off Malaysia. The $2+ billion EPC contract was awarded to Samsung/JDC. Delivery is scheduled in 2018.

• ENI ordered a production barge for use on the Jangkrik field off Indonesia. The $1.1 billion EPCI contract was awarded to Saipem/Hyundai/Chiyoda/Tripatra. Delivery is to be at end 2016.

• Exmar/Pacific Rubiales ordered a regas barge in anticipation of using the unit on a future terminal project. Wison Nantong will build the hull and handle the unit integration. Delivery is scheduled in late 2015.

Two other production floater contracts appear to have reached an advanced stage of negotiations. Premier is about to contract for a leased FPSO for the Catcher field in the U.K. North Sea. Premier has selected the preferred bidder and BWO looks like the winner. Premier also appears to have earmarked Teekay to supply a cylindrical FPSO for the Bream field in the Norwegian North Sea. Despite the pick-up in orders in early 2014, it still looks like the production floater market is in a temporary slow period. The sector lacks the vibrancy of previous years. Causing the slowdown is a mixture of cost escalation, inefficiencies caused by local content barriers, supply chain bottlenecks, oil companies pulling back on upstream investments and better financial returns from shale/tight oil and gas investments.

236 floating production projects are in various stages of planning as of beginning March. Of these, 57% involve an FPSO, 15% another type oil/gas production floater, 22% liquefaction or regasification floater and 6% storage/offloading floater. Brazil and Africa are the major locations of floating production projects in the visible planning stage. We are tracking 51 projects in Africa, 48 projects in Brazil – 42% of the visible planned floating production projects worldwide.

In terms of future production floater requirements, Brazil is clearly the leader, as several Brazilian projects will require multiple production units (up to 12 FPSOs in one project). When these large projects are taken into account, Brazil represents almost 30% of the visible floating production system orders in the planning stage.

For this reason the downsized business plan just announced by Petrobras should cause concern in the floating production sector. In late February Petrobras said its five-year capital spending plan for 2014/18 would be almost 7% lower than the five year plan announced last year.

The Author

IMA provides market analysis and strategic planning advice in the marine and offshore sectors. Over 40 years we have performed more than 350 business consulting assignments for 170+ clients in 40+ countries. We have assisted numerous shipbuilders, ship repair yards and manufacturers in forming a a plan of action to penetrate the offshore market. Our assignments have included advice on acquiring an FPSO contractor, forming an alliance to bid for large FPSO contracts, satisfying local content requirements and targeting unmet requirements through technology development.

Tel: 1 202 333 8501

e: [email protected]

www.imastudies.com(As published in the March 2014 edition of Maritime Reporter & Engineering News - www.marinelink.com)

-

)

March 2024 - Marine Technology Reporter page: 42

)

March 2024 - Marine Technology Reporter page: 42versions Image courtesy Kongsberg Discovery are featured in the series, and all withstand reverse pressure, too, and can be installed into both dry and oil-? lled canisters. MacArtney introduced a space and weight-saving ø12.7 mm SubConn Nano, a Nano connector which offers a versatile and robust performance

-

)

March 2024 - Marine Technology Reporter page: 39

)

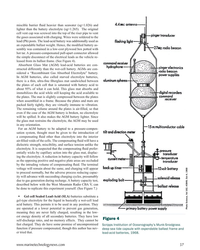

March 2024 - Marine Technology Reporter page: 397 A 35Ah AGM lead-acid battery is tested using the West Mountain Radio CBA to show the effect of simply ? lling the battery voids with mineral oil as a compensating ? uid. The CBA is programmed to cut-off at a voltage of 10.50v. The top line (red) shows the unmodi? ed AGM battery capacity of

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36, Thus, there are no implodable spaces, and so are candidate and UPS, have speci? c guidelines available on their websites. cells for pressure-balanced, oil-? lled (PBOF) assemblies. This author has personally tested pouch LiPos to 20,000 psi im- Lead-Acid: The venerable lead-acid battery comes in three

-

)

March 2024 - Marine Technology Reporter page: 35

)

March 2024 - Marine Technology Reporter page: 35.com/BPD.htm). have been tested ? Alkaline (alkaline-manganese dioxide): These prima- ry cells are available in the widest number of standard sizes, in oil-? lled bags and are commonly available around the world. This is handy to pressures of 20,000psi without if you are in a remote port and need

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’ Merlin riser systems

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

April 2024 - Maritime Reporter and Engineering News page: 47

)

April 2024 - Maritime Reporter and Engineering News page: 47.com Powering the fleet for 60 years! HYDRAULIC NOISE, SHOCK AND VIBRATION SUPPRESSOR Noise, Shock, VibraO on & PulsaO on in Quiet, Smooth Flow Out Oil Bladder Nitrogen (blue) Manufactured by MER Equipment Three Stage Noise & PulsaO on in ReducO on Chamber (206) 286-1817 www.merequipment.com QUALITY

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42OPINION: The Final Word Seeing the Ship as a System Shipping must engage with the decarbonization realities that lie ahead by changing the way it crafts maritime legislation to re? ect its place in the interconnected, interdependent world economy, said Eero Lehtovaara, ABB Marine & Ports. ABB Marine &

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications • DGPS coastal differential global positioning systems • VHF port communication systems Nautel

-

)

April 2024 - Maritime Reporter and Engineering News page: 39

)

April 2024 - Maritime Reporter and Engineering News page: 39Tech Files Latest Products, Systems and Ship Designs “Wall Climbing Robot” Danish Pilot calls gets ClassNK Nod LEGO Model "A tribute build to a work life at sea" Image courtesy MOL, Sumitomo Heavy Industries lassNK granted its Innovation Endorse- Image courtesy Espen Andersen/DanPilot ment for

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38, including collecting MARPOL liquid The tanker vessel Archangel, 274 meters long and 85,474 and solid waste, transporting personnel and provisions, and oil gt, was moored using the 3-ton pulling capacity of the moor- spill response services. Images courtesy Consulmar Crowley's New LNG Containerships Carbon

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35becoming as interconnected as onboard sys- size training materials, including micro-learning videos, gam- tems. Kongsberg Digital has integrated NORBIT’s oil spill ing apps, VR programs and online mentoring. detection system with its K-Pos DP system for simulation- “These digital methods are more effective

-

)

April 2024 - Maritime Reporter and Engineering News page: 34

)

April 2024 - Maritime Reporter and Engineering News page: 34scenarios, but zooming in, the industry is now working on more speci? c targets. By Wendy Laursen Image above: Kongsberg Digital has integrated NORBIT’s oil spill detection system with its K-Pos DP system for simulation-based training of offshore professionals at Equinor. 34 Maritime Reporter & Engineering

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32? xed wind. The subsidies won’t be a plentiful, and then a second on a luf? ng jib. This reduces the time it would there won’t be the same downturn in oil and gas that made all ordinarily take, weeks, to recon? gure the wiring of an ordi- the high-spec construction vessels available at attractive rates

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25vessels can MSC will see up to 20 new ships deliver to carry the equivalent of 30 C-17 transports. the ? eet in the next ? ve years. This includes new oil- Our Combat Logistics Force (CLF) is the key to keep- ing our ships at sea and in the ? ght, and sustain our forces ers, towing, salvage and rescue

-

)

April 2024 - Maritime Reporter and Engineering News page: 21

)

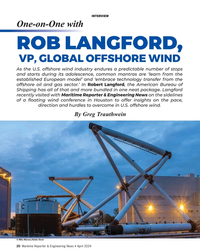

April 2024 - Maritime Reporter and Engineering News page: 21along with our continued support to the in a UK design ? rm working in the North Sea marine industry,” said Langford. “We continue to hire key in- oil and gas platforms, the holy grail of rigorous dividuals and partner to provide best-in-class solutions.” R conditions in offshore energy production

-

)

April 2024 - Maritime Reporter and Engineering News page: 20

)

April 2024 - Maritime Reporter and Engineering News page: 20and starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas sector.’ In Robert Langford, the American Bureau of Shipping has all of that and more bundled in one neat package. Langford recently visited

-

)

April 2024 - Maritime Reporter and Engineering News page: 19

)

April 2024 - Maritime Reporter and Engineering News page: 19more exposed to redeployment risk and there re- mains a concern that overbuilding of a commoditized vessel may result in future oversupply as seen in the oil & gas OSV space in the 2008-2014 period. www.marinelink.com 19 MR #4 (18-33).indd 19 4/5/2024 8:13:37 A

-

)

April 2024 - Maritime Reporter and Engineering News page: 18

)

April 2024 - Maritime Reporter and Engineering News page: 18through dual fuel near shore Taiwanese market, which is also actively served by engines and (space for) a bunkering system. Currently metha- CTVs. Oil & gas offshore support vessels have been widely nol is a preferred energy carrier although hydrogen and liquid deployed to support construction logistics

-

)

April 2024 - Maritime Reporter and Engineering News page: 17

)

April 2024 - Maritime Reporter and Engineering News page: 17or under construction in the North Euro- pean wind segment. Tier 2 and Tier 3 walk-to-work (W2W) vessels are cur- rently active in the segment, but as oil www.marinelink.com 17 MR #4 (1-17).indd 17 4/5/2024 8:40:33 A

-

)

April 2024 - Maritime Reporter and Engineering News page: 16

)

April 2024 - Maritime Reporter and Engineering News page: 16charter to a wind turbine OEM or offshore wind in-built crane and gangway. farm operator to service and maintain equipment dur- ¦Tier 2: Generally, oil & gas tonnage (MPSVs, PSVs, ing the operations period of the wind farm. A typical etc.) with ? xed gangway, serving oil & gas and SOV will accommodat

-

)

April 2024 - Maritime Reporter and Engineering News page: 15

)

April 2024 - Maritime Reporter and Engineering News page: 15hydro-acoustic design of a propulsor that delays cavitation meets its underwater noise limits. This will require specialized inception and cavitating area. The third approach should be test sites or specialized mobile underwater testing equipment. isolation mounting of a vibro-active equipment and

-

)

April 2024 - Maritime Reporter and Engineering News page: 11

)

April 2024 - Maritime Reporter and Engineering News page: 11wide culture of continuous improvement and Cooper safety awareness. Captain Aaron Cooper is a Master Mariner with 30 years of experience in the oil and gas industry. He is the programmes A Cultural Shift director at OCIMF. With standardized data collection and sharing protocols, THE LEADER SLIDING