Oil And Gas Supply

-

- OP/ED: Offshore Wind Marine News, Sep 2019 #20

Set to Soar, Taking Offshore Support Industry With it.

Offshore energy development is opening a new front in the United States -- the Atlantic seaboard, with strong winds, a shallow continental shelf and a proximity to dense population centers is driving strong interest in offshore wind development. The offshore oil and gas supply chain stands to benefit in a big way from billions in coming investment. In fact, it is already playing a role.Companies in the Gulf of Mexico, which traditionally support the offshore oil and gas sector, helped build and install the nation’s first offshore wind project, the Block Island Wind Farm (BIWF), which has been operating offshore Rhode Island since 2016. Louisiana-based Gulf Island Fabrication, Inc. constructed the jacket foundations supporting BIWF’s five turbines. Lift boat operator Falcon Global (formerly Montco Offshore), also based in Louisiana, provided feeder vessels and crews to install BIWF.

While a landmark project, the five turbine, 30 MW BIWF is small compared to the much larger commercial scale projects that are on the horizon. Today, offshore wind projects totaling 3,110 MW of capacity are contracted to provide electricity in Rhode Island, Massachusetts, Connecticut, New York, New Jersey, Maryland and Virginia. Additional offshore wind power contracts are expected to be signed in New York and Maine in 2019, bringing to eight the total number of states to which offshore wind power will soon be providing electricity.

And, this is just the tip of the iceberg. Many of the same Atlantic states have their own offshore wind power commitments stretching to 2030 and beyond. In addition to the 3,110 MW of offshore wind projects already contracted to supply power, contracts are expected to be signed for approximately 17,000 MW of additional projects as a result of state commitments by 2030, bringing the total forecasted amount of contracted offshore wind power between 2020 and 2030 to over 20,000 MW.

To date, the Bureau of Ocean Energy Management (BOEM) has issued 15 active offshore wind leases that have generated $473 million to the U.S. Treasury. Much of that revenue -- $405 million-- resulted from the December 2018 sale of three wind leases offshore Massachusetts. This record setting sale demonstrates the potential for huge amounts of revenue to the government from future offshore wind lease sales.

The promise of this new American energy industry is tremendous. Offshore wind is poised to make significant job, manufacturing, and infrastructure contributions not only along the Gulf Coast and other coastal states but also throughout the country. Significant investments are already being made to improve port infrastructure, train workers, construct crew vessels, and develop supply chains.

In a recent white paper, the University of Delaware’s Special Initiative on Offshore Wind (SIOW) estimates that America's growing offshore wind power industry – projected to generate 18.6 GW of clean, cost-effective power in seven states on the Atlantic Seaboard by 2030 – presents a nearly $70 billion CAPEX revenue opportunity to businesses in the offshore energy supply chain. The report identifies significant opportunities for companies that will build, supply and support the U.S. offshore wind sector, including the need to procure, fabricate and install 1,700 wind turbine generators, 1,750 subsea foundations, 45 offshore substations, 16 onshore substations and approximately 5,000 miles of cable. While this capital investment alone is massive, the operations and maintenance needs will also be substantial, driving their own supply chain demands and opportunities.

The stage is set for offshore wind to boom off our Atlantic coast, and with BOEM working to start the process in the Pacific, developers and companies in the offshore energy supply chain need to get ready to build. To that end, the National Ocean Industries Association (NOIA) and the Offshore Marine Service Association (OMSA) are jointly hosting an offshore wind summit in New Orleans on September 19th to further our industry’s understanding of the emerging U.S. offshore wind market and the opportunities it presents. Details of the NOIA-OMSA Offshore Wind Summit: Advancing U.S. Vessel Opportunities in the Emerging Offshore Wind Sector are available at www.offshoremarine.org.

The emerging U.S. offshore wind sector provides a tremendous opportunity for U.S. companies that actively get in and engage. With the inherent synergies between offshore wind and offshore oil and gas with respect to jobs, manufacturing, and expertise, opportunities abound for companies that have traditionally supplied and serviced the offshore oil and gas industry.

While competition from established supply chain providers in Europe will be significant, keep in mind that offshore wind is not just an American or European industry. Interest in offshore wind is growing globally, and companies that engage in this space domestically will have the tools to compete as Asia, Africa, the Middle East and others look to this affordable energy resource as a key to the future.

The U.S. offshore oil and gas supply chain is full of companies that have experienced ups and downs and jumped into new industry opportunities (think deepwater) with both feet fighting for domestic and global market share. Offshore wind offers a similar dynamic; it is a win-win opportunity for all involved. Wind companies get the unrivaled expertise and skill of companies operating offshore in the Gulf of Mexico, and in turn, service companies tap a new revenue stream, learn a new industry, and can export their expertise globally in the future, driving growth and opportunity worldwide.

Offshore wind has arrived in the U.S. and is set to soar; those who grab it today will be positioned to take flight.

Nicolette Nye is Vice President of Communications and Member Development of the National Ocean Industries Association (NOIA) in Washington, DC. She staffs NOIA’s Offshore Renewables Committee. She joined the staff of NOIA in 2008, after nearly a decade at the Department of the Interior’s Minerals Management Service (MMS). A retired Navy Chief Petty Officer, Nicolette served her final two military tours in Hawaii, where she was Senior Journalist for the Commander in Chief, U.S. Pacific Command and Force Journalist for the Commander Submarine Force Pacific. She served two tours in Japan as a broadcast journalist at the Far East Network in both Misawa and Yokota. Nicolette serves on The National Oceanic and Atmospheric Administration (NOAA) Ocean Energy Advisory Board (OEAB).

This article first appeared in the September 2019 print edition of MarineNews magazine.

-

- Asia Pacific Spill Response OSRL Increases Capabilities Maritime Reporter, Jul 2013 #34

subsea well intervention services to our members and stakeholders in the region,” said OSRL Chief Executive Robert Limb. Located within a dedicated oil and gas supply facility with wharf access and in proximity to key airports, the new base is strategically placed for OSRL to mount an emergency response either

-

- Floating Production System Orders Outlook Maritime Reporter, May 2014 #12

remains in the $100 to $110 range and deepwater drillers are operating at high utilization. But the sector is hitting competition from shale/tight oil and gas supply, energy companies have been cutting capital spending budgets and deepwater drillers are not quite as bullish as in recent past. Growing

-

- Wind Energy Workboats: A US Offshore Build-up Maritime Reporter, Nov 2017 #60

. States have power companies buying offshore wind energy, and experienced offshore operators are hiring the new wind-service vessels from elements of their oil-and-gas supply chain. The Jones Act, too, is being overcome by fleet owners and designers joining the U.S. offshore wind build-up. “The algorithms

-

- Wind Energy: The Good News in Offshore Marine Technology, Sep 2017 #40

. States have power companies buying offshore wind energy, and experienced offshore operators are hiring the new wind-service vessels from elements of their oil-and-gas supply chain. The Jones Act, too, is being overcome by fleet owners and designers joining the U.S. offshore wind build-up. “The algorithms

-

- Opportunities Gust Off US Shores Marine News, Sep 2020 #27

her Network’s mission of tying together disparate players, Burdock added, “It’s also a great technology that can incorporate our oil and gas supply chain…that helps [offshore oil and gas participants] move into offshore wind.”There are other business angles. In early August,

-

)

March 2024 - Marine Technology Reporter page: 42

)

March 2024 - Marine Technology Reporter page: 42versions Image courtesy Kongsberg Discovery are featured in the series, and all withstand reverse pressure, too, and can be installed into both dry and oil-? lled canisters. MacArtney introduced a space and weight-saving ø12.7 mm SubConn Nano, a Nano connector which offers a versatile and robust performance

-

)

March 2024 - Marine Technology Reporter page: 39

)

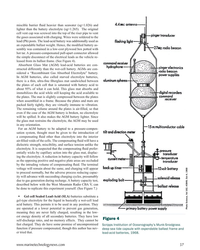

March 2024 - Marine Technology Reporter page: 397 A 35Ah AGM lead-acid battery is tested using the West Mountain Radio CBA to show the effect of simply ? lling the battery voids with mineral oil as a compensating ? uid. The CBA is programmed to cut-off at a voltage of 10.50v. The top line (red) shows the unmodi? ed AGM battery capacity of

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36, Thus, there are no implodable spaces, and so are candidate and UPS, have speci? c guidelines available on their websites. cells for pressure-balanced, oil-? lled (PBOF) assemblies. This author has personally tested pouch LiPos to 20,000 psi im- Lead-Acid: The venerable lead-acid battery comes in three

-

)

March 2024 - Marine Technology Reporter page: 35

)

March 2024 - Marine Technology Reporter page: 35.com/BPD.htm). have been tested ? Alkaline (alkaline-manganese dioxide): These prima- ry cells are available in the widest number of standard sizes, in oil-? lled bags and are commonly available around the world. This is handy to pressures of 20,000psi without if you are in a remote port and need

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’ Merlin riser systems

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 19

)

March 2024 - Marine Technology Reporter page: 19About the Author vey with the pipe tracker is not required, resulting in signi? - Svenn Magen Wigen is a Cathodic Protection and corrosion control cant cost savings, mainly related to vessel charter. expert having worked across The major advantage of using FiGS on any type of subsea engineering, design

-

)

March 2024 - Marine Technology Reporter page: 8

)

March 2024 - Marine Technology Reporter page: 8INSIGHTS SUBSEA DEFENSE Copyright RomanenkoAlexey/AdobeStock WHEN THE SHOOTING STOPS: BLACK SEA MINE CLEARANCE WILL FEATURE ADVANCED TECH, CONOPS By David Strachan, Senior Analyst, Strikepod Systems ince the beginning of the war in Ukraine, mine warfare mines have been the weapon of choice for both

-

)

April 2024 - Maritime Reporter and Engineering News page: 3rd Cover

)

April 2024 - Maritime Reporter and Engineering News page: 3rd CoverYour Specialist Ofshore Lubricant Partner T Togeth her w we go o furt ther r Our commitment to customer service and technical support extends to ofshore operations. With our robust global supply chain, we deliver the optimal marine lubrication solution to your ?eet, precisely when and where it’s needed.

-

)

April 2024 - Maritime Reporter and Engineering News page: 48

)

April 2024 - Maritime Reporter and Engineering News page: 48Index page MR Apr2024:MN INDEX PAGE 4/5/2024 1:33 PM Page 1 ANCHORS & CHAINS MILITARY SONAR SYSTEMS tel:+44 (0) 1752 723330, [email protected] , www.siliconsensing.com Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Massa Products Corporation, 280 Lincoln Street, SONAR TRANSDUCERS

-

)

April 2024 - Maritime Reporter and Engineering News page: 47

)

April 2024 - Maritime Reporter and Engineering News page: 47.com Powering the fleet for 60 years! HYDRAULIC NOISE, SHOCK AND VIBRATION SUPPRESSOR Noise, Shock, VibraO on & PulsaO on in Quiet, Smooth Flow Out Oil Bladder Nitrogen (blue) Manufactured by MER Equipment Three Stage Noise & PulsaO on in ReducO on Chamber (206) 286-1817 www.merequipment.com QUALITY

-

)

April 2024 - Maritime Reporter and Engineering News page: 42

)

April 2024 - Maritime Reporter and Engineering News page: 42OPINION: The Final Word Seeing the Ship as a System Shipping must engage with the decarbonization realities that lie ahead by changing the way it crafts maritime legislation to re? ect its place in the interconnected, interdependent world economy, said Eero Lehtovaara, ABB Marine & Ports. ABB Marine &

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications • DGPS coastal differential global positioning systems • VHF port communication systems Nautel

-

)

April 2024 - Maritime Reporter and Engineering News page: 39

)

April 2024 - Maritime Reporter and Engineering News page: 39Tech Files Latest Products, Systems and Ship Designs “Wall Climbing Robot” Danish Pilot calls gets ClassNK Nod LEGO Model "A tribute build to a work life at sea" Image courtesy MOL, Sumitomo Heavy Industries lassNK granted its Innovation Endorse- Image courtesy Espen Andersen/DanPilot ment for

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38, including collecting MARPOL liquid The tanker vessel Archangel, 274 meters long and 85,474 and solid waste, transporting personnel and provisions, and oil gt, was moored using the 3-ton pulling capacity of the moor- spill response services. Images courtesy Consulmar Crowley's New LNG Containerships Carbon

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35becoming as interconnected as onboard sys- size training materials, including micro-learning videos, gam- tems. Kongsberg Digital has integrated NORBIT’s oil spill ing apps, VR programs and online mentoring. detection system with its K-Pos DP system for simulation- “These digital methods are more effective

-

)

April 2024 - Maritime Reporter and Engineering News page: 34

)

April 2024 - Maritime Reporter and Engineering News page: 34scenarios, but zooming in, the industry is now working on more speci? c targets. By Wendy Laursen Image above: Kongsberg Digital has integrated NORBIT’s oil spill detection system with its K-Pos DP system for simulation-based training of offshore professionals at Equinor. 34 Maritime Reporter & Engineering

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32? xed wind. The subsidies won’t be a plentiful, and then a second on a luf? ng jib. This reduces the time it would there won’t be the same downturn in oil and gas that made all ordinarily take, weeks, to recon? gure the wiring of an ordi- the high-spec construction vessels available at attractive rates

-

)

April 2024 - Maritime Reporter and Engineering News page: 29

)

April 2024 - Maritime Reporter and Engineering News page: 29RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND U.S. Navy photo by Bill Mesta/released U.S. Navy photo by Ryan Carter Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command, visits USNS Patuxent (T-AO 201) for a tour of the ship at Naval Station Norfolk, Va., November 20, 2023.

-

)

April 2024 - Maritime Reporter and Engineering News page: 28

)

April 2024 - Maritime Reporter and Engineering News page: 28to be placed on a number of our ships to add additional capability. MSC can also lease ship or contract Military Sealift Command’s ? eet replenishment oiler USNS Joshua Humphreys for services as needed. For example, we (T-AO 188) sends fuel to MSC’s fast combat support ship USNS Arctic (T-AOE have

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25vessels can MSC will see up to 20 new ships deliver to carry the equivalent of 30 C-17 transports. the ? eet in the next ? ve years. This includes new oil- Our Combat Logistics Force (CLF) is the key to keep- ing our ships at sea and in the ? ght, and sustain our forces ers, towing, salvage and rescue

-

)

April 2024 - Maritime Reporter and Engineering News page: 23

)

April 2024 - Maritime Reporter and Engineering News page: 23up pace, Langford proposes that in the U.S. market, a correctly paced approach to suit supporting supply chain might be best in the long term. “It really boils down to Visit us at OTC 2024 further demonstrations … let’s build it. But let’s not try and Booth # 1338 3030 E. Pershing St. do everything at

-

)

April 2024 - Maritime Reporter and Engineering News page: 21

)

April 2024 - Maritime Reporter and Engineering News page: 21along with our continued support to the in a UK design ? rm working in the North Sea marine industry,” said Langford. “We continue to hire key in- oil and gas platforms, the holy grail of rigorous dividuals and partner to provide best-in-class solutions.” R conditions in offshore energy production