Transportation

-

- U.S.-FLAG CRUISING: READY TO SAIL? Maritime Reporter, Jul 1992 #16

New Gaming Law First Step In Opening Lucrative Market To U.S. Operators * Editor's Note: The Transportation Institute is a maritime trade association based in the Washington, D. C.

area which represents more than 140 U.S.-flag shipping companies engaged in the nation's foreign and domestic waterborne commerce.

Among the institute's members are American Hawaii Cruises, operating the only two deep-draft U.S.-flag cruise ships, and Delta Queen Steamboat company, which operates on the nation's inland rivers.

Interest among the institute's member companies in U.S.-flag cruise activities and gaming boat operations has increased as a result of recent developments. Those companies offer vessel management services, ownership and investment opportunities.

Recently President Bush signed into law P.L. 102-251, which included provisions to partially redress the inability of potential U.S.- flag cruise operators to offer onboard gaming as is done on foreign-flag ships serving U.S. ports.

While important, the significance of the legislation is apparently misunderstood by some observers of the cruise industry and distorted by others.

One widely read marine publication declared the law a failure because no U.S.-flag vessels had been built within six weeks of passage.

One must wonder how even meeting with designers could be scheduled in that timeframe, let alone signing a contract, ordering materials and building a vessel in only six weeks.

One problem does remain, however, which limits the short term impact of the legislation in opening up the day cruise market. When E L.

102-251 was passed it amended the Gambling Devices (Johnson) Act regarding the possession and transport of gaming equipment. It did not address the poorly crafted, ill defined Gambling Ship Act which prohibits U.S. citizen involvement in ships used "principally" for the purpose of gaming or offering "large scale commercial gambling." Unfortunately, those terms are not explained anywhere in federal law. In April 1991, the U.S. Department of Justice (DOJ) attempted for the first time in 40 years to explain the meaning of the law.

Essentially, DOJ said that a ship offering gaming was a gambling ship unless it called on a foreign port every voyage or stayed at sea for more than 24 hours and offered food service and cabins to all passengers.

DOJ then went on to say that their statement was only "guidance" not clarification and enforcement was up to the various federal attorneys whose replacement in the future could view the "guidance" differently.

In any event according to DOJ, a vessel could meet the guidance and still be in violation of, or fail to meet it and not violate the Gambling Ship Act. Since, with one exception, foreign- flag cruises-to-nowhere are apparently immune from DOJ action only prospective U.S.-flag operators continue to suffer the inequity.

Each state has the authority to control or prohibit cruises-to-nowhere on the intrastate itineraries.

EnactmentofEL. 102-251 didclarify beyond a doubt the ability of U.S.-flag vessel to conduct gaming operations on international or inter- state voyages which will be beneficial over the long term. The law, however, is not an end unto itself and was not thought of by supporters as being such. Just as casino gaming is now an important source of onboard revenue for foreign-flag operators, it soon will be an important key to success for U.S.-flag operators as well. It is an important first step and further indication of the sea change which is occurring with regard to U.S.-flag cruise prospects To fully appreciate the importance of this development, some background is in order.

The enormous growth in the U.S.- based, foreign-flag cruise industry is, to a degree, the result of the absence of U.S.-flag competition. Until recently, less than strenuous enforcement of U.S. law and regulation against foreign-flag vessels also facilitated their operation. Without U.S.-flag competition, foreign operators were awarded the U.S. market by default. One of the reason that market grew rapidly is because of a confluence of trend among the American public, the source of 85 percent of worldwide cruise passengers. Significant among those trend is the willingness to spend greater amounts of disposable income for leisure activities. In spending that income, however, Americans are taking more, but shorter vacations.

Two increasingly popular leisure activities among Americans are cruise vacations/excursions and gamingpursuits. Theparallel growth of those two activities has been a major factor in the development of the cruise sector. By not recognizing those trends and not removing competitive obstacles which prevented involvement by U.S.-flag operators, the industry became predominately a foreign-flag community [see table, page 8]. Where offshore shipboard gaming is involved, it has been an entirely foreign domain. That largely unregulated floating gaming industry is based in the United States and caters mostly to an American clientele, an irony not lost on the U.S.

Government.

According to Gaming & Wagering News, from 1982 to 1990 the gross annual wager of the United States grew at 10.82 percent yearly, jumping from $125.7 billion to $286.2 billion, a staggering 127.55 percent increase. In 1990, $1.8 billion of that amount was wagered in shipboard casinos and an undetermined amount via shipboard lotteries. Most of that money was wagered by Americans, but none on U.S.-flag ships.

Studies done for cruise lines indicate that passengers prefer shipboard casinos to be larger, better appointed and open longer hours.

Thus, shipboard gaming will eventually make an even greater contribution to the industry's bottom line.

The fact that onboard gaming is critical to the success of the cruise industry awakened the U.S. Government to the need to grant equal treatment to its own national fleet.

A parallel development which also heightened official awareness and illuminated the possibilities for U.S.

marine industries has been the rapid growth of state-authorized onboard gaming. The phenomenon began in Iowa with the first boat beginning operation in April 1991. Illinois followed shortly thereafter with the first operation beginning in Alton in September 1991. Since that time Mississippi, Louisiana, and Missouri have passed legislation which authorize waterborne gaming, although Missouri voters will have to approve it in a statewide referendum in November and Mississippi voters have a mixed record of approval in county referendums, there is interest in at least 15 other states.

The market has not yet matured nationwide, although there has already been some repositioning of equipment from one market (Iowa) to another (Mississippi). While the state level activities comprise an industry unto itself, there are also some factor which underscore the potential for U.S.-flag cruise activities.

To date, state level waterborne gaming has been focused exclusively on inland waterways. The predominant inland gaming vessel configuration has been the paddlewheeler.

That is primarily the result of a state requirement, usually related to the heritage factor in promoting gaming boats as hubs for tourism development. As the industry moves into tidewater states where gaming vessels will have to cruise on open saltwater, larger monohull and especially SWATH vessels will be utilized.

The latter design in particular portends well for U.S. interests.

As the recent launch of the Radisson Diamond indicates [see this month's cover story], there is much interest in this design for cruise purposes. The United States is particularly well situated to capitalize on interest in the SWATH approach. U.S. yard have built several SWATH vessels and an American firm designed the interiors on the Radisson ship. Currently, Ocean Systems, Navatek and SwathTech America (in conjunction with J.J.

McMullen, Studio Bertolotti and McDermott, Inc.) all have impressive gaming boat designs available.

SwathTech America through its marketing arm, WorldSwath, also has developed a revolutionary cruise ship design using a SWATH configuration for carrying up to 1,500 passengers.

That directly addresses another obstacle to U.S.-flag cruise activity which is the perceived inability of U.S. shipyards to deliver a quality cruise ship on time and at a reasonable price. Again, the current situation is dramatically different from just a short time ago. U.S. shipyard labor costs are substantially lower than those in most countries which build cruise ships. Also, the extensive U.S. Navy construction work, which sustained the American shipbuilding base, is rapidly disappearing.

Consequently, some major and mid-size American yards are looking at cruise ship projects and discussing teaming arrangements with prominent European designers and builders in order to transfer technology and management expertise. This latter development prompted the President of one of the world's leading cruise lines to state at an industry conference that: "Fortunately, there are some exceptions and some competitive U.S. yards. With the proper investment, effort and motivation, I am convinced that they could redevelop the ability to construct cruise vessels on an internationally competitive basis." Already, some of the reluctance to seriously consider an American shipbuilding or design alternative is being alleviated by the development of the domestic gaming boat sector.

Boats designed for some markets will have a capacity for up to 3,500 passengers and, in addition to the obvious casino, will include other onboard amenities such as dining rooms, lounges, shops, arcades, etc.

of significant size and complexity. It must be remembered that the gaming boat industry is less than two years old. Notably, U.S. shipyards, designers and marine architects have demonstrated an ability to provide large, soundly built vessels, with well-appointed public spaces of a quality level sufficient to meet the demands of the existing market.

Also, operators of inland gaming boats pay substantial licensing fees, state taxes, some as high as 20 percent of adjusted gross gaming revenue, per passenger taxes and a variety of local fees in addition to the usual state and federal corporate taxes. Those operators utilize large onboard crews and shoreside staff at prevailing U.S. wages and under state and federal labor regulations.

The structure of administrative rules, regulation and daily oversight are extensive and time consuming.

Yet that structure has not stopped the industry from prospering, especially in jurisdictions with less onerous requirements. In 1991, with less than a full year of operation, the gaming boats were the most popular new tourist attraction in the United States according to a travel industry survey. To date, more than 4.5 million people sailed on only eight gaming boats generating more than $165 million in adjusted gross gaming revenue. At least seven more boats are coming on line in Illinois.

In addition to those impressive figures can be added revenues from passage, dining/bars and gift shop/ arcades. The foreign-flag cruise industry may boast to potential investors in public offerings that it weathered the recession and Operation Desert Storm. During the same period, however, an All-American industry exploded and is still growing!

Some analysts are beginning to reexamine the outdated belief that U.S. operating costs are prohibitive and regulations too burdensome.

While certainly different from the cruise sector, the experience in the gaming boat market coupled with recent developments in federal law is a strong indicator that a U.S.-flag cruise operation can succeed.

A splendid array of coastwise and nearby foreign itineraries, enhanced shipboard convention deductibility, and shipboard gaming coupled with marketing an American product will all help to propel the development of a U.S.-flag cruise fleet. Not all the steps have been taken, but the progress made thus far and a growing determination on the part of U.S. marine industries to play a greater role will eventually launch a U.S.-flag industry which will not only survive but prosper

-

- A Call for Transportation Management Upgrades Maritime Reporter, Apr 2013 #26

Reduce the Headaches: The Need for an Upgraded Transportation Management System In 2009, the United States alone shipped more than 2.2 billion pounds of goods such as coal, crude materials like wood, sand and gravel, and primary manufactured goods (United States Census Bureau). Undoubtedly, this required

-

- Insights: Outgoing Transportation Sec. Connaughton Marine News, Feb 2014 #12

Outgoing Secretary of Transportation for the Commonwealth of Virginia Until January of this year, Sean Connaughton oversaw seven state agencies with more than 9,700 employees and combined annual budgets of $5 billion. Connaughton is probably better known to MarineNews readers as the U.S. Department of

-

- MN 100: Bouchard Transportation Marine News, Aug 2015 #16

The Company: Bouchard Transportation’s history dates back to its incorporation in 1918 by founder, Capt. Fred Bouchard, the youngest tugboat captain in the Port of New York. Bouchard is a family owned business and the nation’s largest independently-owned ocean-going petroleum barge company. The company’s

-

- MN100: Tidewater Transportation and Terminals Marine News, Aug 2016 #89

The Company: Nearly 85 years ago, Tidewater pioneered commercial transportation on the upper Columbia Snake River system and opened up one of the nation’s most isolated regions to global markets. Today, Tidewater Holdings is comprised of Tidewater Barge Lines, Tidewater Terminal Company, and since 2014

-

- MN100: GE Transportation Marine Marine News, Aug 2016 #26

The Company: GE Transportation is a global digital industrial leader and supplier to the marine industry. Established more than a century ago, GE Transportation is a division of the General Electric Company that began as a pioneer in passenger and freight locomotives. That innovative spirit still drives GE

-

- W.L. Bull Jr. Named Marine Transportation Director For NLFI Maritime Reporter, Oct 1977 #65

Northern Liquid Fuels International, Ltd. (NLFI), Houston, Texas, has named William L. Bull Jr. director of marine transportation. Mr. Bull, formerly manager of supply and t r a n s p o r t a t i o n for Tropigas International Corporation in Miami, Fla., will be responsible for the operation of

-

- Study 56—'Sea Trade And Transportation Of Coal' Maritime Reporter, Nov 15, 1977 #41

sizes employed in the coal trade and the constraints imposed upon these by ports, concluding with a discussion of the future trends in sea transportation. For a copy of Study No. 56— "SEA TRADE AND TRANSPORTATION OF COAL," write to HPD Shipping Publications, 34 Brook Street, Mayfair, London W1Y

-

- W.H. Blaylock Joins Energy Transportation As Safety Coordinator Maritime Reporter, Jun 15, 1976 #39

William H. Blaylock Jr. has joined Energy Transportation Corporation, 540 Madison Avenue, New York, N.Y., as safety coordinator. Upon completion of studies at Georgia Institute of Technology, Mr. Blaylock served with the U.S. Coast Guard for over 26 years as recruit training instructor, operations

-

- Los Angeles Sections—SNAME, MTS, ASNE—Discuss LNG Needs, Transportation And Shore Facilities Maritime Reporter, Apr 1977 #50

present time exceeds the capabilities of the United States to meet. He was thus premising the need for importing LNG into this country by marine transportation. He drew the correlation between that of our own nation and that of other countries both as to the supply and demand, now and for the future

-

- A g r i - T r a n s Elects Paul J. Staadeker VP Transportation Maritime Reporter, Dec 1978 #14

Paul J. Staadeker has been elected vice president, Transportation Services for Agri-Trans Corporation in Long Grove, 111., reporting to R.A. Wilson, executive vice president and general manager. Mr. Staadeker will have responsibility for equipment dispatch, traffic management, member services

-

- CF Industries Names R.A. Wilson To Head Transportation Group Maritime Reporter, Jan 1977 #10

CF Industries, Inc., manufacturer and distributor of basic chemical fertilizers, has named Richard A. Wilson to head its newly formed transportation management group. According to a statement by D.V. Borst, executive vice president and general manager, Plant Food Division, the reorganization

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43restraint on any haste to participation included a "Transition in er systems would include an outline reform CII until a better understanding Transportation" panel session covering of standards for secure data exchange, of the impact of changing vessel speeds how to reduce shipping’s carbon foot-

-

)

April 2024 - Maritime Reporter and Engineering News page: 24

)

April 2024 - Maritime Reporter and Engineering News page: 24assumes the title of MSC’s Flag Aide during the ceremony. NEEDS MILITARY MORE SEALIFT MARINERS, NEW SHIPS COMMAND Founded as the Military Sea Transportation Service (MSTS) and renamed Military Sealift Command in 1970, MSC today not only support the Navy, but we are the Department of Defense’s provider

-

)

April 2024 - Maritime Reporter and Engineering News page: 23

)

April 2024 - Maritime Reporter and Engineering News page: 23offshore wind; and the foreign ? ag Maersk supply WTIV at Seatrium Singapore, together with U.S. ? ag feeder ATBs for transportation and installation of the Empire Wind. Three newbuild SOVs and three conversions/retro? ts were award- ed, too, and 22 CTVs were also announced. The ? rst US rock installa

-

)

April 2024 - Maritime Reporter and Engineering News page: 12

)

April 2024 - Maritime Reporter and Engineering News page: 12Prius Prime is the green- where we concluded that methanol is a prom- est car you can buy in the United States. ising sustainable liquid fuel for transportation The Council assesses vehicle “green scores” not only by Mdevices when batteries cannot do the job. While their on-road emissions, but also upstream

-

)

April 2024 - Marine News page: 40

)

April 2024 - Marine News page: 40, built by C&C Marine and Repair in Belle 12-inch General Eisenhower, and the 8-inch General Swing. Esperanza “Hope” Andrade The Texas Department of Transportation (TxDOT) christened its new ferry in Galveston Bay. Named for the ? rst female chair of the TxDOT and ? rst Latina Secre- tary of State, Esperanza

-

)

April 2024 - Marine News page: 21

)

April 2024 - Marine News page: 21the vi- ACP writes that when Atlantic projects are built “the opti- mal wind turbine generator (WTG) height would exceed ability of the Marine Transportation System (MTS), and this restriction” and that “a condition restricting height to the USCG is closely tracking issues of competing ocean uses

-

)

April 2024 - Marine News page: 18

)

April 2024 - Marine News page: 18of ploited. The International Ship and Port Facility Security the most vulnerable areas is the security around our mari- (ISPS) Code and the Maritime Transportation Security time operations. The Biden-Harris Administration’s recent Act (MTSA) of 2002 exemplify this lag, as they were con- Executive Order to

-

)

April 2024 - Marine News page: 15

)

April 2024 - Marine News page: 15seven, but it really takes now to make sure that folks understand that tug and barge a united industry, and so I just really appreciate the great transportation is the most sustainable mode of freight work of AWO members, of coalition partners, shippers, transportation? How can we make sure that our ports

-

)

April 2024 - Marine News page: 12

)

April 2024 - Marine News page: 12modalities that have been approved. We are the challenges involved as well as forthright in describing all strongly supporting the Department of Transportation’s de- the bene? ts so that folks know that the industry is out there cision to allow oral ? uid testing as a drug testing alterna- and can make

-

)

April 2024 - Marine News page: 8

)

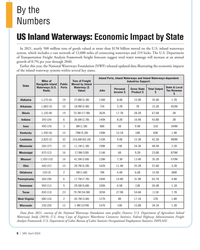

April 2024 - Marine News page: 8on the U.S. inland waterways system, which includes a vast network of 12,000 miles of connecting waterways and 219 locks. The U.S. Department of Transportation Freight Analysis Framework freight forecasts suggest total water tonnage will increase at an annual growth of 0.7% per year through 2040. Earlier

-

)

April 2024 - Marine News page: 6

)

April 2024 - Marine News page: 6naval of? cer who writes on maritime and 7 Jeff Vogel security issues. He is a regular contributor to New is a shareholder in Cozen O’Connor’s Transportation Wave Media titles. & Trade Group. He focuses his practice on strategic and operational matters affecting the United States 4 Joe Nicastro

-

)

February 2024 - Maritime Reporter and Engineering News page: 42

)

February 2024 - Maritime Reporter and Engineering News page: 42meet gled for years to recruit an operational domain to help protect safety, security, and environmental re- and retain a suf? cient the marine transportation system from quirements. A January 2022 GAO re- workforce. The U.S. Gov- threats that could be delivered through port found that the Coast Guard’s

-

)

February 2024 - Maritime Reporter and Engineering News page: 38

)

February 2024 - Maritime Reporter and Engineering News page: 38, CTO, Foreship, the prospect established infrastructure for production, storage, of generating ammonia using renewable energy sources makes and transportation. the prospect of ammonia in maritime even more attractive. “If • Global Availability: Ammonia is globally produced you do E-ammonia, going

-

)

February 2024 - Maritime Reporter and Engineering News page: 29

)

February 2024 - Maritime Reporter and Engineering News page: 29synergies,” said Ebeling. “But we have an independent board of US directors at ARC. Our chairman is General John Handy, a former commander of U.S. Transportation Command. We have a strong U.S. citizen leadership team also, and that’s really to make sure that we maintain U.S. control of the com- pany and

-

)

February 2024 - Maritime Reporter and Engineering News page: 28

)

February 2024 - Maritime Reporter and Engineering News page: 28cost the provides DoD access to MSP partici- were transported to the region, either government tens of billions of dollars pants’ global intermodal transportation on U.S.-? ag commercial ships or US. to try to replicate that … if they could network of terminals, facilities, logistic government owned

-

)

February 2024 - Maritime Reporter and Engineering News page: 12

)

February 2024 - Maritime Reporter and Engineering News page: 12waterways around the Mississippi River to levels not seen for Retaining the top spot for another year is Fire/Explosion decades, impacting global transportation of crops such as grain. with 34% of industry respondents citing it as the leading 2024 business risk for marine and shipping businesses. Although

-

)

February 2024 - Maritime Reporter and Engineering News page: 11

)

February 2024 - Maritime Reporter and Engineering News page: 11, and as long And yes, Ladies and Gentlemen, we will have entered a as there are lots of waterfront delivery points, the delivery can bene? cial transportation cycle with the ability to achieve be done in smaller moving units. Those smaller moving units massive system wide ef? ciency increases. But

-

)

February 2024 - Maritime Reporter and Engineering News page: 10

)

February 2024 - Maritime Reporter and Engineering News page: 10be packed in 8 feet wide boxes did we important, but it needs to be a single ? xed width and having achieve the incredible ef? ciency of intermodal transportation. spent a fair amount of time on this issue I am pretty certain Before that, cargo transportation was inef? cient mayhem, and that 5 feet is

-

)

February 2024 - Marine News page: 42

)

February 2024 - Marine News page: 42Jeff Bellerud as chief operating of? cer. Jonathan Daniels has been named ex- ecutive director of the Maryland Depart- Cribley Returns to C-I ment of Transportation’s Maryland Port Edison Chouest Offshore af? liate C- Administration. Innovation welcomed back Lucas Cribley as its new business development

-

)

February 2024 - Marine News page: 39

)

February 2024 - Marine News page: 39seeks to accelerate its ferry electri? cation program. The WSF ferry system, the largest in the country, is be- The Washington State Department of Transportation’s ing converted to hybrid-electric power by 2040 following (WSDOT) WSF in early December issued a request for in- mandates from the Washington

-

)

February 2024 - Marine News page: 32

)

February 2024 - Marine News page: 32Regulatoy Update Changes to MARAD’s Title XI: Good News for Offshore Wind? By Eric Haun The U.S. Department of Transportation’s Maritime Ad- U.S. shipowners to obtain new vessels from U.S. ship- ministration (MARAD) in December issued a ? nal rule yards cost effectively through long-term debt repayment

-

)

February 2024 - Marine News page: 27

)

February 2024 - Marine News page: 27other countries. That’s a slow process, however, and mercial vessels.” Buy added that it isn’t ? xing the workforce issue. NTSB follows the use and transportation of lithium In 2024, passenger safety will undoubtedly progress batteries in all modes, including maritime. Their staff in- along these many different

-

)

February 2024 - Marine News page: 23

)

February 2024 - Marine News page: 23to imagine any captain or maritime operator not paying close attention to all of the is- sues raised by the U.S. Coast Guard (USCG) or the National Transportation Safety Board (NTSB), even though most ves- sels may have little in common with a DUKW or dive boat. This broader focus yields other information

-

)

February 2024 - Marine News page: 20

)

February 2024 - Marine News page: 20Column Washington Watch Will 2024 Settle the Turbulence of US Offshore Wind? By Jeff R. Vogel, Shareholder, Cozen O’Connor’s Transportation & Trade Group There is no denying that “commercial conditions driven by in? ation, interest that 2023 was a challenging year for the U.S. offshore wind rates and