Underwater Surveillance Systems

-

- BUSINESS OPPORTUNITIES IN THE NEW NAVAL TECHNOLOGY PROGRAM Maritime Reporter, Jul 1988 #31

Over the next two years the U.S.

Navy will spend more than $18 billion on developing new systems and equipment. The program offers many exciting business opportunities for manufacturers, engineering firms, systems integrators, etc.

Spending Is Up For New Technology Navy R&D spending has grown impressively over the past 10 years.

In 1980, the Navy spent $4.6 billion for R&D. This figure has now more than doubled—to $9.5 billion in 1988 and $9.2 billion in 1989. Exhibit 1, "Trend in the Navy R&D Budget," provides details on Navy R&D spending from 1980-1989.

Range of Technology Development Navy technology development ef- forts range from the highly esoteric to the very practical. They include development of sensors for anti-air and antisubmarine warfare, C3 systems for command and control, ship and naval aircraft development, missile and torpedo engineering, electronic warfare concepts, etc.

Some of the most advanced technology is being developed—advanced composites, parallel computing, laser communications, distributed control systems, etc. And some of the more mature technology is being refined—hull forms, propeller design, mines, electric drive, navigation systems, etc.

Program Structure There are more than 270 Navy R&D programs—grouped according to stage of development: • 6.1 and 6.2 programs involve research and exploratory development; • 6.3 programs deal with advanced development; • 6.4 programs focus on system and component engineering.

Projects usually enter the system at the 6.1 or 6.2 level, transition to 6.3 when found feasible and move to 6.4 engineering as the final R&D stage. Transition into the procurement budget (SCN, WPN or OPN) follows successful test and demonstration.

Funding requirements generally increase dramatically as a project moves through this development/ production pipeline. Exhibits 2 and 3 depict project transition and a typical funding profile.

Business Strategy Successful Navy contractors have often been involved in early stages of system R&D. For example: • RCA traces its highly successful role as Aegis manufacturer and system integrator to involvement in R&D efforts in the 1960s. Procurement contracts received by RCA for Aegis systems now exceed $3 billion.

• Boeing's involvement in the Sea Lance stand-off weapon can be traced back many years to its role in early exploratory research.

• Martin Marietta's development role in vertical launch system design led to its current position as one of two VLS suppliers.

• GE's early and sustained involve- ment in sonar sensor R&D has positioned the firm as dominant sonar system supplier.

What distinguishes these firms is their use of the Navy funded R&D to: (1) establish initial position; (2) widen and deepen technical development; (3) evolve into a key developer role; and (4) transition into full production as sole source or lead manufacturer.

Opportunities exist for both large and small firms to employ similar strategy for future business development— using Navy R&D as the vehicle. This strategy entails: (1) developing an understanding of future R&D programs; (2) matching the firm's capabilities with these programs; (3) measuring the competition; (4) shortlisting programs and areas of interest; and (5) formulating and implementing a plan of action for initial entry and growth.

Entry can be either at prime or subcontract level. Contact with Navy managers in key activities will provide the basis for identifying prime contract opportunities. Contact with current prime contractors will provide the basis for establishing a position as subcontractor.

To illustrate the nature and extent of opportunities in Navy technology, one area—underwater sound surveillance systems—is described as detailed from an IMA Report.

Underwater Sound Surveillance Systems The concept of planting listening devices on the ocean floor dates from WWII. After the war, the Navy began development of deep ocean arrays of hydrophones designed to listen for submarines. Since then, a number of sound surveillance system (SOSUS) arrays have been placed in position off the U.S. coast and in overseas locations.

The IUSS program (PE 24311) is designed to improve underwater surveillance systems and hardware.

Specific work includes: (1) software development for the Wide Band Acoustic Recall; and (2) development of prototype signal characterization algorithms.

FDS (PE 63784) is a major development program to design and install an advanced undersea surveillance system using fiber optic technology employing a large number of sensors in fields or barriers. Development efforts build on Bell Laboratories' experience in commercial fiber optic communications systems.

Work involves development of multiplexer/sensor hardware, modified cable handling equipment and improved deployment technique.

Future Direction Major IUSS milestones include sea trials in October 1989 and system EDM specification in September 1990. DNSARC IIA for the FDS was scheduled in May 1988. Prototype production is planned to start in July 1989. Final design specifications are to be completed by April 1990. Procurement plans call for 7,150 NM cable, 200 clusters, 205 multiplexers/repeaters and 339 repeaters by 1992.

Comments and Issues Advances in quieting technology have greatly reduced the effectiveness of on-board listening devices.

Offboard ASW sensors are a high priority element in the Navy's future ASW strategy. Development of the IUSS will expand on existing SOSUS capability. In the longer term, the Navy hopes to develop and deploy the FDS and plans to spend almost $700 million on FDS RDT&E through program completion.

How to Order IMA's Full Report on Naval Technology A recently published report by IMA provides details for 204 specific naval technology development activities.

Current and planned efforts are described. Navy managers and current key contractors are named.

A five-year funding profile from FY 1985 through 1989 is provided for each program. Issues affecting future spending are discussed.

The report contains a four-year history of major Navy technology development and engineering contracts.

These contracts are arranged in alphabetical order according to contractor. The period covered extends from January 1984 through December 1987.

Organization charts and names of key personnel in 13 commands or laboratories involved in naval technology development are provided.

The 220-page report is available for $550. It can be obtained by contacting: International Maritime Associates, Inc., 835 New Hampshire Avenue, N.W., Washington, D.C.

20037; telephone: (202) 333-8501.

Telephone orders will be accepted.

-

- DIRECTORY U.S. NAVY BUYING OFFICES Maritime Reporter, Nov 1984 #84

responsibility for Navy and Marine Corps aircraft systems; air-launched weapons systems and subsystems; airborne electronics systems; air-launched underwater sound systems; airborne pyrotechnics; astronautics and spacecraft systems; airborne mine countermeasures equipment (except for explosive, explosive

-

)

March 2024 - Marine Technology Reporter page: 4th Cover

)

March 2024 - Marine Technology Reporter page: 4th CoverGlow a little longer. Superior sensor performance on a rmance on a – – RBRtridentfraction of the power RBRtridente teee ackscatter or turbidity with hi i in n n t t th h h he e e s sa a am m m me Measure chlorophyll a, fDOM, and backscatter or turbidity within the same e e sensor package using the

-

)

March 2024 - Marine Technology Reporter page: 48

)

March 2024 - Marine Technology Reporter page: 48Index page MTR MarApr2024:MTR Layouts 4/4/2024 3:19 PM Page 1 Advertiser Index PageCompany Website Phone# 17 . . . . .Airmar Technology Corporation . . . . . . . . . .www.airmar.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(603) 673-9570 9 . . . . . .Birns, Inc. . . . . . . . . . .

-

)

March 2024 - Marine Technology Reporter page: 45

)

March 2024 - Marine Technology Reporter page: 45with zero carbon emissions • Teledyne Marine Acquires Valeport Teledyne Marine agreed to acquire Valeport a leader in the design and manufacture of underwater sensors and pro? l- ers. Valeport is one of the UK’s leading manufacturers of oceanographic and hydrographic instrumentation. The in- dependent

-

)

March 2024 - Marine Technology Reporter page: 44

)

March 2024 - Marine Technology Reporter page: 44Metron signed a partnership agreement with Cellula Ro- the CARIS Ping-To-Chart work? ow, allowing for full above- botics, USA Inc., to expand uncrewed underwater vehicle and-below- water image capture with survey grade accuracy (UUV) capabilities for advanced operations in dynamic envi- 44 March/April

-

)

March 2024 - Marine Technology Reporter page: 43

)

March 2024 - Marine Technology Reporter page: 43Image courtesy Kongsberg Discovery Image courtesy Teledyne Marine New Products Teledyne Marine had its traditional mega-booth at Oi, busy start to ? nish. Image courtesy Greg Trauthwein offers quality sub-bottom pro? ling capability without the need tion of offshore windfarms. GeoPulse 2 introduces new

-

)

March 2024 - Marine Technology Reporter page: 42

)

March 2024 - Marine Technology Reporter page: 42, a Nano connector which offers a versatile and robust performance, making it suitable for multiple applica- tions and the increasingly compact design of underwater in- struments, equipment and systems. This splash and wet-mate connector is manufactured from high-grade titanium and neo- prene to withstand deep

-

)

March 2024 - Marine Technology Reporter page: 41

)

March 2024 - Marine Technology Reporter page: 41Outland Technology Image courtesy Exail Image courtesy Submaris and EvoLogics Vehicles The ROV-1500 from Outland Technology represents a leap forward in underwater robotics, a compact remotely operated vehicle (ROV) weighing in at less than 40 lbs (19kg) the ROV- 1500 is easy to transport and deploy. Similar

-

)

March 2024 - Marine Technology Reporter page: 40

)

March 2024 - Marine Technology Reporter page: 40hicles (ROTVs), inspection-class Remotely Operated Vehicles to withstand the most severe ocean conditions, the new DriX (ROVs), as well as Autonomous Underwater Vehicles (AUVs). O-16 has been designed for long-duration operations (up to Its gondola, located below the surface, can further host a wide 30

-

)

March 2024 - Marine Technology Reporter page: 39

)

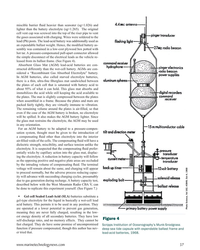

March 2024 - Marine Technology Reporter page: 39Photo courtesy Global Ocean Design Figure 7 A 35Ah AGM lead-acid battery is tested using the West Mountain Radio CBA to show the effect of simply ? lling the battery voids with mineral oil as a compensating ? uid. The CBA is programmed to cut-off at a voltage of 10.50v. The top line (red) shows the

-

)

March 2024 - Marine Technology Reporter page: 38

)

March 2024 - Marine Technology Reporter page: 38LANDER LAB #10 Photo courtesy West Mountain Radio Photo courtesy of Clarios/AutoBatteries.com Figure 6 The West Mountain Radio Computerized Battery Analyzer (CBA V) attaches to a Figure 5 laptop by a USB-B cable, and to a battery by Powerpole® Connectors. Exploded view of an AGM lead-acid battery.

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 36

)

March 2024 - Marine Technology Reporter page: 36LANDER LAB #10 Of special interest for marine applications, LiPo batteries are Shipping any kind of lithium battery can be a challenge, and offered in a “pouch” design, with a soft, ? at body. The pouch IATA regs vary with the batteries inside or outside an instru- is vacuum-sealed, with all voids ?

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33regulated industry in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’

-

)

March 2024 - Marine Technology Reporter page: 32

)

March 2024 - Marine Technology Reporter page: 32FEATURE SEABED MINING by a sea? oor plume from its pilot collection system test. pact, nodule collection system that utilizes mechanical and The Metals Company recently signed a binding MoU with hydraulic technology. Paci? c Metals Corporation of Japan for a feasibility study on The company’s SMD

-

)

March 2024 - Marine Technology Reporter page: 31

)

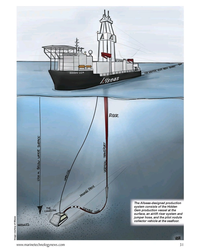

March 2024 - Marine Technology Reporter page: 31The Allseas-designed production system consists of the Hidden Gem production vessel at the surface, an airlift riser system and jumper hose, and the pilot nodule collector vehicle at the sea? oor. Image courtesy of Allseas www.marinetechnologynews.com 31 MTR #3 (18-33).indd 31 4/4/2024 2:12:41

-

)

March 2024 - Marine Technology Reporter page: 30

)

March 2024 - Marine Technology Reporter page: 30FEATURE SEABED MINING bilical. It has passive heave compensation which nulli? es the necott. “The focus since then has been on scaling while en- wave, current and vessel motions that in? uence loads in the suring the lightest environmental impact,” says The Metals power umbilical. The LARS can

-

)

March 2024 - Marine Technology Reporter page: 29

)

March 2024 - Marine Technology Reporter page: 29n January, Norway said “yes” to sea- bed mining, adding its weight to the momentum that is likely to override the calls for a moratorium by over 20 countries and companies such as I Google, BMW, Volvo and Samsung. Those against mining aim to protect the unique and largely unknown ecology of the sea?

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 23

)

March 2024 - Marine Technology Reporter page: 23. Kevin Mackay, marine ge- ologist at the National Institute of Water and Atmosphere Research (NIWA), New Zealand, said, “There are over one million underwater volcanoes, although only about 120 are known to have been active in the last 11,000 years—a number that is likely to be a gross under- estimate

-

)

March 2024 - Marine Technology Reporter page: 20

)

March 2024 - Marine Technology Reporter page: 202024 Editorial Calendar January/Februay 2024 February 2024 March/April 2024 Ad close Jan.31 Ad close March 21 Ad close Feb. 4 Underwater Vehicle Annual Offshore Energy Digital Edition ?2?VKRUH:LQG$)ORDWLQJ)XWXUH ?2FHDQRJUDSKLF?QVWUXPHQWDWLRQ 6HQVRUV ?6XEVHD'HIHQVH ?6XEVHD'HIHQVH7KH+XQWIRU ?0DQLS

-

)

March 2024 - Marine Technology Reporter page: 19

)

March 2024 - Marine Technology Reporter page: 19About the Author vey with the pipe tracker is not required, resulting in signi? - Svenn Magen Wigen is a Cathodic Protection and corrosion control cant cost savings, mainly related to vessel charter. expert having worked across The major advantage of using FiGS on any type of subsea engineering, design

-

)

March 2024 - Marine Technology Reporter page: 18

)

March 2024 - Marine Technology Reporter page: 18TECH FEATURE IMR There are also weaknesses in terms of accuracy because of FiGS Operations and Bene? ts signal noise and the ability to detect small ? eld gradients. In Conventional approaches to evaluating cathodic protection this process there is a risk that possible issues like coating (CP)

-

)

March 2024 - Marine Technology Reporter page: 17

)

March 2024 - Marine Technology Reporter page: 17• Integrity assessment, and otherwise covered, e.g., by rock dump. As for depletion of • Mitigation, intervention and repair. sacri? cial anodes, this can be dif? cult or even impossible to Selecting the best method for collecting the data these work- estimate due to poor visibility, the presence of

-

)

March 2024 - Marine Technology Reporter page: 16

)

March 2024 - Marine Technology Reporter page: 16, FORCE Technology he principle behind sacri? cial anodes, which are water structures, reducing the need for frequent repairs and used to safeguard underwater pipelines and struc- replacements, which also aligns well with sustainable opera- tures from corrosion, is relatively straightforward. tional practices