Value Chain

-

- Digital Developments Continue Apace in the Workboat Space Marine News, Nov 2019 #76

Sustainable, energy-efficient working practices and environmental regulatory compliance are among the hot-button topics driving the spread of maritime digitalization.

The benefits of a digital strategy for companies working within the maritime industry soon stack up. In addition to providing operational/logistical streamlining, data-based insights, a competitive edge and a reputational leg-up, connecting operational systems and consolidating interfaces also drives the levels of efficiency required for tangible environmental and financial sustainability.Once the preserve of companies always expected to be on board for early adoption of new technologies, the ability to access and analyze vessel data using cloud-based solutions is now a realistic option for more commercial operators.

The recent signing of a Memorandum of Understanding (MoU) between KONGSBERG and MAN Energy Solutions, with the purpose of exploring the potential for collaboration on a common data infrastructure for the maritime sector reflects the fact that digitalization is now firmly in the maritime mainstream. The collaboration has been established to broaden the value offering to vessel operators, improve return on investment in digital solutions and increase the adoption of secure connectivity.

Under the MoU, MAN Energy Solutions is set to investigate the possibility of using Kongsberg Digital’s data-infrastructure solution, Vessel Insight, to securely collect and transmit data using MAN Energy Solution’s digital platform, MAN CEON. A successful trial would allow MAN Energy Solutions to use advanced services such as PrimeServ Assist, its remote monitoring and optimization package, to better serve customers.

The complexity of data capture and transfer drives up the cost of these essentially non-core activities and prevents efficient development of value adding solutions to the market. Collaboration between vendors in the industrial digital value chain is therefore a win-win for vendors, who can focus on digital development within their core competencies, and customers, who will get faster access to better and more cost-efficient solutions.

The collaboration between the industrial software company and the world-leading engine and marine solution provider aims to solve a key challenge for the broader adoption of digital solutions, namely the high cost of capturing quality data from the vessels, which leaves vessel owners and operators with an unattractive ROI on their digital investments. This could help accelerate the maritime transformation, where new technology and digital solutions enable a move towards smarter, more efficient, safer and greener operations.

From MAN’s perspective, digitalization supports its commitment to help its customers increase the safety, reliability and predictability of their individual vessel performance and overall fleet. Through the cooperation with KONGSBERG, MAN aims to securely onboard customers faster to provide our new digital services, advanced analytics and support; areas in which it can provide unique benefits to their business. The company is also expecting faster development of its core functionality, supported by a stronger focus and customer interaction.

Maritime Digitalization: fundamentals in practice

Clearly, the benefits outlined above all point to the three cost-reducing and business-enhancing fundamentals of maritime digitalization: asset lifecycle optimization, value chain transformation and operational excellence. The first of these simply equates to maximizing the profits achievable from a company’s assets over their complete working life, from planning and acquisition through to operation and maintenance (and, finally, disposal).Value chain transformation, meanwhile, involves the integration of a company’s financial and operational structures in order to strengthen and coordinate the overall corporate framework while achieving transparency between internal departments and third-party agents. In regard to operational excellence, this encourages firms to automate key processes from the ground up, starting with basic administrative functions – for example, installing analytical dashboards, moving from paper to digital logbooks – but potentially leading to increased autonomy in the operation of custom-designed, state-of-the-art vessels.

One example of the latter, an uncrewed and remotely-operated fireboat series design named RALamander, is currently under development by Vancouver-based naval architects and marine engineers Robert Allan Ltd in collaboration with Kongsberg Maritime. The thinking behind the fireboat’s flexibly autonomous capabilities is simply to enable first responders to tackle hazardous port fires involving explosion risks or toxic smoke more rapidly and assertively than would previously have been possible, while the firefighters themselves can control operations via a remote console in conditions of total safety. The deployment of Kongsberg Maritime’s low-latency, high-bandwidth control and communications system means that the semi-portable operator console can be located on a manned fireboat, tug or pilot boat as appropriate.

If the RALamander fireboat series represents digital technology’s future potential, the fact remains that there are still maritime companies out there still working within a traditional framework of manual processes which are becoming less relevant, practicable and competitive with every passing day. As the industry moves inexorably towards integration and automation in everything from supply chains and logistics to vessel control and port operations, the need to adopt a considered long-term digital strategy becomes ever more pressing.

Integrated digital platforms

An admitted stumbling block for some is the perceived enormity and expense of collating, consolidating, encrypting, storing, sharing and leveraging all-important data streams from numerous different sources, all the while balancing transparency with confidentiality – and maintaining stringent cyber security protocols. The fear is that having to use a series of different applications to access data stored in multiple discrete databases would be time-consuming, costly, vulnerable and a hindrance to the provision of a joined-up view, with all the disadvantages for decision-making and profit margins that this would entail.It might seem like the logical way to deal with these issues at a stroke is for companies to adopt an integrated digital platform which acts as a unified, central, single-source library for digital applications. KONGSBERG’s solution, however, is an open, collaborative, cloud-based ecosystem named Kognifai. Already eliciting positive feedback from early adopters and partner firms, the platform represents a cogent argument for the business potential of shared, integrated, open-source applications. It is in effect a digital marketplace and operational platform.

Along with the new Kognifai enabled Vessel Insight solution, it supports the maritime industry’s general migration towards shore-based management systems which can leverage advanced data analytics, derived from onboard sensors, to optimize fleet operations, servicing intervals and the allocation of spare parts. The same information-sharing principles would also provide vessel crews with the at-a-glance knowledge necessary to ensure observance of strict environmental compliance laws, while also enabling them to trade route and voyage details with port authorities to facilitate port operations and reduce the likelihood of congestion occurring.

If the benefits arising from a well-coordinated digital strategy are inarguable, some gently persistent encouragement may still be necessary to persuade certain firms to take up the reins. The most prudent advice in such cases is to begin with a manageable digital overhaul of processes such as log-keeping, accounts, predictive maintenance scheduling and customer service. A larger-scale digital plan of action can then, if desired, be gradually rolled out across all sectors of a company’s business. The future is already upon us: and only the best-prepared should expect to emerge on the far side of the digital revolution with a smile and an ongoing, viable business.

Vigleik Takle is the Senior Vice President – Maritime Digital Solutions – at Kongsberg.

This article first appeared in the November 2019 print edition of MarineNews magazine.

-

- Green Marine: Hempel Charts its Growth & Sustainability Course Maritime Reporter, May 2021 #38

renewable electricity, and we'll shift to electric vehicles and equipment wherever possible. We're also going to work strategically across our value chain to reduce our impact.”To that end, Hempel launched its sustainability framework dubbed Futureproof, an initiative that lies at the heart of

-

- Expect the Unexpected on the Inland Waterways Marine News, Sep 2021 #24

that it had joined the newly launched Blue Sky Maritime Coalition, an organization with the mission of accelerating “the U.S. and Canada maritime value chain’s pathway to net zero greenhouse gas (GHG) emissions by jointly developing and executing a roadmap to a commercially viable net-zero emission

-

- Alt-fueled Workboats: Building the Business Case Marine News, Mar 2022 #26

, Kirby and Campbell Transportation. Total membership is 70 companies and organizations. The mission: “to accelerate the U.S. and Canada maritime value chain’s pathway to net zero greenhouse gas (GHG) emissions by jointly developing and executing a road map to a commercially viable net-zero emission

-

- Excelerate Energy & the Year of LNG Maritime Reporter, Jun 2014 #34

current mid-scale capabilities. Can you sum up your near term business prospects in a sentence. We have developed a full suite of midstream value chain solutions and are capable of working from the well head all the way through the downstream LNG marketing downstream, and continue to work with counterpar

-

- MTR100: MacArtney Marine Technology, Aug 2016 #57

wherever needed. The cornerstones of the MacArtney fields of operation are: Oil and Gas: solutions from seabed to surface, supplying the entire value chain Defense: supplying connectivity products, instrumentation, deck- and-over-the-side handling equipment Ocean Science: handling scientific

-

- SMM Interview: Three Questions for Claus Ulrich Selbach Maritime Reporter, Aug 2018 #98

make SMM the world's biggest trade fair for the maritime sector. Even more important is the quality of the fair's 2200 exhibitors which cover the entire value chain of the maritime industry. This allows us to claim international technology and innovation leadership once again.At the exhibition stands, visitors

-

- New Horizons: Cruise Industry Challenges & Solutions for 2017 Maritime Reporter, Apr 2017 #14

blends. As the marine industry transitions increasingly to natural gas, GE’s Marine Solutions brings experience of working across the whole LNG value chain for two decades—from production to processing, transport and propulsion—to help achieve the smooth transition. The Digital Wave Booming demand

-

- New Lives for Old Ships: Inside Keppel O&M’s FLNG Conversion Solution Maritime Reporter, Sep 2020 #34

solutions that can quantifiably reduce their carbon footprint. Companies are reviewing not only their own emissions, but also emissions throughout their value chain. They are relooking their business models and making commitments to their shareholders to reduce emissions.”Keppel O&M supports the circular

-

- VDRs for Inland Vessels: Does It Make Sense? Marine News, Oct 2019 #36

revolution is sweeping through all industrial sectors, including marine transportation as a key tool for increasing visibility into the full value chain. Increasingly, manufacturers of modern engines, auxiliary machinery and electronic systems are designing remote access capability into their equipment

-

- Challenges of Underwater Structure Monitoring for Offshore Operations Marine Technology, Mar 2020 #30

, ensuring the reliability of the data.The Northern Lights project is a result of the Norwegian government’s ambition to develop a full-scale CCS value chain in the country by 2024. As part of this ambition, the Norwegian government issued feasibility studies on capture, transport and storage solutions

-

- IMO2020: The Rise of Bulk Liquid Hydrogen in Norway Maritime Reporter, Jul 2019 #44

by Norled, a local transportation provider in Norway, to be used on the Finnøy route north east Stavanger by 2021.To further develop the hydrogen value chain, Moss, Wilhelmsen, Equinor and DNV-GL set out to design a bulk carrier to supply liquid hydrogen to proposed ferries and cruise ships operating

-

)

March 2024 - Marine Technology Reporter page: 23

)

March 2024 - Marine Technology Reporter page: 23elatively inactive since 2014, the Hunga Tonga–Hunga Ha‘apai (HT-HH) submarine volcano began erupting on December 20, 2021, reaching peak intensity on January 15, 2022. This triggered tsunamis throughout the Pa- R ci? c, destroyed lives and infrastructure, and generated the largest explosion recorded

-

)

March 2024 - Marine Technology Reporter page: 17

)

March 2024 - Marine Technology Reporter page: 17‘stabbing’. It involves the use of a contact probe Field Gradient Technology (a.k.a., ‘CP stabber’) making direct contact measurement to Data quality and value improves through the use of non-con- the steel structure and the anodes, either by divers or ROVs. tact surveys using ? eld gradient sensor technology

-

)

March 2024 - Marine Technology Reporter page: 7

)

March 2024 - Marine Technology Reporter page: 7Set a Course for your Career Become a NOAA professional mariner! Sail with NOAA’s fleet of research marinerhiring.noaa.gov 1-833-SAIL-USA (724-5872) and survey ships! - Detects all iron and steel Get your next salvage - Locate pipelines, anchors and job done faster chains with a JW Fishers

-

)

April 2024 - Maritime Reporter and Engineering News page: 3rd Cover

)

April 2024 - Maritime Reporter and Engineering News page: 3rd CoverYour Specialist Ofshore Lubricant Partner T Togeth her w we go o furt ther r Our commitment to customer service and technical support extends to ofshore operations. With our robust global supply chain, we deliver the optimal marine lubrication solution to your ?eet, precisely when and where it’s needed.

-

)

April 2024 - Maritime Reporter and Engineering News page: 48

)

April 2024 - Maritime Reporter and Engineering News page: 48Index page MR Apr2024:MN INDEX PAGE 4/5/2024 1:33 PM Page 1 ANCHORS & CHAINS MILITARY SONAR SYSTEMS tel:+44 (0) 1752 723330, [email protected] , www.siliconsensing.com Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Massa Products Corporation, 280 Lincoln Street, SONAR TRANSDUCERS

-

)

April 2024 - Maritime Reporter and Engineering News page: 31

)

April 2024 - Maritime Reporter and Engineering News page: 31already felt the need for upgrad- offshore installation. Large ring cranes can optimize the use of ing crane lifting capacity on existing offshore high-value offshore installation vessels by assembling the tur- wind installation vessels: NOV is upgrading the bines ef? ciently, even as offshore wind components

-

)

April 2024 - Maritime Reporter and Engineering News page: 29

)

April 2024 - Maritime Reporter and Engineering News page: 29RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND U.S. Navy photo by Bill Mesta/released U.S. Navy photo by Ryan Carter Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command, visits USNS Patuxent (T-AO 201) for a tour of the ship at Naval Station Norfolk, Va., November 20, 2023.

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25. We are competing with the commercial stop the ? ow of logistics, using all means of war? ghting, from shipping companies, as well as other jobs that value the skills seabed to cyber to space and everything in between. Operating our ships in the contested logistics environment that our mariners have

-

)

April 2024 - Maritime Reporter and Engineering News page: 23

)

April 2024 - Maritime Reporter and Engineering News page: 23offshore wind; and the foreign ? ag Maersk supply WTIV at Seatrium Singapore, together with U.S. ? ag feeder ATBs for transportation and installation of the Empire Wind. Three newbuild SOVs and three conversions/retro? ts were award- ed, too, and 22 CTVs were also announced. The ? rst US rock installa

-

)

April 2024 - Maritime Reporter and Engineering News page: 11

)

April 2024 - Maritime Reporter and Engineering News page: 11processes, novations will be crucial in unlocking the full potential of this integrity and reliability. pioneering initiative. SIRE 2.0 also values the importance of human factors and the fostering of a no-blame culture to inspections and aims The Author to improve the understanding of human

-

)

April 2024 - Maritime Reporter and Engineering News page: 6

)

April 2024 - Maritime Reporter and Engineering News page: 6Editorial MARITIME REPORTER AND ENGINEERING NEWS his month’s coverage is M A R I N E L I N K . C O M almost an afterthought HQ 118 E. 25th St., 2nd Floor following the tragedy that New York, NY 10010 USA T +1.212.477.6700 Tunfolded in Baltimore in the wee hours of Tuesday, March 26, CEO John C.

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27heavy newbuilds posture, saying, “We like more complex the conversion of a 2014 built 280 class Platform Supply projects, that have more added value.” vessel into a high spec Service Operation Vessel (SOV), to Complexity also ties into the human resources side of be named HOS Rocinante. Eastern

-

)

April 2024 - Marine News page: 18

)

April 2024 - Marine News page: 18Column Cybersecurity The Maritime Industry Has Unique Cybersecurity Challenges By Joe Nicastro, Field CTO, Legit Security With supply chain attacks on the rise, works, while foundational, have not evolved in tandem and nation-state attackers constantly looking for new ways with these digital threats

-

)

April 2024 - Marine News page: 17

)

April 2024 - Marine News page: 17OpEd Shipbuilding can industrial base. building, repairing, repowering and local communities at a time in which Second, the Congress must pri- maintaining ships, not to mention our maritime strength is needed more oritize stable and predictable budgets the massive supply chain that sup- than ever

-

)

April 2024 - Marine News page: 14

)

April 2024 - Marine News page: 14Insights tion on a couple of issues, including engine room crew- For AWO, as an organization, what is its top ing on ATBs with automated systems. This is an issue priorities for the coming six to 12 months and that Congress thought that it addressed in the last Coast what’s being done to address them? Gua

-

)

April 2024 - Marine News page: 11

)

April 2024 - Marine News page: 11Q&A Increasingly, cyber security has been gaining focus as an area of concern across maritime supply chains, and recently the Coast Guard has been tasked with creating and enforcing maritime cyber standards. What do you hope to see from these standards as they are drafted and put to use? Two key

-

)

April 2024 - Marine News page: 10

)

April 2024 - Marine News page: 10Insights Jennifer QQQQQQQQQAAA & Carpenter President & CEO, American Waterways Operators The towboat, tug and barge industry is in a pe- CARB’s harbor craft rules have been center riod of rapid evolution. How is AWO—now in its stage of late. AWO’s stance on the situation has 80th year of existence—adapt

-

)

April 2024 - Marine News page: 8

)

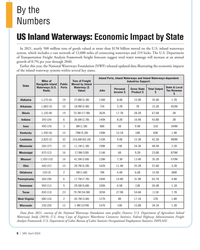

April 2024 - Marine News page: 8By the Numbers US Inland Waterways: Economic Impact by State In 2021, nearly 500 million tons of goods valued at more than $158 billion moved on the U.S. inland waterways system, which includes a vast network of 12,000 miles of connecting waterways and 219 locks. The U.S. Department of Transportation

-

)

February 2024 - Maritime Reporter and Engineering News page: 48

)

February 2024 - Maritime Reporter and Engineering News page: 48Index page MR Feb2024:MN INDEX PAGE 2/8/2024 11:05 AM Page 1 ANCHORS & CHAINS MILITARY SONAR SYSTEMS tel:+44 (0) 1752 723330, [email protected] , www.siliconsensing.com Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Massa Products Corporation, 280 Lincoln Street, SONAR TRANSDUCERS

-

)

February 2024 - Maritime Reporter and Engineering News page: 43

)

February 2024 - Maritime Reporter and Engineering News page: 43OPINION: The Final Word lenges related to quality of life factors GAO made six recommendations that may affect this. Currently, reports on also affects the Coast Guard’s ability to the Coast Guard, among other things, these types of issues are expected to be retain personnel. For example, in April

-

)

February 2024 - Maritime Reporter and Engineering News page: 31

)

February 2024 - Maritime Reporter and Engineering News page: 31EAL AND STERN TUBE DAMAGES “Our recommendations “A good bearing are simple. Please design is have good control over important.” your oil quality in the primary barrier, the aft – Øystein Åsheim Alnes sealing system,” Head of section for Propulsion and Steering, – Arun Sethumadhavan DNV

-

)

February 2024 - Maritime Reporter and Engineering News page: 29

)

February 2024 - Maritime Reporter and Engineering News page: 29invest- sen Group ASA, ARC is able to tap a guide our strategic decisions, whether ments and decisions to continue to shipping, port and logistics value chain that’s from the U.S. government or the grow our US ? ag merchant ? eet.” globally that measures its experience in IMO.” centuries, not decades

-

)

February 2024 - Maritime Reporter and Engineering News page: 28

)

February 2024 - Maritime Reporter and Engineering News page: 28mariners from develop- Ebeling’s point is highlighting the hand in glove with the cargo preference ing countries which crew the majority cumulative true value of MSP and the laws,” said Ebeling. “Those are the of the international commercial ? eet. operations it supports. laws that generate the cargo

-

)

February 2024 - Maritime Reporter and Engineering News page: 25

)

February 2024 - Maritime Reporter and Engineering News page: 25MATTHEW HART, MANAGER & PLATFORM LEADER, MARINE & STATIONARY POWER SYSTEMS, WABTEC fuel blends up to 100% are in operation maintenance intervals to make sure that What’s the biggest challenge today, running on both biodiesel and re- our engines don’t have to be touched in your job? newable diesel blends.