United Soybean Board

-

- Rethinking Inland Infrastructure Finance Marine News, Sep 2016 #20

P3: An alternative to tolls or lockage fees in public-private partnerships for inland waterways.

Within the generally sorry state of the U.S. inland waterways infrastructure, there are some locations where conditions are particularly dire. Among those in this latter situation are several locks and dams on the Illinois River, including the La Grange Lock and Dam and the Peoria Lock and Dam, both of which were completed in 1939. Both of them are on the U.S. National Register of Historic Places, which is a dubious distinction for a major transportation facility of the twenty-first century.The farmers in Illinois provide a significant portion of our nation’s corn and soybean crops, and the Illinois River plays an important role in getting those crops from the farms in Illinois to the Mississippi River and thence to New Orleans for export. It would be a major hardship for many corn and soybean growers in Illinois if either of the La Grange or Peoria lock and dam facilities were to become inoperable. However, there remain many competing needs for new construction, rehabilitations and major repairs throughout the inland waterways system, and the funding provided by Congress never addresses more than a small fraction of these needs.Corn and soybean growers in Illinois are understandably worried, therefore, that one or both of the La Grange or Peoria lock and dam facilities might fail before the necessary money is found to keep that from happening. Reflecting this concern, two organizations representing these constituencies—the Illinois Corn Growers Association (ICGA) and the Illinois Soybean Association (ISA)—have recently conducted extensive studies and proposed alternative solutions to fund the refurbishment or replacement of these locks and dams. Both organizations gave detailed presentations of similar solutions at the 12th Annual Waterways Symposium in New Orleans in November 2015.Public/Private PartnershipsBoth organizations propose using public-private partnerships in which some of the funding would be provided by private parties in some combination of debt and equity. As has been previously recognized with other public-private partnership proposals, such a structure needs to include a revenue source to provide economic return to the private party lender or equity investor. Both the ICGA and the ISA proposals include payments in the nature of fees or charges to be paid based on usage of the locks in order to generate this revenue.By and large, the inland waterways industry has opposed having such lock usage fees, by whatever name they might be called, as an element of any proposed public-private partnership for funding improvements to the inland waterways infrastructure. In April of this year, for example, Waterways Council, Inc. submitted letters to the Senate Environment and Public Works Committee and the House Transportation and Infrastructure Committee signed by 75 organizations, including carriers, shippers, port authorities, labor unions, and trade associations (including several agricultural industry groups), opposing the imposition of tolls or lockage fees on inland waterways transportation. This opposition is repeatedly voiced by representatives of the inland waterways industry at conferences and in publications whenever any suggestion of such tolls or lockage fees arises.Those who propose tolls or lockage fees typically emphasize that what they are proposing this is just one suggestion and that other ideas are welcome if they will address the undisputed and urgent needs at hand. To help the inland waterways industry avoid being perceived as only naysayers who oppose tolls and lockage fees but who do not offer constructive alternatives, I wish to present—or perhaps it might be more accurately said, to recall—a public-private partnership approach that largely follows what has been recently suggested by ICGA and ISA, but without the tolls or lockage fees component.The models of debt and equity financing that have been suggested by ICGA and ISA recall those that were proposed in studies done in 2013 by the Texas Transportation Institute for the United Soybean Board and by the Horinko Group for the U.S. Soybean Export Council, but with this difference: the 2013 studies included proposals to use some portion of the fuel tax revenues that are paid into the Inland Waterways Trust Fund to provide the necessary debt service and return on equity for such financing.Sorting out the Funding RulesThe use of funds received by the Inland Waterways Trust Fund to support the issuance of bonds is also contemplated by Section 2004 of the Water Resources Reform and Development Act of 2014 (WRRDA 2014). That section of the statute requires the Army Corps of Engineers to study “potential benefits and implications of authorizing the issuance of federally tax-exempt bonds secured against the available proceeds, including project annual receipts, in the Inland Waterways Trust Fund.” By a memorandum dated June 28, 2016, the Corps issued “implementation guidance” which was simply a report that the study has not yet been started since no funds have yet been specifically appropriated for it.In the model presented by ISA at the Waterways Symposium in November 2015, annual revenues of approximately $11 million were projected to support a total of approximately $150 million of combined debt and equity financing. The ISA model also assumed that there would be contributions from the Federal government and other sources totaling approximately $405 million, for a total of approximately $555 million, which could be applied to address the needs of several lock and dam installations on the Illinois River in addition to those of La Grange and Peoria. The ISA model assumed a financing term of 30 years, bond proceeds (i.e., debt) in the amount of $128 million in two tiers with interest rates of 3.5 percent and 4.75 percent, respectively, and an annual return of 11 percent on an equity investment of $22 million.A Twist on the PlanA variation on this theme that should be considered would be the issuance of the same amount of total financing, i.e., $150 million, but comprised entirely of bonds or other forms of debt. According to the presentation by ISA, this amount should be sufficient to address the needs of at least the La Grange Lock and Dam and the Peoria Lock and Dam. Assuming that this bond financing would have the same term as in the ISA model, i.e., 30 years, and that the same amount of annual revenue, $11 million, would be available from the Inland Waterways Trust Fund for the payment of interest and principal on these bonds, this would translate into an effective interest rate of 6 percent on the bonds, which would be attractive in today’s interest rate environment.The ISA model assumed an interest rate of only 4.75 percent on the portion of the bonds with a Standard and Poor’s rating of BBB, generally considered the lowest rating that qualifies as investment grade. Even further, if those bonds were tax-exempt, a possibility contemplated by Section 2004 of WRRDA 2014, then such an interest rate would represent an even higher effective return to the holder of such bonds. On the other hand, if the interest rate on the bonds turned out to be less than 6 percent, then either a greater amount of financing could be raised for the same $11 million of annual debt service, or the required annual debt service on $150 million of bond proceeds would be less, or the length of the financing term could be shortened. Anyone who has refinanced a home mortgage to take advantage of declining interest rates knows how these factors relate to each other.To be sure, committing a certain amount from the Inland Waterways Trust Fund to support a long-term bond financing would make those funds unavailable for any other infrastructure projects during the term of that financing. However, the ISA and ICGA models, the studies for the United Soybean Board and the U.S. Soybean Export Council, other proposals for public-private partnerships, and the Corps of Engineers itself all recognize the cost savings and other advantages that come from borrowing against a future revenue stream to obtain full funding of a project up-front, rather than paying for it piecemeal. To return to the home mortgage illustration, no one buys a home one room at a time, year by year, as each year’s current income allows.In a letter to Congress earlier this year, the Inland Waterways Users Board reported that, for the 10-year period 2005–2014, each penny of the fuel tax paid by carriers on the inland waterways generated $4 million each year for the Inland Waterways Trust Fund. This means that, in effect, less than three cents of the current 29-cents per gallon fuel tax would need to be allocated to supporting a bond financing of $150 million.This alternative proposal would require some legislative changes in order for it to be implemented, but so also would the imposition of some form of toll or lockage fee. Each Water Resources Development Act that is passed by Congress provides an opportunity to enact such changes, as most recently evidenced by the important steps taken in WRRDA 2014. There is currently pending in Congress a bill that will hopefully become the Water Resources Development Act of 2016, and efforts are being made to have such enactments restored to a biennial schedule. Each of them will provide an opportunity to find a way to use public-private partnerships to provide funding to restore and improve the inland waterways infrastructure. In this article, it can be seen that this would be feasible – without tolls or lockage fees.

The AuthorJames A. Kearns is a Partner at Bryan Cave LLP. Mr. Kearns has represented owners, operators, financial institutions (as both lessors and lenders), and end users for more than 30 years in the purchase, construction and financing of vessels engaged in both the foreign and coastwise trades of the United States, including compliance with the requirements of the Jones Act for the ownership, chartering and transfer of vessels. Kearns has earned an LL.M. (in Taxation), New York University, J.D. cum laude, University of Notre Dame, 1974, and a B.S.E.E., summa cum laude, University of Notre Dame, 1971. Reach him at [email protected](As published in the September 2016 edition of Marine News) -

- The Quest to Fund Inland Waterways Marine News, Feb 2015 #18

further, such additional revenues could be leveraged through, say, bond financing to achieve even more dramatic results. A study prepared for the United Soybean Board by the Center for Ports and Waterways of the Texas Transportation Institute, titled “New Approaches for U.S. Lock and Dam Maintenance and Funding

-

- Illinois Waterway Closures: Look for the Workaround Marine News, Oct 2019 #26

Director of the Soy Transportation Coalition, which is comprised of thirteen state soybean boards, the American Soybean Association, and the United Soybean Board. The thirteen participating states encompass 85% of total U.S. soybean production.Next summer’s Waterway work “is very much on our radar,” Steenhoek

-

- WRRDA: Charting a New Course Marine News, Jul 2014 #26

studies that have recently been conducted are two that have been sponsored by the soybean industry. The first of these is a study prepared for the United Soybean Board by the Center for Ports and Waterways of the Texas Transportation Institute, titled “New Approaches for U.S. Lock and Dam Maintenance and Funding

-

- WRRDA: Clearing the Channel for P3 Projects Marine News, Nov 2014 #40

solution would be to use the fuel tax revenues that the IWTF receives each year. Indeed, this approach has been proposed by a study prepared for the United Soybean Board by the Center for Ports and Waterways of the Texas Transportation Institute, titled “New Approaches for U.S. Lock and Dam Maintenance and Funding

-

)

March 2024 - Marine Technology Reporter page: 43

)

March 2024 - Marine Technology Reporter page: 43Image courtesy Kongsberg Discovery Image courtesy Teledyne Marine New Products Teledyne Marine had its traditional mega-booth at Oi, busy start to ? nish. Image courtesy Greg Trauthwein offers quality sub-bottom pro? ling capability without the need tion of offshore windfarms. GeoPulse 2 introduces new

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 17

)

March 2024 - Marine Technology Reporter page: 17• Integrity assessment, and otherwise covered, e.g., by rock dump. As for depletion of • Mitigation, intervention and repair. sacri? cial anodes, this can be dif? cult or even impossible to Selecting the best method for collecting the data these work- estimate due to poor visibility, the presence of

-

)

March 2024 - Marine Technology Reporter page: 15

)

March 2024 - Marine Technology Reporter page: 15sensor options for longer mission periods. About the Author For glider users working in ? sheries and conservation, Shea Quinn is the Product Line Manager the Sentinel can run several high-energy passive and active of the Slocum Glider at Teledyne Webb acoustic sensors, on-board processing, and imaging

-

)

March 2024 - Marine Technology Reporter page: 14

)

March 2024 - Marine Technology Reporter page: 14TECH FEATURE TELEDYNE SLOCUM GLIDERS to hold over 3.5 times as many lithium primary batteries as the the water column and its thrusters give it the ability to stay standard Slocum Glider, and to physically accommodate up to on track in strong currents or other dif? cult ocean condi- 8 different sensor

-

)

March 2024 - Marine Technology Reporter page: 6

)

March 2024 - Marine Technology Reporter page: 6MTR Editorial Advisors Gallaudet Hardy The Honorable Tim Gallaudet, Kevin Hardy is President PhD, Rear Admiral, U.S. of Global Ocean Design, Navy (ret) is the CEO of creating components and Ocean STL Consulting and subsystems for unmanned host of The American Blue vehicles, following a career

-

)

March 2024 - Marine Technology Reporter page: 3

)

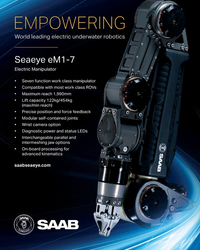

March 2024 - Marine Technology Reporter page: 3EMPOWERING World leading electric underwater robotics Seaeye eM1-7 Electric Manipulator • Seven function work class manipulator • Compatible with most work class ROVs • Maximum reach 1,990mm • Lift capacity 122kg/454kg (max/min reach) • Precise position and force feedback • Modular self-contained

-

)

March 2024 - Marine Technology Reporter page: 2

)

March 2024 - Marine Technology Reporter page: 2March/April 2024 On the Cover Volume 67 • Number 3 Image courtesy NIWA-Nippon Foundation TESMaP / Rebekah Parsons-King 8 Subsea Defense Black Sea Mines When the shooting stops in the Ukraine, the tough work of clearing mines will commence. By David Strachan 12 Gliders Slocum Sentinel 22 Teledyne

-

)

April 2024 - Maritime Reporter and Engineering News page: 48

)

April 2024 - Maritime Reporter and Engineering News page: 48Silicon Sensing Systems Ltd, Clittaford Road Southway, Massa Products Corporation, 280 Lincoln Street, UNDERWATER SONAR SENSORS Plymouth, Devon PL6 6DE United Kingdom , UK , Hingham, MA 02043-1796 , tel:(781) 749-4800, tel:+44 (0) 1752 723330, [email protected] [email protected] contact: Nick Landis

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43“The industry is an ecosystem which includes owners, managers, mariners, shipyards, equipment makers, designers, research institutes and class societies: all of them are crucial,” – Eero Lehtovaara, Head of Regulatory & Public Affairs, ABB Marine & Ports All images courtesy ABB Marine and Ports provi

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41Nautel provides innovative, industry-leading solutions speci? cally designed for use in harsh maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications

-

)

April 2024 - Maritime Reporter and Engineering News page: 29

)

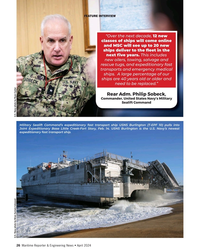

April 2024 - Maritime Reporter and Engineering News page: 29RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND U.S. Navy photo by Bill Mesta/released U.S. Navy photo by Ryan Carter Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command, visits USNS Patuxent (T-AO 201) for a tour of the ship at Naval Station Norfolk, Va., November 20, 2023. ENDLESS

-

)

April 2024 - Maritime Reporter and Engineering News page: 26

)

April 2024 - Maritime Reporter and Engineering News page: 26and emergency medical ships. A large percentage of our ships are 40 years old or older and need to be replaced.” Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command Military Sealift Command’s expeditionary fast transport ship USNS Burlington (T-EPF 10) pulls into Joint Expedition

-

)

April 2024 - Maritime Reporter and Engineering News page: 25

)

April 2024 - Maritime Reporter and Engineering News page: 25RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND Photo by Brian Suriani USN Military Sealift Command From a global supply chain perspective, What makes MSC so vital to the we’ve learned a lot about dealing with Navy’s ? eet and our military disruptions. COVID delivered a big forces around the world? wake-up

-

)

April 2024 - Maritime Reporter and Engineering News page: 12

)

April 2024 - Maritime Reporter and Engineering News page: 12about methanol This study concluded that the Toyota Prius Prime is the green- where we concluded that methanol is a prom- est car you can buy in the United States. ising sustainable liquid fuel for transportation The Council assesses vehicle “green scores” not only by Mdevices when batteries cannot

-

)

April 2024 - Maritime Reporter and Engineering News page: 8

)

April 2024 - Maritime Reporter and Engineering News page: 8Training Tips for Ships © By tuastockphoto/AdobeStock Tip #58 Enhancing Behavior-Based Safety By Murray Goldberg, CEO, Marine Learning Systems ave you ever heard the term “Behaviour-Based environment where each individual feels personally respon- Safety”? Although the term itself is relatively sible for

-

)

April 2024 - Maritime Reporter and Engineering News page: 7

)

April 2024 - Maritime Reporter and Engineering News page: 7- EWIGXSVWTIGMjGIZIRXJSVJEWXZIWWIPW 11 operating at high speed forsecurity Southampton JUNE in partnership with TO interventions and Search & Rescue. United Kingdom ???? 13 Celebrate innovation and excellence in the commercial marine industry at The European For more information (SQQIVGMEP2EVMRI&[EVHW *(2&W

-

)

April 2024 - Maritime Reporter and Engineering News page: 2

)

April 2024 - Maritime Reporter and Engineering News page: 2NO.4 / VOL. 86 / APRIL 2024 16 Photo on the Cover: U.S. Navy photograph by Brian Suriani/Released Photo this page: Copyright Björn Wylezich/AdobeStock 16 SOVs: Analyzing the Market Drivers Departments As offshore wind grows globally, so too do the dynamics around SOVs. By Philip Lewis 4 Authors & Contribut

-

)

April 2024 - Marine News page: 38

)

April 2024 - Marine News page: 38collaboration Imagine a shipyard as a football team, where the dis- parate execution of roles, along with precise timing and placement are paramount for a united victory. Just as dif- ferent football teams leverage their unique strengths to create an advantage to win games, shipyards must em- ploy unique strategies

-

)

April 2024 - Marine News page: 37

)

April 2024 - Marine News page: 37Feature Electric Tugs could change down the road. “What do we really need an In San Diego, eWolf’s transits will typically run 20-30 engineer to do? There are no moving parts. So, how does minutes, “not the optimal operation to really see a lot of that [role] change? How does that change where we work?

-

)

April 2024 - Marine News page: 36

)

April 2024 - Marine News page: 36Feature Electric Tugs the construction of which has fallen behind schedule. “When you’re out on the leading edge of these technolo- gies, everything has to catch up,” Manzi said. “Permitting has to catch up, regulation has to catch up, standards have to catch up. And we’ve faced all three of those challenge

-

)

April 2024 - Marine News page: 34

)

April 2024 - Marine News page: 34Feature Electric Tugs All images courtesy Eric Haun The eWolf’s power integrates into eWolf features a 6.2 MWh Orca ABB’s DC grid architecture, which battery energy storage system distributes to all the consumers from Corvus Energy. throughout the vessel. 12 to 16 inches. If you’ve got 14 inches and

-

)

April 2024 - Marine News page: 33

)

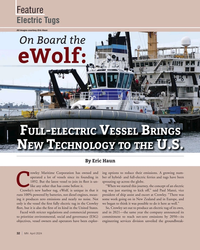

April 2024 - Marine News page: 33Feature Electric Tugs ing tug design. ABB was brought on as systems integrator, and Coden, Ala. shipbuilder Master Boat Builders began building the vessel later that year. The result of these efforts is the 82-foot-long tug eWolf, built to ABS class and is compliant with U.S. Coast Guard Subchapter M

-

)

April 2024 - Marine News page: 32

)

April 2024 - Marine News page: 32? rst fully electric tug in the Crowley we began to think it was possible to do it here as well.” ? eet, but it is also the ? rst of its kind in the United States. So, Crowley set out to produce an electric tug of its own, Faced with stricter regulations and commercial pressure and in 2021—the same year