Michael C Hagan

-

- LEADING INLAND OPERATORS SPEAK OUT Maritime Reporter, Mar 1992 #16

Barge Operators Assess Impact Of OPA And Future Of The Industry The repercussions of the Oil Pollution Act of 1990 have been felt by the entire marine industry, but no where more acutely then in U.S.

inland waterway and coastal transport operations. Unlimited liability, escalating carrier insurance, and mandated equipment modifications are j u s t part of the onus of OPA t h a t operators must bear. To more fully assess the impact OPA 90 has had and will have on future inland and coastal water transportation operations, MARITIME REPORTER conducted interviews with some of the largest and most influential operators in the brown water market.

The following is a brief look at some of their insightful comments on the Oil Pollution Act, the Clean Air Act and the near term future of the industry.

The Impact Of OPA "The enactment of the Oil Pollution Act (OPA) of 1990 will have effects on different parts of the country.

How these effects manifest themselves over the long term will certainly impact our business," said Raymond Hickey, president and chief operating officer of Tidewater Barge Lines, Inc., Vancouver, Wash.

"We have called OPA, 'The Act of Emotion.' A law irrespective of differing regional product and transportation characteristics." Tidewater operates along the Columbia/Snake River system in the Pacific Northwest. The company barges clean or refined petroleum products along a short—465 miles— inland river, making their operations extremely sensitive to cost increases.

"The question that concerns us," said Mr. Hickey, "is, 'Are we going to be competitive with other modes [of transportation] after passing along costs associated with OPA compliance to our customers in a recessionary environment?'" According to the company's statistics, tugs and barges haul about 12 percent of the nation's freight for about 2 percent of the cost.

"If you have 3,500 tons of grain, you'll need 116 trucks or 35 rail cars to move it. All I need is one tug and barge," he said "The Oil Pollution Act has and will continue to affect Dixie Carriers' operations. In many instances, the effects of OPA 90 will be positive because operators will be forced to more carefully attend to their business.

Conformance with the requirements of OPA has caused Dixie Carriers to continue to validate the adequacy of its own operating procedures and has increased our costs," said J.H. Pyne, president of the Houston, Texas, water transportation firm.

Dixie Carriers, Inc. and its marine transportation subsidiaries comprise Houston-based Kirby Corporation's marine transportation segment.

Dixie's Inland Division, operating inland tank barges primarily along the Gulf Intracoastal Waterway, Houston Ship Channel and the Mississippi River and its tributaries, has a fleet of 123 barges and 47 towboats.

Dixie's Offshore Division, operating among ports along the Gulf of Mexico, as well as ports in the Caribbean Basin and along the Atlantic and Pacific Coasts, transports dry bulk and liquid cargoes using eight barges, eight tugboats and one shifting and fleeting boat.

Brent Transportation, another Dixie company, operates an inland fleet of 61 barges and 18 towboats.

Mr.Pyne sighted the areas of increased crew training, equipment modifications (to comply both with the OPA double-hull requirement and Clean Air Act for vapor control), refinement of emergency spill response plans, compliance audits and spiraling insurance premiums. Dixie will spend in excess of $5 million for vapor control equipment alone in 1992.

"The Oil Pollution Act has and will continue to have a significant impact on our fleet," said Fred C.

Raskin, president of the Cincinnati- based Ohio River Company.

"We have over 40 single-skin tank barges that handle refined petroleum products, and current legislation will require their retirement/ replacement by 2015." Mr. Raskin also pointed out t h a t general operations in both the dry and liquid cargo areas will be impacted by spill contingency plans, as well as additional training and licensing requirements.

Looking Ahead Although Mr. Pyne thought business conditions would be flat for 1992, he predicted better conditions in the years ahead.

"Looking beyond 1992, we are very optimistic about our business. For the first time since the late 1970s, the inland tank barge fleet is in balance. Other t h an pipelines, which require higher dedicated volume than barges, marine transportation will continue to remain the most cost efficient method of moving bulk commodities between U.S. coastal and inland ports." Mr. Raskin of Ohio River Co., however, thought conditions in the industry would improve this year.

He believed a return to more normal weather and economic conditions coupled with a resumption of grain exports to the Commonwealth of Independent States (the former Republics of the Soviet Union) would help make 1992 a "good year." "The stability of riverborne grain demand will be strongly affected by the level ofU.S. exports to CIS, which in t u rn is heavily influenced by the amount of loan credit the United States is willing to provide," said Michael C. Hagan, president and chief operating officer, American Commercial Lines, Inc. "Current governmental actions suggest the CIS will continue to receive U.S.

agricultural aid," continued Mr.

Hagan. "Based upon that assumption, American Commercial Barge Lines, Inc. anticipates 1992 barge grain demand to improve slightly over 1991 volume. However, wide fluctuations in spot grain freight rates will probably continue." Clean Air Act & Coal Transportation "The Clean Air Act amendments will alter coal transportation patterns and alternatives," said Mr.

Hagan. "As sources of coal shift, inland river operators are wellpositoned to benefit from the changing shipper requirements. With a number of river-served utility plants being affected by Phase I of the C AA amendments, river trasnportation patterns will result in potentially longer hauls, further straining equipment capacity.

"We anticipate a solid 5 to 7 percent increase in export coal tonnage over 1991 volumes, driven principally by increasing demand for U.S.

steam coal exports," stated Mr.

Hagan. "The continued growth in export coal demand should attract covered barges normally used in the grain trade." Mr. Hagan also believed that domestic coal activity would improve moderately over last year, posting a 1 to 2 percent growth rate.

Fleet, Operation Expansion In 1992, Dixie Carriers plans to take delivery of the last three of a series of twelve 29,000-barrel inlandchemicaltankbarges.

Thecompany has also announced its intended acquisition of two inland tank barge operators, Sabine Towing & Transportation Company and Ole Man River Company. With these acquisitions, the Dixie fleet will consist of268 tank barges and 104 boats.

For 1992, Tidewater plans to put into operation, a solid waste program, transfer station, container yard, barge transportation and landfill, three new wood chip barges, a second wood chip loading facility, expand its container operation at Boardman, Ore., and complete the construction of a new floating repair service for Tidewater Barge.

The Ohio River Co. is currently building about 150 dry cargo hopper barges at its Port Allen, La., facility.

-

)

February 2024 - Maritime Reporter and Engineering News page: 36

)

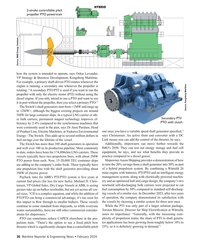

February 2024 - Maritime Reporter and Engineering News page: 36time for ABB’s PTI/PTO system is ? ve years at management system, along with electrically powered machin- current fuel prices (far less for new fuels). Michael D. Chris- ery and an optimized hull and cargo design, the company’s two tensen, VP Global Sales, Dry Cargo Vessels at ABB, is seeing newbuild self-discha

-

)

January 2024 - Maritime Reporter and Engineering News page: 48

)

January 2024 - Maritime Reporter and Engineering News page: 48429498089, [email protected] V5G 4R8 Canada , tel:604 433-4644, fax:604 433-5570, JMS Naval Architects, 70 Essex Street, Mystic, CT , [email protected] USA , tel:(860) 536-0009 EXT 2, fax:(860) 536-9117, SENSORS [email protected] INERTIAL SENSING SYSTEMS Silicon Sensing

-

)

December 2023 - Maritime Reporter and Engineering News page: 48

)

December 2023 - Maritime Reporter and Engineering News page: 48Canada , tel:604 433-4644, fax:604 433-5570, JMS Naval Architects, 70 Essex Street, Mystic, CT , Silicon Sensing Systems Ltd, Clittaford Road Southway, [email protected] USA , tel:(860) 536-0009 EXT 2, fax:(860) 536-9117, Plymouth, Devon PL6 6DE United Kingdom , UK , tel:+44 [email protected]

-

)

November 2023 - Marine News page: 8

)

November 2023 - Marine News page: 8level of need, there has been FY22 U.S. federal dredging market compiled in Septem- a steady climb,” Gerhardt said. “On average the hopper ber 2023 by Michael Gerhardt, senior director of govern- dredging market, which has ? uctuated between $300 mil- ment affairs at Mike Hooks, LLC, 52 Jones Act dredg-

-

)

November 2023 - Maritime Reporter and Engineering News page: 76

)

November 2023 - Maritime Reporter and Engineering News page: 76Canada , tel:604 433-4644, fax:604 433-5570, JMS Naval Architects, 70 Essex Street, Mystic, CT , Silicon Sensing Systems Ltd, Clittaford Road Southway, [email protected] USA , tel:(860) 536-0009 EXT 2, fax:(860) 536-9117, Plymouth, Devon PL6 6DE United Kingdom , UK , tel:+44 [email protected]

-

)

November 2023 - Maritime Reporter and Engineering News page: 69

)

November 2023 - Maritime Reporter and Engineering News page: 69and in the nearby East Australian Exercise Area. Austra- tion, as well as partners in academia and industry, were stake- lia’s Chief of Navy, Vice Admiral Michael Noonan, noted that holders in these exercises. AW 22 was designed to help implement the Navy’s RAS-AI One of the important lessons learned during

-

)

November 2023 - Maritime Reporter and Engineering News page: 64

)

November 2023 - Maritime Reporter and Engineering News page: 64COMPANY IN FOCUS: W&O Company in Focus: In June 2023, Michael Hume rejoined W&O as President. W&O Image courtesy W&O or more than 48 years, W&O has focused exclusively Primary Product/Service on serving the maritime industry with products and W&O focuses solely on the maritime industry with prod- servi

-

)

October 2023 - Marine News page: 44

)

October 2023 - Marine News page: 44. rector of business development. SUNY Maritime’s New Operations Managers Murdaugh Kruger Alfultis to Retire at Two Ohio River Ports Rear Admiral Michael Alfultis will re- Ports of Indiana has ? lled two key tire in 2024 after nearly a decade as pres- leadership roles at its Ohio River ident of SUNY

-

)

September 2023 - Maritime Reporter and Engineering News page: 64

)

September 2023 - Maritime Reporter and Engineering News page: 64, tel:604 433-4644, fax:604 433-5570, Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Silicon Sensing Systems Ltd, Clittaford Road Southway, [email protected] Texas 77087 , tel:(713) 644-1183, fax:(713) 644-1185, Plymouth, Devon PL6 6DE United Kingdom , UK , tel:+44 david@anchormarinehou

-

)

June 2023 - Marine News page: 33

)

June 2023 - Marine News page: 33operate vada, the Paci? c Islands, and 148 Tribal Nations) EPA and on the rivers despite record low water conditions. It’s a USACE work together on BU. Michael Brogan, with the credit to the Corps’ proactive work to identify dredging Region 9 press of? ce, said “(EPA’s) top focus continues to needs and

-

)

August 2023 - Maritime Reporter and Engineering News page: 64

)

August 2023 - Maritime Reporter and Engineering News page: 64, Britmar Marine LTD, 102 2433 Dollarton Hwy N. Vancouver V7H OA1 BC Canada, North Vancouver , Canada (0) 1752 723330, [email protected] [email protected] ENGINE ORDER TELEGRAPH METEOROLOGICAL INSTRUMENTS SENSORS Prime Mover Controls, 3600 Gilmore Way Burnaby B.C. R.M. Young

-

)

August 2023 - Marine News page: 44

)

August 2023 - Marine News page: 44Gibbs & Cox, a Leidos company, an- Dumont Takes the Helm at nounced the creation of the Donald L. Cal Maritime Blount Memorial Graduate Scholarship. Michael J. Dumont has started his The scholarship is offered through the tenure as interim president of California Society of Naval Architects and Marine

-

)

July 2023 - Marine Technology Reporter page: 16

)

July 2023 - Marine Technology Reporter page: 16conductivity, a tendency to lack of grain structure found in wrought material. ACKNOWLEDGEMENTS The author gratefully acknowledges the contributions of Michael May, Decisive Testing; Mike Gomper (Clint Precision Manufactur- ing); Reed Jackson (RJ Machine); Rob Klidy, Manager, Scripps Institution of Oceanography/UC

-

)

June 2023 - Maritime Reporter and Engineering News page: 48

)

June 2023 - Maritime Reporter and Engineering News page: 48, Britmar Marine LTD, 102 2433 Dollarton Hwy N. Vancouver V7H OA1 BC Canada, North Vancouver , Canada (0) 1752 723330, [email protected] [email protected] ENGINE ORDER TELEGRAPH METEOROLOGICAL INSTRUMENTS SENSORS Prime Mover Controls, 3600 Gilmore Way Burnaby B.C. R.M. Young

-

)

June 2023 - Maritime Reporter and Engineering News page: 19

)

June 2023 - Maritime Reporter and Engineering News page: 19means of quickly “? ghting back”. Maritime Cybersecurity, October 2022. The U.S. Coast Guard recently released the Maritime Cy- 2 Chris C. Demchak and Michael L. Thomas, War on the Rocks, October 15, bersecurity Assessment & Annex Guide (MCAAG) to help 2021, Can’t Sail Away From Cyber Attacks:‘Sea-Hacking’

-

)

May 2023 - Maritime Reporter and Engineering News page: 64

)

May 2023 - Maritime Reporter and Engineering News page: 64V5G 4R8 Canada , tel:604 433-4644, fax:604 433-5570, Anchor Marine & Supply, INC., 6545 Lindbergh Houston, (0) 1752 723330, [email protected] [email protected] Texas 77087 , tel:(713) 644-1183, fax:(713) 644-1185, [email protected] METEOROLOGICAL INSTRUMENTS SENSORS

-

)

May 2023 - Maritime Reporter and Engineering News page: 57

)

May 2023 - Maritime Reporter and Engineering News page: 57in 1831 to light up inven- needed to break through ice or against strong headwinds. However, despite these bene? ts, there are some key areas tor Michael Faraday’s smile. If only he could see how far that at- where conventional shaft generators fall short. This is where traction to magnets has come

-

)

April 2023 - Maritime Reporter and Engineering News page: 48

)

April 2023 - Maritime Reporter and Engineering News page: 48V5G 4R8 Canada , tel:604 433-4644, fax:604 433-5570, Anchor Marine & Supply, INC., 6545 Lindbergh Houston, (0) 1752 723330, [email protected] [email protected] Texas 77087 , tel:(713) 644-1183, fax:(713) 644-1185, [email protected] METEOROLOGICAL INSTRUMENTS SENSORS

-

)

April 2023 - Maritime Reporter and Engineering News page: 42

)

April 2023 - Maritime Reporter and Engineering News page: 42midship manifold. Future-Fuel-Ready Courage Majestic Fast Ferry Adds Enters Service on the Rhine Vessel Trio Copyright: Covestro Deutschland AG, Michael Rennertz Image courtesy Incat Crowther Following a successful initial loading operation and maid- en voyage on the river Rhine, Covestro and HGK Shipping

-

)

February 2023 - Maritime Reporter and Engineering News page: 48

)

February 2023 - Maritime Reporter and Engineering News page: 48, tel:604 433-4644, fax:604 433-5570, Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Silicon Sensing Systems Ltd, Clittaford Road Southway, [email protected] Texas 77087 , tel:(713) 644-1183, fax:(713) 644-1185, Plymouth, Devon PL6 6DE United Kingdom , UK , tel:+44 david@anchormarinehou

-

)

February 2023 - Maritime Reporter and Engineering News page: 20

)

February 2023 - Maritime Reporter and Engineering News page: 20GOVERNMENT SHIPBUILDING Chief of Naval Operations Admiral Michael Gilday to Huntington Ingalls Industries Ingalls Shipbuilding in Pascagoula, Miss., shipyard in January 2023 and toured several ships, including the ? rst Flight III guided missile destroyer, Jack H. Lucas (DDG 125). HII Ingalls Shipbuild

-

)

February 2023 - Maritime Reporter and Engineering News page: 18

)

February 2023 - Maritime Reporter and Engineering News page: 18Surface Navy Association 35th Annual Sym- than it has in decades. The Navy wants two Virginia-class subs posium in Washington, Chief of Naval Operations Michael per year, but industry is only delivering at a rate of 1.2 a year. 18 Maritime Reporter & Engineering News • February 2023 MR #2 (18-33).indd

-

)

February 2023 - Marine News page: 31

)

February 2023 - Marine News page: 31Transportation) saw the com- and Manhattan. A builder has yet to be announced. missioning of its third newbuild, Dorothy Day, in late 2022, joining SSG Michael H. Ollis, and Sandy Ground, Arthur Imperatore was delivered to NY Waterway from Yank Marine in 2022. which joined the ? eet earlier in the year

-

)

January 2023 - Maritime Reporter and Engineering News page: 44

)

January 2023 - Maritime Reporter and Engineering News page: 44Canada , tel:604 433-4644, fax:604 433-5570, Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Prime Mover Controls, 3600 Gilmore Way Burnaby B.C. [email protected] Texas 77087 , tel:(713) 644-1183, fax:(713) 644-1185, V5G 4R8 Canada , tel:604 433-4644, fax:604 433-5570, david@anchormarinehous