Outlook

-

- OUTLOOK FOR THE $35-BILLION ANNUAL NAVY SHIPBUILDING MARKET Maritime Reporter, Jul 1989 #25

Technology Development To Be Given Added Emphasis Navy Shipbuilding Program Navy ship construction has been the major business driver for shipbuilders and ship systems manufacturers in this country over the past decade. This article deals specifically with Navy ship construction over the next 10 years. As documented in IMA's report, the Navy program is entering a period which will dramatically impact industry.

As shown in Exhibit 1, the U.S.

Navy over the past eight years has funded construction or conversion of 175 major ships—an average of 22 ships per year. As a result, the size of the deployable battle forces has grown from 479 ships in 1980 to 568 ships currently—with 574 ships projected for 1990. Exhibit 2 shows the trend and composition of the deployable battle force over the past decade.

This program has had a major impact on industry. Exhibit 3 shows the shipyards now involved in Navy ship construction or conversion. Exhibit 4 shows the trend in the number of shipyards building or repairing Navy ships over the period 1978- 1988.

Will Navy Maintain the Pace of Ship Construction?

The Assistant Secretary of Navy (S & L) last year stated: " .v. to keep the size of Navy we are talking about, you would need to build at a continuing pace of 18 to 20 ships a year. ..." It is useful to compare this projected rate of construction with past activity. The Navy ordered 236 ships in the 1960s—an average of almost 24 ships annually. During the 1970s (a period of declining defense spending), the Navy bought 147 ships—an average of 15 ships annually. In the 1980s, the Navy has thus far ordered 184 ships—an average of 20 ships annually. Will the pace of orders in th 1990s be similar to the 1960s/1980s—or the 1970s?

It is also useful to examine the trend in unit cost. Navy ships in the 1960s cost an average of $24 million each. This figure became $88 million in the 1970s—and $209 million in the 1980s.

No one questions that the ships now being ordered are technologically superior to those ordered in the 1960s. Rather, the question is whether the Navy can continue to maintain a building pace of 18 to 20 per year in light of (1) future funding constraints and (2) continued growth in ship prices.

During the 1980s there was minimal conflict among the proponents of submarine, surface combatant and aircraft carrier programs. There was enough money for growth in all three areas. Things have changed— and difficult trade-offs need to be made. There are not sufficient funds for all of the proposed programs.

More clashes over priorities and funds can be expected within the Navy. Submariners, for example, have already been staking their claim to funds by talking up a future role for submarines which infringes on the traditional turf of aircraft carriers.

Technology Development Will Be Given Added Emphasis The Navy is under pressure to study and introduce new concepts— not simply buy more of the same.

Technology-push developments are already getting greater attention in the Navy. Opportunities have opened in a variety of new areas— including fiber optics, composite armor, stealth concepts, ship survivability, etc.

It is important to remember that necessary changes will bring new opportunities and the fact still remains that the Navy plans call for an average of $35 billion annually in expenditures over the next 10 years, approximately a third of which will be spent for ship equipment.

iMA has just completed an indepth assessment of Navy ship construction over the next ten years.

The 220-page report, released in June 1989, evaluates future business drivers and assesses likely construction requirements in nine categories of Navy ships: • submarines • surface combatants • aircraft carriers • amphibious ships • combat logistics ships • sealift ships • mine warfare ships • ocean survey and surveillance ships • boats and service craft.

Only a few of the findings and conclusions from the report are highlighted in the above article.

More in-depth and extensive coverage is available in the full IMA report, which can be purchased for $950. To order, contact: IMA Associates, Inc., 835 New Hampshire Avenue, N.W., Washington, D.C.

20037; telephone: (202) 333-8501; and telefax: (202) 333-8504.

-

- THE OUTLOOK FOR U.S. NAVY SHIPBUILDING AND SHIP REPAIR Maritime Reporter, Jun 1989 #24

Status of U.S. Navy Ship Modernization and Maintenance NAVY BUDGET The proposed Navy budget is $101.7 billion in FY 1990 and $105.1 billion in FY 1991. This would represent a three to four percent increase over current spending. Described below are Navy's plans and budget for major program activitie

-

- REVIEW AND OUTLOOK Maritime Reporter, Jun 1989 #44

and expectations that shipyards in Canada had "bottomed- out" from the 1985-86 slump and were now into a gradual recovery phase. And now for the outlook—aye, there's the rub! On the commercial side, the last delivery of vessels currently under construction is scheduled for January 1990, and very

-

- LONG TERM OUTLOOK FOR U.S. NAVY SHIPBUILDING Maritime Reporter, Feb 1989 #29

NAVY PROJECTS SPENDING $11 BILLION PER YEAR Editor's Note: This article only forecasts business opportunities in the shipbuilding sector. For a projection of business opportunities in the ship repair and maintenance sector over the next 10 years, see Mr. McCaul's article, "U.S. Ship Maintenance &

-

- REVIEW AND OUTLOOK Maritime Reporter, Jun 1988 #62

. During the first quarter of 1988, several new contracts were awarded, with a virtual 50-50 balance between new construction and refit/ repair. The outlook through '88 into the next decade appears promising, for several reasons. First, world shipping increased steadily over the past 20 months, with

-

- U.S. SHIPBUILDING OUTLOOK Maritime Policy—1980-1985 Maritime Reporter, Jun 1986 #40

When the Administration assumed office in 1981, the shipbuilding industry understood that it would be challenged to meet the performance and cost objectives of an expanded naval construction program. Further, the shipbuilding industry knew that performing the backlog of commercial and Navy work

-

- CANADIAN SHIPBUILDING REVIEW AND OUTLOOK Maritime Reporter, Jun 1986 #63

from 1984, and at C$131,204,000 was the lowest since 1978. This is a reflection of the shipping industry's financial difficulties worldwide. The outlook for the repair industry in 1986, both commercial and government, is clouded by the government's decision to allocate work previously done in

-

- US SHIPBUILDING OUTLOOK Markets & Cost Saving Maritime Reporter, Jun 1985 #44

Editor's note: The following report is reprinted from the 1984 Annual Report of the Shipbuilders Council of America that was released in April, 1985. For the shipbuilding and shiprepair industries, 1984 was a year in which "holding ground" was a primary operative phrase. The present policy of the

-

- McDermott Official Says Marine Building Outlook In Gulf Area Is 'Best Ever Maritime Reporter, Oct 1981 #16

"The outlook for marine construction in the Gulf of Mexico in the 1980s is, in my view, not only good, it is great," Robert E. Howson, president of McDermott Marine Construction, recently told participants in a symposium sponsored by the University of New Orleans on the "Economic Future of the Gulf

-

- Positive Outlook for Global Subsea Development, Deepwater Strengthening Maritime Reporter, Apr 2002 #50

There are 2,511 identified pending, probable and possible subsea production wells forecast (base case) worldwide over the next six years. Some 18 percent of these subsea completions will be installed in North America, 30 percent in Africa/Mediterranean, eight percent in Asia-Pacific, 26 percent in the

-

- World Offshore Drilling Activity: A 5-Year Outlook Maritime Reporter, Apr 2003 #36

are both expected to see declines in expenditure. Asia's forecast five-year spend is approximately $4.5 billion less than the previous period, and the outlook is similar in Western Europe, where forecast expenditure is more than $5.2 billion less than the 1998-2002 level. The biggest influence on these

-

- Outlook for Floating Production Systems Maritime Reporter, Sep 2003 #52

strengths/vulnerabilities and evaluate options for optimizing market position. This article is taken from a new in-depth assessment by IMA of the outlook for FPSO vessels, production semis, TLPs and spars. The HO page report is the 19th in a series of in-depth analyses by IMA of this market sector

-

)

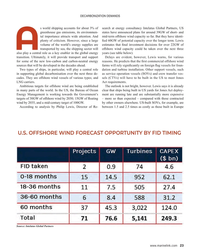

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22have a real impact on the players that While that has yet to transpire, Lanford assesses the potential. remain, Langford maintains an optimistic outlook long term. “To meet the US offshore wind goal of 30GW by 2030, we “We are engaged with multiple US OSW wind develop- see the demand of 5 to 7 installation

-

)

February 2024 - Marine News page: 4

)

February 2024 - Marine News page: 4, of Mike Kozlowski • [email protected] Tel: 561-733-2477 Fax: 561-732-9670 course, especially on the political side where the outlook is hazy at best. Gary Lewis • [email protected] But one thing is for certain, it’s going to be a wild ride. Tel: 516-441-7258

-

)

January 2024 - Marine Technology Reporter page: 54

)

January 2024 - Marine Technology Reporter page: 54Power, which offers a compelling, modular engineered solution and value proposition to the market. Newly minted Gazelle CFO Alvaro Ortega discusses the outlook for Gazelle in the offshore ? oating wind sector. By Greg Trauthwein oday, it’s acknowledged that the vast potential for depth].” offshore wind extends

-

)

November 2023 - Marine News page: 35

)

November 2023 - Marine News page: 35Schwarz, there is a promising outlook there. “Worldwide there is a growing imperative to reduce emissions,” he ex- plained. “Across the United States, we see more attention, action and investment to develop shore-based power instal- lations as part of the overall effort of port decarbonization, which

-

)

November 2023 - Maritime Reporter and Engineering News page: 23

)

November 2023 - Maritime Reporter and Engineering News page: 23, Schellenberger said. switched from production of goods to a buyer of them. One in three seafarers looks for connectivity on board as Pomeroy said: “The outlook for now for the economy feed- more important than salary when looking at which owner or ing back into shipping isn’t great, but it will come back

-

)

September 2023 - Maritime Reporter and Engineering News page: 44

)

September 2023 - Maritime Reporter and Engineering News page: 44Shipping & Ports Annual 2023 CONTAINER SHIPPING OUTLOOK Container Shipping 2023: Post-Covid Turmoil Continues ©eyewave/AdobeStock While container shipping thrived during Covid, the thrill is gone as rapidly changing trade patterns premised on geopolitical turmoil and logistic chain snarls have sent

-

)

August 2023 - Maritime Reporter and Engineering News page: 23

)

August 2023 - Maritime Reporter and Engineering News page: 23sels (CTVs) will have to be built in the US to meet Jones LNG carriers. Act requirements. Ambitious targets for offshore wind are being established The outlook is not bright, however. Lewis says it is already in many parts of the world. In the US, the Bureau of Ocean clear that ships being built in US yards

-

)

June 2023 - Maritime Reporter and Engineering News page: 19

)

June 2023 - Maritime Reporter and Engineering News page: 19Security Plans required by MTSA. In 2021, the Coast Guard Sea Naval Base,” USNI News, 21 June 2021. released an updated version of the Cyber Strategic Outlook 4 John Filitz, Maritime Port Systems Cybersecurity Vulnerability; NMIO Bulletin (CSO), placing responsibility to “prevent and respond” to Vol

-

)

May 2023 - Maritime Reporter and Engineering News page: 30

)

May 2023 - Maritime Reporter and Engineering News page: 30more time and energy to bring forth new products. To easy task. Much of the detail in the EU ETS regulations have allow the industry to keep pace, a new outlook of openness yet to be determined, and the new dynamic between shipown- instead of consolidation must be adopted.” 30 Maritime Reporter & Engineering

-

)

August 2022 - Maritime Reporter and Engineering News page: 5

)

August 2022 - Maritime Reporter and Engineering News page: 5SETTING THE COURSE TO LOW CARBON SHIPPING ZERO CARBON OUTLOOK Download your copy today www.eagle.org/outlook2022 MR #8 (1-17).indd 5 8/2/2022 1:48:36 PM

-

)

July 2022 - Marine Technology Reporter page: 52

)

July 2022 - Marine Technology Reporter page: 52and many others across the offshore energy sector, Echo Sounder (MBES), station holding and winch-deployed are banking on continued vibrant activity and outlook for the sensor payloads for versatile ocean survey capability. offshore wind market. “Yearly global spending on offshore SEA-KIT’s H-class USV is

-

)

June 2022 - Maritime Reporter and Engineering News page: 28

)

June 2022 - Maritime Reporter and Engineering News page: 28are being built in the Atlantic bottom-? xed projects. U.S., and offshore wind port development is accelerating. Among foundations for the positive outlook, two major Outer Intelatus Global Partners has just released the latest in its series Continental Shelf (OCS) projects with around 940 megawatts

-

)

June 2022 - Maritime Reporter and Engineering News page: Cover

)

June 2022 - Maritime Reporter and Engineering News page: CoverJune 2022 MARITIME REPORTER AND ENGINEERING NEWS marinelink.com VAN OORD Pieter Van Oord’s outlook for maritime, including the “next, next generation” in offshore wind. Port Logistics Offshore Wind US Coast Guard Small Cutters Patrol a Big Ocean Digitalization One-on-One with “Mr. ECDIS” Tor Svanes Marine

-

)

May 2022 - Maritime Reporter and Engineering News page: 11

)

May 2022 - Maritime Reporter and Engineering News page: 11, many within that Eastern Navigation has been work- the industry will certainly be hoping that ing the vessel at various intervals since Future Outlook ‘what goes around, does indeed come purchase, and thus generating positive VesselsValue expects the large AHTS all the way back around’ and ?

-

)

May 2022 - Marine News page: 35

)

May 2022 - Marine News page: 35market is expected to continue gain- First you build the right ing strength. “It’s been a good market, and I think we have equipment, and we’ve a great outlook in the future,” McGuire said. “We have these ‘deepening’ cycles that come through every 10 or h h d d done that. Once we build the right 15 years

-

)

April 2022 - Marine News page: 4

)

April 2022 - Marine News page: 4212-254-6271 in the New York Bight lease sale is testament to how bright the American John Cagni • [email protected] offshore wind outlook is and how con? dent developers are in the strength of Tel: 631-472-2715 the U.S. offshore wind industry as a whole. Companies continue to

-

)

March 2022 - Marine News page: 24

)

March 2022 - Marine News page: 24in? ect higher. Not surprisingly…the near- and medium- Hill, who helped to push this funding over the goal line.” term setup looks good… And while the outlook for U.S. Noteworthy projects funded included the Kentucky Lock GDP remains constructive, which should buoy continued (on the Tennessee River, near

-

)

March 2022 - Marine News page: 21

)

March 2022 - Marine News page: 212021. The authors not- ed, “The last 20 years validate that the underlying markets relevant to barge demand are stable and resilient, and the summary outlook for 2025 anticipates that tonnages will be slightly lower and ton-miles slightly higher than 2019. The increase in ton-miles is in spite of a reduction

-

)

January 2022 - Marine Technology Reporter page: 25

)

January 2022 - Marine Technology Reporter page: 25forecasts would aid safety, route planning, navigation, resup- ply and fuel purchases. Forecasters also continue to work with models to improve sea ice outlooks by understanding the in? uences, for exam- ple, of snow on ice and of melt ponds. They will also use a new data portal to look at potential bias

-

)

January 2022 - Marine Technology Reporter page: 24

)

January 2022 - Marine Technology Reporter page: 24Some puzzles have popped up over the 14 years of the net- rector Hajo Eicken. work’s existence. For example, the median June forecasts for “The sea ice outlook provides a unique opportunity for a di- the coming season correlate best with observations of the pre- verse group to work together to seek common

-

)

January 2022 - Marine Technology Reporter page: 23

)

January 2022 - Marine Technology Reporter page: 23after the then-record Arctic sea ice minimum of 2007. “That really shocked some scientists and garnered a lot of public attention,” Bhatt said. Sea ice outlook forecasts began the following year and con- tinued through 2013 on minimal funding. The National Science EMPOWERING www.marinetechnologynews.com

-

)

January 2022 - Marine News page: 14

)

January 2022 - Marine News page: 14? ow of re- writing this column strictions on life in general and travel in particular. The just a few weeks earlier than late December, my opening outlook for the foreseeable future is yet again cloaked in remarks would have been decidedly upbeat. After two uncertainty, but one thing is absolutely

-

)

January 2022 - Marine News page: 4

)

January 2022 - Marine News page: 4very best to plot future courses. Mike Corrigan, head of trade John Cagni • [email protected] association Interferry, delivers his outlook starting on page 14, followed by Tel: 631-472-2715 Barry Parker’s assessment of the sector on page 18. Frank Covella • covella@marinelink

-

)

January 2022 - Maritime Reporter and Engineering News page: 21

)

January 2022 - Maritime Reporter and Engineering News page: 21shortages for keeping the ? ow of cargo stable during challenging times. and higher prices, the supply chain’s current state also has un- Long term outlook (2030 and beyond) intended consequences. A container ship was responsible for causing a recent oil spill that has polluted more than 24 miles The