Latin America

-

- Subsea Vessels Poised for Increased Global Demand Maritime Reporter, Oct 2013 #56

In its latest subsea vessels report Douglas-Westwood (DW) forecast more than $100b of expenditure on subsea vessel operations over the next five years – with global demand is expected to increase by 23%. The increase in expenditure is expected to be higher than the growth in vessel days, due to the move towards higher specification vessels to cater for deeper and more complicated field development programs.

Dayrates for high specification dive support vessels (DSV) and multipurpose support vessels (MSV) are expected to increase by over 40% by 2017. High spec flexlay dayrates are expected to remain similar and low spec decrease marginally. Pipelay vessel rates are expected to increase by up to 8% for high spec, whilst light well intervention vessel (LWIV) rates are anticipated to increase slightly.

The deepwater Golden Triangle (Africa, GoM and Brazilian areas), is expected to account for the majority of global expenditure on vessel operations over the forecast period. North America is forecast to be the largest market followed by Latin America and Africa.

Drivers and Indicators

Global energy demand has grown significantly over the past 50 years and is forecast to continue, driven by developing economies. Oil is a fuel of huge importance mainly due to its role in transportation, where it cannot be readily substituted by alternative energy sources. Oil consumption is forecast to grow from today’s 90 million barrels per day to 107mbpd by 2035. Production will increasingly have to come from unconventional sources and also deeper water. This will cause all sectors of the subsea market to increase in tandem. With the anticipated growth in offshore developments, there are more opportunities for subsea vessels to be used and due to the move towards deep and ultra-deep waters, the need for higher specification vessels is looking particularly positive.

The move towards deeper water activities has rendered some older vessels inadequate. Saturation of sections of the market, particularly for some DSV/MSV types is now evident, with some retention of high demand for flexlay/pipelay vessels. DW expects an upside trend of activity in vessels supply. This is largely due to the move towards building higher capability vessels to cater for deeper water activities, but also the retiring of less capable vessels and meeting increasing demand in Latin America, Africa and Asia.

Market Demand by Region

Africa

Africa will remain one of the world’s most significant regions for subsea developments. A large number are currently onstream and more are planned for the forecast period. Projects such as Total’s Kizomba field in Angola (2014), Shell’s Bonga South in West Nigeria, (2015) and Total’s Egina field in Nigeria, (2014), will increase the demand for subsea vessels. Total vessel operations expenditure over the 2013-2017 period is in the $16bn region, a significant increase from the preceding five years, and is anticipated to be largely driven by the deepwater region requiring higher specification vessels.

Asia

Over the next five years, field development activities in the Asian region will also increasingly require vessels with deepwater capabilities. Production has, until recently, been restricted to shallow water fields, but there are now a number of deepwater projects producing or underway. Vessel demand is expected to see strong growth with developments such as Shell’s Gumusut (Malaysia), Chevron’s Gehem and Gendalo (Indonesia), Salamander’s Bualuang (Thailand), Reliance Industries’ MA-D6 (India) and CNOOC’s Xijiang 32-1 (China). Expenditure is expected to increase by a CAGR of 11% over the next five years.

Australasia

Australia’s offshore oil & gas reserves are found in the Bonaparte, Browse and Canarvon Basins off the west coast, as well as in the Otway, Bass and Gippsland Basins off the southern coast. Large shallow water gas developments will continue to dominate subsea activities off the west coast of Australia until 2016. There are no visible projects in 2017 but major projects are due to come onstream beyond the forecast period. Field development will account for the largest demand in the region followed by IRM.

Eastern Europe & FSU

Vessel demand is expected to be driven by on-going pipeline projects in the region, while field development activity is expected to remain sporadic over the next five years. The subsea sector is relatively small in the EE and FSU region with lower demand for vessels that carry out field construction, IRM and subsea intervention tasks than other regions. Vessel demand is expected to exceed 20,000 days over the next five years.

Latin America

High specification vessels are required as this region continues to develop deepwater assets and move towards ultra deepwater (>2,000m) such as Petrobras’ pre-salt basins. A large amount of deepwater production has already occurred in Latin America with the vast majority off Brazil. Companies active include BG, BP, Chevron, Devon Energy, Petrogal/Galp, El Paso, Pemex (Mexico NOC), PDVSA (Venezuela NOC), Petrobras (Brazil NOC), Repsol, Shell, Statoil and Total. Expenditure in Latin America was left relatively unscathed by the economic downturn. The region is expected to have the largest vessel spend led primarily by Brazil, and is forecast to grow strongly, accelerating from 2014 due to an increase in field development activity. Vessel day demand from 2013-2017 is expected to increase by more than 65% from the prevailing five year period.

Middle East

Subsea expenditure in the region will continue to be driven by shallow pipelines and fixed platforms, with just one subsea tree is slated to be installed from 2013-2017. Beyond that time, spend is expected to be driven by the three deepwater fields all of which are located off Israel. Meanwhile the Middle East has a relatively small base of subsea infrastructure and there are no visible field development projects over the forecast period with vessel demand mainly coming from pipeline projects. The region is expected to have a relatively low spend, some 4% of the global total.

North America

Over the next five years subsea expenditure in the region is expected to be dominated by deepwater developments, predominately in the U.S. Gulf of Mexico (GoM). North America will also remain one of the world’s most significant regions for subsea vessel demand and expenditure due to the IRM needs of the massive installed base of offshore infrastructure. Total expenditure from 2013-2017 is expected to be the largest of all the regions.

Norway

Norway is a mature region, with much shallow water production but little deepwater activity to date and expenditure will therefore arise from projects in water depths of 250-500m. In total, vessel spend is set to decrease by a CAGR of 2% over the forecast period. This is due to the lack of visibility of pipeline construction projects in 2017. Vessel demand is forecast to peak in 2016 due to an anticipated increase in pipeline activity that year. Overall activity in the next five years is expected to be driven by IRM as field developments and pipeline activity fluctuate.

U.K.

The U.K. is a mature region, with much shallow water production and field developments that utilize subsea trees are typically tied back to existing infrastructure. Shallow water developments will continue to dominate U.K. subsea expenditure. Being a mature market, vessel demand is greatly driven by IRM activities on existing infrastructure. Over the forecast five-year period, expenditure and vessel demand for both IRM and field development will account for over 45% of the total.

RoWE

The Rest of Western Europe is also a mature region, with shallow water production and little deepwater activity to date. However, there are potential deepwater gas developments in the waters of the eastern Mediterranean.

Apart from those, the maturity of the infrastructure in the region means that IRM plays a significant role in vessel demand.

Conclusions

Global demand for subsea vessel operations is expected to grow over the forecast period particularly for the higher spec vessels. With the move to deeper waters, the requirements for vessels with a longer duration on site and with higher technical and operational capabilities are increasing, giving rise to higher expenditure forecasts. The outlook for the subsea vessel operations market shows good long-term growth potential, particularly in North America, Latin America, Africa and Asia-Pacific.

The Author

Calvin Ling, Douglas-Westwood, Singapore

Ling is involved with the day to day execution of strategic consulting and transaction support services for a range of corporate and financial clients within the energy and oil & gas industry. Calvin holds a Bachelors in Engineering (Hons) (Civil) and a Master of Science (MSc) (Geotechnical Engineering and Management) from the University of Birmingham, U.K.

The Report

The World Subsea Vessel Operations Market Forecast 2013-2017 analyzes the main factors driving demand for MSV, DSV, Flexlay, LWIV and Pipelay Vessels. Results analyse vessel demand for key subsea markets, with historic data covering the period 2008-2012 and forecast data for 2013-2017. Read more: www.douglas-westwood.com/shop/shop-infopage.php?longref=1188

(As published in the October 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

-

- Increase in Demand for the Hot Subsea Vessel Market Marine Technology, Oct 2013 #8

for the majority of global expenditure on vessel operations over the forecast period. North America is forecast to be the largest market followed by Latin America and Africa. Drivers and Indicators Global energy demand has grown significantly over the past 50 years and is forecast to continue, driven

-

- The Rise of the Work-class ROV Market Marine Technology, Nov 2013 #30

2013-2017. Construction support accounts for 20% and repair and maintenance (R&M) for 4%. The largest regional market is expected to be Africa, with Latin America, North America and Asia also important players. The ‘Golden Triangle’, comprised of Brazil, the Gulf of Mexico and Africa, is forecast to account

-

- Subsea Vessel Ops Predicted to Grow Over Coming Years Marine Technology, Dec 2014 #30

pipeline installation projects in Azerbaijan and Russia. Vessel demand is anticipated to be approximately 22,000 days over the forecast period. Latin America Latin America is one of the largest regional markets with total expenditure amounting to $18.2bn between 2015 and 2019, an 86% increase from the

-

- MN 100: Crowley Marine News, Aug 2014 #20

company providing services in domestic and international markets through six operating lines of business: Puerto Rico/Caribbean liner services; Latin America liner services; logistics; marine contract solutions; deep sea petroleum transportation; and petroleum transportation, distribution and sales in

-

- Offshore Drilling: 5-Year Projection is $189B Maritime Reporter, Jul 2004 #24

from $37bn (22 percent of the total) in the previous 5-year period," said study author, Dr. Michael R. Smith of EnergyFiles Ltd. Africa and Latin America saw deepwater drilling expenditure exceeding shallow water drilling expenditure for the first time in 2003 and the gap will increase in both

-

- Martin Named President Of Korea Gulf Oil Co. Maritime Reporter, Feb 15, 1977 #25

of increasing responsibility in Gulf Oil Trading Company, in New York, N.Y., and Pittsburgh, Pa., he became vice president of Gulf Oil Company — Latin America and GOTCO regional manager in Coral Gables, Fla., in 1972. He returned to London as vice president of Gulf Oil Company — Eastern Hemisphere

-

- National Supply Names World Marketing Group For Drilling Equipment Maritime Reporter, Aug 1977 #22

Petersen are four area managers: William F. Jennings — North America; Phillip P. Musmeci — Europe, Africa and the Middle East; Thomas B. Herndon — Latin America, and Robert D. Stottlemeyer — Far East. According to T.C. (Ted) Rogers, National Supply president, the new organization will enable the company

-

- Pan American Hovercraft Offers Color Brochure On New Design Hovercraft Maritime Reporter, Mar 1989 #43

signed licensing agreements with Slings by Aviation, Ltd., York, England, to market an innovative passenger hovercraft in the U.S., Canada, Latin America and the Caribbean. Pan American Hovercraft is offering a full-color brochure detailing the 23-passenger SAH 2200 hovercraft. The hovercraft

-

- Tideland Signal Offers Free 30-Page Brochure On Aids To Mavigation For Ports And Harbors Maritime Reporter, Sep 1986 #6

. The colorfully illustrated publication discusses Tideland projects in such areas as Africa and the Middle East, Europe, Australasia, the Far East, Latin America, and Canada. This is followed by three domestic sections. The first covers Gulf Coast projects such as Galveston Bay Entrance Channels in Texas

-

- V e n e z u e l a n Y a r d A w a r ds $ 1 . 2 - M i l l i o n Production Line C o n t r a c t To TTS Maritime Reporter, Mar 15, 1983 #42

on order; however, the line is designed to suit a wide range of applications. The order marks Total Transportation System's first installation in Latin America. The TTS Group, headquartered in Norway, has installed mechanized production lines and custom-designed material-handling systems in about

-

- Martinez And Faass Join Waukesha Engine Division In International Sales Posts Maritime Reporter, May 1981 #51

he had eight years' experience with the Cummins Engine Company, and 10 years' experience at Robert Bosch in both sales and service in Europe and Latin America. Waukesha Engine Division manufactures heavy-duty diesel and gas engines for the marine, petroleum, off-highway equipment, and power generation

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38Tech Files Latest Products, Systems and Ship Designs Zero-Emission Mooring Service of a Tanker Consulmar achieved a milestone by executing what it calls ing boat Castalia, which operates on full electric propulsion. the world's ? rst zero-emissions mooring service for a tanker. Equipped with two 150 kW

-

)

April 2024 - Marine News page: 26

)

April 2024 - Marine News page: 26Feature ECO Edison, the ? rst U.S.- Shipbuilding built wind farm service operations vessel. Ørsted U.S. SHIPBUILDING REPORT By Barry Parker If nothing else, building vessels in the U.S. is a com- handle), handling “…government and commercial work, plicated business. primarily newbuilds, but also

-

)

April 2024 - Marine News page: 16

)

April 2024 - Marine News page: 16OpEd Shipbuilding U.S. Commercial Shipbuilding and Repair Industry Ensures American Strength at Sea By Matthew Paxton, President, Shipbuilders Council of America As Senator Roger Wicker force, the U.S. is falling behind. China, Korea and Japan of Mississippi once said, “Growth in commercial ship-

-

)

April 2024 - Marine News page: 6

)

April 2024 - Marine News page: 6Marine News April 2024 • Volume 35 Number 4 Contributors 1 2 3 5 4 6 7 1 Tom Ewing 5 Barry Parker is a freelance writer specializing in marine, energy and envi- of bdp1 Consulting Ltd provides strategic and tac- ronmental issues. He contributes regularly to this magazine. tical support, including

-

)

April 2024 - Marine News page: 2

)

April 2024 - Marine News page: 2Marine News April 2024 • Volume 35 Number 4 Contents Features 20 Navigation and Wind Farms 20 Competing ocean uses are raising existential questions. As the U.S. offshore industry continues to ramp up, many topics still need to be resolved By Tom Ewing 26 2024 U.S. Shipbuilding Report If

-

)

February 2024 - Maritime Reporter and Engineering News page: 20

)

February 2024 - Maritime Reporter and Engineering News page: 20MARKETS FPSO technology dominates the region’s FPS demand. duction and storage of low and zero emission energy carriers, In all, 18 countries in West and East Africa are expected such as methanol and ammonia. One exciting development to receive new FPSOs, FLNGs and FPUs between 2024 and leverages

-

)

February 2024 - Marine News page: 42

)

February 2024 - Marine News page: 42People & Companies Rella Hired as Wiltshire Leading Port Everglades St. Johns President Glenn A. Wiltshire has taken over as Joe Rella has been appointed as presi- acting director of Broward County’s Port Rella Barton dent of St. Johns Ship Building. Everglades Department. Barton Named Vineyard CEO New

-

)

February 2024 - Marine News page: 35

)

February 2024 - Marine News page: 35Feature Marine Simulation “We enable workers to develop critical worksite-speci? c competencies by engaging them in challenging simulation training programs,” said Clayton Burry, vice president of sales at Virtual Marine. “We’ve been involved heavily in the research associated with simulation as well

-

)

January 2024 - Marine Technology Reporter page: 35

)

January 2024 - Marine Technology Reporter page: 35JIM MCNEILL: LEADING EARTH’S CITIZEN WARRIORS ACROSS THE SEA By Celia Konowe n the face of intensifying climate change and McNeill, former scientist and internationally renowned associated environmental unknowns, one world British explorer, has more than 36 years of experience travel- explorer has

-

)

January 2024 - Marine Technology Reporter page: 26

)

January 2024 - Marine Technology Reporter page: 26SUBSEA VEHICLES DEFENSE Orca Extra Large Unmanned Undersea Test Vehicle. The Navy’s top of? cer wants more players on the ? eld Unmanned Underwater Systems = Force Multiplier Source: Boeing By Edward Lundquist peaking at the Surface Navy Association’s an- (i.e., a mix of ships that avoids ‘putting too

-

)

January 2024 - Maritime Reporter and Engineering News page: 18

)

January 2024 - Maritime Reporter and Engineering News page: 18TECH FEATURE A New Era for Great Lakes Freighters with Modern Marine Epoxies By Justin Peare, Marine Coatings Representative, Great Lakes Region & Matt Heffernan, Commercial Marine Business Manager, North America, Sherwin-Williams Protective & Marine he Motor Vessel Mark W. Barker – the ? rst U.S.

-

)

January 2024 - Maritime Reporter and Engineering News page: 14

)

January 2024 - Maritime Reporter and Engineering News page: 14The Path to Zero work to make OceanWings suitable for lyzed the vessel’s behavior in relation to its maiden voyage – marking it as the commercial vessels was actually a scale the use of its four OceanWings. ? rst modern wind assisted modern ship down of the original design. The wing- Their goals went

-

)

January 2024 - Maritime Reporter and Engineering News page: 13

)

January 2024 - Maritime Reporter and Engineering News page: 13wingsail design since 2018 by French where apparent wind takes precedence under engines alone. Critically, despite tech startup AYRO has the potential to over true wind. AYRO’s wingsails gen- originally being developed to be handled leave a much larger legacy; by provid- erate propulsive force even

-

)

January 2024 - Maritime Reporter and Engineering News page: 12

)

January 2024 - Maritime Reporter and Engineering News page: 12The Path to Zero © Jifmar Group Library Americas Cup Innovation & a Carbon-Free Shipping Future By Giorgio PROVINCIALI, CTO of AYRO and Former America’s Cup Performance Predictions Leader he Golden Gate Yacht Club sign, all of which were changed by the success in bringing the Americas Cup (GGYC)

-

)

January 2024 - Maritime Reporter and Engineering News page: 4

)

January 2024 - Maritime Reporter and Engineering News page: 4Authors & Contributors MARITIME REPORTER AND ENGINEERING NEWS M A R I N E L I N K . C O M ISSN-0025-3448 USPS-016-750 No. 1 Vol. 86 Maritime Reporter/Engineering News Goldberg Haun (ISSN # 0025-3448) is published monthly Galdorisi except for March, July, and October by Maritime Activity Reports, Inc.

-

)

January 2024 - Maritime Reporter and Engineering News page: 2

)

January 2024 - Maritime Reporter and Engineering News page: 2NO.1 / VOL. 86 / JANUARY 2024 22 Roy Campe shows Maritime Reporter around the CMB.TECH workshop in Antwerp. Photo: Greg Trauthwein | Photo on the Cover: courtesy CMB.TECH 8 Big Ships and a Fuel Cell Future Departments With fuel cells having the potential to play a big role in decarbonizing the mari- 4

-

)

November 2023 - Marine Technology Reporter page: 32

)

November 2023 - Marine Technology Reporter page: 32SONAR TECHNOLOGIES DAWN MASSA STANCAVISH, MASSA ue to grow that process and have quality products throughout. I know your business is driven by multiple mar- kets – defense, offshore energy and science –but let’s start on the defense business as it’s most A big part of that equation is technology

-

)

December 2023 - Maritime Reporter and Engineering News page: 36

)

December 2023 - Maritime Reporter and Engineering News page: 36G REAT of HIPS S 2023 Eastern Shipbuilding OPC: A “G -C ”AME HANGER he much-needed replacement for the Coast The OPC is based on the Vard Marine Inc., VARD 7 110 Guard’s long-serving medium endurance cut- Offshore Patrol Vessel design. Vard has been working with ters (WMECs) took a giant step closer

-

)

December 2023 - Maritime Reporter and Engineering News page: 30

)

December 2023 - Maritime Reporter and Engineering News page: 30G REAT of HIPS S SHIP OWNER/OPERATOR Ship Owner Mitsui O.S.K. Lines, Ltd. 2023 Shipbuilder Oshima Shipbuilding LOA 235m Breadth 43m Deadweight About 100,422 tons Flag/Port of registry Japan/Port of Noshiro WIND CHALLENGER SPECIFICATIONS Height Up to about 53 m (4-tier) Width About 15 m Sail

-

)

November 2023 - Marine News page: 64

)

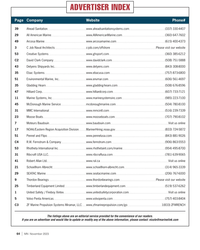

November 2023 - Marine News page: 64ADVERTISER INDEX Page Company Website Phone# 39 Ahead Sanitation www.aheadsanitationsystems.com (337) 330-4407 29 All American Marine www.AllAmericanMarine.com (360) 647-7602 49 Arcosa Marine www.arcosamarine.com (615) 400-4373 3 C Job Naval Architects c-job.com/offshore Please visit our

-

)

November 2023 - Marine News page: 47

)

November 2023 - Marine News page: 47teries. All of this happens seamlessly through Stewart and ning, the towboat is expected to have an estimated 27% Stevenson’s power management system.” reduction in emissions compared to a conventional towing Propulsion is provided by two 575 KW Danfoss elec- vessel, the company added. tric motors that

-

)

November 2023 - Marine News page: 44

)

November 2023 - Marine News page: 44Length: 525 ft. Breadth: 88.5 ft. Feature Depth: 55.1 ft. Draft, design: 21.4 ft. Range: 10,000+ miles @ 18 knots Propulsion: Diesel Electric Great Vessels of 2023 Engines: Wabtec (4) separated in two engine rooms MARAD Total installed power: 16,800 kW Emergency generator: 900kW Electric propulsion

-

)

November 2023 - Marine News page: 38

)

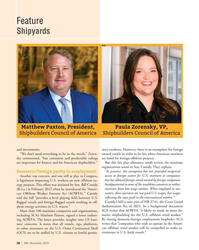

November 2023 - Marine News page: 38Feature Shipyards SCA SCA Matthew Paxton, President, Paula Zorensky, VP, Shipbuilders Council of America Shipbuilders Council of America and investments. nent residents. However, there is an exemption for foreign “We don’t need everything to be in the weeds,” Zoren- owned vessels in order to be fair

-

)

November 2023 - Marine News page: 37

)

November 2023 - Marine News page: 37Feature Shipyards By Tom Ewing hen asked about the top issues facing if operating policies are murky. shipbuilders, executives at the Ship- As an example, Paxton and Zorensky cited a CBP ruling builders Council of America (SCA) linked to the installation of wind tower monopiles (steel W listed a number