Pacific Rim

-

- Impact Of Lifting Alaskan North Slope Oil Export Ban On The U.S. Maritime Industry Maritime Reporter, Feb 1991 #68

G.A.O. Assesses Nation's Energy Security And The Negative Effect On Maritime Industry The Export Administration Act of 1979 places restrictions on the export of Alaskan North Slope crude that effectively ban its export. The act states that "no domestically produced crude oil transported through the Alaska pipeline may be exported from the United States." The purpose of this ban was to restrict "the export of goods where necessary to protect the domestic economy from excessive drain of scarce materials and to reduce the serious inflationary impact of foreign demand." This provision of the law was part of the compromise that permitted the construction of the Trans-Alaska Pipeline. The act allows the ban to be lifted only upon the President's certification that the export of Alaskan oil is in the national interest and meets several other specified conditions.

If the ban on exporting Alaskan North Slope crude oil remains in place, Alaskan North Slope production will, of course, continue to go to U.S. ports. However, because of declining Alaskan North Slope production, shipments to eastern U.S.

ports, i.e., those on the East Coast, the Caribbean, and the Gulf of Mexico, will probably cease at some time in the next several years.

Producers of Alaskan North Slope crude prefer to sell their crude to West Coast refiners, given the cost of transporting it to East Coast refiners.

If the ban on exporting Alaskan North Slope crude oil is removed, some of it is likely to be exported to Pacific Rim countries. Since transportation costs to Pacific Rim ports are much less than those to eastern U.S. ports, oil that is currently transported to the eastern United States is likely to be exported. In addition, some Alaskan North Slope crude that would have gone to the U.S.

West Coast may also be exported, since the cost of transporting oil to some Pacific Rim destinations is comparable to, if not lower than, the cost to U.S. West Coast ports. In this regard, the heavier weight of Alaskan North Slope crude is more likely to be attractive to refiners in Pacific Rim countries that it is to U.S. West Coast refiners, who refine more of their oil into light products, such as gasoline.

The probable economic effects of lifting the ban on Alaskan North Slope crude (as compared with leaving it in place) will be to • increase the price of Alaskan North Slope crude at the wellhead—because of the reduction in transportation costs and the attractiveness of Alaskan North Slope crude to Pacific Rim refiners—and, consequently, the price that West Coast refiners pay for crude oil; • promote economic efficiency by reducing transportation costs in the Alaskan North Slope crude oil trade, increasing domestic oil production, allowing better use of refinery processing resources, and ensuring that Alaskan North Slope oil is allocated to its highest valued uses; and • accelerate the decline in tanker demandandhurttheU.S. maritime industry because Alaskan North Slope exports are likely to be transported on foreign-flag rather than U.S.-flag tankers.

The energy supply disruption resulting from Iraq's invasion of Kuwait has focused attention on U.S. energy security and, in particular, our reliance on imported oil.

From an energy security standpoint, the effect of lifting the Alaskan North Slope export ban would probably be to increase total U.S. oil imports but possibly decrease net imports (total imports minus exports) to the extent that refinery efficiency is improved and Alaskan North Slope oil production increases in response to higher prices. Finally, lifting the ban could also contribute to the integrated world market's smooth and efficient functioning.

Since 1987, the amount of Alaskan North Slope oil shipped to eastern ports has declined as a result of decreasing Alaskan North Slope production and increasing West Coast consumption. Because transportation costs to eastern ports are considerably higher than those to the West Coast, Alaskan producers sell most of their oil to West Coast refiners.

This trend is expected to continue, so that in the near future Alaskan North Slope crude shipments to eastern ports will cease. The exact timing of this development will depend to a large extent upon the rate of decline of Alaskan production.

Using the Energy Information Administration's (EIA) base case assumption of Alaskan production, shipments to eastern ports could cease by 1992, even if West Coast demand for Alaskan production remains constant.

If the ban on exports of Alaskan North Slope crude is lifted, industry and public authorities generally agree that the oil now shipped to eastern U.S. ports—about 300 mbd—will be exported to Pacific Rim countries. This will occur, to a large extent, because such action would reduce transportation costs by a considerable amount. This reduction in transportation costs would increase the amount Alaskan North Slope producers receive for the oil.

Figure 2 illustrates the resultant pattern of oil distribution. Conceptually this figure illustrates the minimum impact of lifting the ban.

In addition, some of the oil that is now shipped to the West Coast may also be exported, but opinions vary on how much. A possible maximum impact of lifting the ban might be one in which the only Alaskan North Slope oil that would continue to be shipped to the West Coast would be oil used by integrated oil companies, that is, those that produce oil in Alaska and transport it to their own refineries on the West Coast. In 1989, these companies used around 570 mbd of Alaskan North Slope crude.

Impact On U.S. Shipping The U.S. maritime industry also stands to lose from lifting the ban on Alaskan North Slope crude exports.

As a result of the Jones Act (the Merchant Marine Act of 1920), U.S.- flag tankers transport virtually all Alaskan North Slope crude. In 1989, U.S.-flag tankers transported 93.4 percent of all Alaskan North Slope crude oil loaded al Valdez, Alaska.

If the ban is lifted and some of this oil is exported, foreign-flag tankers, because their costs are lower, are likely to transport that oil. This will accelerate the loss of U.S. ships, which will be laid up, scrapped, or sold anyway as Alaskan North Slope production decreases.

Between 1989 and 1995, the Maritime Administration (MarAd) estimates that 32 shi^*s will be lost because i f declining Alaskai North Slope production, even if the ban stays in place. However, if the ban is lifted and exports begin in 1991, the same losses occur as in the minimum exports case, but earlier. An additional seven ships are lost if there are maximum exports.

The loss of these ships would also affect the national defense through reduced availability of U.S.-flag, "militarily useful" tankers; the federal budget through possible guaranteed loan defaults; and national unemployment by threatening seafarers' jobs.

Lifting the ban on Alaskan crude exports would affect U.S. energy security in three ways. First, it would increase total, or gross, U.S. imports.

Second, it would possibly lead to a decrease in net imports. Finally, in an integrated world oil market, U.S. energy security depends in large part of this market's smooth and efficient functioning.

Lifting the ban would probably lead to gains in economic efficiency.

However it would also have a negative effect on independent refiners on the West Coast and certainly on the U.S. maritime industry.

-

- Peter Brix Elected To Board Of Twin City Barge Maritime Reporter, Jan 9, 1982 #61

, a trustee of Lewis and Clark College, a member of the board of directors of American Waterways Operators, Inc., and is a vice president of the Pacific Rim Trade Association

-

- A.R. Larsen To Offer Turnkey Interior Services Maritime Reporter, Mar 2002 #23

renovated galleys on commercial ships, fishing vessels, factory trawlers, oil rigs, cruise lines, passenger ferries and pleasure crafts around the Pacific Rim and beyond. For the past year, the company has been closely involved with the construction and renovation of complete galley interiors including

-

- Port Of Portland Appoints European Representative Maritime Reporter, Nov 15, 1981 #20

. European countries account for about 8 percent of the cargo handled by Portland. With 80 percent of Portland's cargoes originating or destined for Pacific rim countries, the Port's priorities have been in those markets. With an effective representative program now well in force throughout the Far

-

- Schnitzer-Leven Marine Company Names Hemphill Marine Services Manager Maritime Reporter, Mar 15, 1980 #52

the marine resources of the Schnitzer Group of companies and Lasco Shipping Co., which manages a fleet of modern bulk carriers operating in the Pacific Rim

-

- LNG: Emananating, Evolving from Excelerate Maritime Logistics Professional, Q2 2013 #58

, the United Kingdom and Western Europe. Meanwhile in the United States, LNG production shifted from the Gulf of Mexico to Alaska with the advent of the Pacific-Rim trade, which would grow to include large scale, green-field LNG production facilities in the Arabian Gulf, Malaysia and Indonesia. The bulk of

-

- APL Dedicates New Seattle Terminal Maritime Reporter, Jan 4, 1982 #99

A m e r i c a n P r e s i d e n t Lines (APL), operator of the West Coast's largest fleet of trans- Pacific ships, recently dedicated its new $29-million Seattle, Wash, terminal. Mrs. Charles Royer, wife of the Seattle mayor, broke a champagne bottle against a $3-million crane to formally open

-

- APL To Build Five New Ships Maritime Reporter, Dec 1986 #7

larger, more efficient ships, we expect to be able to meet customer demand and continue to participate in increasing trade volumes in the Pacific Rim." He noted that the ships have been designed to accommodate elongation at a later date. With the new ships, APL plans to increase sailing frequency

-

- SNAME 2000 Aims To Connect Leaders Maritime Reporter, Sep 2000 #28

(SNAME) is scheduled to be held in Vancouver, B.C., Canada — giving both attendees and exhibitors a direct connection with industry leaders from the Pacific Rim. the Northwestern U.S. and Canada. International networking, as well as the traditionally solid technical conference line-up could most definitely

-

- OCEANS '77 Conference Set For October 17-18-19 Maritime Reporter, Oct 1977 #16

is "An International Conference to discuss and explore developing technology and its impact on public policy and education with a focus on the Pacific Rim." In some 40 sessions, more than 200 papers will be presented in fulfilling the conference objective of bringing together a strong interdisciplinary

-

- Risk Breakers: Craig Perciavalle President, Austal USA Maritime Logistics Professional, Q1 2013 #28

and positioning our company to capitalize upon our unique Pacific heritage, our facilities in the Pacific Basin, and our partnerships throughout the Pacific Rim.” (As published in the 1Q edition of Maritime Professional - www.maritimeprofessional.com)

-

- Ballast Water Leadership Maritime Reporter, Aug 2014 #28

commander’s portfolio. Admiral Zukunft’s duties as JIATF-West commander embraced diplomacy and maritime law enforcement cooperation with the entire Pacific Rim. Confronting bad actors of every stripe from pirates to traffickers, Zukunft and the Coast Guard wrote new chapters in the annals of international

-

)

November 2023 - Maritime Reporter and Engineering News page: 69

)

November 2023 - Maritime Reporter and Engineering News page: 69TECH FEATURE: AUTONOMY MARTAC unmanned surface vehicles MANTAS and Devil Ray were mainstays of this exercise. Here is how one defense analyst captured the essence of MARTAC’s participation in IMX 22: MARTAC has a strong presence in 5th Fleet operating with Task Force 59, a Middle-East-based task force

-

)

March 2023 - Marine Technology Reporter page: 24

)

March 2023 - Marine Technology Reporter page: 24INSIGHTS FELIX SCHILL, HYDROMEA The offshore industry, particularly the rapid acceleration of offshore wind, is resulting in more structure going into the water than ever before, in a short window of time … infrastructure that has to be monitored and maintained. “We really see the potential for a

-

)

January 2023 - Maritime Reporter and Engineering News page: 11

)

January 2023 - Maritime Reporter and Engineering News page: 11units that make relatively small plastic parts. The feedback technology in shipboard research use cases, but created a self- we were getting from the ? eet is that they need larger metal contained, mobile 3D metal printshop by out? tting a common parts,” said Jim Pluta, additive manufacturing (AM)

-

)

November 2022 - Marine Technology Reporter page: 9

)

November 2022 - Marine Technology Reporter page: 9neme, Calif., from August 22 to Sep- commander of the RIMPAC Combined demonstration of our success.” tember 2, 2022. Southwest Regional Force Air Component Command. “The In addition to Denver, the ex-USS Rod- Maintenance Center (SWRMC) par- SINKEXs at RIMPAC provide us with a ney M. Davis (FFG 60) was

-

)

November 2022 - Marine Technology Reporter page: 8

)

November 2022 - Marine Technology Reporter page: 8Eye on the Navy E -USS X D ENVER STILL SERVED UNTIL SUNK Ex-USS Denver is sunk during RIMPAC 2022 Photo from video by Petty Of? cer 3rd Class Demitrius Williams Explosive charges aboard the ship enabled battle damage assessment (BDA) teams to respond to actual damage By Edward Lundquist he former

-

)

November 2022 - Maritime Reporter and Engineering News page: 22

)

November 2022 - Maritime Reporter and Engineering News page: 22Back to the Drawing Board The Amazon Model in Global Naval Deterrence By Rik van Hemmen announced that the In- dian Ocean High Risk IMO Area (HRA) will be re- moved on 01 Jan 2023. It was a rare but really reassuring example that international cooperation can be success- ful. Meanwhile at the time of

-

)

November 2021 - Maritime Reporter and Engineering News page: 14

)

November 2021 - Maritime Reporter and Engineering News page: 14Back to the Drawing Board Where are the Transportation Macro Designers? s naval architects and marine engineers we are famil- Really good designers, who have made many design spiral iar with the design spiral. While design is not truly trips, can draw a near complete design on the back of an enve- a

-

)

September 2021 - Maritime Reporter and Engineering News page: 42

)

September 2021 - Maritime Reporter and Engineering News page: 42‘marine grade’ when Military Sealift Command hospital ship USNS Mercy’s (T-AH 19) sits anchored off the coast of Trincomolee, Sri Lanka in support of Pacific Partnership 2018 (PP18), April 26, 2018. U.S. Navy photo 42 Maritime Reporter & Engineering News • September 2021 MR #9 (34-49).indd 42 9/7/2021

-

)

May 2021 - Marine Technology Reporter page: 40

)

May 2021 - Marine Technology Reporter page: 40Collection In 2002, with the dynamic duo of Argus and Little Herc, we inspected a likely target that turned out to be PT-109. Shifting sand on the Pacific Ocean floor had buried all but one torpedo tube, visible here, and a small portion of the boat’s aft port deck. Odyssey Enterprises/Institute

-

)

May 2021 - Marine Technology Reporter page: 34

)

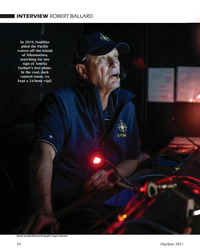

May 2021 - Marine Technology Reporter page: 34INTERVIEW ROBERT BALLARD In 2019, Nautilus plied the Pacific waters off the island of Nikumaroro, searching for any sign of Amelia Earhart’s lost plane. In the cool, dark control room, we kept a 24-hour vigil. Gabriel Scarlett/National Geographic Image Collection 34 May/June 2021 MTR #4 (34-49).

-

)

February 2021 - Maritime Reporter and Engineering News page: 2

)

February 2021 - Maritime Reporter and Engineering News page: 2EBDG pitched in with some design services for global adventurer 14 Profiles in Training Erden Eruc, who will embark soon on his solo row across the Pacific. Mike Corrigan, CEO, Interferry By Greg Trauthwein 16 Government Update USCG Authorization Act 18 Cyber Security 26 Cruise Shipping’s Fight

-

)

November 2020 - Marine News page: 34

)

November 2020 - Marine News page: 34WORKBOATS Workboat Prof le: Geronimo By Eric Haun Sause Bros. Ocean Towing Co. ause Bros. Ocean Towing Co., Inc., based in Coos dent of hull and machinery at Sause Bros. Bay, Ore., got its start transporting timber with a Babcock has worked at Sause since 1993, ? rst as an en- single wooden tug in the

-

)

September 2020 - Maritime Reporter and Engineering News page: 44

)

September 2020 - Maritime Reporter and Engineering News page: 44NAVIES & COVID-19 Fit for Fight Navies challenged by COVID at sea, ashore By Edward Lundquist espite the COVID-19 pandemic, navies adjusted Shipboard infections how they operate at home and while deployed, to COVID cases have occurred on naval vessels around the keep their forces ready for any missions

-

)

August 2020 - Maritime Reporter and Engineering News page: 52

)

August 2020 - Maritime Reporter and Engineering News page: 52Tech Files Maritime Propulsion Schottel SyDrive-M: Hybrid Azimuth Propulsion Schottel won a new order for its patented SYDRIVE-M system, a hybrid propulsion concept is based on the Schottel Y-Hybrid thruster technol- ogy that connects a port and starboard azimuth thrusters. The contract is to supply

-

)

August 2020 - Marine News page: 56

)

August 2020 - Marine News page: 56one hundred p Operators Vane Brothers Foss Maritime Company Supported by project management and marine engineer- ing group, Foss provides comprehensive marine transporta- tion services, from global turnkey logistics/transportation services to inland movements and total project manage- Patrick Stant ment.

-

)

July 2020 - Maritime Reporter and Engineering News page: 64

)

July 2020 - Maritime Reporter and Engineering News page: 64. . . . . . . . . . . . . . . . . . . . .www.omnithruster.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(330) 963-6310 C4 . . . . .Pacific Green Marine Technologies . . . . . . . . . . . . . . . . . . . . . .www.pacificgreenmarine.com . . . . . . . . . . . . . . . . . . . . . . . .

-

)

July 2020 - Marine News page: 58

)

July 2020 - Marine News page: 58PRODUCTS Retractable Rim Thruster Electro- SCHOTTEL launched a retractable Hybrid Drive variant of its rim thruster. Covering Waterjet pro- the power range up to 500 kW, and pulsion special- with internal propeller blades are hy- ist HamiltonJet drodynamically designed to be highly

-

)

May 2020 - Marine Technology Reporter page: 25

)

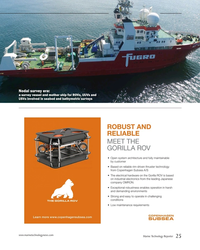

May 2020 - Marine Technology Reporter page: 25Nodal survey era: a survey vessel and mother ship for ROVs, UUVs and USVs involved in seabed and bathymetric surveys Fugro ROBUST AND RELIABLE MEET THE GORILLA ROV • Open system architecture and fully maintainable by customer • Based on reliable rim-driven thruster technology from Copenhagen Subsea

-

)

May 2020 - Maritime Reporter and Engineering News page: 35

)

May 2020 - Maritime Reporter and Engineering News page: 35studies at UC Berkeley, Waterhouse “It was a challenging time to start my career, and a challeng- took a year off on a sailboat journey around the Pacific before ing time to start a new engineering firm,” Waterhouse said. returning home and taking a position with Nickum and Spauld- When the firm re-opened

-

)

April 2020 - Maritime Reporter and Engineering News page: 29

)

April 2020 - Maritime Reporter and Engineering News page: 29Broadly speaking, what are the main types of vessels where we would fnd the Voith propulsion solution? You will fnd Voith Propellers primarily in tugs, ferries, yachts, mine countermeasures vessels and, of course, off- shore support vessels for many years. What are the primary performance benefts? Voith

-

)

April 2020 - Maritime Reporter and Engineering News page: 28

)

April 2020 - Maritime Reporter and Engineering News page: 28INTERVIEW DR. DiRk JüRgens, ManageR Of ReseaRCH anD DevelOPMent, vOitH tuRBO MaRine is the limit. The main features of the VLJ are high effciency and The ‘Voith’ name is a well-known one in the maritime indus- quiet running. Our products differ signifcantly from competi- try, but to start please provide

-

)

March 2020 - Marine Technology Reporter page: 50

)

March 2020 - Marine Technology Reporter page: 50Tech Files GorillaGorilla ROVROV Built to be robust, reliable in the demanding of shore sector openhagen Subsea launched a new powerful is based on Copenhagen The Gorilla ROV Remotely Operated Vehicle (ROV), speci? cally Subsea’s Rim-driven thruster, technology which, com- developed for the

-

)

February 2020 - Maritime Reporter and Engineering News page: 80

)

February 2020 - Maritime Reporter and Engineering News page: 80. . . . . . . . . . . . . . . . . . . .www.omnithruster.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(330) 963-6310 1 . . . . . .Pacific Green Marine Technologies . . . . . . . . . . . . . . . . . . . . . .www.pacificgreenmarine.com . . . . . . . . . . . . . . . . . . . . . . . .

-

)

February 2020 - Maritime Reporter and Engineering News page: 1

)

February 2020 - Maritime Reporter and Engineering News page: 1quality swift installation and world beating device efficiency are just some of the reasons why more and more Watch a video ship operators are choosing Pacific Green. to see how it works www.pacificgreenmarine.com Contact our team at +47 469 51 442 or email [email protected] Part of the Pacific