Southern Rhode Island

-

- In Rhode Island, the Future is Blowing in the Wind Marine Technology, Mar 2013 #44

It’s powerful, it’s clean, and it’s something the Ocean State has plenty of: energy-rich offshore winds. Rhode Island, along with its designated developer, Deepwater Wind, hopes to be the first in the U.S. to harness that blow, starting with an initial, five-turbine, 30-MW demonstration project off Block Island, to be quickly followed by the nation’s first 1,000-MW farm situated further out in federal waters.

Besides bragging rights, successful deployment could put the state well on its way to diversifying its energy resources and reducing its fossil fuel consumption. From an economic standpoint, the Rhode Island projects, coupled with other anticipated wind farm developments in the region, are expected to provide the state and its subsea maritime industry with a significant payout via the creation of new jobs, new job categories, the facilitation of new and existing business expansion, increased shipping and rail traffic, and manufacturing and vessel-building opportunities – all combining to infuse new life and a brighter future into existing ports.

The potential for the marine industry is enormous, agree many observers. “We’re talking hundreds of jobs,” said Fara Courtney, Executive Director of the Cambridge, Mass.-based U.S. Offshore Wind Collaborative (USOWC). Moreover, as the industry grows there will be a need for larger scale, specialized vessels to handle construction and transport. “If you look at the supply chain in Europe, the amount and types of equipment used for wind farming are incredible. It’s a huge industry just waiting to start up here,” said Grover Fugate, executive director of Rhode Island’s Coastal Resources Management Council (CRMC).

For example, the economic benefits from Block Island alone could net Rhode Island an estimated $107 million in constant 2010 dollars terms or $92 million in net present value (NPV) as of Jan. 1, according to a July 2010 report prepared for the Rhode Island Economic Development Corp. (RIEDC), by Boston-based Levitan & Associates, a management consulting firm specializing in energy. (Levitan based its calculations on an assumed January 2013 startup date.) It also estimated that a then 385-megawatt proposal by Deepwater would provide the state $886 million in constant 2010 dollars or $659 million in NPV terms as of January 1. That proposal has since been bumped up to 1,000 megawatts. Do the math.

Deepwater, meanwhile, claims that even a single 1,000-megawatt project might be enough to “entice both domestic and foreign suppliers to seriously consider establishing significant parts of their fabrication, manufacturing, assembly, and support services” in Rhode Island and Massachusetts. The developer is already committed, under a joint development agreement with the state of Rhode Island, to doing pretty close to that. It will be leasing 117 acres at Quonset Business Park, for the storage, fabrication, and staging of its offshore components; locating its regional headquarters and foundation manufacturing headquarters in Rhode Island, and encouraging its vendors to use local workers where possible.

A Three-Hour Tour

The course to getting there, however, is both arduous and studded with obstacles. Hauling in offshore wind power is neither easy, nor free. It currently takes developers years to navigate their way through the choppy slop of appropriate siting, analysis and mapping of waterway traffic, including marine and avian patterns; wind and ocean currents and speed; a host of ecological and environmental concerns; supply chain issues; utility contracts and connection; financial commitments; and a veritable sea of state and federal regulations from seemingly all possible angles and agencies.

Rival Cape Wind in Massachusetts, for example, is more than a decade into the process, and despite having won construction permits, must surmount legal challenges before it can start. And in Rhode Island, lawsuits have similarly forced Deepwater to ratchet back to 2014, the planned spring 2013 launch of its $250 million Block Island pilot, which is designed to power about 10,000 households in the region and cut by 40% power rates on Block Island, currently among the highest in the nation.

That delay could push out the start date on its utility-scale, regionally focused project, the roughly $6 billion Deepwater Wind Energy Center (DWEC). The large scale wind farm is designed to function as a regional energy center, producing 1,000 megawatts off 200 turbines, most of which will be located in the ocean waters of southern Rhode Island Sound 20 to 25 miles from the shoreline. The DWEC would feed into a cable system called the New England –Long Island Interconnector, which will deliver energy to Long Island and Southern New England, enough to power 350,000 homes. Leases for federally-sited wind farms are slated to be auctioned in the first half of this year. Deepwater has said it expects construction to begin in 2014 or 2015, with the first wind turbines in operation by the end of 2016 or 2017.

Federal legislation passed in January may help speed things up a bit. The new law extends production and investment tax credits for wind-energy projects that begin construction by Jan. 1, 2014. There are also state and federal mandates to get going on renewable energy goals, pressure that has particular resonance for the 28 coastal states that consume 78% of the US electricity production.

A July 2008 U.S. Department of Energy’s report, “20 per cent Wind Energy by 2030,” found that offshore wind capacity could provide 54 gigawatts (GW) of the 300 GW needed to deliver 20% of the nation’s electricity from wind energy by 2030. As luck would have it for Rhode Island and Massachusetts, about a quarter of the country’s wind reserves are located in an area south of Martha’s Vineyard, which also happens to be the Bureau of Ocean Energy Management’s designated range for large wind farms.

Even better, wind farm developers and their backers aren’t just wading through regulatory marshes. They are closely examining the region’s harbors and ports, looking for proximity to projects, access to water and space availability. Ports with channels deep enough to accommodate the huge vessels needed by the industry, and sizeable staging areas for assembling components, are going to be critical to the construction and maintenance of these farms, and both states are determined to win the lion’s share of that lucrative business.

Tiny R.I. has already taken some giant steps toward that goal, compared to other states. “Rhode Island has really stepped out in advance of many other states and done some very innovative things to help the industry move forward,” said USOWC’s Courtney.

“Rhode Island is very well positioned to be a winner, than any other state,” said energy analyst Steven Kopits, managing director of Douglas-Westwood in New York.

The CRMC in particular draws special praise for developing the Rhode Island Ocean Special Area management (SAMP) plan, a spatial marine mapping of a defined area of the ocean floor off the Rhode Island coast. (See RI SAMP). The SAMP provides regulatory standards for offshore development and was used to designate siting areas for wind farming in both state and federal waters. President Obama’s Ocean Policy Task Force called it a national model for marine spatial planning.

If you build it, they will come

In New England, where the battle to be first in the water has now extended from the wind farm proposals out to the ports, yet another ace in Rhode Island’s pocket is The Port of Davisville at Quonset Business Park in North Kingstown. One of the largest ports in the northeast with 3,200 acres, it is also the seventh largest importer of autos in the country and home to 168 companies that employ almost 9,000 people. Longtime, key tenants include Electric Boat Corp. and Senesco Marine. Located near the mouth of Narragansett Bay, the port features four berths and five terminals with over 58 acres of laydown and terminal storage.

“To have that much property on the waterfront with a combination of rail connects, airstrip and deep water access at one facility – I think it is a fantastic asset,” said Jim Dodez, Vice President of Marketing and Strategic Planning, KVH Industries, Inc. in Middletown, R.I.

Steven King, managing director of the port, believes wind farm activity could muscle its way into the number two or three spot in the port’s business lineup once the market takes off, some three years or so down the road. To get ready, Quonset has made $30 million in infrastructure improvements, including a $7.5 million dredging project, the purchase of a $4 million Gottwald 7608 Mobile Harbor “super” Crane that can lift up to 140 metric tons and stands approximately 126 feet high, structural improvements to Pier 2 to support the crane and the addition of lighting and new fendering to Pier 1, King said.

Hot on Quonset’s heels, though, is a $100 million project to build South Terminal in in the economically depressed fishing and shipping port of New Bedford, Mass. The project will “purpose build” a multi-use terminal to serve foremost as a base of operations for the assembly, staging and transport base of offshore energy-related projects. Cape Wind has committed to working out of the new terminal.

Rhode Island is betting that Davisville is ideally suited and situated to serve as the preferred base port for primary staging and maintenance for a collection of regional wind farms, and it’s not alone in that assessment. Although they believe there will work enough to go around eventually, right now, industry observers say there is no doubt that Davisville is the most attractive option.

“From an economic development point of view, Quonset, by any metrics is an ideal port from which to support offshore wind development,” said Malcolm Spaulding, co-founder of South Kingston, R.I.-based ASA Sciences and URI Professor Emeritus of Ocean Engineering. “The biggest competition to supporting offshore wind at Davisville is really the port’s other businesses, primarily auto imports, which like wind farms, gobbles up a lot of space.”

Beyond the ports, the double-edged sword of offshore wind offers still more economic opportunities. It will create more construction, design, transportation and maintenance jobs, but that’s partly because the offshore environment is more complex and more hostile, and easily accessed. “You can’t just put two guys in a truck and send them out to fix X number of turbines a day,” said Kopits. “For starters, you need a vessel , and it has to be crewed, and you’ll probably need a barge as well – you can see how much more expensive this is going to be.”

And there are the project-specific vessels that will have to be built to construct the platforms and haul huge payloads once the industry gets underway. These include new-generation purpose-built vessels heavy lift vessels, jackups, offshore supply vessels, transport vessels and barges and cable lay vessels. The available fleet of construction vessels today are in the Gulf of Mexico or off the coast of Europe, where Kopits says most are booked out for the next year. He estimates a combined total of 20-25 new ships of all kinds may eventually be needed, but he suspects they’ll mostly be built in non-union shipyards in the South.

(As published in the March 2013 edition of Marine Technologies - www.seadiscovery.com)

-

)

March 2024 - Marine Technology Reporter page: 26

)

March 2024 - Marine Technology Reporter page: 26FEATURE OCEANOGRAPHIC INSTRUMENTATION & SENSORS Kevin Mackay, TESMaP voyage leader and Center head of the South and West Paci? c Regional Centre of Seabed 2030. Kevin in the seismic lab at Greta Point looking at the Hunga Tonga-Hunga Ha’apai volcano 3D map completed with data from the TESMaP voyage

-

)

March 2024 - Marine Technology Reporter page: 22

)

March 2024 - Marine Technology Reporter page: 22FEATURE OCEANOGRAPHIC INSTRUMENTATION & SENSORS Aerial view of HT-HH volcano, showing new multibeam depth data overlaid on islands satellite image. © SEA-KIT, NIWA-Nippon Foundation TESMaP 22 March/April 2024 MTR #3 (18-33).indd 22 4/4/2024 9:08:10 AM

-

)

April 2024 - Marine News page: 41

)

April 2024 - Marine News page: 41Vessels Gripper ing European CTV operator Northern Offshore Services (N-O-S) and U.S.-based investment ? rm OIC. The vessel, based on N-O-S’ 30-meter G-class design, fea- tures Volvo Penta’s IPS propulsion system and is said to be “hybrid-ready”, meaning it was built with space reserved for all the

-

)

April 2024 - Marine News page: 40

)

April 2024 - Marine News page: 40Vessels General Arnold Chasse, La. The 32-inch CSD will immediately begin work on Phase Four of the Corpus Christi Ship Channel Improvement Project. The project will bene? cially reuse 100% of the dredged material removed from the channel deepening and widening. The General Arnold is the newest,

-

)

April 2024 - Marine News page: 31

)

April 2024 - Marine News page: 31McAllister Towing Grace McAllister, one of three sisters from Washburn & Doughty. ered WINDEA Courageous, the ? rst of three CTVs for an earlier contract with Windea CTV LLC. Other shipyards known to be build- ing CTVs at the moment include Blount Boats and Sensesco Marine, both in Rhode Island

-

)

April 2024 - Marine News page: 30

)

April 2024 - Marine News page: 30Feature Shipbuilding Crowley Crowley’s electric tug eWolf, built by Master Boat Builders. Administration (MARAD) put a cost of $97 million on the ulatory ? lings, the vessel “is expected to be delivered and vessel. The same yard has also been contracted to build an operational in 2025.” Filings with

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27Feature Shipbuilding Loumania Stewart / U.S. Coast Guard focus), which require very different business systems to be in place. “We’ve been able to do both,” he said, noting that having systems in place for government jobs makes East- ern Shipbuilding “move-in ready for the Navy and other DOD agencies

-

)

April 2024 - Marine News page: 24

)

April 2024 - Marine News page: 24Feature Navigation cables, 9 miles of cables connecting substations and up to blurred, undependable information for vessel crews. two export transmission cables with “associated secondary In the fairways Notice, the USCG references the NAS cable protection” (text is from the permit) within a 42-mile-

-

)

April 2024 - Marine News page: 23

)

April 2024 - Marine News page: 23the rule new projects might be set within historical vessel routes, con? icting with existing maritime uses and users. The USCG’s fairway proposal is based on BOEM’s exist- ing WEA projections (contained in the December Notice). The 18 proposed fairways, traf? c separation schemes and precautionary

-

)

February 2024 - Maritime Reporter and Engineering News page: 13

)

February 2024 - Maritime Reporter and Engineering News page: 13is the latest risk to hit shipping companies and supply chains. More than 400 container ships were diverted via the Cape of Good Hope around the southern tip of Africa between mid-December 2023 and the beginning of January 2024, as a result of the attacks, prolonging journeys and causing delays to

-

)

February 2024 - Marine News page: 40

)

February 2024 - Marine News page: 40Vessels HOS Warhorse & HOS Wild Horse shipyard construction contracts were wrongfully termi- nated. Gulf Island and Hornbeck settled in October 2023, clearing way for the builds to be completed by another yard. Eastern secured the contract to complete the builds from Zurich American Insurance Company

-

)

February 2024 - Marine News page: 23

)

February 2024 - Marine News page: 23Passenger Vessel Safety occur on a sightseeing vessel or an Ohio River dinner cruise? This contrast between speci? c – sometimes very speci? c – and general comes to mind when considering the numerous safety advisories pertaining to recent amphibious DUKW boat tragedies or the 2019 Conception dive boat

-

)

February 2024 - Marine News page: 8

)

February 2024 - Marine News page: 8By the Numbers © Dragon Claws / Adobe Stock Rebuilding the Foundations of US Offshore Wind By Philip Lewis, Director of Research, Intelatus Global Partners As we enter a New Year, the memories of the shocks to with a potential of 3.3-6.3 GW in Delaware and Chesa- the foundations to the U.S. offshore wind

-

)

January 2024 - Marine Technology Reporter page: 59

)

January 2024 - Marine Technology Reporter page: 59All images courtesy Oceanology International participants and to deliver another packed three days of exhi- Oi24 Events and Features bition and conference activity, features, workshops and one- Oceanology International is able to capitalize on the advan- to-one meetings.” tages of ExCeL’s expansive 18

-

)

January 2024 - Marine Technology Reporter page: 37

)

January 2024 - Marine Technology Reporter page: 37an online dashboard will convey ? ndings and share stories. GETTING UNDERWAY Sailing to remote parts of the ocean between June and Oc- “A modern-day warrior is not about war. It’s about the per- tober, Ocean Warrior intends to cover 10,000 nautical miles son—honesty, integrity, empathy, intelligence

-

)

January 2024 - Maritime Reporter and Engineering News page: 41

)

January 2024 - Maritime Reporter and Engineering News page: 41In the Shipyard Latest Deliveries, Contracts and Designs Van Oord Upgrades Heavy-lift Gulf Craft, Incat Crowther an Oord’s heavy-lift installation vessel Team on Virgin Island Ferry VSvanen will receive a major upgrade: the gan- try crane will be extended by 25m, making the vessel ready to handle the

-

)

December 2023 - Maritime Reporter and Engineering News page: 36

)

December 2023 - Maritime Reporter and Engineering News page: 36G REAT of HIPS S 2023 Eastern Shipbuilding OPC: A “G -C ”AME HANGER he much-needed replacement for the Coast The OPC is based on the Vard Marine Inc., VARD 7 110 Guard’s long-serving medium endurance cut- Offshore Patrol Vessel design. Vard has been working with ters (WMECs) took a giant step closer

-

)

December 2023 - Maritime Reporter and Engineering News page: 33

)

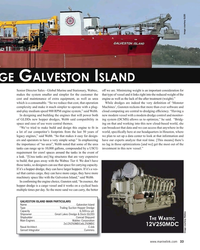

December 2023 - Maritime Reporter and Engineering News page: 33Image courtesy GLDD DGE ALVESTON SLAND G I Senior Director Sales - Global Marine and Stationary, Wabtec, off we are. Minimizing weight is an important consideration for makes the system smaller and simpler for the customer the that type of vessel and it links right into the reduced weight of the cost

-

)

December 2023 - Maritime Reporter and Engineering News page: 32

)

December 2023 - Maritime Reporter and Engineering News page: 32G REAT of HIPS S 2023 GLDD H DOPPER REDG NE OF THE BEST FEATURES OF THE ALVESTON IS HER RELATIVE SHALLOW DRAFT FOR HER CAPACITY O THAT ALLOWS HER TO GET CLOSER TO THE BEACH TO BE MORE EFFICIENT AND TO USE LESS ENERGY TO GET THE WORK DONE HE S GOT THE LATEST SUITE OF DREDGE CONTROLS IN AUTOMATION AND

-

)

December 2023 - Maritime Reporter and Engineering News page: 2

)

December 2023 - Maritime Reporter and Engineering News page: 2NO.12 / VOL. 85 / DECEMBER 2023 18 Photo on the Cover: Royal Caribbean Group | Photo this page: FMD 18 Robots in the Engineroom Departments Fairbanks Morse Defense is developing robotics in-house to address the US 4 Authors & Contributors Navy’s need for future autonomous vessels. 6 Editorial By Greg

-

)

November 2023 - Marine News page: 49

)

November 2023 - Marine News page: 49R.B. WEEKS Eastern Shipbuilding Group Florida shipbuilder Eastern Ship- rier islands and nourishing beaches an electrical power, propulsion, and building Group (ESG) this Spring de- lost to erosion, aiding the U.S. Army dredge machinery package by Royal livered R.B. Weeks, a 8,550 cubic yard Corps of

-

)

November 2023 - Marine News page: 48

)

November 2023 - Marine News page: 48Feature Great Vessels of 2023 Great Lakes Dredge & Dock Corporation GALVESTON ISLAND Delivered this year amid an ongoing dredge building ed by a USCG requirement for crawl spaces around the boom in the United States, Galveston Island is the ? rst tanks in the event of a leak, Webb noted. “[Urea tanks

-

)

November 2023 - Marine News page: 30

)

November 2023 - Marine News page: 30Core Power, a developer of Molten Salt Reactors (MSR) speci? cally for the maritime sectors, has been involved in successful testing alongside utility Southern Company, Terra Power, a business incubator tied to Bill Gates. California’s push for ‘green’ Alex Parker, managing partner at Rose Cay Maritime

-

)

November 2023 - Marine News page: 10

)

November 2023 - Marine News page: 10By the Numbers Jones Act Dredging Commercial Fleet Orderbook Over Past Five Years CompanyDredge NameDredge TypeCapacityShipyardStatus Manson ConstructionFrederick PaupHopper15,000 cyKeppel AmFELS (TX)Expected delivery Q4 2023 Cashman DredgingMighty QuinHopper (T&B)4,000 cyFeeny’s Shipyard (NY)In service