U S West Coast

-

- West Coast Shipyards Maritime Reporter, Jul 16, 1985 #34

In our world of rapid and continuous change, we have come to accept many situations and events which, just a few years ago, we would have thought "could never happen": the first man on the moon; Japan's technological ascendancy over many major U.S. industries; $33 per barrel oil; the breakup of the world's best telephone system, Ma Bell; and a trillion dollar national debt, to name just a few. Most of us would not have conceived of such developments very long before they occurred, and I don't believe our foresight is greatly improved now.

Today, I'm going to discuss a future possibility you probably haven't thought about because it is in that "it could never happen" category.

What would happen if, by the year 2000, there were no longer any privately-owned, full-service shipyards, that is, shipyards capable of doing both naval and commercial work, operating on the West Coast?

What economic, social and military impact would such a development have on our nation, and on the Pacific region?

Your immediate response will, understandably, be that such a development is highly unlikely and could easily be avoided by common sense government and public support.

As a person who has been intimately involved with shipbuilding for over 40 years, I must reply that, no, this possibility is not unlikely but, yes, it can be avoided with public support.

Let me review some of the reasons why I don't think this scenario can be easily dismissed.

As you well know, the U.S. shipbuilding industry is currently undergoing a drastic shakeout caused by a variety of factors: First, commercial ship construction and repair work is at an all-time low. Shipyards solely dependent on this sector are desperately short of work and many have closed. Todd has not been exempt; we closed our Brooklyn and Houston Divisions in 1983.

Second, current government policy through the Maritime Administration has eliminated construction differential subsidies and will use operating differential subsidies to actually promote the construction of ships for the U.S. Merchant fleet in foreign shipyards. Jones Act protection is in jeopardy and, in my opinion, is very likely to disappear, I regret to say.

Third, the few healthy yards remaining are engaged in naval construction and repair but, as Vice Admiral Joseph Metcalf, Deputy Chief of Naval Operations (Surface Warfare), recently said, "The Navy simply cannot generate the work required either in repair, new construction or conversion to maintain the existing industrial base in any condition of profitability. We are almost the only game in town but we are by no means a large enough game to support so many players." Which facilities are likely to succumb?

The industrial base to which Admiral Metcalf referred is currently comprised of 23 shipyards, not all of which have work today and only 5 of which are located on the West Coast, three in this area (Todd, Lockheed and Tacoma). Obviously, any further shakeout here on the West Coast would be a severe blow to the national security interest, and to the Pacific region.

Last summer, the local ship supervisor of shipbuilding for the Navy who was also in charge of Navy repair contracts in the Northwest— was quoted by the press as saying that unless shipyards out here got their wage costs more in line with Eastern competitors, they could not expect to get any more work. This apparently reflected the Navy's "low-bid" procurement policy, which has ignored the need to maintain shipbuilding resources on all coasts and has resulted in the overwhelming majority of new construction contracts being awarded to East and Gulf Coast operations.

Todd's two major competitors for frigate/destroyer/cruiser type ships, for instance, one of which is on the East Coast, the other on the Gulf, will share an estimated $11 billion of ongoing work during the next five years, including 27 Aegis cruisers (CG 47) and several Aegis destroyers (DDG 51), whereas the opportunities available to all five West Coast mobilization base shipyards are a small fraction of that amount during the same period.

This lack of work has impacted employment unfavorably in the Seattle area. In the past three years, 6,000 jobs have been lost and about 3,000 of these layoffs have been at Todd's Seattle Division.

What is the cost differential between East and West Coast private shipyards that has led to such a harsh procurement policy towards Pacific Coast shipyards? An October 1984 Maritime Administration report estimated West Coast shipbuilding costs to be 4.6% higher than in the East and 9.2% higher than in the Gulf. Is this such a considerable difference that our nation can risk losing its West Coast private shipyard capability to build and support the Pacific Fleet, plus the U.S. merchant fleet and ships owned by nations of the Pacific Basin, our number one trading area? Further, what will the real defense costs be after the initial savings by low-bid, or "low balling" procurement have been realized?

For the Navy, follow-on cost increases would be unavoidable for normal peacetime operations and would be greatly increased under emergency conditions. Why? Let me describe a few "could never happen" scenarios based on a series of interrelated events which are pure fiction today but have enough plausibility to be seriously considered for contingency planning. Scenario number one: • The Panama Canal is blocked by terrorist action. As a result, submarines, cruisers and other ships built in the East and assigned to Pacific fleet duty, which normally travel an average of 6,000 miles to West Coast ports, must now travel around the tip of South America, adding over 10,000 miles to the voyage. Clearly, this compromises fleet readiness, increases operating costs, exposes the ships to unnecessary risk and involves the crew and ship in weeks of nonproductive activity. Scenario number two: • Government-owned shipyards replace the private sector on the West Coast. Since naval yards had not been building naval vessels, they will not be able to overhaul and repair them as costeffectively as the experienced private builder. Furthermore, in my judgment, having dealt with relative private and government shipyards' costs since before World War II, the cost of doing work in Government non-taxpaying yards in terms of dollars, time and bottom line results are 30% higher than private yards and this cost variance would be further increased by West Coast Navy yards' wage rates which are 18.7% higher than their East Coast counterparts, as reported in the 1984 Maritime Administration report.

Over the 30-year life expectancy of the ships, therefore, the added cost of life-cycle support services required to keep a ship in state of readiness would far exceed any savings realized from initial low-bid purchase. Scenario number three: • The national shipbuilding industrial base is reduced to eight East and Gulf Coast yards because West Coast yards, forced to bid for new business at a 4.6% to 9.2% loss by Navy procurement policy, are eventually closed down. New construction and repair competitions fail to reduce prices since fewer competitors exist—the inevitable economic result of creating near monopolistic conditions— and government yards are overloaded.

"Surge" capacity is nonexistent, labor strikes for less overtime, and crew morale sinks because of overhaul delays and prolonged separations from families at home ports. The problem is particularly acute for the nine Pacific Fleet aircraft carriers and their escort ships, some of which must return to the East for major overhaul. The fleet is put at greater risk when a South American country, denied further credit by the U.S., gives the USSR rights to establish a naval base in return for economic aid.

As these scenarios so clearly point out, the loss of future naval work and industrial capacity would have a severely unfavorable impact on the nation, and the Pacific region.

Implausible as some of these fictional occurrences may seem today, present government maritime policy and procurement actions are heading this nation towards an era of maritime insufficiency that could bring them about. By allowing our U.S.-flag merchant fleet to decline— as of January 1, 1985, our active fleet totaled only 393 ships, down 50 units from 1984—by concentrating the overwhelming majority of our nation's fleet construction and repair resources in the Eastern half of the country and by allowing West Coast resources to wither, government policy will surely lead the United States into economic, military and political decline by abdicating its position of supremacy at sea and leaving the world's sealanes open to whatever nations have the ability to command or interdict them. Lack of sealift capability spells weakness to our opponents just as surely as does lack of domestic sources of basic commodities and strategic materials. Admiral Ike Kidd said it concisely: "If the (merchant ship)-owning nations chose to deny sealift to us, the result could be economic blackmail to which we could not respond in peacetime, much less in war." This concern was dramatized by the following fictional scenario by Harlan Ullman in the May issue of Naval Institute Proceedings which, if present downward trends continue for the merchant marine and shipbuilding industries, could be tomorrow's reality.

Thus, scenario number four: • "It is winter 1990. The war in the Persian Gulf between Iran and Iraq, after ten years of bloodshed, has finally spilled over. As a result of a series of bone-chilling winters and other economic factors, Western dependence on Gulf oil significantly grew in the latter part of the 1980s. A Western naval task force, largely composed of U.S. forces, was ordered into the Gulf to protect both the shipping routes and the oilproducing facilities on the Arabian Peninsula. Conflict resulted, and large numbers of Western forces were brought to bear. Unfortunately, because of the spread of advanced weapons to the belligerent states and terrorist groups acting in their behalf, Western naval losses, including warships and merchantmen, have been heavy. But worse, after several months of a grinding campaign of attrition, the United States has found itself increasingly hamstrung by lack of a merchant fleet. It has only limited ability to provide the "wherewithal" for Western forces engaged in the region and the cargo capacity to compensate for the economic embargo imposed by non-aligned states against all belligerents. Further, erosion of the U.S. shipbuilding base has made repair work on damaged ships a very lengthy process." Surely, this scenario suggests that now is the time to return to reality and a good start would be to observe the law of the land. In 1956, Congress recognized the importance of maintaining a geographically-dispersed shipbuilding mobilization base to enable us to build ships when and where they're needed, on all three coasts, and enacted statute 10.7302. I quote: "Construction on the Pacific Coast. The Department of the Navy shall have constructed on the Pacific Coast of the United States such vessels as the President determines necessary to maintain shipyard facilities there adequate to meet the requirements of national defense. Aug. 10, 1956, c. 1041, 70A Stat. 451" Second, in regard to shipbuilding and repair, the government should not be involved in any activity that the private sector can do better and at less cost—and that applies to all our coasts.

Third, we must face up to the real cost of not maintaining total seapower resources. The difficulties we face in making such an analysis have been the lack of an overall maritime strategy, the mistaken belief that U.S. maritime industries must survive under "free market" conditions, and the misconception that the Navy can fulfill its peacetime or military missions effectively with its own sealift resources and a greatly diminshed shipbuilding industrial base.

Without a clear national policy to maintain adequate seapower resources it is difficult to accurately define how much of each resource (naval, merchant and industrial) is needed and how we can pay for it.

This subject needs urgent consideration at the highest policy levels. I believe the Center for Strategic & International Studies has stated the issue succinctly in its recent report "Forecasts for U.S. Maritime Industries in 1989: Balancing National Security and Economic Considerations." This report concludes that "U.S. commercial maritime capabilities will probably decline by a third or more by this decade's end. That condition may or may not be in the national interest. That decline must not, however, occur by default.

Broader public debate and discussion are essential. The issue is too vital to be resolved through inaction." This issue, we believe, transcends partisan and parochial interests and is truly a national issue. Furthermore, it is an issue on which we have clear historical perspective. Two world wars have demonstrated beyond all argument the essentiality of maintaining three-coast shipbuilding capacity, as reported in Frederick Lane's comprehensive history of World War II shipbuilding entitled "Ships for Victory." I quote: "In 1940 and 1941, the Maritime Commission and the leaders of the shipbuilding industry attempted to applv lessons learned from 1917-1919. Recalling the overconcentration in the Northeast, they wisely placed many new shipyards on the Gulf and Pacific Coasts." In addition, of four administrative offices established, "the most important regional office was that in Oakland, California" which from 1939 to 1945 delivered 10.2 million displacement tons of ships all from West Coast commercial yards, compared with 7.7 and 3.9 million displacement tons, respectively, on the East and Gulf Coasts.

Todd is fully committed to seeing that none of the foregoing scenarios becomes a reality. We intend to speak out and to stay in business despite current and projected difficulties in our industry.

Should the citizens of the West Coast also be concerned about these "could never happen here" events?

You bet they should. We have the responsibility to make citizens in our ten neighboring Western states aware that they, too, have a stake in maintaining a healthy private West Coast shipbuilding industry and must convince government decision makers to redirect national policy towards preserving balanced maritime resources.

As things now stand, the West Coast is the area most severely impacted by government misdirection.

It is also a strategically located maritime/ industrial center of immense value to national security and economic well-being. The message to be sent is not from a supplicant with hat in hand, but from a group of proud and productive citizens who are greatly disturbed at its government's shortsightedness. We at Todd urge you to share our sense of deep concern on this issue and we pledge to support your action with all our resources.

-

- Impact Of Lifting Alaskan North Slope Oil Export Ban On The U.S. Maritime Industry Maritime Reporter, Feb 1991 #68

G.A.O. Assesses Nation's Energy Security And The Negative Effect On Maritime Industry The Export Administration Act of 1979 places restrictions on the export of Alaskan North Slope crude that effectively ban its export. The act states that "no domestically produced crude oil transported through the

-

- U.S. NAVY OVERHAUL MARKET Maritime Reporter, Jul 16, 1985 #24

This article is an excerpt from IMA's recent quarterly update on the Navy ship maintenance and overhaul market. Information is current as of 1 July, except where noted. ANALYSIS OF FUTURE CONTRACTING Navy has issued a new ship maintenance planning schedule covering FY 1985-1986. We have analyzed th

-

- Raymond International Expands Offshore Services To U.S. West Coast Maritime Reporter, Apr 1984 #30

Raymond International Inc. of Houston has expanded its services to the offshore oil and gas industry by establishing an offshore projects group at the Oakland, Calif., headquarters of Raymond's wholly owned subsidiary, Raymond Kaiser Engineers Inc. The new group will provide engineering and constructi

-

- PMSA Study Shows Impact Of Maritime Industry On 3 West Coast States Maritime Reporter, Apr 1991 #51

A recent study done by SRI International of Menlo Park, Calif., for the Pacific Merchant Shipping Association (PMSA) revealed the maritime industry's economic impact on three West Coast states. Maritime and related industries in California generate $14.4 billion annually, $4 billion in northern

-

- Seaworthy Systems Opens West Coast Branch Office In San Francisco Bay Area Maritime Reporter, Oct 1989 #8

Seaworthy Systems, Inc. recently announced the opening of their West Coast branch office in the San Francisco Bay area. Seaworthy is a full-service firm offering significant capabilities, both technical and managerial, in the fields of marine engineering, naval architecture, industrial power, financi

-

- Hornblower Dining Yachts Contracts Trinity Marine Group To Build West Coast's Largest Diner Boat Maritime Reporter, Jan 1989 #14

The Trinity Marine Group has been awarded a contract to build a 183-foot diner boat for Hornblower Dining Yachts of California. The new flagship of the Hornblower fleet, largest of its type on the West Coast, will operate out of the Los Angeles Harbor beginning in the spring of 1989. While new in

-

- Sohio Oil, Subsidiary Of BP America, Makes West Coast Acquisitions Maritime Reporter, Jan 1989 #41

BP America recently announced that its subsidiary, Sohio Oil Company, has agreed to acquire a West Coast refinery and marketing assets from Mobil Oil. The action marks the company's first move to the West Coast as a refiner and marketer. As part of the transaction, Sohio Oil is purchasing Mobil's 79

-

- Dillingham Restructures West Coast Operations— Key Executives Named Maritime Reporter, Jul 15, 1986 #5

A total restructuring of Dillingham Corporation's West Coast maritime transportation operations and the appointment of several key executives was announced recently by J. Joseph Casey, company president and chief executive officer. The restructuring includes the formation of Foss Maritime, a new oper

-

- MAN-B&W Diesel Holds Symposium For West Coast Marine Industry Leaders Maritime Reporter, Jan 15, 1983 #22

A diesel engine symposium conducted recently in San Francisco by MAN-B&W Diesel was very well attended by a wide cross section of important West Coast shipowners, operators, and naval architects. A brief introduction by the president of American MAN Corp., K. Peter Koch, was followed by a presentati

-

- J.J. Henry Company Opens West Coast Office In San Diego Maritime Reporter, Mar 15, 1981 #7

A.C. Brown, senior vice president of the J.J. Henry Co., Inc. and general manager of the Moorestown Production Division, has announced the opening of a branch office in San Diego. The new facility will be fully coordinated with the firm's Production Division headquarters in Moorestown, N.J., and

-

- NASSCO Launches The S/S Blue Ridge- First Of Three For West Coast Shipping Maritime Reporter, Dec 15, 1980 #26

National Steel and Shipbuilding Company (NASSCO), San Diego, Calif., recently launched the 658-foot S S Blue' Ridge, the first of three 37,500-dwt product carriers that NASSCO is building for West Coast Shipping, a subsidiary of Union Oil Company of California. The Blue Ridge hull was constructed in

-

)

March 2024 - Marine Technology Reporter page: 39

)

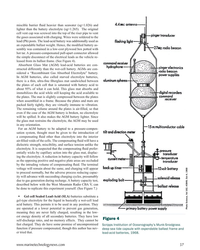

March 2024 - Marine Technology Reporter page: 39Photo courtesy Global Ocean Design Figure 7 A 35Ah AGM lead-acid battery is tested using the West Mountain Radio CBA to show the effect of simply ? lling the battery voids with mineral oil as a compensating ? uid. The CBA is programmed to cut-off at a voltage of 10.50v. The top line (red) shows the

-

)

March 2024 - Marine Technology Reporter page: 38

)

March 2024 - Marine Technology Reporter page: 38LANDER LAB #10 Photo courtesy West Mountain Radio Photo courtesy of Clarios/AutoBatteries.com Figure 6 The West Mountain Radio Computerized Battery Analyzer (CBA V) attaches to a Figure 5 laptop by a USB-B cable, and to a battery by Powerpole® Connectors. Exploded view of an AGM lead-acid battery.

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33regulated industry in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’

-

)

March 2024 - Marine Technology Reporter page: 26

)

March 2024 - Marine Technology Reporter page: 26FEATURE OCEANOGRAPHIC INSTRUMENTATION & SENSORS Kevin Mackay, TESMaP voyage leader and Center head of the South and West Paci? c Regional Centre of Seabed 2030. Kevin in the seismic lab at Greta Point looking at the Hunga Tonga-Hunga Ha’apai volcano 3D map completed with data from the TESMaP voyage

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 9

)

March 2024 - Marine Technology Reporter page: 9from marinas along the western coast. The exact number of lizing laser detection systems can detect mines just below the mines, as well as their locations, remains largely a mystery, surface, even those hiding in murky water. The Airborne Laser although reports suggest that over three hundred have been

-

)

April 2024 - Maritime Reporter and Engineering News page: 27

)

April 2024 - Maritime Reporter and Engineering News page: 27RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND With COVID, we had to make some hard choices for our Do your CIVMARs have upward mobility? mariners because we couldn’t rotate. Many of our mariners The Navy has Sailors who become “Mustangs,” and work found other employment, and were able to use their skills

-

)

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22INTERVIEW WE ARE ENGAGED WITH MULTIPLE US OSW WIND DEVELOPMENTS AND SEEING AN UP-TICK FOR CVA, TECHNOLOGY REVIEW AND RISK REDUCTION SERVICES IN EARLY DEVELOPMENT PHASES. WITH NEW LEASE ROUNDS COMING AND NEW OPPORTUNITIES, WE DO NOT SEE A BIG SLOWDOWN FOR OSW DEVELOPMENTS APART FROM THE OBVIOUS

-

)

April 2024 - Maritime Reporter and Engineering News page: 18

)

April 2024 - Maritime Reporter and Engineering News page: 18MARKETS & gas activity returns, we anticipate that supply of the vessels The Question of Emissions to offshore wind projects will reduce, driving demand for ad- Given that SOVs and CSOVs operate in a segment target- ditional CSOVs. ing reduced emissions, and many operate in the North Eu- Outside of China

-

)

April 2024 - Maritime Reporter and Engineering News page: 6

)

April 2024 - Maritime Reporter and Engineering News page: 6Editorial MARITIME REPORTER AND ENGINEERING NEWS his month’s coverage is M A R I N E L I N K . C O M almost an afterthought HQ 118 E. 25th St., 2nd Floor following the tragedy that New York, NY 10010 USA T +1.212.477.6700 Tunfolded in Baltimore in the wee hours of Tuesday, March 26, CEO John C.

-

)

April 2024 - Marine News page: 37

)

April 2024 - Marine News page: 37Feature Electric Tugs could change down the road. “What do we really need an In San Diego, eWolf’s transits will typically run 20-30 engineer to do? There are no moving parts. So, how does minutes, “not the optimal operation to really see a lot of that [role] change? How does that change where we work?

-

)

April 2024 - Marine News page: 33

)

April 2024 - Marine News page: 33Feature Electric Tugs ing tug design. ABB was brought on as systems integrator, and Coden, Ala. shipbuilder Master Boat Builders began building the vessel later that year. The result of these efforts is the 82-foot-long tug eWolf, built to ABS class and is compliant with U.S. Coast Guard Subchapter M

-

)

April 2024 - Marine News page: 28

)

April 2024 - Marine News page: 28Feature Shipbuilding WindServe Marine you don’t have the sustained backlog.” Previous editions of Marine News’ U.S. Shipbuilding re- port have noted the increasing concern about what ABS’s Bleiberg (moderating the Marine Money panel) called “the big push for sustainable” shipping”, adding that: “What we

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27Feature Shipbuilding Loumania Stewart / U.S. Coast Guard focus), which require very different business systems to be in place. “We’ve been able to do both,” he said, noting that having systems in place for government jobs makes East- ern Shipbuilding “move-in ready for the Navy and other DOD agencies

-

)

April 2024 - Marine News page: 26

)

April 2024 - Marine News page: 26Feature ECO Edison, the ? rst U.S.- Shipbuilding built wind farm service operations vessel. Ørsted U.S. SHIPBUILDING REPORT By Barry Parker If nothing else, building vessels in the U.S. is a com- handle), handling “…government and commercial work, plicated business. primarily newbuilds, but also

-

)

April 2024 - Marine News page: 25

)

April 2024 - Marine News page: 25though indirectly and not linked to navigation concerns, say, for NOAA’s own ? eet. Rather, NOAA hands-off the issue to its Integrated Ocean Observing System which suggests that BOEM include a requirement, as a condition of project ap- proval, that wind companies “must develop a high frequency radar

-

)

April 2024 - Marine News page: 24

)

April 2024 - Marine News page: 24Feature Navigation cables, 9 miles of cables connecting substations and up to blurred, undependable information for vessel crews. two export transmission cables with “associated secondary In the fairways Notice, the USCG references the NAS cable protection” (text is from the permit) within a 42-mile-

-

)

April 2024 - Marine News page: 22

)

April 2024 - Marine News page: 22Feature Navigation inside the approved lease area as a requirement under the BOEM’s attention to the USCG’s recent 27-page Federal terms and conditions of a speci? c lease. Register Notice (January 19) to establish “shipping safety • For structure siting, the USCG (again) “insists” that fairways along

-

)

April 2024 - Marine News page: 21

)

April 2024 - Marine News page: 21Feature Navigation “Wind Turbines: The Bigger, the Better” – USDOE Of? ce of Energy Ef? ciency & Renewable Energy, August 24, 2023 ast December the Bureau of Ocean Energy Man- Agencies write: we want to advance wind energy, but ocean agement (BOEM) published a proposed sale no- areas can only yield so

-

)

April 2024 - Marine News page: 19

)

April 2024 - Marine News page: 19• Investment in Infrastructure and Onshoring Man- sharing best practices. Additionally, given the global nature ufacturing: The administration is committing over $20 of maritime operations, international cooperation is essen- billion towards U.S. port infrastructure over the next tial for establishing

-

)

April 2024 - Marine News page: 14

)

April 2024 - Marine News page: 14Insights tion on a couple of issues, including engine room crew- For AWO, as an organization, what is its top ing on ATBs with automated systems. This is an issue priorities for the coming six to 12 months and that Congress thought that it addressed in the last Coast what’s being done to address them? Gua

-

)

April 2024 - Marine News page: 13

)

April 2024 - Marine News page: 13Q&A We’ve still got some work to do. Despite the new guid- Looking across the industry, what are some ance, we are seeing differences in the way that the Coast other important regulatory issues that AWO is Guard is applying crewing and life-saving requirements to currently paying attention to? ATBs from

-

)

April 2024 - Marine News page: 12

)

April 2024 - Marine News page: 12Insights century technology in 2024.” That’s an area of focus. industry. We want to do that in a realistic way. These are We also want to make sure that we have workers on our great careers where a hardworking person can make a six- vessels who are ? t for duty. One of the things that we have ? gure