Underwater Connector Technology

-

- A Closer Look at Maritime Finance and Risk Maritime Logistics Professional, Q2 2014 #14

Maritime businesses face a broader range of risks than most. A look at some recent business transactions is proof enough.

Risk is a critical element of every maritime-related business transaction from a financial risk management perspective, a market perspective, or often both. As with most business segments, maritime dealmakers and financiers employ elaborate risk management tools to evaluate the efficacy of acquisitions, loans and investments. But perhaps even more important are the markets for goods and services that have developed around the risky nature of most marine business sub-segments. These markets have attracted a great deal of investment in recent years as maritime companies strive to manage their risks in order to enhance financial performance as well as improve their public relations and safety records.

Maritime businesses face a broader range of risks than most, from navigation and safety in normal at-sea operations to the threat of piracy and catastrophic collisions or environmental mishaps. Just a few months into 2014, mariners have already faced nearly 100 pirate attacks with dozens of crewmembers taken hostage. Ship collisions and groundings remain a regular occurrence with incidents from the US Gulf Coast to Virginia to South Korea already this year, bringing human casualties as well as environmental hazards. And of course, the mystery of the vanished Malaysian Airline flight 370 has ignited a massive high-profile search at sea, bringing focus to the challenges of tracking and locating any object in the expansive maritime domain.

Risk Creates Markets

In recent years such risks have spurred deal activity in businesses that are dedicated to maritime safety and environmental matters. In December 2013, France-based Orolia (NYSE Alternext Paris: ALORO) announced its agreement to acquire Techno-Sciences, Inc. (TSi) of Beltsville, MD. Orolia has grown via a number of successful acquisitions and is firmly established as a leader in the emergency response market and in the Maritime Domain Awareness (MDA) sector. In January 2014, Orolia announced the creation of McMurdo Group to unite its Positioning, Tracking and Monitoring Division and its Boatracs, Kannad, McMurdo, SARBE and TSi brands. With the acquisition of TSi, Orolia has added capabilities including satellite ground stations and mission control software, as well as coastal surveillance and offshore asset protection solutions. Orolia has experienced solid growth and is actively pursuing additional acquisitions in their niche markets.

Safety and environmental compliance are focus areas for Drew Marine, which was acquired by an affiliate fund of private equity group The Jordan Company from another marine-savvy PEG, J.F. Lehman & Company last November. Concurrently with the Drew acquisition, The Jordan Company acquired Lehman’s portfolio company ACR Electronics. ACR is a leader in maritime and aviation safety and survival solutions such as rescue beacons and lighting products. As noted in a past article, J.F. Lehman acquired OPA 1990-compliance leader National Response Corp (NRC) from Seacor in 2012. In March of 2014, NRC completed the add-on acquisition of UK-based Sureclean Limited, a provider of specialty environmental and industrial solutions.

Examining another area of risk, recent months have brought a handful of deals in marine security and defense. In early 2014, The McLean Group represented 3 Phoenix in their sale to Ultra Electronics of the UK for $87 million. 3 Phoenix provides real-time sensor and processing solutions, primarily for Navy radar and sonar systems. The company will augment Ultra’s existing Tactical & Sonar Systems division. In April TE Connectivity (NYSE: TEL), formerly Tyco Electronics, signed an agreement to acquire SEACON Group, a provider of underwater connector technology for military and other subsea customers for $490 million in cash. Finally, Swedish military contractor SAAB has just announced that it is in talks to acquire ThyssenKrupp Marine Systems, a builder of submarines and warships in Europe.

An interesting deal took place in Canada during the first quarter, when a group of independent board members of Rutter Inc. consummated a tender offer for the shares of the publicly-traded company. A provider of defense, navigation and maritime surveillance technology centered mainly on radar applications, Rutter had been struggling for years and watched its share price fall by 95% since 2006. The investor group commenced their tender offer to buy all the outstanding shares of the company in January, and by March had received deposits of more than 38% of the shares, giving the group an 80% controlling interest overall. The new owners will now de-list Rutter from the Toronto exchange and perform an acquisition of remaining shares at the same price as their tender offer.Financial Risk and M&A Deals

Financial transactions, particularly large ones, involve a complex and in-depth evaluation of risks by players on both sides of the deal. In Mergers and Acquisitions, sellers generally seek to diversify their portfolios by reducing their exposure to the risk of holding ownership in the subject company. Meanwhile, the buyer and its advisors expend often enormous time and resources in the analysis of the risks they are taking on during the “due diligence” period.

Over time, we can assess risk tolerance levels in the market by examining compiled data from a collection of transactions where deal metrics have been reported. Figure 1 displays all worldwide marine and port-related deals drawn from a number of proprietary data sources. Explaining the chart in brief, the blue section of the columns displays the deal count for the first quarter of each year, whereas the red section of the columns shows the number of deals for the remainder of that year. The green line tracks the ratio of average Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). EV is just the total value of the company, including all of the debt and equity (stock value) that make up the company’s balance sheet. EBITDA is really the cash flows that a buyer will have to finance the transaction without regard to the current financial arrangements of the target company.

Figure 1 shows that in the recovery years from 2009 to 2011, deal counts as well as value ratios increased each year. The high EV/EBITDA number in 2011 was affected by some Asian port deals that had very high reported values, but the trend is an interesting subject for analysis. In effect, buyers showed a growing willingness to accept increasingly higher risk over this three-year period, paying a higher price for the same or slightly higher cash flows. Since that time, enthusiasm on the buy side has waned a bit in the aggregate, though it should be noted that a thorough analysis would involve study of the type of deals and even individual transactions to get a clear picture of the risk landscape.

Risk is a central issue in almost every facet of maritime and offshore industries. Markets are both affected by and actually created by the many risks inherent in maritime activities. This explains why marine finance involves a complex set of activities that are focused on identifying and quantifying risk, and then allocating resources based on the expected risks in a given transaction.

(As published in the 2Q 2014 edition of Maritime Professional - www.maritimeprofessional.com)

-

)

March 2024 - Marine Technology Reporter page: 48

)

March 2024 - Marine Technology Reporter page: 48Index page MTR MarApr2024:MTR Layouts 4/4/2024 3:19 PM Page 1 Advertiser Index PageCompany Website Phone# 17 . . . . .Airmar Technology Corporation . . . . . . . . . .www.airmar.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(603) 673-9570 9 . . . . . .Birns, Inc. . . . . . . . . . .

-

)

March 2024 - Marine Technology Reporter page: 47

)

March 2024 - Marine Technology Reporter page: 47PRODUCT, PROFESSIONAL, VESSELS, MTR BARGES & REAL ESTATE FOR SALE Marketplace INNOVATIVE. UNIQUE. PROVEN. ALLAMERICANMARINE.com ???????????????????????????????????????? 9??????????SiC A????????ArC????????????????S???????C?????????9???Ç????????? ????????????????Ý???????S???y???????????????????K???:???? MAR

-

)

March 2024 - Marine Technology Reporter page: 45

)

March 2024 - Marine Technology Reporter page: 45with zero carbon emissions • Teledyne Marine Acquires Valeport Teledyne Marine agreed to acquire Valeport a leader in the design and manufacture of underwater sensors and pro? l- ers. Valeport is one of the UK’s leading manufacturers of oceanographic and hydrographic instrumentation. The in- dependent

-

)

March 2024 - Marine Technology Reporter page: 44

)

March 2024 - Marine Technology Reporter page: 44Metron signed a partnership agreement with Cellula Ro- the CARIS Ping-To-Chart work? ow, allowing for full above- botics, USA Inc., to expand uncrewed underwater vehicle and-below- water image capture with survey grade accuracy (UUV) capabilities for advanced operations in dynamic envi- 44 March/April

-

)

March 2024 - Marine Technology Reporter page: 43

)

March 2024 - Marine Technology Reporter page: 43Image courtesy Kongsberg Discovery Image courtesy Teledyne Marine New Products Teledyne Marine had its traditional mega-booth at Oi, busy start to ? nish. Image courtesy Greg Trauthwein offers quality sub-bottom pro? ling capability without the need tion of offshore windfarms. GeoPulse 2 introduces new

-

)

March 2024 - Marine Technology Reporter page: 42

)

March 2024 - Marine Technology Reporter page: 42, a Nano connector which offers a versatile and robust performance, making it suitable for multiple applica- tions and the increasingly compact design of underwater in- struments, equipment and systems. This splash and wet-mate connector is manufactured from high-grade titanium and neo- prene to withstand deep

-

)

March 2024 - Marine Technology Reporter page: 41

)

March 2024 - Marine Technology Reporter page: 41Outland Technology Image courtesy Exail Image courtesy Submaris and EvoLogics Vehicles The ROV-1500 from Outland Technology represents a leap forward in underwater robotics, a compact remotely operated vehicle (ROV) weighing in at less than 40 lbs (19kg) the ROV- 1500 is easy to transport and deploy. Similar

-

)

March 2024 - Marine Technology Reporter page: 40

)

March 2024 - Marine Technology Reporter page: 40hicles (ROTVs), inspection-class Remotely Operated Vehicles to withstand the most severe ocean conditions, the new DriX (ROVs), as well as Autonomous Underwater Vehicles (AUVs). O-16 has been designed for long-duration operations (up to Its gondola, located below the surface, can further host a wide 30

-

)

March 2024 - Marine Technology Reporter page: 38

)

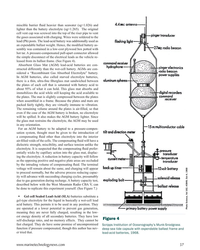

March 2024 - Marine Technology Reporter page: 38LANDER LAB #10 Photo courtesy West Mountain Radio Photo courtesy of Clarios/AutoBatteries.com Figure 6 The West Mountain Radio Computerized Battery Analyzer (CBA V) attaches to a Figure 5 laptop by a USB-B cable, and to a battery by Powerpole® Connectors. Exploded view of an AGM lead-acid battery.

-

)

March 2024 - Marine Technology Reporter page: 37

)

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33regulated industry in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’

-

)

March 2024 - Marine Technology Reporter page: 32

)

March 2024 - Marine Technology Reporter page: 32FEATURE SEABED MINING by a sea? oor plume from its pilot collection system test. pact, nodule collection system that utilizes mechanical and The Metals Company recently signed a binding MoU with hydraulic technology. Paci? c Metals Corporation of Japan for a feasibility study on The company’s SMD

-

)

March 2024 - Marine Technology Reporter page: 30

)

March 2024 - Marine Technology Reporter page: 30FEATURE SEABED MINING bilical. It has passive heave compensation which nulli? es the necott. “The focus since then has been on scaling while en- wave, current and vessel motions that in? uence loads in the suring the lightest environmental impact,” says The Metals power umbilical. The LARS can

-

)

March 2024 - Marine Technology Reporter page: 29

)

March 2024 - Marine Technology Reporter page: 29n January, Norway said “yes” to sea- bed mining, adding its weight to the momentum that is likely to override the calls for a moratorium by over 20 countries and companies such as I Google, BMW, Volvo and Samsung. Those against mining aim to protect the unique and largely unknown ecology of the sea?

-

)

March 2024 - Marine Technology Reporter page: 27

)

March 2024 - Marine Technology Reporter page: 27SEA-KIT USV Maxlimer returning from HT-HH caldera in Tonga. © SEA-KIT International data and further assess ecosystem recov- ery. What is known, noted Caplan-Auer- bach, is that the impact of submarine vol- canoes on humans is rare. “The HT-HH eruption was a tragedy, but it was very unusual. It let us

-

)

March 2024 - Marine Technology Reporter page: 26

)

March 2024 - Marine Technology Reporter page: 26FEATURE OCEANOGRAPHIC INSTRUMENTATION & SENSORS Kevin Mackay, TESMaP voyage leader and Center head of the South and West Paci? c Regional Centre of Seabed 2030. Kevin in the seismic lab at Greta Point looking at the Hunga Tonga-Hunga Ha’apai volcano 3D map completed with data from the TESMaP voyage

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 23

)

March 2024 - Marine Technology Reporter page: 23. Kevin Mackay, marine ge- ologist at the National Institute of Water and Atmosphere Research (NIWA), New Zealand, said, “There are over one million underwater volcanoes, although only about 120 are known to have been active in the last 11,000 years—a number that is likely to be a gross under- estimate

-

)

March 2024 - Marine Technology Reporter page: 20

)

March 2024 - Marine Technology Reporter page: 202024 Editorial Calendar January/Februay 2024 February 2024 March/April 2024 Ad close Jan.31 Ad close March 21 Ad close Feb. 4 Underwater Vehicle Annual Offshore Energy Digital Edition ?2?VKRUH:LQG$)ORDWLQJ)XWXUH ?2FHDQRJUDSKLF?QVWUXPHQWDWLRQ 6HQVRUV ?6XEVHD'HIHQVH ?6XEVHD'HIHQVH7KH+XQWIRU ?0DQLS

-

)

March 2024 - Marine Technology Reporter page: 19

)

March 2024 - Marine Technology Reporter page: 19About the Author vey with the pipe tracker is not required, resulting in signi? - Svenn Magen Wigen is a Cathodic Protection and corrosion control cant cost savings, mainly related to vessel charter. expert having worked across The major advantage of using FiGS on any type of subsea engineering, design

-

)

March 2024 - Marine Technology Reporter page: 18

)

March 2024 - Marine Technology Reporter page: 18TECH FEATURE IMR There are also weaknesses in terms of accuracy because of FiGS Operations and Bene? ts signal noise and the ability to detect small ? eld gradients. In Conventional approaches to evaluating cathodic protection this process there is a risk that possible issues like coating (CP)

-

)

March 2024 - Marine Technology Reporter page: 17

)

March 2024 - Marine Technology Reporter page: 17• Integrity assessment, and otherwise covered, e.g., by rock dump. As for depletion of • Mitigation, intervention and repair. sacri? cial anodes, this can be dif? cult or even impossible to Selecting the best method for collecting the data these work- estimate due to poor visibility, the presence of

-

)

March 2024 - Marine Technology Reporter page: 16

)

March 2024 - Marine Technology Reporter page: 16, FORCE Technology he principle behind sacri? cial anodes, which are water structures, reducing the need for frequent repairs and used to safeguard underwater pipelines and struc- replacements, which also aligns well with sustainable opera- tures from corrosion, is relatively straightforward. tional practices

-

)

March 2024 - Marine Technology Reporter page: 15

)

March 2024 - Marine Technology Reporter page: 15sensor options for longer mission periods. About the Author For glider users working in ? sheries and conservation, Shea Quinn is the Product Line Manager the Sentinel can run several high-energy passive and active of the Slocum Glider at Teledyne Webb acoustic sensors, on-board processing, and imaging