Page 8: of Marine News Magazine (December 2012)

Innovative Products &

Read this page in Pdf, Flash or Html5 edition of December 2012 Marine News Magazine

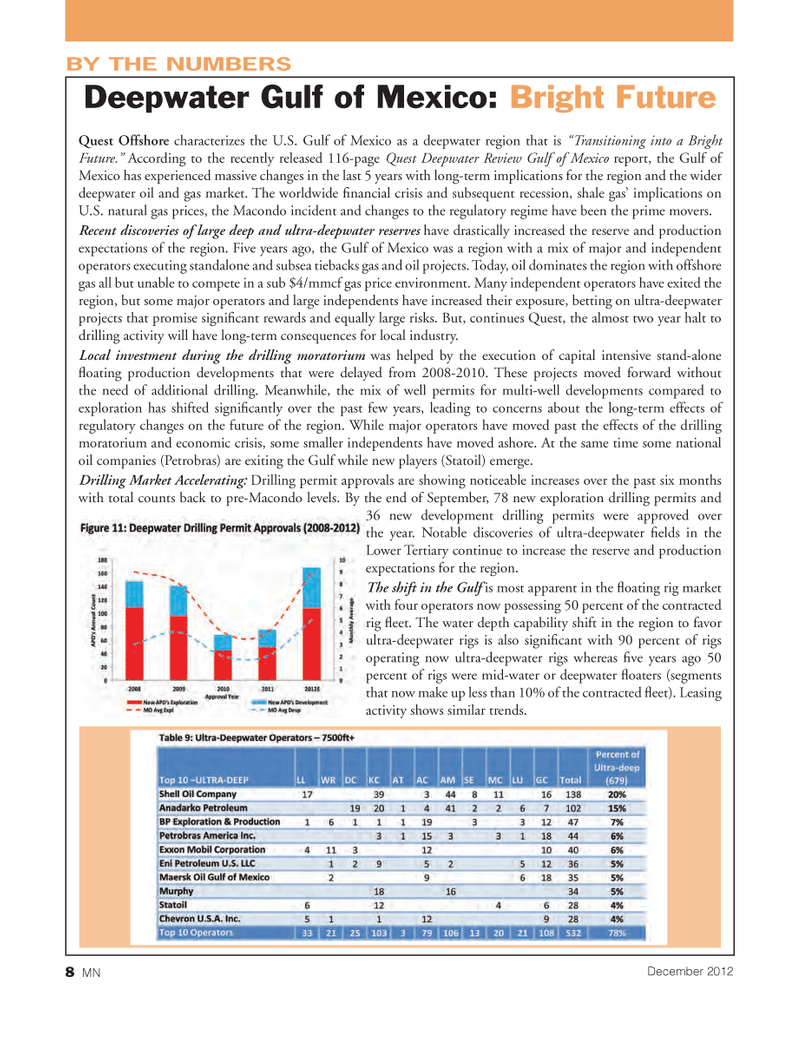

Deepwater Gulf of Mexico: Bright Future Quest Offshore characterizes the U.S. Gulf of Mexico as a deepwater region that is ?Transitioning into a Bright Future.? According to the recently released 116-page Quest Deepwater Review Gulf of Mexico report, the Gulf of Mexico has experienced massive changes in the last 5 years with long-term implications for the region and the wider deepwater oil and gas market. The worldwide Þ nancial crisis and subsequent recession, shale gasÕ implications on U.S. natural gas prices, the Macondo incident and changes to the regulatory regime have been the prime movers. Recent discoveries of large deep and ultra-deepwater reserves have drastically increased the reserve and production expectations of the region. Five years ago, the Gulf of Mexico was a region with a mix of major and independent operators executing standalone and subsea tiebacks gas and oil projects. Today, oil dominates the region with offshore gas all but unable to compete in a sub $4/mmcf gas price environment. Many independent operators have exited the region, but some major operators and large independents have increased their exposure, betting on ultra-deepwater projects that promise signiÞ cant rewards and equally large risks. But, continues Quest, the almost two year halt to drilling activity will have long-term consequences for local industry. Local investment during the drilling moratorium was helped by the execution of capital intensive stand-alone ß oating production developments that were delayed from 2008-2010. These projects moved forward without the need of additional drilling. Meanwhile, the mix of well permits for multi-well developments compared to exploration has shifted signiÞ cantly over the past few years, leading to concerns about the long-term effects of regulatory changes on the future of the region. While major operators have moved past the effects of the drilling moratorium and economic crisis, some smaller independents have moved ashore. At the same time some national oil companies (Petrobras) are exiting the Gulf while new players (Statoil) emerge. Drilling Market Accelerating: Drilling permit approvals are showing noticeable increases over the past six months with total counts back to pre-Macondo levels. By the end of September, 78 new exploration drilling permits and 36 new development drilling permits were approved over the year. Notable discoveries of ultra-deepwater Þ elds in the Lower Tertiary continue to increase the reserve and production expectations for the region. The shift in the Gulf is most apparent in the ß oating rig market with four operators now possessing 50 percent of the contracted rig ß eet. The water depth capability shift in the region to favor ultra-deepwater rigs is also signiÞ cant with 90 percent of rigs operating now ultra-deepwater rigs whereas Þ ve years ago 50 percent of rigs were mid-water or deepwater ß oaters (segments that now make up less than 10% of the contracted ß eet). Leasing activity shows similar trends. BY THE NUMBERS8 MNDecember 2012

7

7

9

9