Page 8: of Marine News Magazine (January 2013)

Training and Education

Read this page in Pdf, Flash or Html5 edition of January 2013 Marine News Magazine

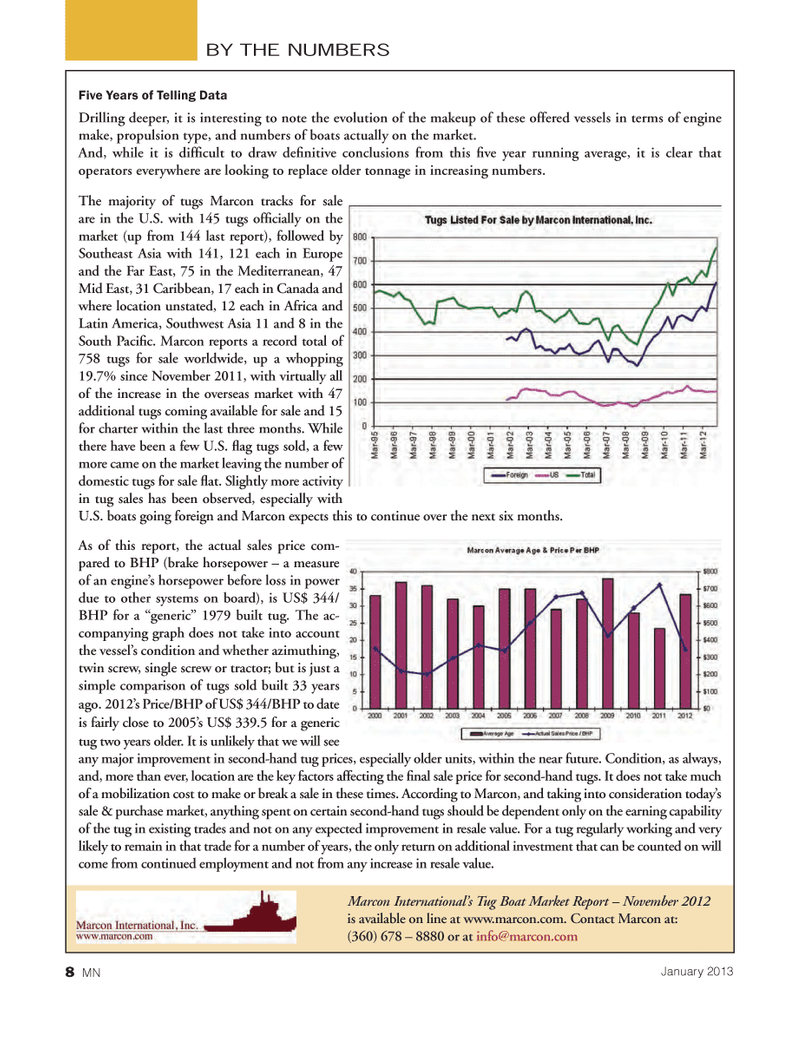

Five Years of Telling Data Drilling deeper, it is interesting to note the evolution of the makeup of these offered vessels in terms of engine make, propulsion type, and numbers of boats actually on the market. And, while it is difÞ cult to draw deÞ nitive conclusions from this Þ ve year running average, it is clear that operators everywhere are looking to replace older tonnage in increasing numbers. The majority of tugs Marcon tracks for sale are in the U.S. with 145 tugs ofÞ cially on the market (up from 144 last report), followed by Southeast Asia with 141, 121 each in Europe and the Far East, 75 in the Mediterranean, 47 Mid East, 31 Caribbean, 17 each in Canada and where location unstated, 12 each in Africa and Latin America, Southwest Asia 11 and 8 in the South PaciÞ c. Marcon reports a record total of 758 tugs for sale worldwide, up a whopping 19.7% since November 2011, with virtually all of the increase in the overseas market with 47 additional tugs coming available for sale and 15 for charter within the last three months. While there have been a few U.S. ß ag tugs sold, a few more came on the market leaving the number of domestic tugs for sale ß at. Slightly more activity in tug sales has been observed, especially with U.S. boats going foreign and Marcon expects this to continue over the next six months. As of this report, the actual sales price com- pared to BHP (brake horsepower Ð a measure of an engineÕs horsepower before loss in power due to other systems on board), is US$ 344/ BHP for a ÒgenericÓ 1979 built tug. The ac- companying graph does not take into account the vesselÕs condition and whether azimuthing, twin screw, single screw or tractor; but is just a simple comparison of tugs sold built 33 years ago. 2012Õs Price/BHP of US$ 344/BHP to date is fairly close to 2005Õs US$ 339.5 for a generic tug two years older. It is unlikely that we will see any major improvement in second-hand tug prices, especially older units, within the near future. Condition, as always, and, more than ever, location are the key factors affecting the Þ nal sale price for second-hand tugs. It does not take much of a mobilization cost to make or break a sale in these times. According to Marcon, and taking into consideration todayÕs sale & purchase market, anything spent on certain second-hand tugs should be dependent only on the earning capability of the tug in existing trades and not on any expected improvement in resale value. For a tug regularly working and very likely to remain in that trade for a number of years, the only return on additional investment that can be counted on will come from continued employment and not from any increase in resale value. BY THE NUMBERSMarcon International?s Tug Boat Market Report ? November 2012 is available on line at www.marcon.com. Contact Marcon at: (360) 678 Ð 8880 or at [email protected] 8 MNJanuary 2013 MN Jan2013 Layout 1-17.indd 8MN Jan2013 Layout 1-17.indd 81/4/2013 10:59:53 AM1/4/2013 10:59:53 AM

7

7

9

9