Page 8: of Marine News Magazine (May 2013)

Combat & Patrol Craft Annual

Read this page in Pdf, Flash or Html5 edition of May 2013 Marine News Magazine

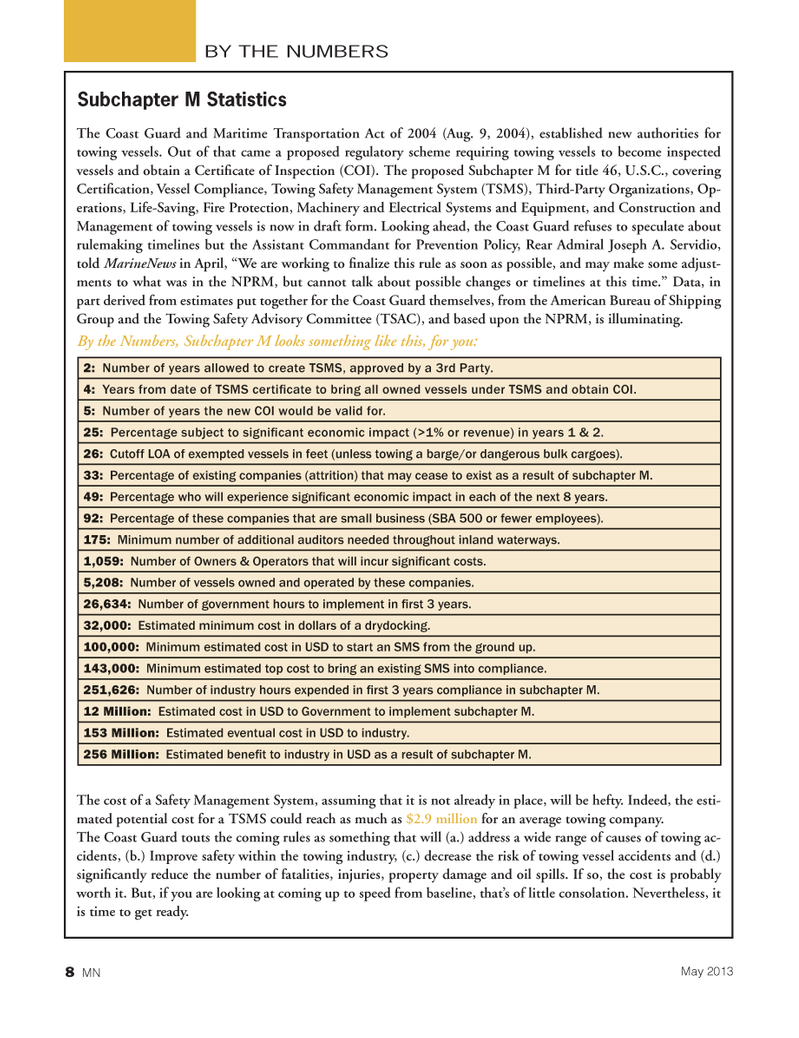

The Coast Guard and Maritime Transportation Act of 2004 (Aug. 9, 2004), established new authorities for towing vessels. Out of that came a proposed regulatory scheme requiring towing vessels to become inspected vessels and obtain a CertiÞ cate of Inspection (COI). The proposed Subchapter M for title 46, U.S.C., covering CertiÞ cation, Vessel Compliance, Towing Safety Management System (TSMS), Third-Party Organizations, Op- erations, Life-Saving, Fire Protection, Machinery and Electrical Systems and Equipment, and Construction and Management of towing vessels is now in draft form. Looking ahead, the Coast Guard refuses to speculate about rulemaking timelines but the Assistant Commandant for Prevention Policy, Rear Admiral Joseph A. Servidio, told MarineNews in April, ÒWe are working to Þ nalize this rule as soon as possible, and may make some adjust- ments to what was in the NPRM, but cannot talk about possible changes or timelines at this time.Ó Data, in part derived from estimates put together for the Coast Guard themselves, from the American Bureau of Shipping Group and the Towing Safety Advisory Committee (TSAC), and based upon the NPRM, is illuminating. By the Numbers, Subchapter M looks something like this, for you: The cost of a Safety Management System, assuming that it is not already in place, will be hefty. Indeed, the esti- mated potential cost for a TSMS could reach as much as $2.9 million for an average towing company. The Coast Guard touts the coming rules as something that will (a.) address a wide range of causes of towing ac- cidents, (b.) Improve safety within the towing industry, (c.) decrease the risk of towing vessel accidents and (d.) signiÞ cantly reduce the number of fatalities, injuries, property damage and oil spills. If so, the cost is probably worth it. But, if you are looking at coming up to speed from baseline, thatÕs of little consolation. Nevertheless, it is time to get ready. 2: Number of years allowed to create TSMS, approved by a 3rd Party. 4: Years from date of TSMS certi Þ cate to bring all owned vessels under TSMS and obtain COI. 5: Number of years the new COI would be valid for. 25: Percentage subject to signi Þ cant economic impact (>1% or revenue) in years 1 & 2. 26: Cutoff LOA of exempted vessels in feet (unless towing a barge/or dangerous bulk cargoes). 33: Percentage of existing companies (attrition) that may cease to exist as a result of subchapter M. 49: Percentage who will experience signi Þ cant economic impact in each of the next 8 years. 92: Percentage of these companies that are small business (SBA 500 or fewer employees). 175: Minimum number of additional auditors needed throughout inland waterways. 1,059: Number of Owners & Operators that will incur signi Þ cant costs. 5,208: Number of vessels owned and operated by these companies. 26,634: Number of government hours to implement in Þ rst 3 years. 32,000: Estimated minimum cost in dollars of a drydocking. 100,000: Minimum estimated cost in USD to start an SMS from the ground up. 143,000: Minimum estimated top cost to bring an existing SMS into compliance. 251,626: Number of industry hours expended in Þ rst 3 years compliance in subchapter M. 12 Million: Estimated cost in USD to Government to implement subchapter M. 153 Million: Estimated eventual cost in USD to industry. 256 Million: Estimated bene Þ t to industry in USD as a result of subchapter M. BY THE NUMBERSSubchapter M Statistics8 MNMay 2013MN May2013 Layout 1-17.indd 8MN May2013 Layout 1-17.indd 85/3/2013 12:29:56 PM5/3/2013 12:29:56 PM

7

7

9

9