Page 14: of Marine News Magazine (April 2016)

Boatbuilding: Construction & Repair

Read this page in Pdf, Flash or Html5 edition of April 2016 Marine News Magazine

INSIGHTS business development, observed bulkers being converted college’s existing welding curriculum for shipyard work. to tankers for oil storage. This is happening everywhere. In 2014 we began working with the Alaska Workforce

Investment Board (AWIB) and the University of Alaska

Can you give us a sense of your backlog? How deep

Southeast Ketchikan Campus (UAS-Ketchikan) to create is it and how far out does it extend?

an industry-led training program tied into our Ketchikan

Vigor is a diversi? ed company with the critical mass need- yard. All three of these programs provide the speci? c ed to provide stability for our workforce. 45% of Vigor’s training necessary to help students land family wage jobs business is in ship repair, 40% in shipbuilding, and 15% in at our shipyards or other area employers. In addition we non-marine fabrication. Our non-marine business is grow- provide internships and support high school programs. ing, our ship repair business is expected to grow slightly Within Vigor, we provide on-the-job training, and we use from last year, and our shipbuilding backlog ranges from our more experienced craftsmen to mentor and train. We 1.5 to 3.5 years depending on the location. If and when the are constantly developing internal talent and have train- market for shipbuilding rebounds, we will be there.

ing programs in place that cover employees from the shop ? oor to executive leadership.

We’re arguably at the backend of one of the longest upswings in the U.S. newbuild markets that domestic

What percentage of your work involves newbuild and yards have seen in many decades. But, this has al- what percentage is repair?

ways been a cyclical industry. That said; when do you

A few years ago, 80% of our business was ship repair. see the pendulum swinging back up again?

I wish I had that crystal ball but I suspect we are a ways Now, thanks to our growth and diversi? cation efforts, away. Likely a few events will need to take place before we 45% of Vigor’s business is in ship repair, 40% in shipbuild- see a signi? cant swing of the pendulum. The price of oil ing, and 15% in non-marine fabrication. will have to rise and oil reserves decline. Vessels currently

Describe the Vigor portfolio of shipyards. How many tied up waiting for work will need to be back in service and do you have now and where are they located?

new exploration will have to resume.

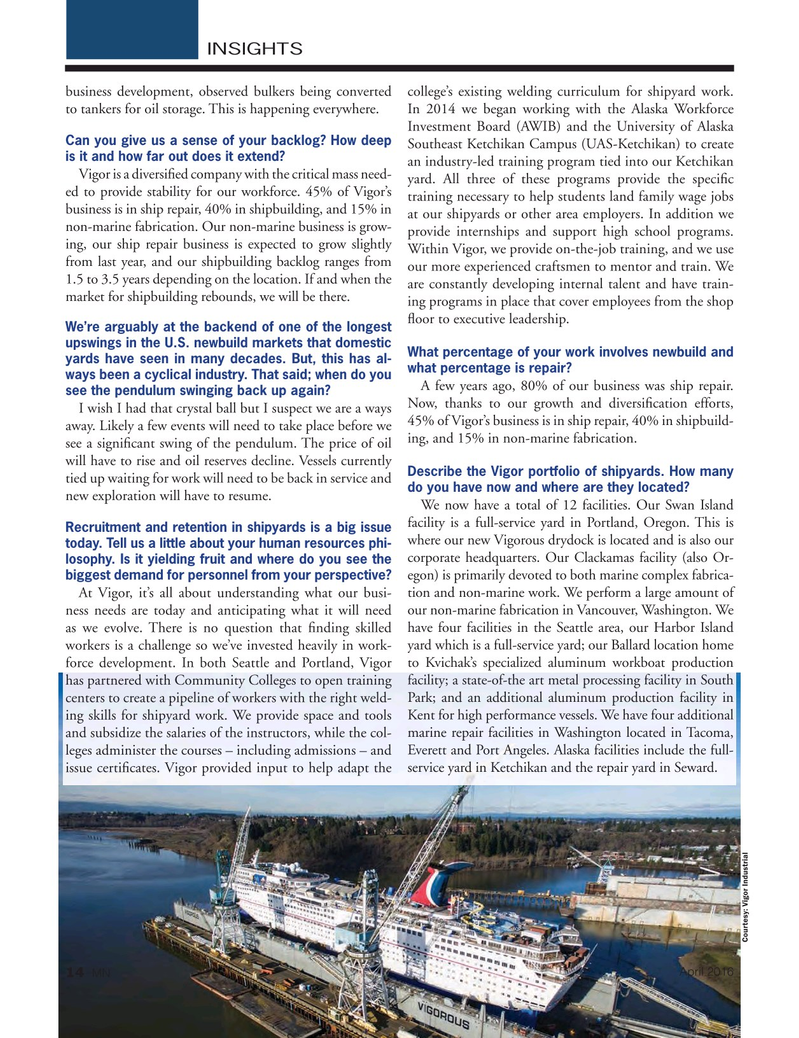

We now have a total of 12 facilities. Our Swan Island facility is a full-service yard in Portland, Oregon. This is

Recruitment and retention in shipyards is a big issue where our new Vigorous drydock is located and is also our today. Tell us a little about your human resources phi- corporate headquarters. Our Clackamas facility (also Or- losophy. Is it yielding fruit and where do you see the egon) is primarily devoted to both marine complex fabrica- biggest demand for personnel from your perspective?

At Vigor, it’s all about understanding what our busi- tion and non-marine work. We perform a large amount of ness needs are today and anticipating what it will need our non-marine fabrication in Vancouver, Washington. We as we evolve. There is no question that ? nding skilled have four facilities in the Seattle area, our Harbor Island workers is a challenge so we’ve invested heavily in work- yard which is a full-service yard; our Ballard location home force development. In both Seattle and Portland, Vigor to Kvichak’s specialized aluminum workboat production has partnered with Community Colleges to open training facility; a state-of-the art metal processing facility in South centers to create a pipeline of workers with the right weld- Park; and an additional aluminum production facility in ing skills for shipyard work. We provide space and tools Kent for high performance vessels. We have four additional and subsidize the salaries of the instructors, while the col- marine repair facilities in Washington located in Tacoma, leges administer the courses – including admissions – and Everett and Port Angeles. Alaska facilities include the full- issue certi? cates. Vigor provided input to help adapt the service yard in Ketchikan and the repair yard in Seward.

Courtesy: Vigor Industrial

April 2016 14 MN

MN April16 Layout 1-17.indd 14 3/18/2016 11:42:18 AM

13

13

15

15