Page 18: of Marine News Magazine (June 2016)

Combat & Patrol Craft Annual

Read this page in Pdf, Flash or Html5 edition of June 2016 Marine News Magazine

FINANCE

Ready or Not, Here it Comes

In January 2016, both the FASB and IFRS announced the ? nalization and formalization of a rule change that will impact lease assets … including boats, ships and barges.

By Richard J. Paine, Sr.

FASB, IASB, GAAP, IFRS. If you are of an organization’ leasing activities ...” an accountant or CFO of a company, There are essentially two types of leases: operating leases this alphabet soup means something and capital leases. Long considered rental agreements, op- special to you. It is shorthand for the erating leases were reported “off balance sheet;” whereas names of the organizations that establish capital leases were considered ? nancing agreements and are standards by which you report on the ? - reported as debt on the balance sheet. Although an operat- nancial condition of your company. ing lease or nautically – a bareboat charter – is a contract

The Financial Accounting Standards specifying a rental agreement for a given period of time, it

Paine

Board (FASB) has since 1973 been the was implied to be a liability (the” lease liability”), but not organization in the nongovernmental true debt. Beginning in 2005, with some false starts and sector that has established and re? ned accounting standards stops, The FASB ? nally began to address the issue which for the preparation and reporting that govern ? nancial re- culminated in the new ASU 2016-2 Leases (Topic 842) ports. The Security and Exchange Commission (SEC) of- and the IASB in IFRS 16 reporting protocols.

? cially recognizes those standards to substantiate the credi- bility, accuracy and clear reporting of ? nancial information. P FAB

HASING IN THE NEW

FASB’s stated mission is to “establish and improve stan- Because of the change, other than for short term leases, dards of ? nancial accounting and reporting that foster ? - FASB will consider operating leases as capital leases and be nancial reporting by nongovernmental entities that provides reportable on a company’s balance sheet as such. Happily, decision useful information to investors and other users of this will not happen overnight. Phase in will have three ? nancial reports.” Similarly, the International Accounting milestones, the ? rst for public companies whose ? scal year

Standards Board (IASB) is responsible for best practices of the begins after December 15, 2018 an the second on De- international ? nancial reporting sector with the same goal. cember 15, 2019. A third for interim statements will phase

These domestic and international organizations provide the in within ? scal years beginning after December 15, 2020.

rules of the road in, respectively, the Generally Acceptable Importantly, the new standards affect all companies that

Accounting Principles (US-GAAP) and the International Fi- lease assets such as real estate, construction equipment, air- nancial Reporting Standard (IFRS). The standards are both planes or ... boats, ships and barges.

similar and divergent in their reporting standards. Although similar, there are some differences between

FASB and IASB treatment, both de? ne leases as a contract

ULE HANGE

R C that conveys the right to use the equipment for a period of

In January 2016, both the FASB and IFRS announced time in exchange for payment of some kind. If a company the ? nalization and formalization of a rule change that can has control over the leased asset, derives economic bene? t and will affect the way private and publicly-traded busi- from its use and the right to specify how and where the asset nesses report their ? nancial condition. is used the previous rules of capital lease vs. operating lease

Russell Golden, FASB Chairman explained, “... the new go out the window. All leases are reported as capital leases.

guidance responds to requests from investors and other ? - Formerly, the rules that governed the categorization of a lease nancial statement users for a more faithful representation as operating or capital were relatively and refreshingly simple:

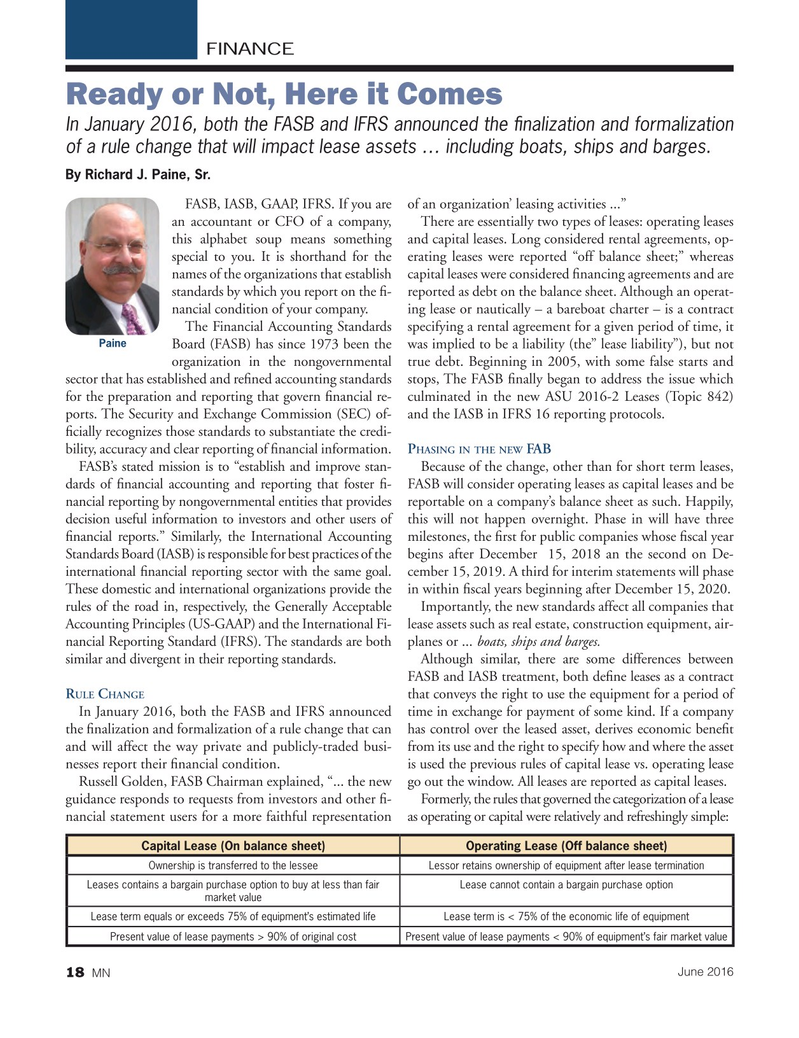

Capital Lease (On balance sheet) Operating Lease (Off balance sheet)

Ownership is transferred to the lessee Lessor retains ownership of equipment after lease termination

Leases contains a bargain purchase option to buy at less than fair Lease cannot contain a bargain purchase option market value

Lease term equals or exceeds 75% of equipment’s estimated life Lease term is < 75% of the economic life of equipment

Present value of lease payments > 90% of original costPresent value of lease payments < 90% of equipment’s fair market value

June 2016 18

MN

MN June16 Layout 18-31.indd 18 5/17/2016 11:01:50 AM

17

17

19

19