Page 32: of Marine News Magazine (June 2016)

Combat & Patrol Craft Annual

Read this page in Pdf, Flash or Html5 edition of June 2016 Marine News Magazine

SHORTSEA SHIPPING

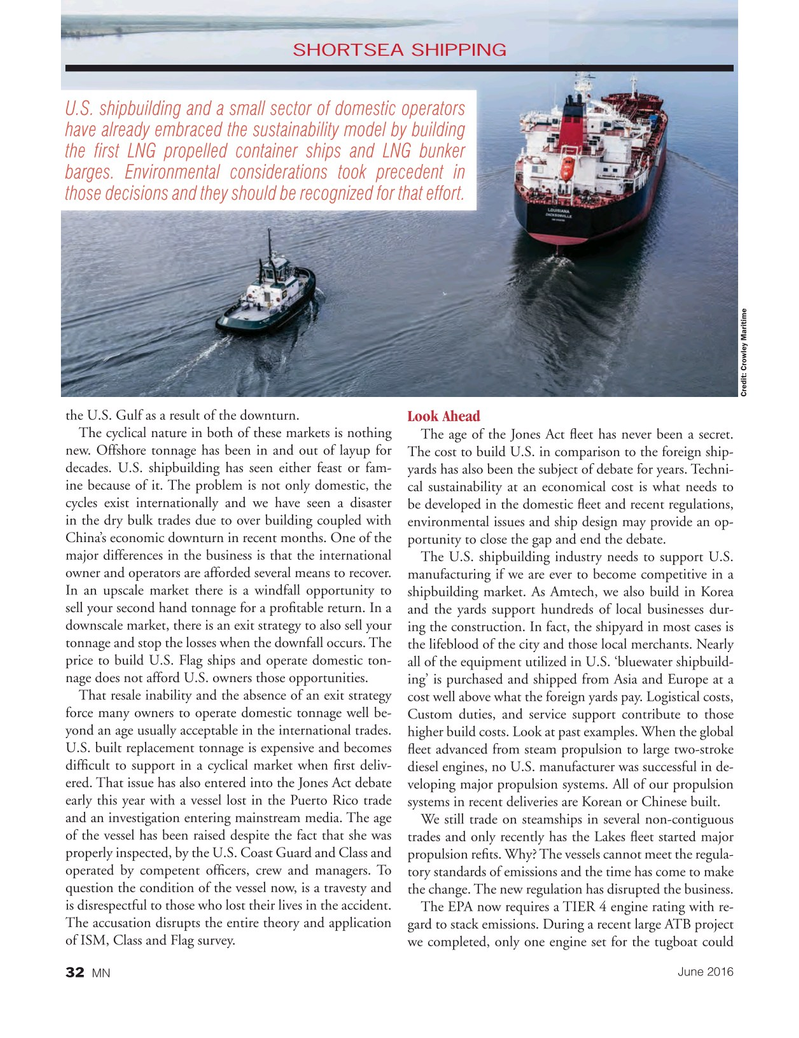

U.S. shipbuilding and a small sector of domestic operators have already embraced the sustainability model by building the ? rst LNG propelled container ships and LNG bunker barges. Environmental considerations took precedent in those decisions and they should be recognized for that effort.

Credit: Crowley Maritime the U.S. Gulf as a result of the downturn.

Look Ahead

The cyclical nature in both of these markets is nothing

The age of the Jones Act ? eet has never been a secret. new. Offshore tonnage has been in and out of layup for The cost to build U.S. in comparison to the foreign ship- decades. U.S. shipbuilding has seen either feast or fam- yards has also been the subject of debate for years. Techni- ine because of it. The problem is not only domestic, the cal sustainability at an economical cost is what needs to cycles exist internationally and we have seen a disaster be developed in the domestic ? eet and recent regulations, in the dry bulk trades due to over building coupled with environmental issues and ship design may provide an op-

China’s economic downturn in recent months. One of the portunity to close the gap and end the debate.

major differences in the business is that the international

The U.S. shipbuilding industry needs to support U.S. owner and operators are afforded several means to recover. manufacturing if we are ever to become competitive in a

In an upscale market there is a windfall opportunity to shipbuilding market. As Amtech, we also build in Korea sell your second hand tonnage for a pro? table return. In a and the yards support hundreds of local businesses dur- downscale market, there is an exit strategy to also sell your ing the construction. In fact, the shipyard in most cases is tonnage and stop the losses when the downfall occurs. The the lifeblood of the city and those local merchants. Nearly price to build U.S. Flag ships and operate domestic ton- all of the equipment utilized in U.S. ‘bluewater shipbuild- nage does not afford U.S. owners those opportunities. ing’ is purchased and shipped from Asia and Europe at a

That resale inability and the absence of an exit strategy cost well above what the foreign yards pay. Logistical costs, force many owners to operate domestic tonnage well be-

Custom duties, and service support contribute to those yond an age usually acceptable in the international trades. higher build costs. Look at past examples. When the global

U.S. built replacement tonnage is expensive and becomes ? eet advanced from steam propulsion to large two-stroke dif? cult to support in a cyclical market when ? rst deliv- diesel engines, no U.S. manufacturer was successful in de- ered. That issue has also entered into the Jones Act debate veloping major propulsion systems. All of our propulsion early this year with a vessel lost in the Puerto Rico trade systems in recent deliveries are Korean or Chinese built. and an investigation entering mainstream media. The age

We still trade on steamships in several non-contiguous of the vessel has been raised despite the fact that she was trades and only recently has the Lakes ? eet started major properly inspected, by the U.S. Coast Guard and Class and propulsion re? ts. Why? The vessels cannot meet the regula- operated by competent of? cers, crew and managers. To tory standards of emissions and the time has come to make question the condition of the vessel now, is a travesty and the change. The new regulation has disrupted the business.

is disrespectful to those who lost their lives in the accident.

The EPA now requires a TIER 4 engine rating with re-

The accusation disrupts the entire theory and application gard to stack emissions. During a recent large ATB project of ISM, Class and Flag survey. we completed, only one engine set for the tugboat could

June 2016

MN 32

MN June16 Layout 32-49.indd 32 5/17/2016 10:41:38 AM

31

31

33

33