Page 34: of Marine News Magazine (November 2018)

Workboat Annual

Read this page in Pdf, Flash or Html5 edition of November 2018 Marine News Magazine

REGIONAL FOCUS: U.S. GULF OF MEXICO

FINANCIAL CONSIDERATIONS This proposal was turned down by Gulfmark’s Board.

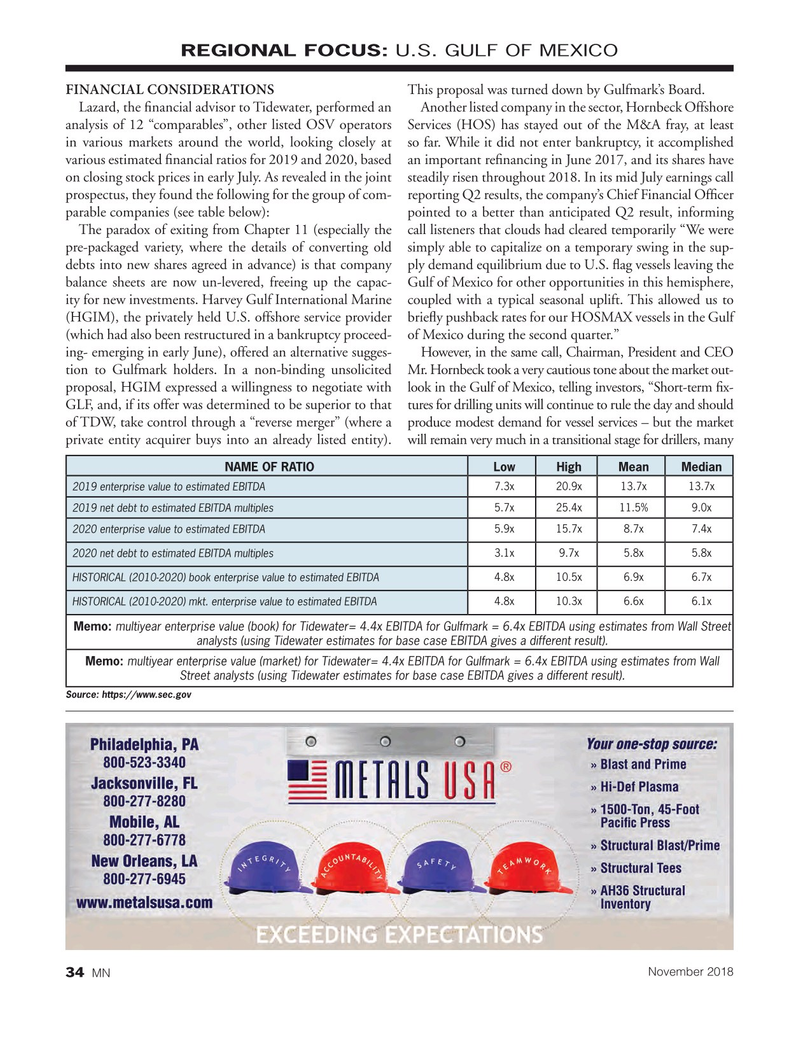

Lazard, the ? nancial advisor to Tidewater, performed an Another listed company in the sector, Hornbeck Offshore analysis of 12 “comparables”, other listed OSV operators Services (HOS) has stayed out of the M&A fray, at least in various markets around the world, looking closely at so far. While it did not enter bankruptcy, it accomplished various estimated ? nancial ratios for 2019 and 2020, based an important re? nancing in June 2017, and its shares have on closing stock prices in early July. As revealed in the joint steadily risen throughout 2018. In its mid July earnings call prospectus, they found the following for the group of com- reporting Q2 results, the company’s Chief Financial Of? cer parable companies (see table below): pointed to a better than anticipated Q2 result, informing

The paradox of exiting from Chapter 11 (especially the call listeners that clouds had cleared temporarily “We were pre-packaged variety, where the details of converting old simply able to capitalize on a temporary swing in the sup- debts into new shares agreed in advance) is that company ply demand equilibrium due to U.S. ? ag vessels leaving the balance sheets are now un-levered, freeing up the capac- Gulf of Mexico for other opportunities in this hemisphere, ity for new investments. Harvey Gulf International Marine coupled with a typical seasonal uplift. This allowed us to (HGIM), the privately held U.S. offshore service provider brie? y pushback rates for our HOSMAX vessels in the Gulf (which had also been restructured in a bankruptcy proceed- of Mexico during the second quarter.” ing- emerging in early June), offered an alternative sugges- However, in the same call, Chairman, President and CEO tion to Gulfmark holders. In a non-binding unsolicited Mr. Hornbeck took a very cautious tone about the market out- proposal, HGIM expressed a willingness to negotiate with look in the Gulf of Mexico, telling investors, “Short-term ? x-

GLF, and, if its offer was determined to be superior to that tures for drilling units will continue to rule the day and should of TDW, take control through a “reverse merger” (where a produce modest demand for vessel services – but the market private entity acquirer buys into an already listed entity). will remain very much in a transitional stage for drillers, many

NAME OF RATIO LowHighMeanMedian 2019 enterprise value to estimated EBITDA 7.3x20.9x13.7x13.7x 2019 net debt to estimated EBITDA multiples 5.7x25.4x11.5%9.0x 2020 enterprise value to estimated EBITDA 5.9x15.7x8.7x7.4x 2020 net debt to estimated EBITDA multiples 3.1x9.7x5.8x5.8x

HISTORICAL (2010-2020) book enterprise value to estimated EBITDA 4.8x10.5x6.9x6.7x

HISTORICAL (2010-2020) mkt. enterprise value to estimated EBITDA 4.8x10.3x6.6x6.1x

Memo: multiyear enterprise value (book) for Tidewater= 4.4x EBITDA for Gulfmark = 6.4x EBITDA using estimates from Wall Street analysts (using Tidewater estimates for base case EBITDA gives a different result).

Memo: multiyear enterprise value (market) for Tidewater= 4.4x EBITDA for Gulfmark = 6.4x EBITDA using estimates from Wall

Street analysts (using Tidewater estimates for base case EBITDA gives a different result).

Source: https://www.sec.gov

November 2018 34

MN

MN Nov18 Layout 32-49.indd 34 MN Nov18 Layout 32-49.indd 34 10/23/2018 11:00:54 AM10/23/2018 11:00:54 AM

33

33

35

35