Page 29: of Offshore Engineer Magazine (Feb/Mar 2013)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2013 Offshore Engineer Magazine

Geology & Geophysics

Rarely, if ever, can the marine The economic indices do not PGS (18-24 streamers), two Sanco seismic business have been so necessarily guarantee untroubled newbuilds for Dolphin (12-16

R busy in so many places around the waters ahead for the seismic streamers), two Amazon class for world. Demand for surveys is nearly business. Starting point for any WesternGeco (14-18 streamers), and at an almost all-time high, being analysis must be consideration of one for Sinopec (eight streamers). stimulated by increased spending the capacity of the marine seismic PGS shows this as an increase in by the big oil companies and the by the big oil companies and the ? eet to meet likely demand for the 3D streamer count of 5% in emergence of a number of new emergence of a number of new seismic services. 2013, 2% in 2014, and 7% in 2015. plays which have been overlooked plays which have been overlooked Lead time for newbuilds is usually in the past. Another highlight in the past. Another highlight Economic balance at least two years; so that, even if in this climate is the rise in the in this climate is the rise in the The perennial worry is that the more vessels are announced, they number of multi-client surveys number of multi-client surveys balance between available vessels will be unlikely to affect the overall targeting the hot plays. targeting the hot plays. and the amount of work on offer balance for some time, especially The trends for 2013 are clear from The trends for 2013 are clear from will alter, as has happened so many if companies retire some of their a series of presentations in January a series of presentations in January times in the past. In this context, it inef? cient, non-economic units – of by the main marine seismic players. by the main marine seismic players. is worth observing that according which there are quite a few.

The most optimistic assessment The most optimistic assessment to PGS calculations, demand for The two companies most likely comes from Dolphin Geophysical comes from Dolphin Geophysical 3D seismic from 2006 to the end of to be looking to increase their citing SEB Enskilda Equity citing SEB Enskilda Equity 2012 has grown by approximately capacity are Polarcus and Dolphin

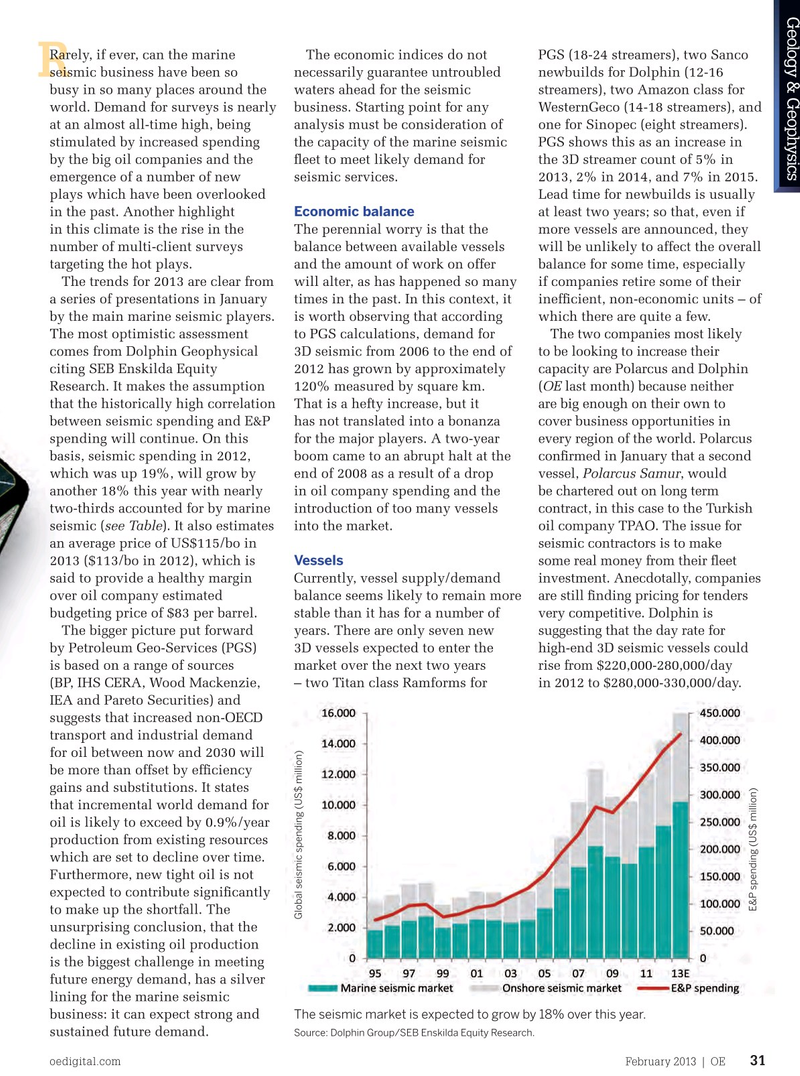

Research. It makes the assumption Research. It makes the assumption 120% measured by square km. (OE last month) because neither that the historically high correlation that the historically high correlation That is a hefty increase, but it are big enough on their own to between seismic spending and E&P between seismic spending and E&P has not translated into a bonanza cover business opportunities in spending will continue. On this spending will continue. On this for the major players. A two-year every region of the world. Polarcus basis, seismic spending in 2012, basis, seismic spending in 2012, boom came to an abrupt halt at the con? rmed in January that a second which was up 19%, will grow by which was up 19%, will grow by end of 2008 as a result of a drop vessel, Polarcus Samur, would another 18% this year with nearly another 18% this year with nearly in oil company spending and the be chartered out on long term two-thirds accounted for by marine two-thirds accounted for by marine introduction of too many vessels contract, in this case to the Turkish seismic ( seismic (see Table). It also estimates into the market. oil company TPAO. The issue for an average price of US$115/bo in an average price of US$115/bo in seismic contractors is to make 2013 ($113/bo in 2012), which is 2013 ($113/bo in 2012), which is Vessels some real money from their ? eet said to provide a healthy margin said to provide a healthy margin Currently, vessel supply/demand investment. Anecdotally, companies over oil company estimated over oil company estimated balance seems likely to remain more are still ? nding pricing for tenders budgeting price of $83 per barrel. budgeting price of $83 per barrel. stable than it has for a number of very competitive. Dolphin is The bigger picture put forward The bigger picture put forward years. There are only seven new suggesting that the day rate for by Petroleum Geo-Services (PGS) by Petroleum Geo-Services (PGS) 3D vessels expected to enter the high-end 3D seismic vessels could is based on a range of sources is based on a range of sources market over the next two years rise from $220,000-280,000/day (BP, IHS CERA, Wood Mackenzie, (BP, IHS CERA, Wood Mackenzie, – two Titan class Ramforms for in 2012 to $280,000-330,000/day.

IEA and Pareto Securities) and IEA and Pareto Securities) and suggests that increased non-OECD suggests that increased non-OECD transport and industrial demand transport and industrial demand for oil between now and 2030 will for oil between now and 2030 will be more than offset by ef? ciency be more than offset by ef? ciency gains and substitutions. It states gains and substitutions. It states that incremental world demand for that incremental world demand for oil is likely to exceed by 0.9%/year oil is likely to exceed by 0.9%/year production from existing resources production from existing resources which are set to decline over time. which are set to decline over time.

Furthermore, new tight oil is not Furthermore, new tight oil is not expected to contribute signi? cantly expected to contribute signi? cantly

E&P spending (US$ million) to make up the shortfall. The to make up the shortfall. The

Global seismic spending (US$ million) unsurprising conclusion, that the unsurprising conclusion, that the decline in existing oil production decline in existing oil production is the biggest challenge in meeting is the biggest challenge in meeting future energy demand, has a silver future energy demand, has a silver lining for the marine seismic lining for the marine seismic business: it can expect strong and business: it can expect strong and The seismic market is expected to grow by 18% over this year. sustained future demand.sustained future demand. Source: Dolphin Group/SEB Enskilda Equity Research.

oedigital.com oedigital.com February 2013 | OE 31 oe_G&GFEBv2.indd 31 31/01/2013 10:34

28

28

30

30