Page 72: of Offshore Engineer Magazine (Feb/Mar 2013)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2013 Offshore Engineer Magazine

Gorgon ? elds transported by subsea LNG capacity is suited to smaller and have a contingent resource of over pipeline to production and shipping remote offshore ? elds, and is able 5tcf of gas and 226 million barrels facilities on Barrow Island. to unlock otherwise stranded gas of condensate.

The Wheatstone LNG project, resources. This approach is planned The Cash-Maple gas ? eld, 100% a $29 billion Chevron-operated for a number of other developments held by PTTEP and situated in the development located at Ashburton that include Bonaparte, Sunrise and Ashmore & Cartier Islands area

North, 12km west of Onslow, has Cash-Maple FLNG projects. of the Timor Sea, is undergoing

Australasia a foundation phase consisting of The Bonaparte LNG project in the a concept study of development two LNG trains with a combined Bonaparte Gulf, a joint venture of options, which include a possible capacity of 8.9mmt/yr and a GDF Suez and Santos, is to begin FLNG unit. Startup of the facility domestic gas plant. First gas is front-end engineering and design is scheduled for 2016. Hoegh LNG expected at a rate of 433bcf/yr. mid-2013 for a 2mmt/yr LNG of Norway is reported to be in ? nal Around 80% of capacity will be development involving the Petrel, talks with PTTEP on an FLNG fed from the Wheatstone and Iago Tern and Frigate gas ? elds. vessel.

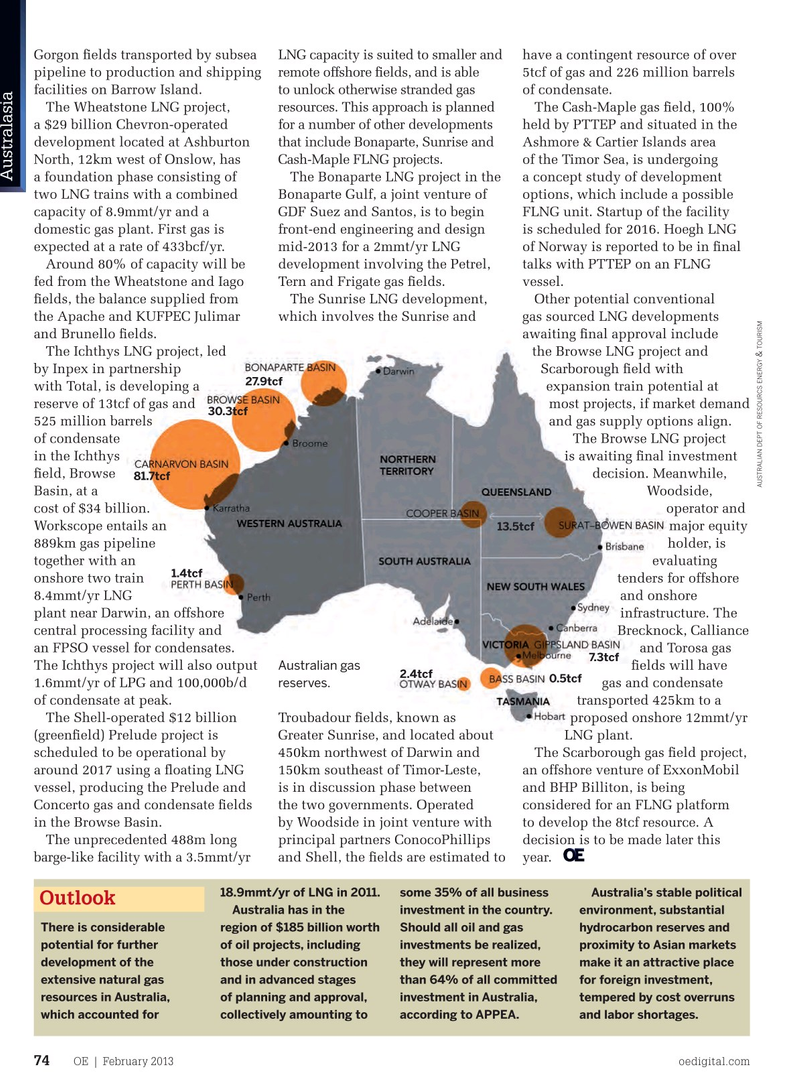

? elds, the balance supplied from The Sunrise LNG development, Other potential conventional the Apache and KUFPEC Julimar which involves the Sunrise and gas sourced LNG developments and Brunello ? elds. awaiting ? nal approval include The Ichthys LNG project, led the Browse LNG project and by Inpex in partnership Scarborough ? eld with 27.9tcf with Total, is developing a expansion train potential at reserve of 13tcf of gas and most projects, if market demand 30.3tcf 525 million barrels and gas supply options align. of condensate The Browse LNG project & in the Ichthys is awaiting ? nal investment ? eld, Browse decision. Meanwhile, 81.7tcf

AUSTRALIANDEPTOFRESOURCSENERGY TOURISM

Basin, at a Woodside, cost of $34 billion. operator and

Workscope entails an major equity 13.5tcf 889km gas pipeline holder, is together with an evaluating 1.4tcf onshore two train tenders for offshore 8.4mmt/yr LNG and onshore plant near Darwin, an offshore infrastructure. The central processing facility and Brecknock, Calliance an FPSO vessel for condensates. and Torosa gas 7.3tcf

The Ichthys project will also output ? elds will have

Australian gas 2.4tcf 0.5tcf 1.6mmt/yr of LPG and 100,000b/d gas and condensate reserves.

of condensate at peak. transported 425km to a

Troubadour ? elds, known as The Shell-operated $12 billion proposed onshore 12mmt/yr

Greater Sunrise, and located about (green? eld) Prelude project is LNG plant.

450km northwest of Darwin and scheduled to be operational by The Scarborough gas ? eld project, 150km southeast of Timor-Leste, around 2017 using a ? oating LNG an offshore venture of ExxonMobil is in discussion phase between vessel, producing the Prelude and and BHP Billiton, is being the two governments. Operated Concerto gas and condensate ? elds considered for an FLNG platform by Woodside in joint venture with in the Browse Basin. to develop the 8tcf resource. A principal partners ConocoPhillips The unprecedented 488m long decision is to be made later this barge-like facility with a 3.5mmt/yr and Shell, the ? elds are estimated to year. 18.9mmt/yr of LNG in 2011. some 35% of all business Australia’s stable political Outlook Australia has in the investment in the country. environment, substantial

There is considerable region of $185 billion worth Should all oil and gas hydrocarbon reserves and potential for further of oil projects, including investments be realized, proximity to Asian markets development of the those under construction they will represent more make it an attractive place extensive natural gas and in advanced stages than 64% of all committed for foreign investment, resources in Australia, of planning and approval, investment in Australia, tempered by cost overruns which accounted for collectively amounting to according to APPEA. and labor shortages.

OE | February 2013 oedigital.com 74 oe_Australasia.indd 74 31/01/2013 13:08

71

71

73

73