Page 30: of Offshore Engineer Magazine (Apr/May 2013)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2013 Offshore Engineer Magazine

Gulf of Mexico, the Arctic, Brazilian 28, with only 20 rigs stacked. fat from last year (82.8%).

deepwater, and East African off- In 2015, more than 289 jackups IHS Petrodata day rate indices shore gas provinces. Infeld notes will be more than 30 years old. track competitive mobile offshore

Petrobras, ExxonMobil, Total, BP, According to Pareto Securities, drilling feet day rates and utiliza-

EPIC

Chevron, and Shell amoung the more scrapping and conversion of older tion for four rig categories: US Gulf signifcant deepwater operators. jackups increased in 2011 and 2012, of Mexico jackup rigs, northwest

Market Review and is expected to continue. Europe jackups, mid-water depth

Shallow water

The North Sea feet is aging, with (2001ft-5000ft) semisubmersibles,

When drilling resumed in the Gulf of high-spec jackups averaging 18 and deepwater (5001+ft) foating rigs.

Mexico, following the post-Macondo years old. But nearly 90 jackups are As of March 15, the IHS Petrodata shutdown, demand surged for shal- under construction worldwide and US Gulf jackup day rate index hit low-water rigs and companies such most will enter the market this year. a four-year high of 487, refecting as Hercules Offshore, with 54 rigs, New jackups need to be able to drill the greatest variation of all four began to shake off years of losses. deeper wells, and require updated rig categories. The feet utilization

At the Howard Weil Energy equipment. averaged 68% for both February and

Conference, Hercules said their March 2013, up 10% from a year

Rig rates, utilization domestic offshore utilization rate ago. Demand for 250 to 300ft jackups improved by about 10% in 2012, Utilization is high for competitive is raising day rates and increasing and that leading edge day rates are offshore drilling rigs, ranging from utilization.

up ~60% year-over year for 200ft 80% for drilling barges, 83.1% for Utilization of jackups off north- mat-cantilever (MC) rigs in the US jackups, 87.5% for drillships, and west Europe remained at 90% in

Gulf of Mexico and they are reac- 88% for semisubmersibles (Rigzone, March, the same average over the tivating stacked capacity. Recent 28 March 2013). Drillships have last 13 months. The IHS Petrodata contracts in the Gulf of Mexico are shown the greatest increase from a day-rate index for European jack- averaging 6-12 months or longer, year ago, up 30.4%, with 80 competi- ups dropped 13 points to 599, but compared with prior contracts of 3 tive rigs in the market now. Semisubs remains 112 points higher than a months or less. Hercules runs the show the next highest improvement, year ago.

third-largest feet of jackups world- up 10.4% from a year ago, with 191 Utilization of mid-water-depth wide and the world’s largest liftboat competitive rigs in the market. There semisubmersibles has remained feet (64), with a core in the West are 30 drilling tenders in the market, steady at 79% for the past three

Africa market. and utilization is 83.3%, essentially months, slightly higher than the

The jackup feet has been average for the past 15 near full utilization since Q4 months, but below the

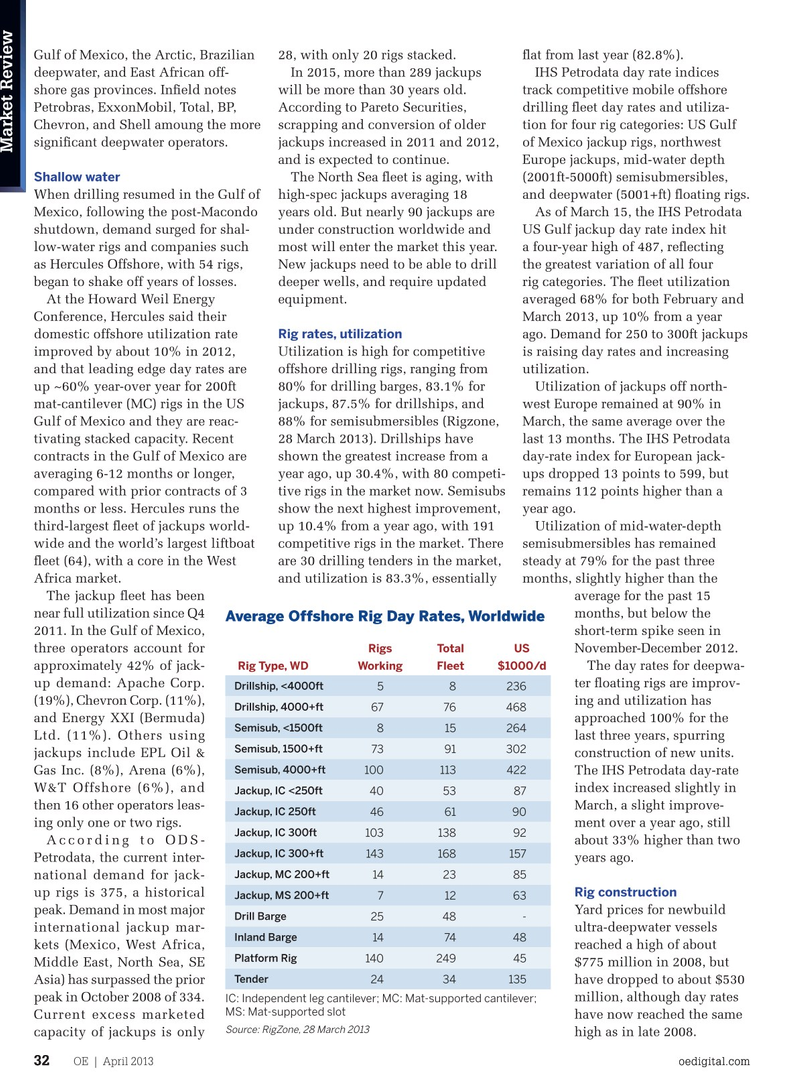

Average Offshore Rig Day Rates, Worldwide 2011. In the Gulf of Mexico, short-term spike seen in

Rigs Total US three operators account for November-December 2012.

Rig Type, WD Working Fleet $1000/d approximately 42% of jack- The day rates for deepwa- up demand: Apache Corp. ter foating rigs are improv-

Drillship, <4000ft 5 8236 (19%), Chevron Corp. (11%), ing and utilization has

Drillship, 4000+ft 67 76 468 and Energy XXI (Bermuda) approached 100% for the

Semisub, <1500ft 8 15264

Ltd. (11%). Others using last three years, spurring

Semisub, 1500+ft 73 91 302 jackups include EPL Oil & construction of new units.

Semisub, 4000+ft 100 113 422

Gas Inc. (8%), Arena (6%), The IHS Petrodata day-rate

W&T Offshore (6%), and index increased slightly in

Jackup, IC <250ft 40 53 87 then 16 other operators leas- March, a slight improve-

Jackup, IC 250ft 46 61 90 ing only one or two rigs. ment over a year ago, still

Jackup, IC 300ft 103 138 92

According to ODS- about 33% higher than two

Jackup, IC 300+ft 143 168 157

Petrodata, the current inter- years ago.

Jackup, MC 200+ft 14 23 85 national demand for jack-

Rig construction up rigs is 375, a historical

Jackup, MS 200+ft 7 12 63 peak. Demand in most major Yard prices for newbuild

Drill Barge 25 48 - international jackup mar- ultra-deepwater vessels

Inland Barge 14 74 48 kets (Mexico, West Africa, reached a high of about

Platform Rig 140 249 45

Middle East, North Sea, SE $775 million in 2008, but

Tender 24 34 135

Asia) has surpassed the prior have dropped to about $530 peak in October 2008 of 334. million, although day rates

IC: Independent leg cantilever; MC: Mat-supported cantilever;

MS: Mat-supported slot

Current excess marketed have now reached the same

Source: RigZone, 28 March 2013 capacity of jackups is only high as in late 2008.

OE | April 2013 oedigital.comoedigital.com 3232 oe_rig market review.indd 32 4/1/13 6:17 PM

29

29

31

31