Page 22: of Offshore Engineer Magazine (Aug/Sep 2013)

Read this page in Pdf, Flash or Html5 edition of Aug/Sep 2013 Offshore Engineer Magazine

Analysis

Quick stats nation: exploration, exploitation, refning, transportation,

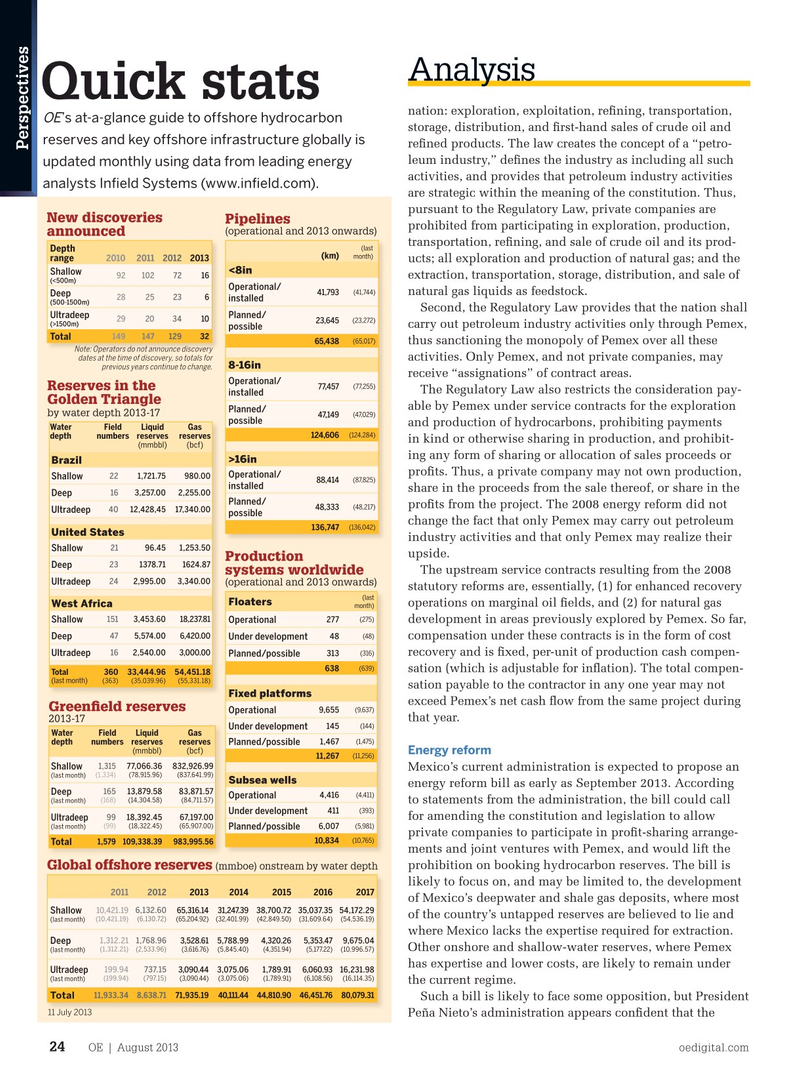

OE ’s at-a-glance guide to offshore hydrocarbon storage, distribution, and frst-hand sales of crude oil and reserves and key offshore infrastructure globally is refned products. The law creates the concept of a “petro-

Perspectives leum industry,” defnes the industry as including all such updated monthly using data from leading energy activities, and provides that petroleum industry activities analysts Infeld Systems (www.infeld.com).

are strategic within the meaning of the constitution. Thus, pursuant to the Regulatory Law, private companies are

New discoveries Pipelines prohibited from participating in exploration, production, (operational and 2013 onwards) announced transportation, refning, and sale of crude oil and its prod- (last

Depth (km) month) range 2010 2011 2012 2013 ucts; all exploration and production of natural gas; and the <8in

Shallow 92 102 72 16 extraction, transportation, storage, distribution, and sale of (<500m)

Operational/ (41,744) natural gas liquids as feedstock.

41,793

Deep 28 25 23 6 installed (500-1500m)

Second, the Regulatory Law provides that the nation shall

Ultradeep Planned/ 29 20 34 10 (23,272) 23,645 (>1500m) carry out petroleum industry activities only through Pemex, possible 149 147 129 32

Total (65,017) 65,438 thus sanctioning the monopoly of Pemex over all these

Note: Operators do not announce discovery dates at the time of discovery, so totals for activities. Only Pemex, and not private companies, may 8-16in previous years continue to change.

receive “assignations” of contract areas.

Operational/ (77,255) 77,457

Reserves in the

The Regulatory Law also restricts the consideration pay- installed

Golden Triangle able by Pemex under service contracts for the exploration

Planned/ by water depth 2013-17 (47,029) 47,149 possible and production of hydrocarbons, prohibiting payments

Water Field Liquid Gas (124,284) 124,606 depth numbers reserves reserves in kind or otherwise sharing in production, and prohibit- (mmbbl) (bcf) ing any form of sharing or allocation of sales proceeds or

Brazil >16in profts. Thus, a private company may not own production,

Operational/ 22 1,721.75980.00

Shallow (87,825) 88,414 installed share in the proceeds from the sale thereof, or share in the

Deep 16 3,257.00 2,255.00

Planned/ profts from the project. The 2008 energy reform did not (48,217) 48,333 40 12,428,45 17,340.00

Ultradeep possible change the fact that only Pemex may carry out petroleum (136,042) 136,747

United States industry activities and that only Pemex may realize their 21 96.45 1,253.50

Shallow upside.

Production 23 1378.71 1624.87

Deep

The upstream service contracts resulting from the 2008 systems worldwide 24 2,995.003,340.00

Ultradeep (operational and 2013 onwards) statutory reforms are, essentially, (1) for enhanced recovery (last

Floaters operations on marginal oil felds, and (2) for natural gas

West Africa month) (275) 151 3,453.60 18,237.81 277

Shallow Operational development in areas previously explored by Pemex. So far, (48) 47 5,574.00 6,420.00 48

Deep Under development compensation under these contracts is in the form of cost 16 2,540.00 3,000.00 313 (316) recovery and is fxed, per-unit of production cash compen-

Ultradeep Planned/possible (639) 638 sation (which is adjustable for infation). The total compen-

Total 360 33,444.96 54,451.18 (last month) (363) (35,039.96) (55,331.18) sation payable to the contractor in any one year may not

Fixed platforms exceed Pemex’s net cash fow from the same project during

Greenfeld reserves (9,637) 9,655

Operational that year.

2013-17 (144) 145

Under development

Water Field Liquid Gas (1,475) 1,467 depth numbers reserves reserves

Planned/possible (mmbbl) (bcf)

Energy reform (11,256) 11,267 1,315 77,066.36 832,926.99

Shallow

Mexico’s current administration is expected to propose an (last month) (1,334) (78,915.96) (837,641.99)

Subsea wells energy reform bill as early as September 2013. According

Deep 165 13,879.58 83,871.57 (4,411) 4,416

Operational (last month) (168) (14,304.58) (84,711.57) to statements from the administration, the bill could call (393) 411

Under development for amending the constitution and legislation to allow 99 18,392.45 67,197.00

Ultradeep (last month) (99) (18,322.45) (65,907.00) (5,981) 6,007

Planned/possible private companies to participate in proft-sharing arrange- (10,765) 10,834 1,579 109,338.39 983,995.56

Total ments and joint ventures with Pemex, and would lift the prohibition on booking hydrocarbon reserves. The bill is

Global offshore reserves (mmboe) onstream by water depth likely to focus on, and may be limited to, the development 2011 2012 201320142015 20162017 of Mexico’s deepwater and shale gas deposits, where most 10,421.19 6,132.60 65,316.14 31,247.39 38,700.72 35,037.35 54,172.29

Shallow of the country’s untapped reserves are believed to lie and (last month) (10,421.19) (6,130.72) (65,204.92) (32,401.99) (42,849.50) (31,609.64) (54,536.19) where Mexico lacks the expertise required for extraction.

Deep 1,312.21 1,768.96 3,528.61 5,788.99 4,320.26 5,353.47 9,675.04

Other onshore and shallow-water reserves, where Pemex (last month) (1,312.21) (2,533.96) (3,616.76) (5,845.40) (4,351.94) (5,177.22) (10,996.57) has expertise and lower costs, are likely to remain under 199.94 737.15 3,090.44 3,075.06 1,789.91 6,060.93 16,231.98

Ultradeep (last month) (199.94) (797.15) (3,090.44) (3,075.06) (1,789.91) (6,108.56) (16,114.35) the current regime.

11,933.34 8,638.71 71,935.19 40,111.44 44,810.90 46,451.76 80,079.31

Total

Such a bill is likely to face some opposition, but President 11 July 2013

Peña Nieto’s administration appears confdent that the

OE | August 2013 oedigital.com 24 021_OE0813_Analysis.indd 24 7/22/13 12:20 AM

21

21

23

23