Page 51: of Offshore Engineer Magazine (Aug/Sep 2013)

Read this page in Pdf, Flash or Html5 edition of Aug/Sep 2013 Offshore Engineer Magazine

EPIC – Lifting also plateaued at about 11,000 tonne changes in the Arctic. Other challenges understanding its capabilities. He says due to physical limitations, Baggaley Baggaley sees are the competency he has had experiences where a vessel, says. of newer operators working in the with DP2 capability, has been selected

Instead, lifting capacity growth offshore renewables sector, and not for a project without the operator real- comes from the now-established working at the high standards expected izing that the system would not meet foatover market, with the use of rapid for offshore. the requirements needed because the ballasting on purpose-built vessels A further concern is the use of capability is not through the full range and barges to control the crucial touch dynamic positioning (DP), specifcally, of the compass. down phase. Offshore lifts of inte-

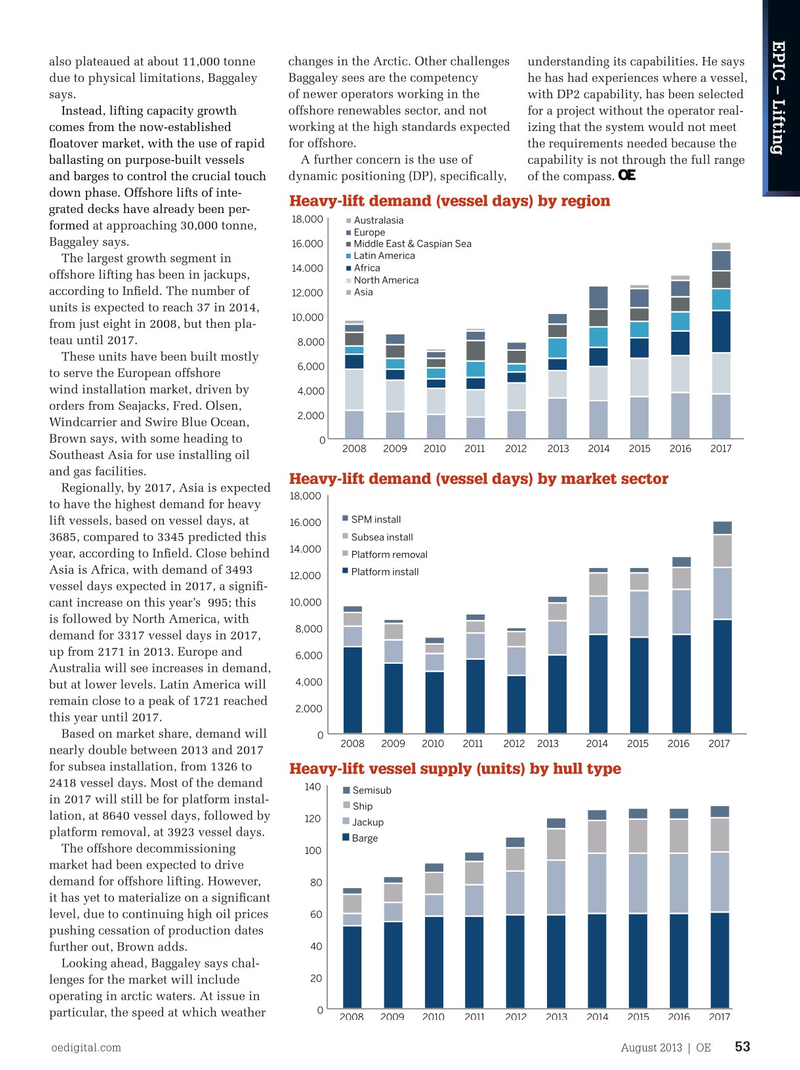

Heavy-lift demand (vessel days) by region grated decks have already been per- 18,000

Australasia formed at approaching 30,000 tonne,

Europe

Baggaley says.

16.000 Middle East & Caspian Sea

Latin America

The largest growth segment in 14.000 Africa offshore lifting has been in jackups,

North America according to Infeld. The number of 12,000 Asia units is expected to reach 37 in 2014, 10,000 from just eight in 2008, but then pla- teau until 2017.

8,000

These units have been built mostly 6,000 to serve the European offshore wind installation market, driven by 4,000 orders from Seajacks, Fred. Olsen, 2,000

Windcarrier and Swire Blue Ocean,

Brown says, with some heading to 0 200820092010 20132014 20112012 201520162017

Southeast Asia for use installing oil and gas facilities.

Heavy-lift demand (vessel days) by market sector

Regionally, by 2017, Asia is expected 18,000 to have the highest demand for heavy

SPM install lift vessels, based on vessel days, at 16.000

Subsea install 3685, compared to 3345 predicted this 14.000 year, according to Infeld. Close behind

Platform removal

Asia is Africa, with demand of 3493

Platform install 12,000 vessel days expected in 2017, a signif- 10,000 cant increase on this year’s 995; this is followed by North America, with 8,000 demand for 3317 vessel days in 2017, up from 2171 in 2013. Europe and 6,000

Australia will see increases in demand, 4,000 but at lower levels. Latin America will remain close to a peak of 1721 reached 2,000 this year until 2017.

Based on market share, demand will 0 017200820092010 20132014 20112012 20152 0162 nearly double between 2013 and 2017 for subsea installation, from 1326 to

Heavy-lift vessel supply (units) by hull type 2418 vessel days. Most of the demand 140

Semisub in 2017 will still be for platform instal-

Ship lation, at 8640 vessel days, followed by 120

Jackup platform removal, at 3923 vessel days.

Barge

The offshore decommissioning 100 market had been expected to drive demand for offshore lifting. However, 80 it has yet to materialize on a signifcant 60 level, due to continuing high oil prices pushing cessation of production dates 40 further out, Brown adds.

Looking ahead, Baggaley says chal- 20 lenges for the market will include operating in arctic waters. At issue in 0 particular, the speed at which weather 017200820092010 20132014 20112012 20152 0162 oedigital.com August 2013 | OE 53 052_OE0813_EPIC3_lifting.indd 53 7/22/13 12:40 AM

50

50

52

52