Page 77: of Offshore Engineer Magazine (Oct/Nov 2013)

Read this page in Pdf, Flash or Html5 edition of Oct/Nov 2013 Offshore Engineer Magazine

typically 10-30% lower than platform-based wells— tivities in the country on an initial two-year contract, there is a key need for operators to improve recovery which began in early 2013.

through the use of well intervention techniques. As the number of subsea wells continues to

On a global basis, the majority of well intervention increase, with more and more coming on-stream activities are carried out in shallow water areas, and across the globe, deepwater intervention demand is this demand mirrors the operational base of global expected to continue its recent growth trend. This subsea wells, with areas such as the North Sea con- expected growth could offer an increasing number taining a signifcant number of wells. Consequently, of opportunities for specialized well intervention the region has the most developed well intervention vessels to enter the market, especially as rig day market. rates continue to climb towards US$600,000/d for

Future growth in intervention demand is antici- an ultra-deepwater unit.

OE REVIEW pated to be driven by activity in the deepwater sector.

During the 2013-2017 forecast period, deep and ultra- Since joining Infeld Systems in 2011, James deepwater well intervention demand is expected to Hearn has primarily been responsible for the rise by a compound annual growth rate (CAGR) of development of the company’s offshore drilling 8% and 18%, respectively. rig database. Most recently James has worked

Infeld Systems believes that the signifcant rise in on a variety of research and bespoke client the number of deepwater well installations will help projects, and recently authored the updated ver- boost the share of global intervention demand taken sion of the company’s Well Intervention Global by deepwater activities to 29% during the 2013–2017 Perspective Report. period, a rise of 8% above the 21% share estimated in 2008-2012.

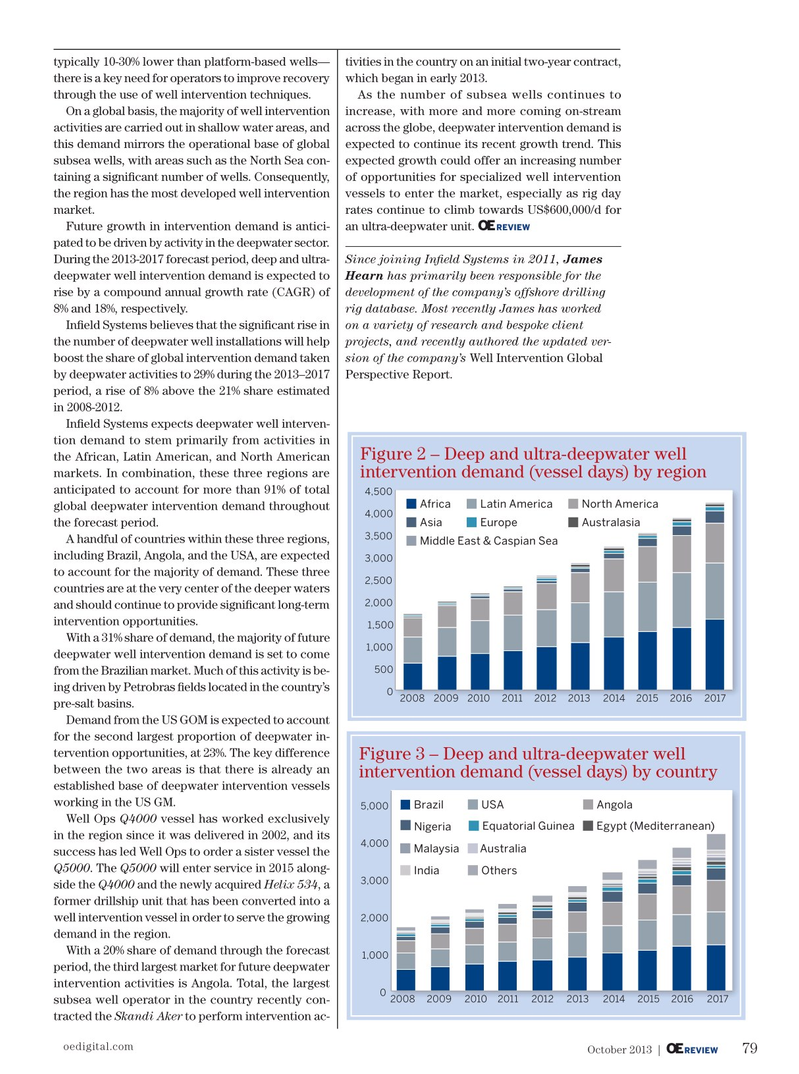

Infeld Systems expects deepwater well interven- tion demand to stem primarily from activities in

Figure 2 – Deep and ultra-deepwater well the African, Latin American, and North American markets. In combination, these three regions are intervention demand (vessel days) by region anticipated to account for more than 91% of total 4,500

Africa Latin America North America global deepwater intervention demand throughout 4,000

Asia Europe Australasia the forecast period. 3,500

A handful of countries within these three regions,

Middle East & Caspian Sea including Brazil, Angola, and the USA, are expected 3,000 to account for the majority of demand. These three 2,500 countries are at the very center of the deeper waters 2,000 and should continue to provide signifcant long-term intervention opportunities.

1,500

With a 31% share of demand, the majority of future 1,000 deepwater well intervention demand is set to come 500 from the Brazilian market. Much of this activity is be- ing driven by Petrobras felds located in the country’s 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 pre-salt basins.

Demand from the US GOM is expected to account for the second largest proportion of deepwater in- tervention opportunities, at 23%. The key difference

Figure 3 – Deep and ultra-deepwater well between the two areas is that there is already an intervention demand (vessel days) by country established base of deepwater intervention vessels working in the US GM.

Brazil USA Angola 5,000

Well Ops Q4000 vessel has worked exclusively

Nigeria Equatorial Guinea Egypt (Mediterranean) in the region since it was delivered in 2002, and its 4,000

Malaysia Australia success has led Well Ops to order a sister vessel the

Q5000. The Q5000 will enter service in 2015 along-

India Others 3,000 side the Q4000 and the newly acquired Helix 534, a former drillship unit that has been converted into a 2,000 well intervention vessel in order to serve the growing demand in the region.

With a 20% share of demand through the forecast 1,000 period, the third largest market for future deepwater intervention activities is Angola. Total, the largest 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 subsea well operator in the country recently con- tracted the Skandi Aker to perform intervention ac- oedigital.com 79

October 2013 | OE REVIEW 078_OE1013_OERinfield.indd 79 9/29/13 10:51 PM

76

76

78

78