Page 52: of Offshore Engineer Magazine (Nov/Dec 2013)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2013 Offshore Engineer Magazine

Drilling and investment

Southeast Asia in Southeast Asia

By Nina M. Rach from using 26% of all offshore rigs in the assets in favor of more strategic and prof- wo countries – Malaysia and region in October 2012, to using 41% in itable projects: •

Indonesia– hold nearly two-thirds

August and September of this year. In February, Newfeld Exploration said

T Capital expenditures of the three most it was exploring the sale of its Asian of the region’s reserves, and active IOCs in Southeast Asia, Chevron, assets.

national oil companies outstrip • In June, Hess announced it would sell

Shell, and Murphy Oil, account for only international oil companies in regional assets offshore Indonesia and Thailand.

25% of total regional spend, while the fve capex.

• In October, Otto Energy announced it most active NOCs spent 35% of total capex:

According to the Infeld Systems • Malaysia’s Petroliam Nasional Bhd would stop offshore Visayas exploration,

Offshore Asia Oil & Gas Market Report to (Petronas), 20% on block PM 323, offshore Malaysia.

2017, four countries control 88% of the • Thailand’s PTT Exploration & At the Barclay’s CEO Energy Power oil and gas reserves in Southeast Asia:

Production (PTTEP), 6% Conference, 12 Sept 2013, Newfeld CEO

Malaysia (44%), Indonesia (19%), Vietnam • Thailand’s PTT Plc., 4% Lee Boothby said the company was now (14%), and Myanmar (11%). Four other • Brunei government, 3% focused on North American “liquids” countries control only 12% of reserves: • Vietnam Oil and Gas Group plays, and confrmed that the interna-

Thailand (6%), Brunei (3%), Philippines (PetroVietnam), 2% tional sales process was underway.

(2%), and Cambodia (1%).

Oddly enough, the four countries Newfeld is the fourth-largest oil pro-

Divesting with the largest reserves accounted for a ducer in Malaysia and owns an interest disproportionately low share of offshore While return on investment is a likely in about 3.3million net acres offshore drilling activity in the region, even when cause of shifting focus, there may be Malaysia and about 290,000 net acres

Chinese drilling is excluded. Based on other competitive factors affecting IOC’s offshore China. The Malaysian felds

Baker Hughes International offshore rig decisions to abandon certain Southeast accounted for 39% of NFX’s revenues count data for the last year (see table), Asian assets. Local government policies, in 2012. Petronas operates some of the drilling activity in these four countries driven by social and political pressures, blocks in the Malay Basin in which has dropped from a high of 78% of all are not always market-oriented. Foreign Newfeld holds an interest.

regional rigs in October 2012, to only investors may question whether they are In late October, the company 57% in September of this year. facing fair competition in the alliances announced that it would sell all of its

Looking at the same data for Thailand, between consumer and producer NOCs equity interests in Newfeld Malaysia

Brunei, and the Philippines (Cambodia and local suppliers. Holdings to SapuraKencana Petroleum had no offshore drilling), those countries The upshot is that some US energy Berhad for a total cash consideration of with a combined 12% of reserves rose companies and drillers are unloading RM2.85 billion (US$898 million). The

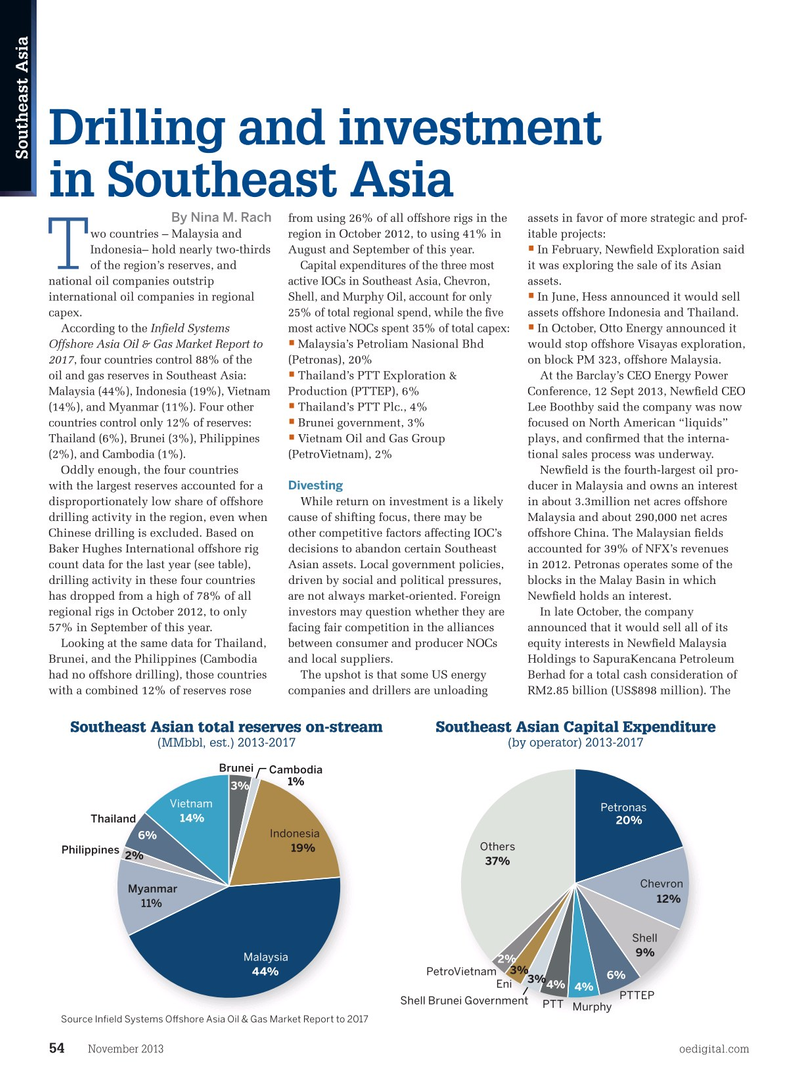

Southeast Asian total reserves on-stream Southeast Asian Capital Expenditure (MMbbl, est.) 2013-2017 (by operator) 2013-2017

Brunei

Cambodia 1% 3%

Petronas Vietnam

Thailand 14% 20% 6% Indonesia

Others 19%

Philippines 2% 37%

Chevron Myanmar 12% 11%

Shell 9%

Malaysia 2%

PetroVietnam 3% 3% 4% 4% 44% 6%

Eni

PTTEP

Shell Brunei Government PTT Murphy

Source In?eld Systems O

51

51

53

53