Page 35: of Offshore Engineer Magazine (Jan/Feb 2014)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2014 Offshore Engineer Magazine

Cyprus also presents opportuni- award 13 oil and gas blocks in an effort to Next, the Gulf of Mexico. Yes, it’s a ties in 2014, after its second license double its production output – 43 blocks mature petroleum province, but there’s round closed in 2013, in which several altogether have been made available. still huge potential here. In the past blocks were awarded. In October 2013, Earlier this year, Total made a discovery few seasons and in the coming year,

Noble Energy indicated that it foresees in the deepwater pre-salt area offshore, we continue to deploy leading-edge

Global exploration prospects: the potential for 150MMcfd well rates which has led to a renewed interest in approaches to acquisition. We are adapt- offshore Cyprus in the Aphrodite ? eld. the area. As a result, many international ing technology and survey designs to

Currently, proven reserves are estimated players have become involved through overcome the challenges of conducting at about 4Tcf of natural gas, and there is the recent licensing round, with 11 com- seismic surveys over targets obscured 2014 and beyond also potential for oil. panies assigned blocks. by salt structures. Improving subsalt

South Africa represents another very imaging ? delity will help reduce explora-

Climate Change will be launching an interesting opportunity. Several interna- tion risk as oil companies explore ever

Africa offshore licensing round mid-year, with Sonangol will be leading an onshore licens- tional oil companies have taken stakes deeper. There has been success here in more than 200,000sq km of acreage to ing round in Angola in 2014 – the onshore in offshore blocks. Recent interest has 2013, with several discoveries, including be made available. PGS has played an oil blocks on offer are in the terrestrial moved from the west and south of the Anadarko announcing in mid-June that it instrumental role in providing seismic areas of the Kwanza basin (Blocks KON country to the eastern offshore area, likely made a major new discovery in the deep- data over areas to be included in the 3, 5, 6, 7, 8, 9, and 17) and Lower Congo chasing the southward extension of plays water Shenandoah play, after Chevron licensing round, thus enabling compa- basin (Blocks CON 1, CON 5, and KON that have been identi? ed further north in announced a discovery at the Coronado nies to properly evaluate opportunities. 6). These onshore areas cover approxi- East Africa, where upstream investment prospect in May. The Gulf of Mexico

Greece offers political stability and an mately 50,000sq km, with large parts will increase substantially over the next continues to represent an important part

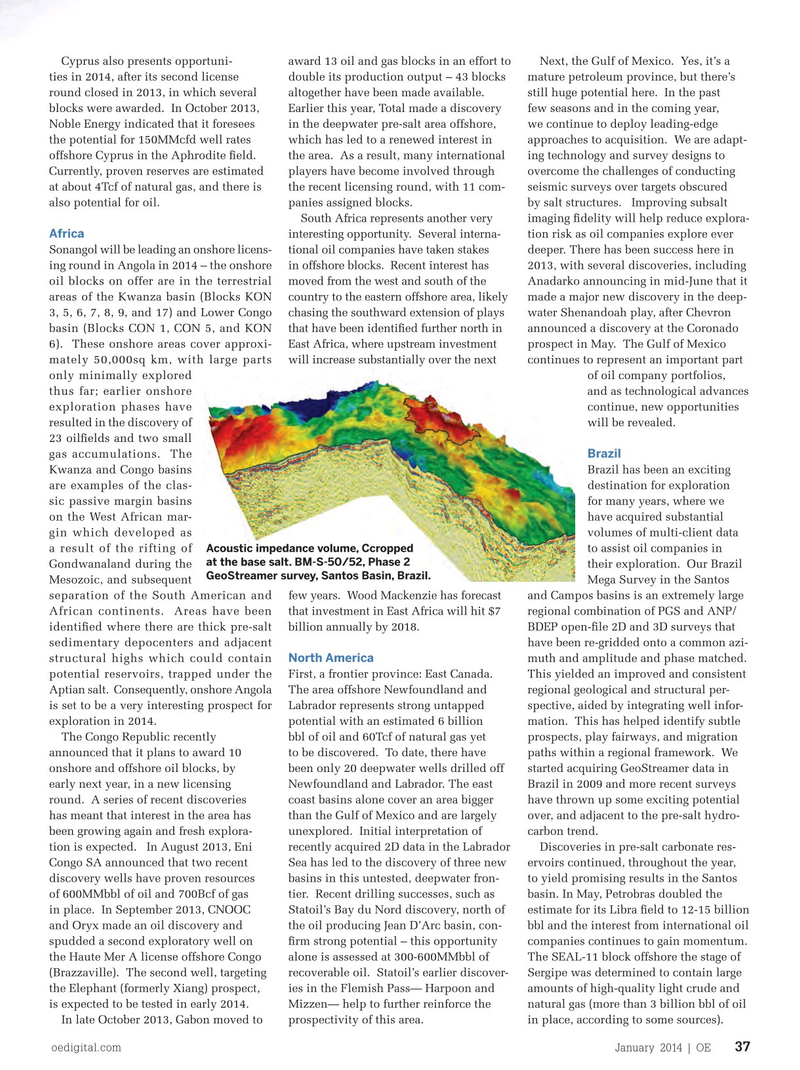

EU transparent framework for hydrocar- only minimally explored of oil company portfolios, bon exploration. Offshore, Greece has thus far; earlier onshore and as technological advances working petroleum systems in place with exploration phases have continue, new opportunities several promising plays, analogues to dis- resulted in the discovery of will be revealed. coveries in adjacent countries, and good 23 oil? elds and two small

Brazil frontier potential in unexplored basins.

34

34

36

36