Page 58: of Offshore Engineer Magazine (Jan/Feb 2014)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2014 Offshore Engineer Magazine

data package concerning the Libra ? eld.

Of these 11 companies, seven can be considered supermajors because of their market value, according to Bloomberg/

PFC Energy estimates as of Dec. 12 2013.

The fact that they paid the participa-

Latin America tion fee does not necessarily con? rm that they would de? nitely participate in the auction and the payment fee was compulsory and individual to each com- pany, even those wishing to submit bids through a consortium. Therefore, some of the companies listed could choose to forfeit the fee and not participate in the auction and some did just that, with

Repsol pulling out of the auction at the last moment. Mitsui and Petronas failed to deposit ? nancial guarantees and also didn’t participate. With the high invest- ments involved, which include EWTs and other ? eld development costs, along with around US$7.5 billion (R$15 bil- lion) as bonus on signing the 35-year, non-renewable E&P contract, virtually guaranteed that the companies involved will form consortiums, with no company competing individually. The ANP has estimated that it could take as much as

R$400 billion to develop the Libra ? eld.

Brazil’s

When the rules were changed in 2010, many local and international oil industry leaders and analysts expressed concern st that the production-sharing model would 1 pre-salt auction reduce investment interest in Brazil’s pre- salt provinces, which include areas in the the Brazilian government, through its and other new rules, such as the pro- Santos, Campos, and Espirito Santo Basins.

For Brazil’s ? rst pre-salt

National Petroleum Agency (ANP). duction-sharing scheme, were designed After the rules were con? rmed auction, new production sharing

Magda Chambriard, head of ANP, said to attract other state-owned players, in for the Libra auction, more rules changed the playing ? eld, that she had expected “more than 40 detriment to the international supermajor than 200 requests for changes companies to bid for Libra,” expressing players, which are mostly private com- were made and turned down attracting fewer, but more surprise at having only about a quarter of panies. The reasons for this preference is by the ANP, who said the area’s substantial bids. the expected interest actually material- that these state-owned players participat- size and potential meant that

By Claudio Paschoa izing. She may well have been surprised, ing in the auction, having signi? cantly the government could charge but it is highly doubtful that the policy- less, if any, experience in operating almost anything it wanted for making nucleus in Brazil’s government deepwater pre-salt ? elds, are therefore the rights. “Libra is beyond was in any way surprised, as the state more agreeable to Petrobras’ operational any possible comparison now-

Brazil auctioned its ? rst pre-salt policy is to maintain tight control over control, and the signi? cant fact that these adays to other fields,” said ? eld, Libra, back in late October. pre-salt exploration and production. The state-owned players are more interested Magda Chambriard during a

B

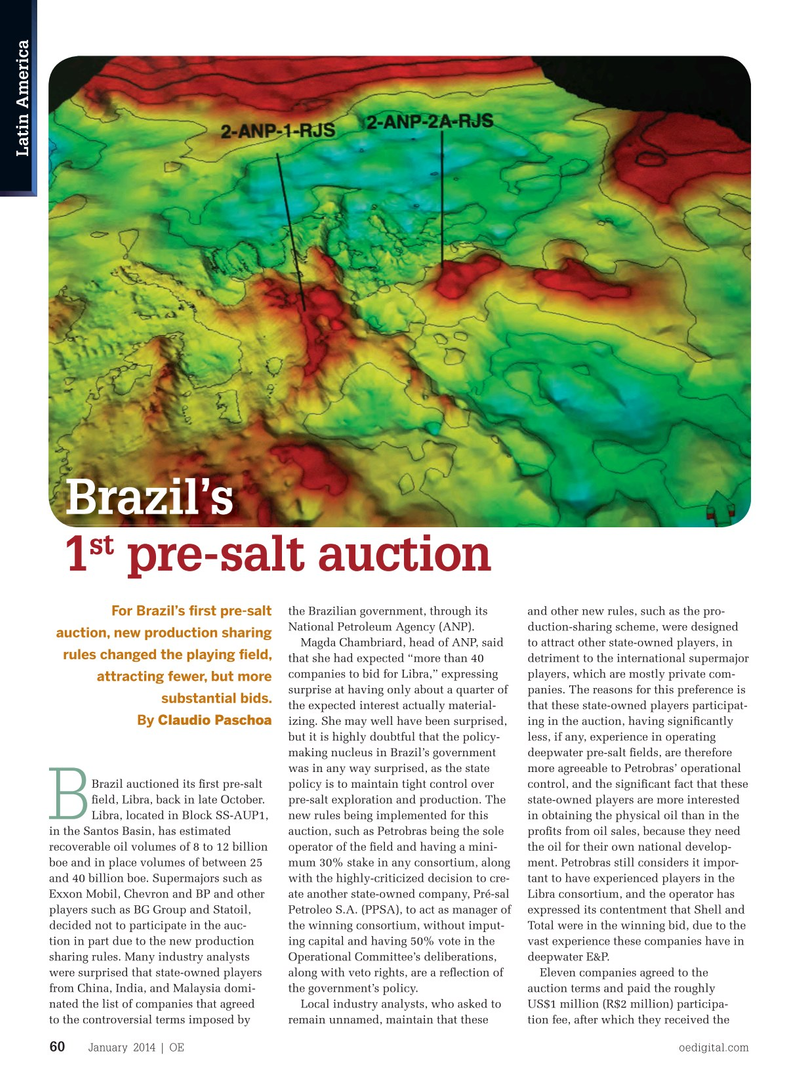

Libra, located in Block SS-AUP1, new rules being implemented for this in obtaining the physical oil than in the global road show to promote in the Santos Basin, has estimated auction, such as Petrobras being the sole pro? ts from oil sales, because they need the auction. “If companies recoverable oil volumes of 8 to 12 billion operator of the ? eld and having a mini- the oil for their own national develop- participate, it is because they boe and in place volumes of between 25 mum 30% stake in any consortium, along ment. Petrobras still considers it impor- see potential value. This is and 40 billion boe. Supermajors such as with the highly-criticized decision to cre- tant to have experienced players in the the biggest auction in 30 to

Exxon Mobil, Chevron and BP and other ate another state-owned company, Pré-sal Libra consortium, and the operator has 40 years around the globe.” players such as BG Group and Statoil, Petroleo S.A. (PPSA), to act as manager of expressed its contentment that Shell and Brazil’s government expects to decided not to participate in the auc- the winning consortium, without imput- Total were in the winning bid, due to the receive around US$300 billion tion in part due to the new production ing capital and having 50% vote in the vast experience these companies have in in royalties and other taxes sharing rules. Many industry analysts Operational Committee’s deliberations, deepwater E&P. from Libra over 30 years. Oil were surprised that state-owned players along with veto rights, are a re? ection of Eleven companies agreed to the rights in the rest for Brazil’s from China, India, and Malaysia domi- the government’s policy. auction terms and paid the roughly post-salt plays will continue to nated the list of companies that agreed Local industry analysts, who asked to US$1 million (R$2 million) participa- be sold on a concession basis, to the controversial terms imposed by remain unnamed, maintain that these tion fee, after which they received the where oil companies own all

January 2014 | OE oedigital.com 60 000-OE0114_LatinAm_Presalt.indd 60 12/19/13 4:17 PM

57

57

59

59