Page 60: of Offshore Engineer Magazine (Jan/Feb 2014)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2014 Offshore Engineer Magazine

one consortium deposited its bid in the strength of the Chinese companies. ballot. With the lack of competition, Shell commented that, “The Libra oil the consortium comprised of Petrobras discovery in Brazil is one of the larg- (10%), Shell (20%), Total (20%), CNPC est deep water oil accumulations in the “Libra feld in Brazil (10%) and CNOOC (10%) offered the world. We look forward to applying is one of the established minimum 41.65% in proft Shell’s global deep water experience

Latin America oil to the Federal government, winning and technology, to support the proftable largest deepwater in the frst pre-salt bidding round held by development of this exciting opportu- the Brazilian National Petroleum Agency nity,” said Peter Voser, Chief Executive accumulations (ANP). With this result, the consortium Offcer, Royal Dutch Shell. has acquired rights and obligations to Total explained that this acquisition is in the world.” the Libra block. As set forth under the part of its strategy to increase its presence law, the National Council for Energy in Brazil. “This stake in a block close to

Policy (Conselho Nacional de Política the very prolifc block BM-S-11, where

Mr. Li Fanrong,

Energética - CNPE) established a 30% the Tupi, Iara and Iracema oil felds were stake to be acquired directly by Petrobras. discovered, will enable Total to partici-

CEO, CNOOC

Therefore, with the auction results, pate in the promising exploration of the

Petrobras’ total participation in the con- schedule of the production systems of pre-salt area of the Santos Basin,” stated sortium will be 40%. A signature bonus this block, will be progressively released Marc Blaizot, Senior vice President, of around US$7.5 billion (R$15 billion) in a timely manner, as the minimum Geosciences at Total E&P. is to be paid by the winning consortium exploration program is developed. Mr. Li Fanrong, CEO of CNOOC com- in a single payment and the total amount Petrobras believes that the integra- mented, “Libra feld in Brazil is one payable by Petrobras will be around tion of expertise and experience of the of the largest deepwater oil accumula-

US$3 billion (R$6 billion) relative to European partners, Shell and Total, with tions in the world. The participation its participation in the consortium. The their expertise in deepwater development of CNOOC Limited in Libra project not

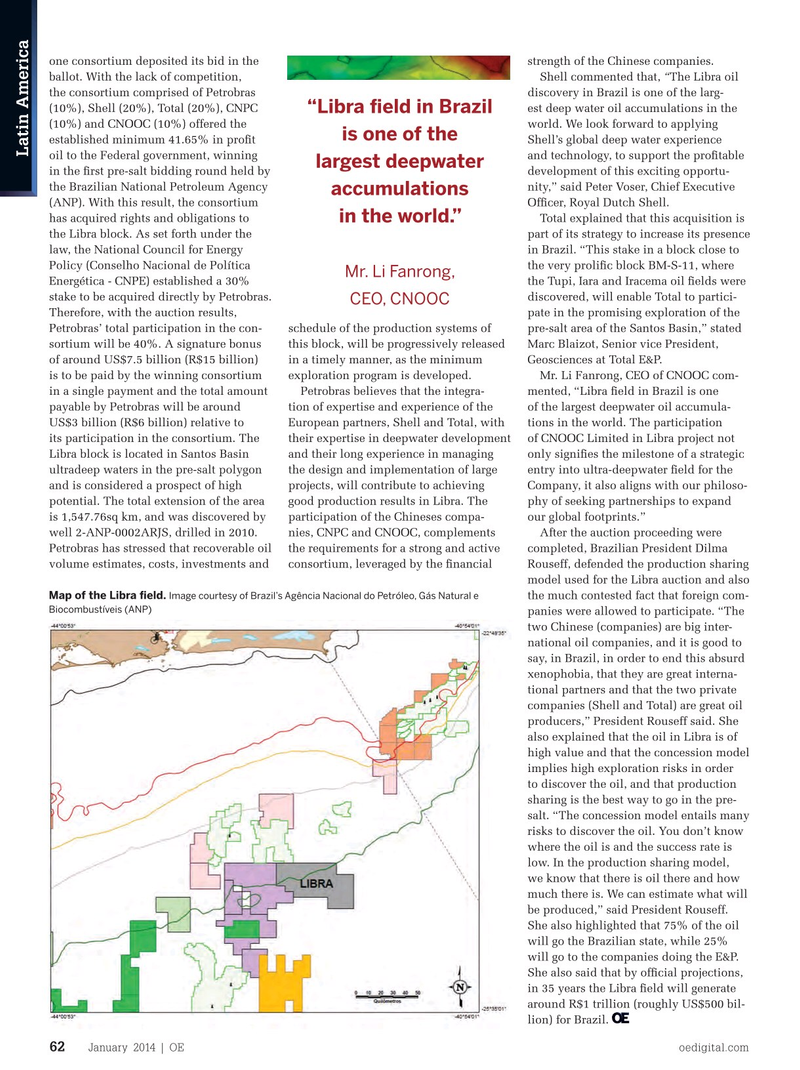

Libra block is located in Santos Basin and their long experience in managing only signifes the milestone of a strategic ultradeep waters in the pre-salt polygon the design and implementation of large entry into ultra-deepwater feld for the and is considered a prospect of high projects, will contribute to achieving Company, it also aligns with our philoso- potential. The total extension of the area good production results in Libra. The phy of seeking partnerships to expand is 1,547.76sq km, and was discovered by participation of the Chineses compa- our global footprints.” well 2-ANP-0002ARJS, drilled in 2010. nies, CNPC and CNOOC, complements After the auction proceeding were

Petrobras has stressed that recoverable oil the requirements for a strong and active completed, Brazilian President Dilma volume estimates, costs, investments and consortium, leveraged by the fnancial Rouseff, defended the production sharing model used for the Libra auction and also

Map of the Libra feld. Image courtesy of Brazil’s Agência Nacional do Petróleo, Gás Natural e the much contested fact that foreign com-

Biocombustíveis (ANP) panies were allowed to participate. “The two Chinese (companies) are big inter- national oil companies, and it is good to say, in Brazil, in order to end this absurd xenophobia, that they are great interna- tional partners and that the two private companies (Shell and Total) are great oil producers,” President Rouseff said. She also explained that the oil in Libra is of high value and that the concession model implies high exploration risks in order to discover the oil, and that production sharing is the best way to go in the pre- salt. “The concession model entails many risks to discover the oil. You don’t know where the oil is and the success rate is low. In the production sharing model, we know that there is oil there and how much there is. We can estimate what will be produced,” said President Rouseff.

She also highlighted that 75% of the oil will go the Brazilian state, while 25% will go to the companies doing the E&P.

She also said that by offcial projections, in 35 years the Libra feld will generate around R$1 trillion (roughly US$500 bil- lion) for Brazil.

January 2014 | OE oedigital.com 62 000-OE0114_LatinAm_Presalt.indd 62 12/19/13 4:17 PM

59

59

61

61