Page 19: of Offshore Engineer Magazine (Feb/Mar 2014)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2014 Offshore Engineer Magazine

Analysis the Gulf of Mexico is consid- (NOC) in proposing which approved and therefore PRI’s ered underexplored. In this existing and prospective political maneuver, as well

Rig stats case, the licenses could be an projects they would like to as the policy directives of appropriate type of contract keep out of future offerings. the Energy Ministry, will be

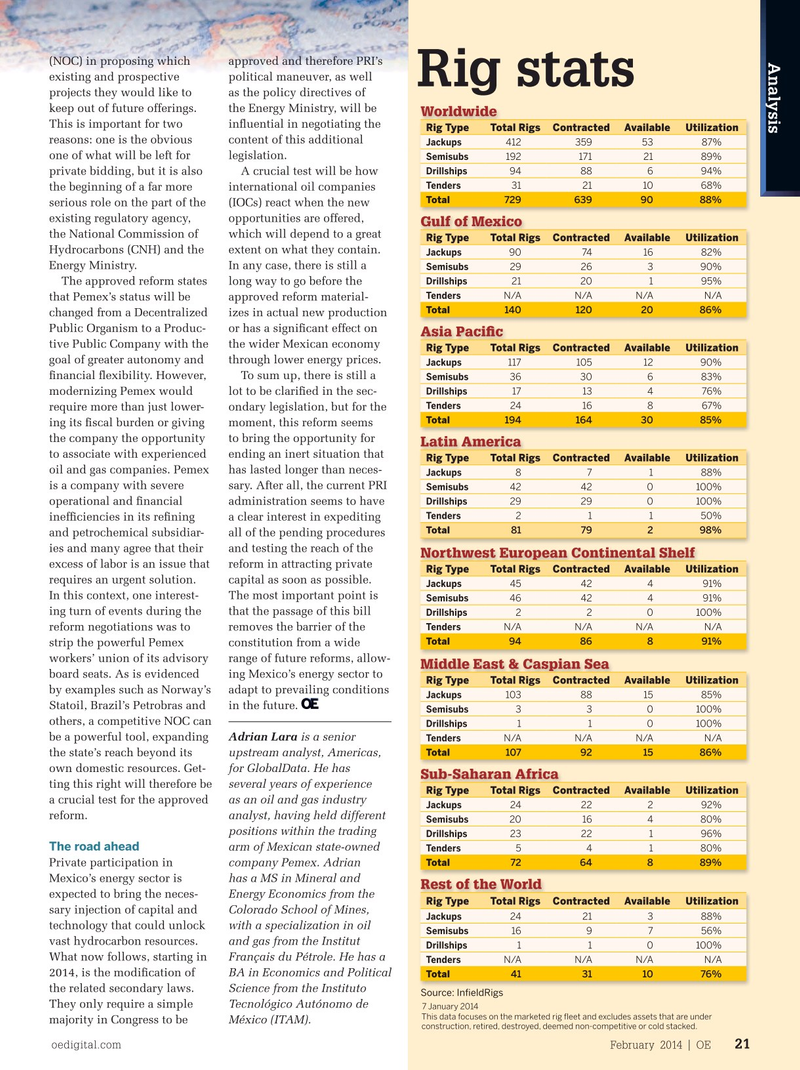

Worldwide for attracting the necessary This is important for two in? uential in negotiating the

Rig Type Total Rigs Contracted Available Utilization capital while also compensat- reasons: one is the obvious content of this additional

Jackups 412 359 53 87% ing for a high exploratory risk. one of what will be left for legislation.

Semisubs 192 171 21 89%

Drillships 94 88 6 94%

Pro? t and production-sharing private bidding, but it is also A crucial test will be how 31 21 10 68%

Tenders contracts will most likely be the beginning of a far more international oil companies

Total 729 639 9088% intended for areas where the serious role on the part of the (IOCs) react when the new

State and Pemex consider existing regulatory agency, opportunities are offered,

Gulf of Mexico that capital has already been the National Commission of which will depend to a great

Rig Type Total Rigs Contracted Available Utilization successfully invested but Hydrocarbons (CNH) and the extent on what they contain.

Jackups 90 74 16 82% that a partnership can still be Energy Ministry. In any case, there is still a

Semisubs 29 26 390% 21 20 1 95%

Drillships bene? cial. The approved reform states long way to go before the

N/A N/AN/A N/A

Tenders

It seems fair to assume that that Pemex’s status will be approved reform material- 140 120 20 86%

Total the ? rst bidding round for changed from a Decentralized izes in actual new production private investors will presum- Public Organism to a Produc- or has a signi? cant effect on

Asia Paci? c ably include production and tive Public Company with the the wider Mexican economy

Rig Type Total Rigs Contracted Available Utilization pro? t-sharing contracts, to test goal of greater autonomy and through lower energy prices.

117 105 1290%Jackups the waters. ? nancial ? exibility. However, To sum up, there is still a

Semisubs 36 30 6 83% 17 13 4 76%

Drillships

The licenses will remain a modernizing Pemex would lot to be clari? ed in the sec- 24 16 8 67%

Tenders politically sensitive and costly require more than just lower- ondary legislation, but for the

Total 194 164 30 85% issue since they are associ- ing its ? scal burden or giving moment, this reform seems ated with concession schemes the company the opportunity to bring the opportunity for

Latin America and might, therefore, be more to associate with experienced ending an inert situation that

Rig Type Total Rigs Contracted Available Utilization dif? cult to implement in an oil and gas companies. Pemex has lasted longer than neces-

Jackups 8 7 188% initial round. Furthermore, is a company with severe sary. After all, the current PRI

Semisubs 42 42 0100% 29 29 0100%

Drillships in subsequent rounds, the operational and ? nancial administration seems to have 2 1 150%

Tenders

Mexican State could bene? t inef? ciencies in its re? ning a clear interest in expediting 81 79 298%

Total from the interaction, feedback and petrochemical subsidiar- all of the pending procedures and results of any previous ies and many agree that their and testing the reach of the

Northwest European Continental Shelf round. Service contracts will excess of labor is an issue that reform in attracting private

Rig Type Total Rigs Contracted Available Utilization remain the preferred scheme requires an urgent solution. capital as soon as possible.

Jackups 45 42 4 91% for oil and gas services In this context, one interest- The most important point is

Semisubs 46 42 4 91% companies and some may ing turn of events during the that the passage of this bill

Drillships 2 2 0100%

Tenders

N/A N/AN/A N/A also incorporate a risk or reform negotiations was to removes the barrier of the

Total 94 86 8 91% performance-related adjust- strip the powerful Pemex constitution from a wide ment. These contracts were workers’ union of its advisory range of future reforms, allow-

Middle East & Caspian Sea originally designed for use board seats. As is evidenced ing Mexico’s energy sector to

Rig Type Total Rigs Contracted Available Utilization in rounds offering offshore by examples such as Norway’s adapt to prevailing conditions 103 88 15 85%

Jackups mature ? elds and some areas Statoil, Brazil’s Petrobras and in the future.

Semisubs 3 3 0100% in the resource-rich onshore others, a competitive NOC can

Drillships 1 1 0100%

Chicontepec play. be a powerful tool, expanding Adrian Lara is a senior

N/A N/AN/A N/A

Tenders 107 92 1586%

Total

However, since Chicontepec the state’s reach beyond its upstream analyst, Americas, is also considered an uncon- own domestic resources. Get- for GlobalData. He has

Sub-Saharan Africa ventional play due to its ting this right will therefore be several years of experience

Rig Type Total Rigs Contracted Available Utilization geological characteristics and a crucial test for the approved as an oil and gas industry 24 22 2 92%Jackups drilling requirements, it’s pos- reform. analyst, having held different

Semisubs 20 16 480% sible that the new contracts positions within the trading

Drillships 23 22 196%

The road ahead will be used for its develop- arm of Mexican state-owned 5 4 180%

Tenders

Total 72 64 8 89% ment (see Table). Private participation in company Pemex. Adrian

Mexico’s energy sector is has a MS in Mineral and

Rest of the World

The new challenges expected to bring the neces- Energy Economics from the

Rig Type Total Rigs Contracted Available Utilization for Pemex sary injection of capital and Colorado School of Mines,

Jackups 24 21 388%

As indicated in the approved technology that could unlock with a specialization in oil

Semisubs 16 9 7 56% reform bill, a Round Zero vast hydrocarbon resources. and gas from the Institut

Drillships 1 1 0100% is expected to be held by What now follows, starting in Français du Pétrole. He has a

Tenders

N/A N/AN/A N/A mid-2014. As is the case in 2014, is the modi? cation of BA in Economics and Political

Total 41 31 10 76% these initial rounds, pref- the related secondary laws. Science from the Instituto

Source: In? eldRigs erential treatment is given They only require a simple Tecnológico Autónomo de 7 January 2014

This data focuses on the marketed rig ? eet and excludes assets that are under to the national oil company majority in Congress to be México (ITAM).

construction, retired, destroyed, deemed non-competitive or cold stacked.

oedigital.com February 2014 | OE 21 019_OE0214_ Analysis.indd 21 1/21/14 12:21 PM

18

18

20

20