Page 60: of Offshore Engineer Magazine (Feb/Mar 2014)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2014 Offshore Engineer Magazine

Companies

Activity

GE Oil & Gas business.

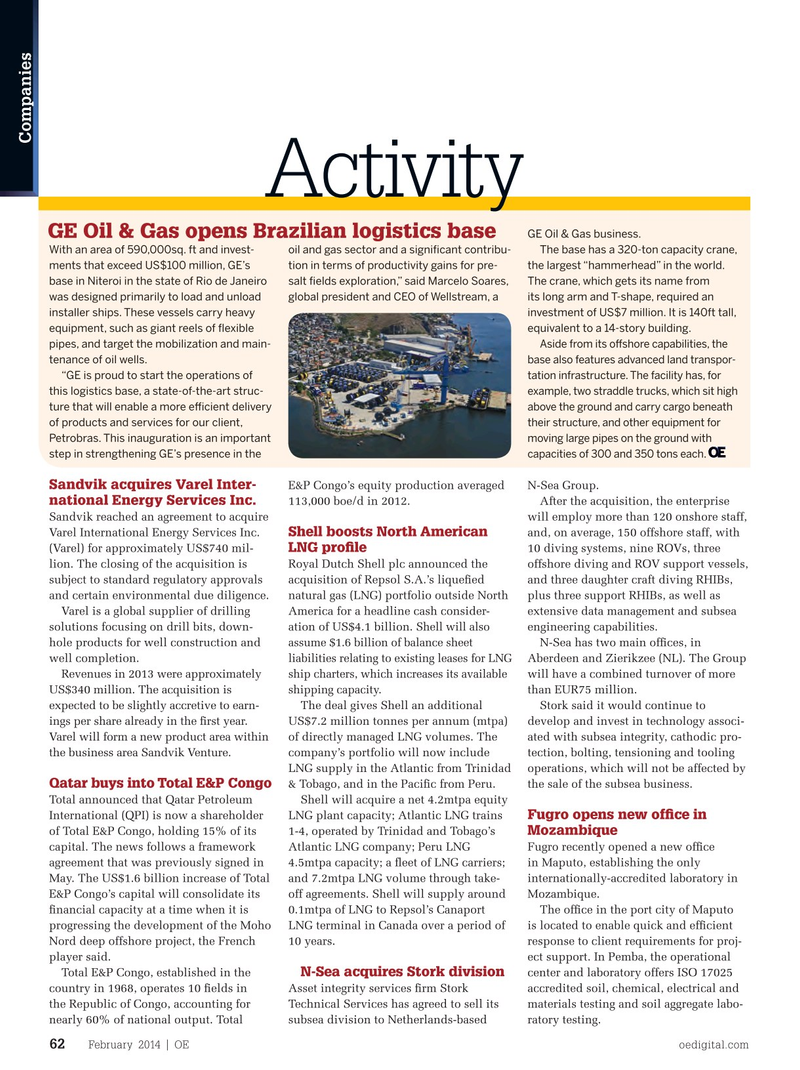

GE Oil & Gas opens Brazilian logistics base

With an area of 590,000sq. ft and invest- oil and gas sector and a signifcant contribu- The base has a 320-ton capacity crane, ments that exceed US$100 million, GE’s tion in terms of productivity gains for pre- the largest “hammerhead” in the world. base in Niteroi in the state of Rio de Janeiro salt felds exploration,” said Marcelo Soares, The crane, which gets its name from was designed primarily to load and unload global president and CEO of Wellstream, a its long arm and T-shape, required an installer ships. These vessels carry heavy investment of US$7 million. It is 140ft tall, equipment, such as giant reels of fexible equivalent to a 14-story building.

pipes, and target the mobilization and main-

Aside from its ofshore capabilities, the tenance of oil wells.

base also features advanced land transpor- “GE is proud to start the operations of tation infrastructure. The facility has, for this logistics base, a state-of-the-art struc- example, two straddle trucks, which sit high ture that will enable a more efcient delivery above the ground and carry cargo beneath of products and services for our client, their structure, and other equipment for

Petrobras. This inauguration is an important moving large pipes on the ground with step in strengthening GE’s presence in the capacities of 300 and 350 tons each.

Sandvik acquires Varel Inter- E&P Congo’s equity production averaged N-Sea Group. national Energy Services Inc.

113,000 boe/d in 2012. After the acquisition, the enterprise

Sandvik reached an agreement to acquire will employ more than 120 onshore staff,

Shell boosts North American

Varel International Energy Services Inc. and, on average, 150 offshore staff, with

LNG profle (Varel) for approximately US$740 mil- 10 diving systems, nine ROVs, three

Royal Dutch Shell plc announced the lion. The closing of the acquisition is offshore diving and ROV support vessels, acquisition of Repsol S.A.’s liquefed subject to standard regulatory approvals and three daughter craft diving RHIBs, natural gas (LNG) portfolio outside North and certain environmental due diligence. plus three support RHIBs, as well as

America for a headline cash consider- Varel is a global supplier of drilling extensive data management and subsea

Shell will also ation of US$4.1 billion. solutions focusing on drill bits, down- engineering capabilities.

assume $1.6 billion of balance sheet hole products for well construction and N-Sea has two main offces, in liabilities relating to existing leases for LNG well completion. Aberdeen and Zierikzee (NL). The Group ship charters, which increases its available

Revenues in 2013 were approximately will have a combined turnover of more shipping capacity.

US$340 million. The acquisition is than EUR75 million.

The deal gives Shell an additional expected to be slightly accretive to earn- Stork said it would continue to

US$7.2 million tonnes per annum (mtpa) ings per share already in the frst year. develop and invest in technology associ- of directly managed LNG volumes. The Varel will form a new product area within ated with subsea integrity, cathodic pro- company’s portfolio will now include the business area Sandvik Venture. tection, bolting, tensioning and tooling

LNG supply in the Atlantic from Trinidad operations, which will not be affected by

Qatar buys into Total E&P Congo & Tobago, and in the Pacifc from Peru. the sale of the subsea business.

Total announced that Qatar Petroleum Shell will acquire a net 4.2mtpa equity

Fugro opens new offce in

International (QPI) is now a shareholder LNG plant capacity; Atlantic LNG trains

Mozambique of Total E&P Congo, holding 15% of its 1-4, operated by Trinidad and Tobago’s

Atlantic LNG company; Peru LNG capital. The news follows a framework Fugro recently opened a new offce 4.5mtpa capacity; a feet of LNG carriers; agreement that was previously signed in in Maputo, establishing the only and 7.2mtpa LNG volume through take- May. The US$1.6 billion increase of Total internationally-accredited laboratory in off agreements. Shell will supply around E&P Congo’s capital will consolidate its Mozambique. 0.1mtpa of LNG to Repsol’s Canaport fnancial capacity at a time when it is The offce in the port city of Maputo

LNG terminal in Canada over a period of progressing the development of the Moho is located to enable quick and effcient 10 years. Nord deep offshore project, the French response to client requirements for proj- player said. ect support. In Pemba, the operational

N-Sea acquires Stork division

Total E&P Congo, established in the center and laboratory offers ISO 17025

Asset integrity services frm Stork country in 1968, operates 10 felds in accredited soil, chemical, electrical and

Technical Services has agreed to sell its the Republic of Congo, accounting for materials testing and soil aggregate labo- subsea division to Netherlands-based nearly 60% of national output. Total ratory testing.

February 2014 | OE oedigital.com 62 000_OE0214_Activity.indd 62 1/20/14 9:15 PM

59

59

61

61