Page 42: of Offshore Engineer Magazine (May/Jun 2014)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2014 Offshore Engineer Magazine

GLOBAL DEEPWATER REVIEW

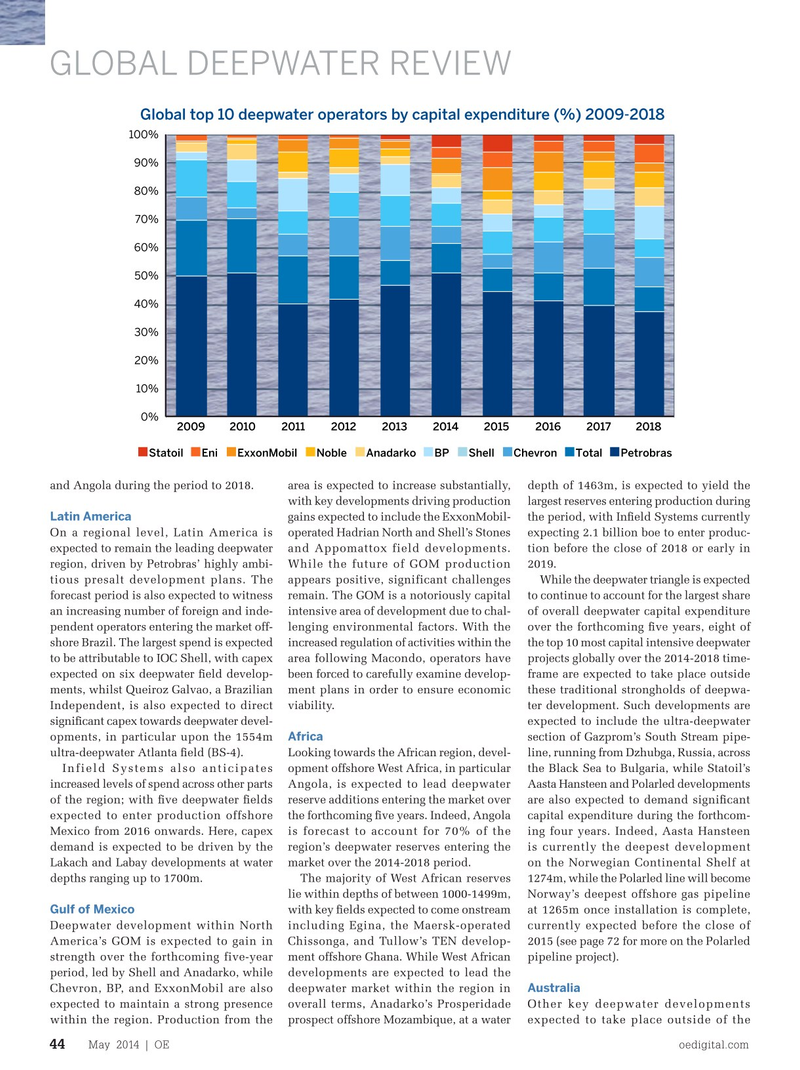

Global top 10 deepwater operators by capital expenditure (%) 2009-2018 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Statoil Eni ExxonMobil Noble Anadarko BP Shell Chevron Total Petrobras and Angola during the period to 2018. area is expected to increase substantially, depth of 1463m, is expected to yield the with key developments driving production largest reserves entering production during

Latin America gains expected to include the ExxonMobil- the period, with In? eld Systems currently

On a regional level, Latin America is operated Hadrian North and Shell’s Stones expecting 2.1 billion boe to enter produc- expected to remain the leading deepwater and Appomattox field developments. tion before the close of 2018 or early in region, driven by Petrobras’ highly ambi- While the future of GOM production 2019. tious presalt development plans. The appears positive, significant challenges While the deepwater triangle is expected forecast period is also expected to witness remain. The GOM is a notoriously capital to continue to account for the largest share an increasing number of foreign and inde- intensive area of development due to chal- of overall deepwater capital expenditure pendent operators entering the market off- lenging environmental factors. With the over the forthcoming ? ve years, eight of shore Brazil. The largest spend is expected increased regulation of activities within the the top 10 most capital intensive deepwater to be attributable to IOC Shell, with capex area following Macondo, operators have projects globally over the 2014-2018 time- expected on six deepwater ? eld develop- been forced to carefully examine develop- frame are expected to take place outside ments, whilst Queiroz Galvao, a Brazilian ment plans in order to ensure economic these traditional strongholds of deepwa-

Independent, is also expected to direct viability. ter development. Such developments are signi? cant capex towards deepwater devel- expected to include the ultra-deepwater

Africa opments, in particular upon the 1554m section of Gazprom’s South Stream pipe- ultra-deepwater Atlanta ? eld (BS-4). Looking towards the African region, devel- line, running from Dzhubga, Russia, across

Infield Systems also anticipates opment offshore West Africa, in particular the Black Sea to Bulgaria, while Statoil’s increased levels of spend across other parts Angola, is expected to lead deepwater Aasta Hansteen and Polarled developments of the region; with ? ve deepwater ? elds reserve additions entering the market over are also expected to demand signi? cant expected to enter production offshore the forthcoming ? ve years. Indeed, Angola capital expenditure during the forthcom-

Mexico from 2016 onwards. Here, capex is forecast to account for 70% of the ing four years. Indeed, Aasta Hansteen demand is expected to be driven by the region’s deepwater reserves entering the is currently the deepest development

Lakach and Labay developments at water market over the 2014-2018 period. on the Norwegian Continental Shelf at depths ranging up to 1700m. The majority of West African reserves 1274m, while the Polarled line will become lie within depths of between 1000-1499m, Norway’s deepest offshore gas pipeline

Gulf of Mexico with key ? elds expected to come onstream at 1265m once installation is complete,

Deepwater development within North including Egina, the Maersk-operated currently expected before the close of

America’s GOM is expected to gain in Chissonga, and Tullow’s TEN develop- 2015 (see page 72 for more on the Polarled strength over the forthcoming five-year ment offshore Ghana. While West African pipeline project).

period, led by Shell and Anadarko, while developments are expected to lead the

Australia

Chevron, BP, and ExxonMobil are also deepwater market within the region in expected to maintain a strong presence overall terms, Anadarko’s Prosperidade Other key deepwater developments within the region. Production from the prospect offshore Mozambique, at a water expected to take place outside of the

May 2014 | OE oedigital.com 44 042_OE0514_DW2_Infield.indd 44 4/18/14 7:12 PM

41

41

43

43