Page 21: of Offshore Engineer Magazine (Oct/Nov 2014)

Read this page in Pdf, Flash or Html5 edition of Oct/Nov 2014 Offshore Engineer Magazine

Analysis choose companies without a proven track record of success. “That gives those [experienced companies] a really big lead

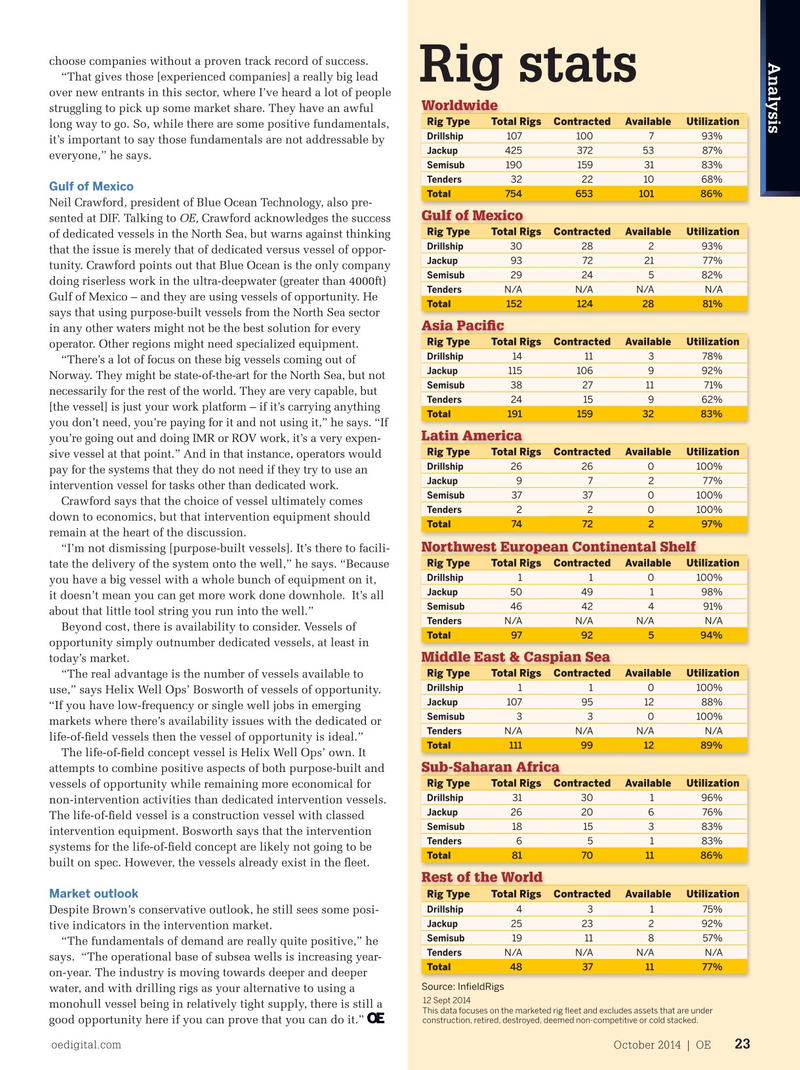

Rig stats over new entrants in this sector, where I’ve heard a lot of people

Worldwide struggling to pick up some market share. They have an awful

Rig Type Total Rigs Contracted Available Utilization long way to go. So, while there are some positive fundamentals,

Drillship 107 100 7 93% it’s important to say those fundamentals are not addressable by 425 372 53 87%Jackup everyone,” he says.

Semisub 190 159 3183% 32 22 10 68%

Tenders

Gulf of Mexico 754 653 101 86%

Total

Neil Crawford, president of Blue Ocean Technology, also pre-

Gulf of Mexico sented at DIF. Talking to OE, Crawford acknowledges the success

Rig Type Total Rigs Contracted Available Utilization of dedicated vessels in the North Sea, but warns against thinking

Drillship 30 28 2 93% that the issue is merely that of dedicated versus vessel of oppor- 93 72 21 77%

Jackup tunity. Crawford points out that Blue Ocean is the only company 29 24 582%

Semisub doing riserless work in the ultra-deepwater (greater than 4000ft)

N/A N/AN/A N/A

Tenders

Gulf of Mexico – and they are using vessels of opportunity. He 152 124 28 81%

Total says that using purpose-built vessels from the North Sea sector

Asia Paci? c in any other waters might not be the best solution for every

Rig Type Total Rigs Contracted Available Utilization operator. Other regions might need specialized equipment.

Drillship 14 11 3 78% “There’s a lot of focus on these big vessels coming out of

Jackup 115 106 9 92%

Norway. They might be state-of-the-art for the North Sea, but not 38 27 11 71%

Semisub necessarily for the rest of the world. They are very capable, but

Tenders 24 15 962% [the vessel] is just your work platform – if it’s carrying anything

Total 191 159 3283% you don’t need, you’re paying for it and not using it,” he says. “If

Latin America you’re going out and doing IMR or ROV work, it’s a very expen-

Rig Type Total Rigs Contracted Available Utilization sive vessel at that point.” And in that instance, operators would

Drillship 26 26 0100% pay for the systems that they do not need if they try to use an

Jackup 9 7 2 77% intervention vessel for tasks other than dedicated work.

The currently in use by Blue Ocean Technol-Harkand Subsea,

Semisub 37 37 0100%

Crawford says that the choice of vessel ultimately comes ogy. President Neil Crawford says that during the campaign, the

Tenders 2 2 0100% down to economics, but that intervention equipment should company has increased its riserless intervention depth record

Total 74 72 2 97% remain at the heart of the discussion. twice: ? rst to 6700ft and now 8200ft. Photo from Blue Ocean Technology.

Northwest European Continental Shelf “I’m not dismissing [purpose-built vessels]. It’s there to facili-

Rig Type Total Rigs Contracted Available Utilization tate the delivery of the system onto the well,” he says. “Because

Drillship 1 1 0100% you have a big vessel with a whole bunch of equipment on it, 50 49 198%

Jackup it doesn’t mean you can get more work done downhole. It’s all

Semisub 46 42 4 91% about that little tool string you run into the well.”

N/A N/AN/A N/A

Tenders

Beyond cost, there is availability to consider. Vessels of

Total 97 92 5 94% opportunity simply outnumber dedicated vessels, at least in

Middle East & Caspian Sea today’s market.

Rig Type Total Rigs Contracted Available Utilization “The real advantage is the number of vessels available to

Drillship 1 1 0100% use,” says Helix Well Ops’ Bosworth of vessels of opportunity. 107 95 1288%

Jackup “If you have low-frequency or single well jobs in emerging

Semisub 3 3 0100% markets where there’s availability issues with the dedicated or

N/A N/AN/A N/A

Tenders life-of-? eld vessels then the vessel of opportunity is ideal.”

Total 111 99 12 89%

The life-of-? eld concept vessel is Helix Well Ops’ own. It

Sub-Saharan Africa attempts to combine positive aspects of both purpose-built and

Rig Type Total Rigs Contracted Available Utilization vessels of opportunity while remaining more economical for

Drillship 31 30 196% non-intervention activities than dedicated intervention vessels.

Jackup 26 20 6 76%

The life-of-? eld vessel is a construction vessel with classed

Semisub 18 15 383% intervention equipment. Bosworth says that the intervention 6 5 183%

Tenders systems for the life-of-? eld concept are likely not going to be 81 70 1186%

Total built on spec. However, the vessels already exist in the ? eet.

Rest of the World

Rig Type Total Rigs Contracted Available Utilization

Market outlook

Drillship 4 3 1 75%

Despite Brown’s conservative outlook, he still sees some posi- 25 23 2 92%

Jackup tive indicators in the intervention market.

Semisub 19 11 8 57% “The fundamentals of demand are really quite positive,” he

Tenders

N/A N/AN/A N/A says. “The operational base of subsea wells is increasing year-

Total 48 37 11 77% on-year. The industry is moving towards deeper and deeper

Source: In? eldRigs water, and with drilling rigs as your alternative to using a 12 Sept 2014 monohull vessel being in relatively tight supply, there is still a

This data focuses on the marketed rig ? eet and excludes assets that are under construction, retired, destroyed, deemed non-competitive or cold stacked.

good opportunity here if you can prove that you can do it.” oedigital.com October 2014 | OE 23 021_OE1014_Analysis.indd 23 9/23/14 11:19 AM

20

20

22

22