Page 25: of Offshore Engineer Magazine (Nov/Dec 2014)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2014 Offshore Engineer Magazine

Analysis

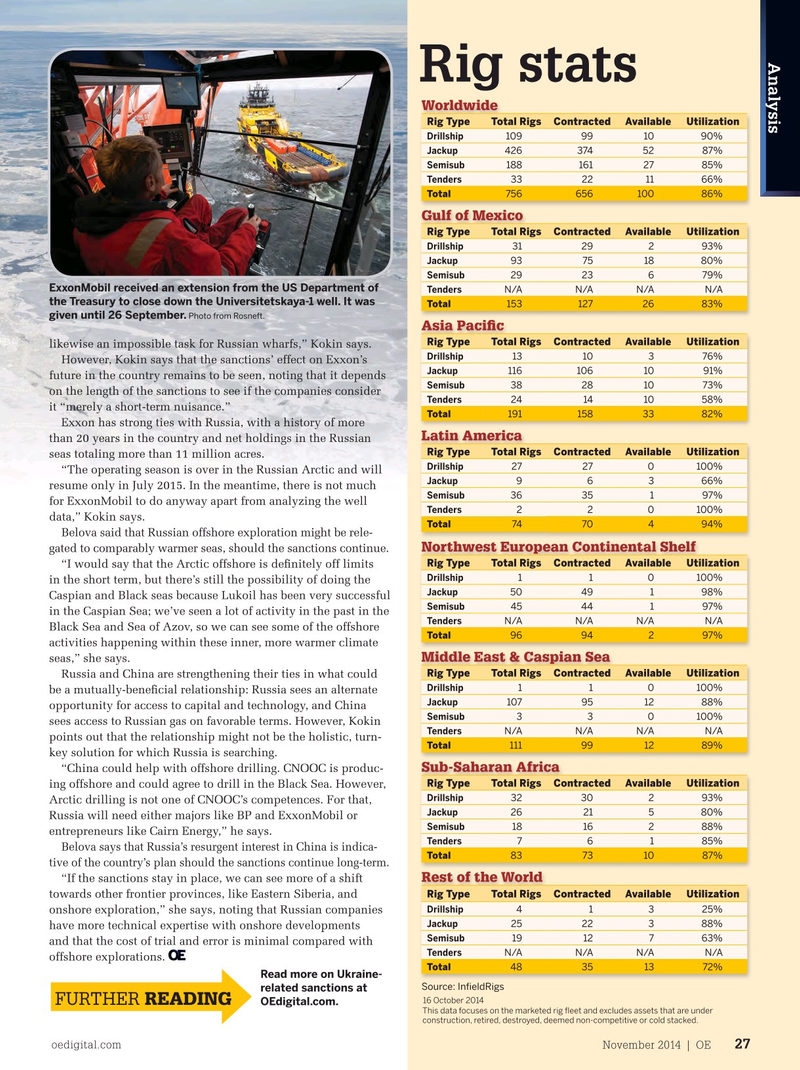

Rig stats

Worldwide

Rig Type Total Rigs Contracted Available Utilization

Drillship 109 99 10 90%

Jackup 426 374 52 87% 188 161 27 85%Semisub 33 22 1166%

Tenders

Total 756 656 100 86%

Gulf of Mexico

Rig Type Total Rigs Contracted Available Utilization

Drillship 31 29 2 93% 93 75 1880%

Jackup 29 23 6 79%

Semisub

Image of the Kara Sea’s winter 2014 ice expedition organized by ExxonMobil received an extension from the US Department of

N/A N/AN/A N/A

Tenders the Arctic Research and Design Center, a joint venture between the Treasury to close down the Universitetskaya-1 well. It was 153 127 26 83%

Total Photo from Rosneft.

Rosneft and ExxonMobil. Rosneft said it was the largest given until 26 September.

Asia Paci? c expedition in the Arctic Ocean since the fall of the Soviet Union.

Photo from Rosneft.

Rig Type Total Rigs Contracted Available Utilization likewise an impossible task for Russian wharfs,” Kokin says.

Drillship 13 10 3 76%

However, Kokin says that the sanctions’ effect on Exxon’s

Jackup 116 106 10 91% future in the country remains to be seen, noting that it depends 38 28 10 73%

Semisub on the length of the sanctions to see if the companies consider

Tenders 24 14 10 58% it “merely a short-term nuisance.” 191 158 3382%

Total

Exxon has strong ties with Russia, with a history of more

Latin America than 20 years in the country and net holdings in the Russian

Rig Type Total Rigs Contracted Available Utilization seas totaling more than 11 million acres.

Drillship 27 27 0100% “The operating season is over in the Russian Arctic and will

Jackup 9 6 366% resume only in July 2015. In the meantime, there is not much 36 35 1 97%

Semisub for ExxonMobil to do anyway apart from analyzing the well

Tenders 2 2 0100% data,” Kokin says.

Total 74 70 4 94%

Belova said that Russian offshore exploration might be rele-

Northwest European Continental Shelf gated to comparably warmer seas, should the sanctions continue.

Rig Type Total Rigs Contracted Available Utilization “I would say that the Arctic offshore is de? nitely off limits

Drillship 1 1 0100% in the short term, but there’s still the possibility of doing the 50 49 198%

Jackup

Caspian and Black seas because Lukoil has been very successful

Semisub 45 44 1 97% in the Caspian Sea; we’ve seen a lot of activity in the past in the

N/A N/AN/A N/A

Tenders

Black Sea and Sea of Azov, so we can see some of the offshore 96 94 2 97%

Total activities happening within these inner, more warmer climate

Middle East & Caspian Sea seas,” she says.

Rig Type Total Rigs Contracted Available Utilization

Russia and China are strengthening their ties in what could

Drillship 1 1 0100% be a mutually-bene? cial relationship: Russia sees an alternate 107 95 1288%

Jackup opportunity for access to capital and technology, and China

Semisub 3 3 0100% sees access to Russian gas on favorable terms. However, Kokin

N/A N/AN/A N/A

Tenders points out that the relationship might not be the holistic, turn-

Total 111 99 12 89% key solution for which Russia is searching.

Sub-Saharan Africa “China could help with offshore drilling. CNOOC is produc-

Rig Type Total Rigs Contracted Available Utilization ing offshore and could agree to drill in the Black Sea. However,

Drillship 32 30 2 93%

Arctic drilling is not one of CNOOC’s competences. For that,

Jackup 26 21 580%

Russia will need either majors like BP and ExxonMobil or

Semisub 18 16 288% entrepreneurs like Cairn Energy,” he says.

7 6 1 85%

Tenders

Belova says that Russia’s resurgent interest in China is indica- 83 73 10 87%

Total tive of the country’s plan should the sanctions continue long-term.

Rest of the World “If the sanctions stay in place, we can see more of a shift

Rig Type Total Rigs Contracted Available Utilization towards other frontier provinces, like Eastern Siberia, and

Drillship 4 1 325% onshore exploration,” she says, noting that Russian companies 25 22 388%

Jackup have more technical expertise with onshore developments 19 12 7 63%

Semisub and that the cost of trial and error is minimal compared with

Tenders

N/A N/AN/A N/A offshore explorations.

Total 48 35 13 72%

Read more on Ukraine-

Source: In? eldRigs related sanctions at 16 October 2014

FURTHER READING

OEdigital.com.

This data focuses on the marketed rig ? eet and excludes assets that are under construction, retired, destroyed, deemed non-competitive or cold stacked.

oedigital.com November 2014 | OE 27 025_OE1114_Analysis.indd 27 10/21/14 2:12 PM

24

24

26

26