Page 27: of Offshore Engineer Magazine (Jan/Feb 2015)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2015 Offshore Engineer Magazine

GLOBAL OFFSHORE MARKET FORECAST

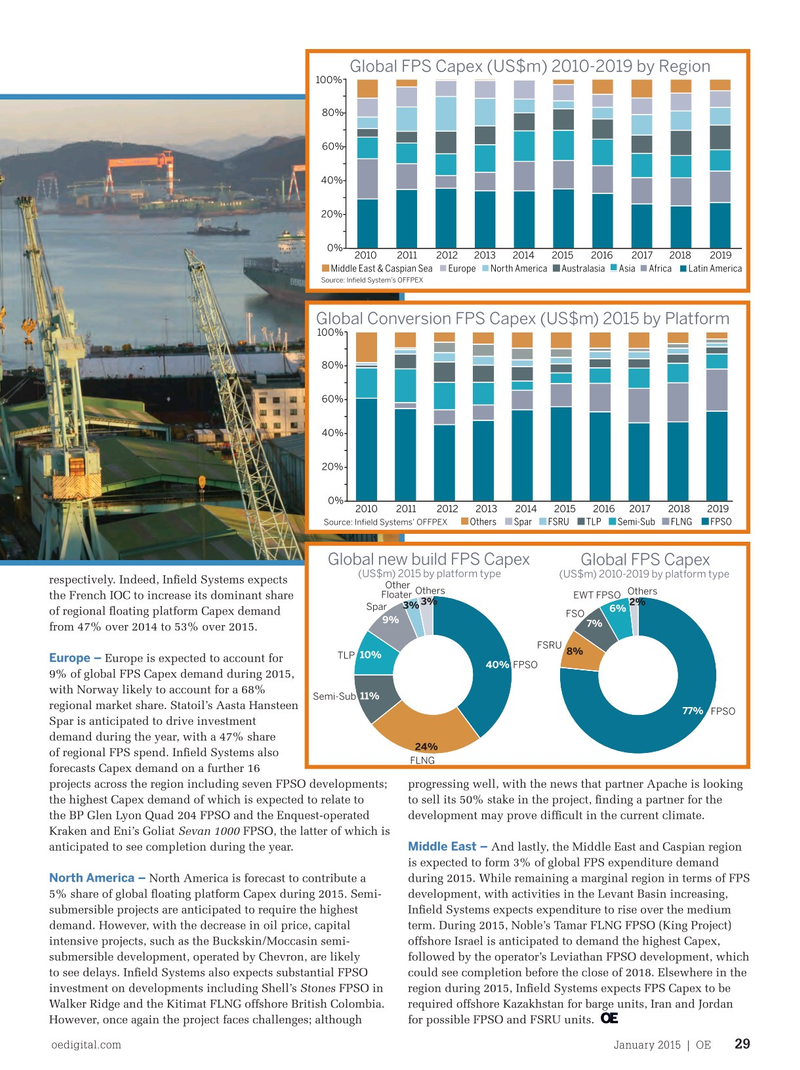

Global FPS Capex (US$m) 2010-2019 by Region 100% 80% 60% 40% 20% 0% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Middle East & Caspian Sea Europe North America Australasia Asia Africa Latin America

Source: In?eld System’s OFFPEX

Global Conversion FPS Capex (US$m) 2015 by Platform 100% 80% 60% 40% 20% 0% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Source: In?eld Systems’ OFFPEX Semi-Sub FLNG Others Spar FSRU TLP FPSO

Global new build FPS Capex Global FPS Capex (US$m) 2015 by platform type (US$m) 2010-2019 by platform type respectively. Indeed, Infeld Systems expects

Other Others EWT FPSO Others

Floater 3% 6% 2% the French IOC to increase its dominant share 3%

Spar of regional foating platform Capex demand

FSO 9% 7% from 47% over 2014 to 53% over 2015.

FSRU 8%

TLP 10%

Europe –

Europe is expected to account for 40% FPSO 9% of global FPS Capex demand during 2015, with Norway likely to account for a 68%

Semi-Sub 11% regional market share. Statoil’s Aasta Hansteen 77% FPSO

Spar is anticipated to drive investment demand during the year, with a 47% share 24% of regional FPS spend. Infeld Systems also

FLNG forecasts Capex demand on a further 16 projects across the region including seven FPSO developments; progressing well, with the news that partner Apache is looking the highest Capex demand of which is expected to relate to to sell its 50% stake in the project, fnding a partner for the the BP Glen Lyon Quad 204 FPSO and the Enquest-operated development may prove diffcult in the current climate.

Kraken and Eni’s Goliat Sevan 1000 FPSO, the latter of which is

Middle East – anticipated to see completion during the year. And lastly, the Middle East and Caspian region is expected to form 3% of global FPS expenditure demand

North America is forecast to contribute a during 2015. While remaining a marginal region in terms of FPS

North America – 5% share of global foating platform Capex during 2015. Semi- development, with activities in the Levant Basin increasing, submersible projects are anticipated to require the highest Infeld Systems expects expenditure to rise over the medium demand. However, with the decrease in oil price, capital term. During 2015, Noble’s Tamar FLNG FPSO (King Project) intensive projects, such as the Buckskin/Moccasin semi- offshore Israel is anticipated to demand the highest Capex, submersible development, operated by Chevron, are likely followed by the operator’s Leviathan FPSO development, which to see delays. Infeld Systems also expects substantial FPSO could see completion before the close of 2018. Elsewhere in the

Stones investment on developments including Shell’s FPSO in region during 2015, Infeld Systems expects FPS Capex to be

Walker Ridge and the Kitimat FLNG offshore British Colombia. required offshore Kazakhstan for barge units, Iran and Jordan

However, once again the project faces challenges; although for possible FPSO and FSRU units. oedigital.com January 2015 | OE 29 028_OE0115_feature1_Infield.indd 29 12/22/14 11:18 PM

26

26

28

28