Page 29: of Offshore Engineer Magazine (Jan/Feb 2015)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2015 Offshore Engineer Magazine

autonomous underwater vehicle (AUV)

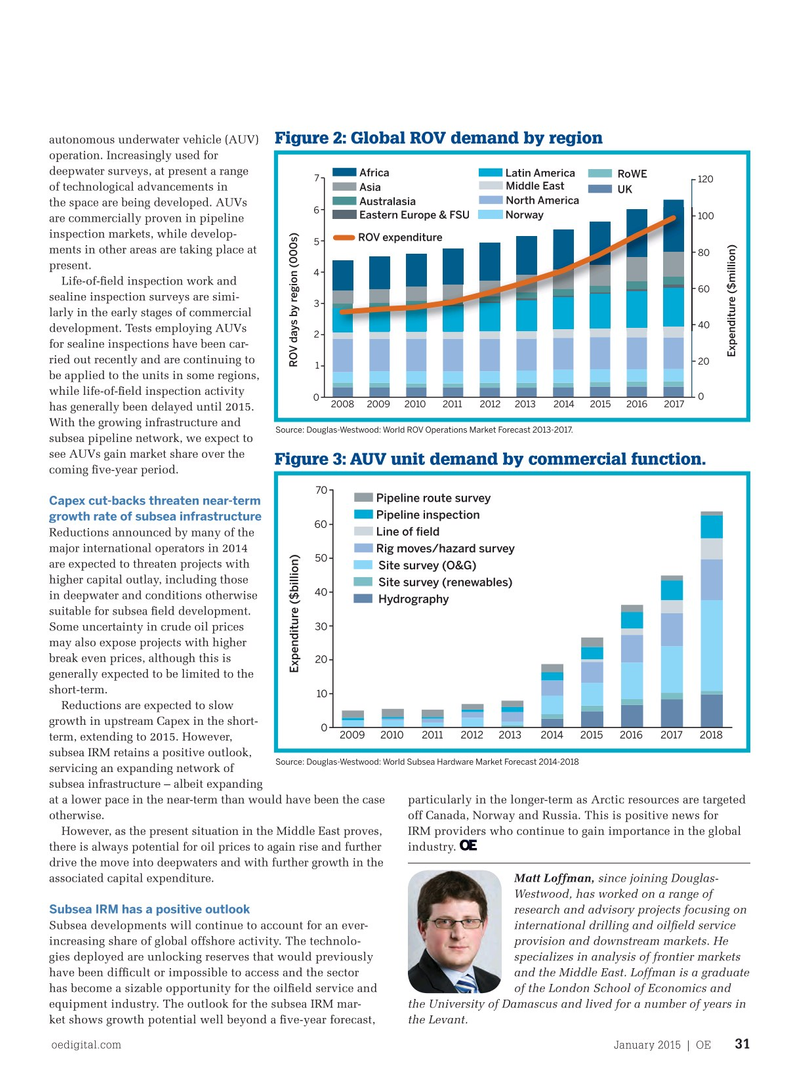

Figure 2: Global ROV demand by region operation. Increasingly used for deepwater surveys, at present a range

Africa

Latin America RoWE 7 120

Middle East of technological advancements in

Asia

UK

Australasia North America the space are being developed. AUVs 6

Eastern Europe & FSU NorwayEastern Europe & FSU Norway 100 are commercially proven in pipeline inspection markets, while develop-

ROV expenditure 5 ments in other areas are taking place at 80 present. 4

Life-of-? eld inspection work and 60 sealine inspection surveys are simi- 3 larly in the early stages of commercial 40 development. Tests employing AUVs 2 for sealine inspections have been car-

Expenditure ($million) ried out recently and are continuing to 20

ROV days by region (000s) 1 be applied to the units in some regions, while life-of-? eld inspection activity 0 0 2009 2008 2010 20112012 2013 2014 2015 2016 2017 has generally been delayed until 2015.

With the growing infrastructure and

Source: Douglas-Westwood: World ROV Operations Market Forecast 2013-2017.

subsea pipeline network, we expect to see AUVs gain market share over the

Figure 3: AUV unit demand by commercial function.

coming ? ve-year period. 70

Pipeline route survey

Capex cut-backs threaten near-term

Pipeline inspection growth rate of subsea infrastructure 60

Line of ?eld

Reductions announced by many of the major international operators in 2014

Rig moves/hazard survey 50 are expected to threaten projects with

Site survey (O&G) higher capital outlay, including those

Site survey (renewables) 40 in deepwater and conditions otherwise

Hydrography suitable for subsea ? eld development. 30

Some uncertainty in crude oil prices may also expose projects with higher break even prices, although this is 20

Expenditure ($billion) generally expected to be limited to the short-term.

10

Reductions are expected to slow growth in upstream Capex in the short- 0 2009 2010 20112012 2013 2014 2015 2016 2017 2018 term, extending to 2015. However, subsea IRM retains a positive outlook,

Source: Douglas-Westwood: World Subsea Hardware Market Forecast 2014-2018 servicing an expanding network of subsea infrastructure – albeit expanding at a lower pace in the near-term than would have been the case particularly in the longer-term as Arctic resources are targeted otherwise. off Canada, Norway and Russia. This is positive news for

However, as the present situation in the Middle East proves, IRM providers who continue to gain importance in the global there is always potential for oil prices to again rise and further industry. drive the move into deepwaters and with further growth in the associated capital expenditure. Matt Loffman, since joining Douglas-

Westwood, has worked on a range of

Subsea IRM has a positive outlook research and advisory projects focusing on

Subsea developments will continue to account for an ever- international drilling and oil? eld service increasing share of global offshore activity. The technolo- provision and downstream markets. He gies deployed are unlocking reserves that would previously specializes in analysis of frontier markets have been dif? cult or impossible to access and the sector and the Middle East. Loffman is a graduate has become a sizable opportunity for the oil? eld service and of the London School of Economics and equipment industry. The outlook for the subsea IRM mar- the University of Damascus and lived for a number of years in ket shows growth potential well beyond a ? ve-year forecast, the Levant. oedigital.com January 2015 | OE 31 030_OE0115_feature2_Global Subsea.indd 31 12/22/14 11:09 PM

28

28

30

30