Page 71: of Offshore Engineer Magazine (Jan/Feb 2015)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2015 Offshore Engineer Magazine

Middle East throughout 2015-2019. Noble that’s really a factor.” sales, FLNG, and Cyprus onshore LNG “In terms of its assets, Israel has a options, according to Noble in a late 2014

Energy alone is predicted to pump long history of protecting its assets very presentation at the Johnson Rice Energy an 84% share of forecast capex off

Israel during the same period. successfully,” Beagelman says. “If you Conference.

“There should be a queue of compare Israel to its current competitors One question mark about the project operators focused on Israel,” (other emerging oil markets), there is no is its ability to become a major export comparison – Israel is already deploy- project and, if so, to where, says Shaffer.

Beagelman says. “Especially when you look to Cyprus, who [has] not ing ‘iron dome’ technology for its naval “It’s still a big feld by itself, but in terms ships and is one of the safest places to be of how much gas is available for export, produced anything as of yet, and offshore.” there’s maybe 250-300 Bcm available for you have three major operators exploring in their waters.”

Still, the Leviathan development is export. That’s not a game-changer for going ahead. Podevyn says that much of Europe, for Asia,” she says.

Like many developing regions, the Israeli offshore sector has had

Noble Energy’s Israeli capex is earmarked Shaffer says that the size of Leviathan’s its share of naysayers and even for Leviathan, which is itself expected to resources, the amount of infrastructure, amount to 69% of Israel’s offshore capi- and the market needs within the area doomsayers, particularly when it comes to bringing Leviathan tal expenditure in 2015-19, with peak bordering Israel are a perfect match. She spending in 2019. does not see Europe or Asia as likely online. The general political unrest in the region might contrib-

Leviathan, which received its name export markets, despite an Israeli vision ute to some general unease among from a giant sea monster in the Bible’s to export to Europe via a new pipeline. investors; that certainly seemed

Old Testament, is in the Mediterranean She points out that globally expensive the case when the Financial

Sea, about 130km from Israel’s coastline, gas exports are facing current market pressure.

Keith Elliott, Noble Energy’s

Senior Vice President, Eastern

Mediterranean Natural, shared a similar perspective with OE, saying: “Gas from these develop- ments [Tamar and the frst phase of Leviathan] could add tremen- dous economic value to Israel and other countries in the region in the form of revenues, fuel costs savings and enhanced environ- mental quality.”

The Leviathan consortium currently has two letters of intent (LOI) in pace: One signed in June

The Tamar feld, which was turned around to export up to 3.75 Tcf of natural from discovery into production in only gas over a 15-year period to the four years. Beagelman points to this as

UK major BG Group’s LNG plant proof positive that Israel has the proper in Idku, Egypt, and a September infrastructure in place to support its growing ofshore sector.

US$15 billion preliminary deal

Photo from Albatross Aerial Photography Ltd.

to supply a base gross quantity of 1.6 Tcf of natural gas over

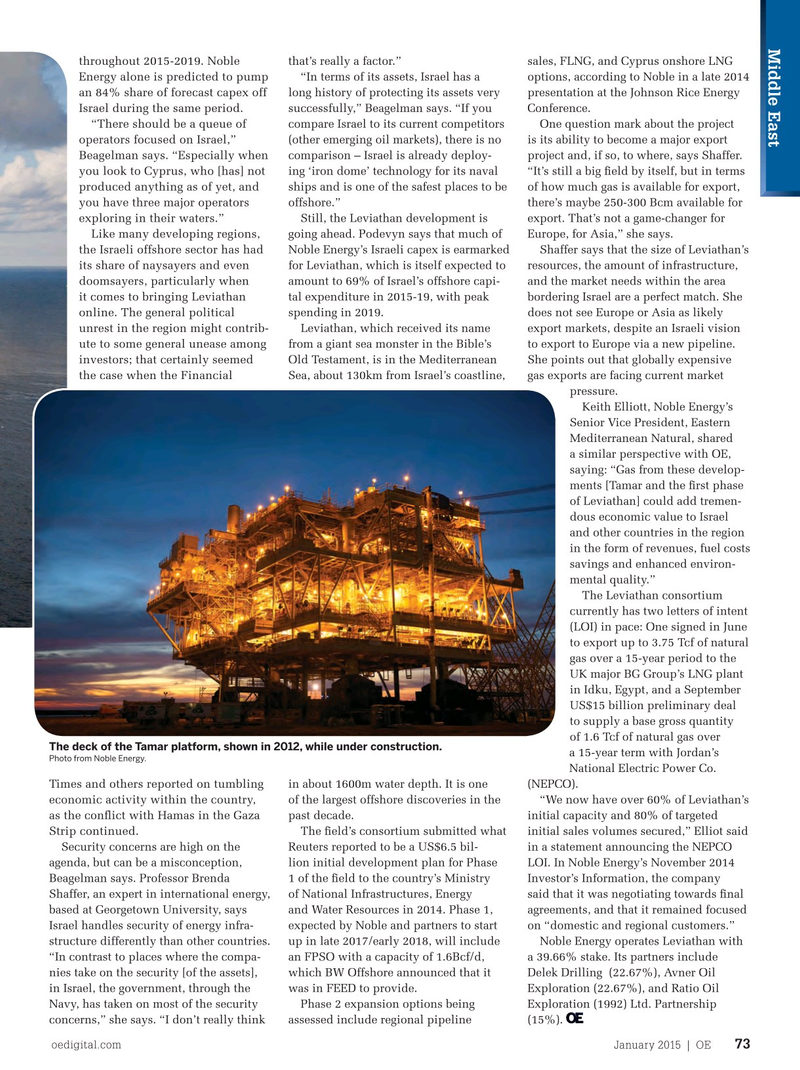

The deck of the Tamar platform, shown in 2012, while under construction. recognizes now the huge discoveries a 15-year term with Jordan’s

Photo from Noble Energy.

and production levels, however, there is

National Electric Power Co. not enough knowledge about the further Times and others reported on tumbling in about 1600m water depth. It is one (NEPCO).

exploration opportunities in Israel’s economic activity within the country, of the largest offshore discoveries in the “We now have over 60% of Leviathan’s offshore deepwater. The geology spells as the confict with Hamas in the Gaza past decade. initial capacity and 80% of targeted it out,” says Joshua Beagelman, COO Strip continued.

The feld’s consortium submitted what initial sales volumes secured,” Elliot said

Security concerns are high on the Reuters reported to be a US$6.5 bil- in a statement announcing the NEPCO of Universal Oil and Gas (UOG), the agenda, but can be a misconception, lion initial development plan for Phase LOI. In Noble Energy’s November 2014 organization which brought Israel its

Beagelman says. Professor Brenda 1 of the feld to the country’s Ministry Investor’s Information, the company frst international oil and gas conference

Shaffer, an expert in international energy, of National Infrastructures, Energy said that it was negotiating towards fnal in 2014. “There will be more natural gas based at Georgetown University, says and Water Resources in 2014. Phase 1, agreements, and that it remained focused discoveries in Israel and oil discover- ies–it just depends who will take the

Israel handles security of energy infra- expected by Noble and partners to start on “domestic and regional customers.” leap.” structure differently than other countries. up in late 2017/early 2018, will include Noble Energy operates Leviathan with

Catarina Podevyn, content analyst “In contrast to places where the compa- an FPSO with a capacity of 1.6Bcf/d, a 39.66% stake. Its partners include for Infeld Systems, said that Israel is nies take on the security [of the assets], which BW Offshore announced that it Delek Drilling (22.67%), Avner Oil driving offshore spend in the region, in Israel, the government, through the was in FEED to provide. Exploration (22.67%), and Ratio Oil holding a 25% share of the central

Navy, has taken on most of the security Phase 2 expansion options being Exploration (1992) Ltd. Partnership

Mediterranean’s forecast offshore capex concerns,” she says. “I don’t really think assessed include regional pipeline (15%). oedigital.com January 2015 | OE 73 072_OE0115_Geofocus2_Israel.indd 73 12/22/14 11:38 AM

70

70

72

72