Page 31: of Offshore Engineer Magazine (Apr/May 2015)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2015 Offshore Engineer Magazine

Analysis

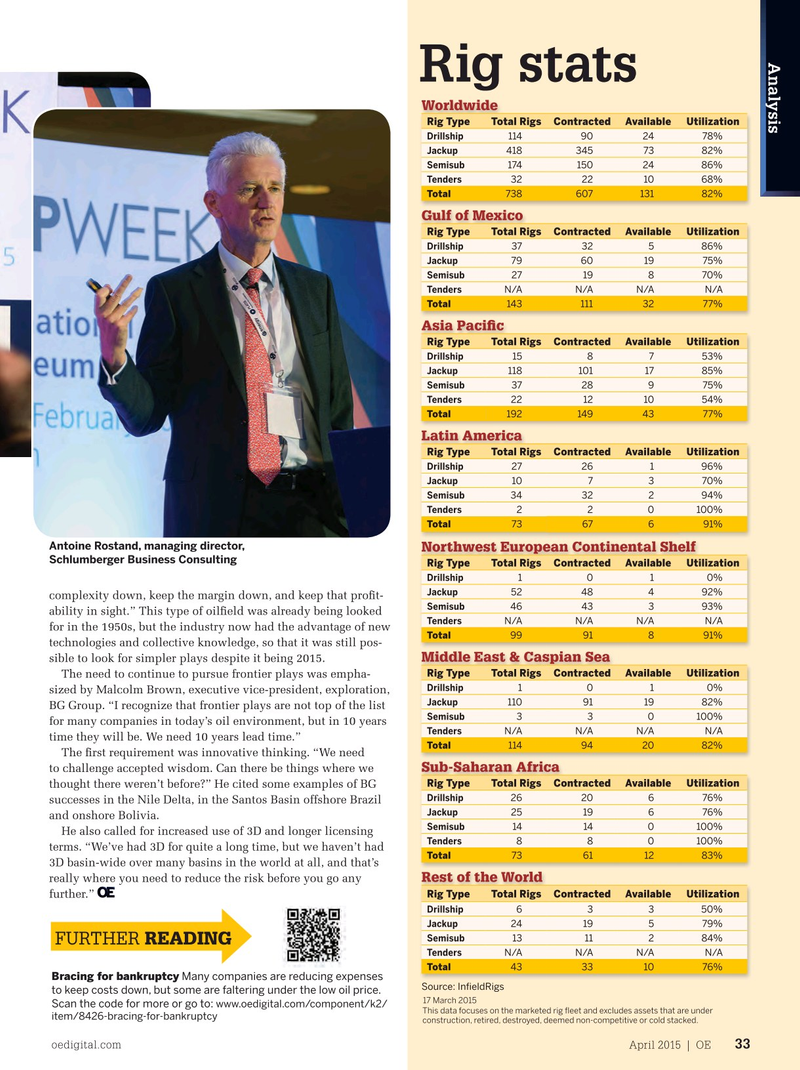

Rig stats

Worldwide

Rig Type Total Rigs Contracted Available Utilization

Drillship 114 90 24 78% 418 345 73 82%

Jackup

Semisub 174 150 24 86% 32 22 10 68%

Tenders 738 607 131 82%

Total

Gulf of Mexico

Rig Type Total Rigs Contracted Available Utilization 37 32 586%Drillship 79 60 19 75%

Jackup 27 19 8 70%

Semisub

N/A N/AN/A N/A

Tenders 143 111 32 77%

Total

Asia Paci? c

Rig Type Total Rigs Contracted Available Utilization

Drillship 15 8 753%

Jackup 118 101 17 85% 37 28 9 75%

Semisub 22 12 1054%Tenders

Total 192 149 43 77%

Latin America

Rig Type Total Rigs Contracted Available Utilization

Drillship 27 26 196%

Jackup 10 7 3 70% 34 32 2 94%

Semisub

Tenders 2 2 0100%

Total 73 67 6 91%

Antoine Rostand, managing director,

Northwest European Continental Shelf

Schlumberger Business Consulting

Rig Type Total Rigs Contracted Available Utilization

Drillship 1 0 1 0% 52 48 4 92%

Jackup complexity down, keep the margin down, and keep that pro? t-

Semisub 46 43 3 93% ability in sight.” This type of oil? eld was already being looked

N/A N/AN/A N/A

Tenders for in the 1950s, but the industry now had the advantage of new 99 91 8 91%

Total technologies and collective knowledge, so that it was still pos-

Middle East & Caspian Sea sible to look for simpler plays despite it being 2015.

Rig Type Total Rigs Contracted Available Utilization

The need to continue to pursue frontier plays was empha-

Drillship 1 0 1 0% sized by Malcolm Brown, executive vice-president, exploration, 110 91 19 82%

Jackup

BG Group. “I recognize that frontier plays are not top of the list

Semisub 3 3 0100% for many companies in today’s oil environment, but in 10 years

N/A N/AN/A N/A

Tenders time they will be. We need 10 years lead time.”

Total 114 94 20 82%

The ? rst requirement was innovative thinking. “We need

Sub-Saharan Africa to challenge accepted wisdom. Can there be things where we

Rig Type Total Rigs Contracted Available Utilization thought there weren’t before?” He cited some examples of BG 26 20 6 76%

Drillship successes in the Nile Delta, in the Santos Basin offshore Brazil 25 19 6 76%

Jackup and onshore Bolivia.

Semisub 14 14 0100%

He also called for increased use of 3D and longer licensing 8 8 0100%

Tenders terms. “We’ve had 3D for quite a long time, but we haven’t had 73 61 1283%

Total 3D basin-wide over many basins in the world at all, and that’s

Rest of the World really where you need to reduce the risk before you go any

Rig Type Total Rigs Contracted Available Utilization further.”

Drillship 6 3 350% 24 19 5 79%

Jackup

Semisub 13 11 2 84%

FURTHER READING

Tenders

N/A N/AN/A N/A

Total 43 33 10 76%

Bracing for bankruptcy Many companies are reducing expenses

Source: In? eldRigs to keep costs down, but some are faltering under the low oil price. 17 March 2015

Scan the code for more or go to: www.oedigital.com/component/k2/

This data focuses on the marketed rig ? eet and excludes assets that are under item/8426-bracing-for-bankruptcy construction, retired, destroyed, deemed non-competitive or cold stacked.

oedigital.com April 2015 | OE 33 031_OE0415_Analysis2_inDepth_IP Week_v2em.indd 33 3/23/15 2:15 PM

30

30

32

32