Page 39: of Offshore Engineer Magazine (May/Jun 2015)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2015 Offshore Engineer Magazine

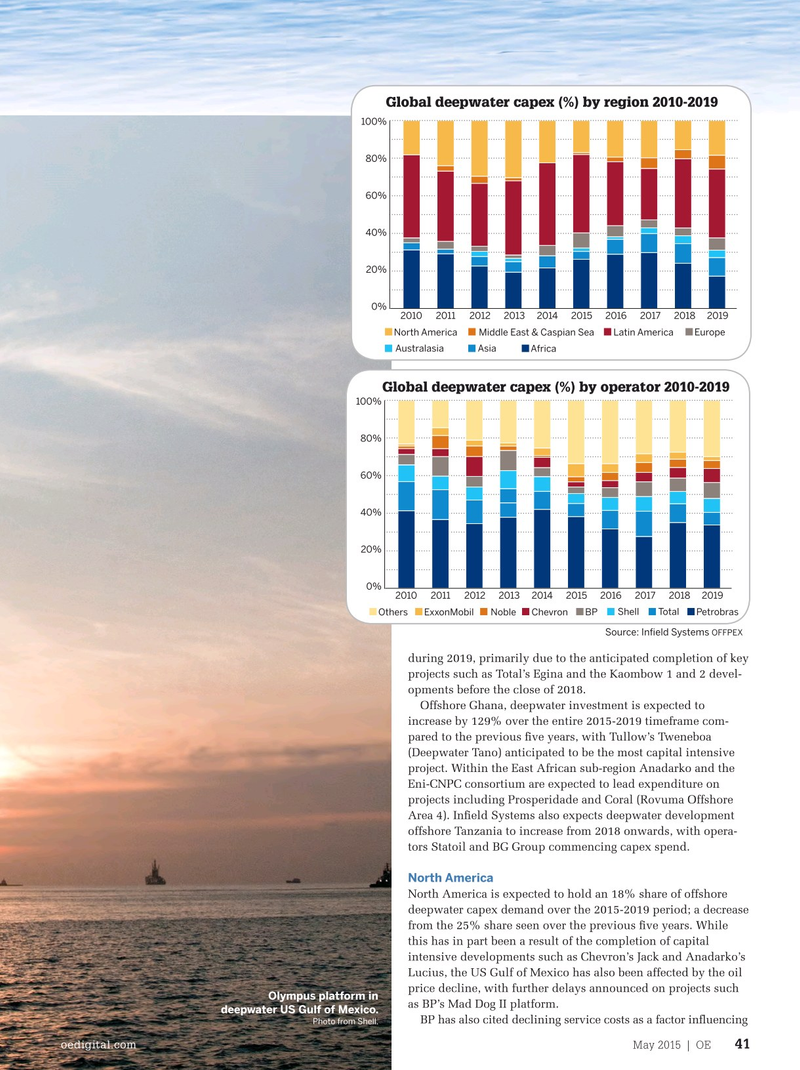

Global deepwater capex (%) by region 2010-2019 100% 80% 60% 40% uncertainties 20% 0% 2010 20112012 2013 2014 2015 2016 2017 2018 2019

North AmericaMiddle East & Caspian Sea Latin America Europe in the deep

Australasia Asia Africa

Global deepwater capex (%) by operator 2010-2019 100% 80% 60% 40% 20% 0% 2010 20112012 2013 2014 2015 2016 2017 2018 2019

Others ExxonMobilNoble Shell Chevron Total BP Petrobras

Source: In? eld Systems OFFPEX during 2019, primarily due to the anticipated completion of key projects such as Total’s Egina and the Kaombow 1 and 2 devel- opments before the close of 2018.

Offshore Ghana, deepwater investment is expected to increase by 129% over the entire 2015-2019 timeframe com- pared to the previous ? ve years, with Tullow’s Tweneboa (Deepwater Tano) anticipated to be the most capital intensive project. Within the East African sub-region Anadarko and the

Eni-CNPC consortium are expected to lead expenditure on projects including Prosperidade and Coral (Rovuma Offshore

Area 4). In? eld Systems also expects deepwater development offshore Tanzania to increase from 2018 onwards, with opera- tors Statoil and BG Group commencing capex spend.

North America

North America is expected to hold an 18% share of offshore deepwater capex demand over the 2015-2019 period; a decrease from the 25% share seen over the previous ? ve years. While this has in part been a result of the completion of capital intensive developments such as Chevron’s Jack and Anadarko’s

Lucius, the US Gulf of Mexico has also been affected by the oil price decline, with further delays announced on projects such

Olympus platform in as BP’s Mad Dog II platform. deepwater US Gulf of Mexico.

BP has also cited declining service costs as a factor in? uencing

Photo from Shell.

oedigital.com May 2015 | OE 41 040_OE0515_Feature1_Infield_v2em.indd 41 4/19/15 11:21 PM

38

38

40

40