Page 52: of Offshore Engineer Magazine (Aug/Sep 2015)

Read this page in Pdf, Flash or Html5 edition of Aug/Sep 2015 Offshore Engineer Magazine

(images) (to come from Mayer Brown) [Byline] Jeannie Stell (copy)

Ho Chi Minh City-based counselor for the law and consultancy frm of Mayer

Brown. She is a member of the frm’s

Global Projects Group.

“While there seems to be no expressed

Boundary disputes: indications that the territorial water disputes alone have adversely affected the

Southeast Asia oil and gas activities, we understand that certain international oil companies (IOCs)

South China Sea have expressed their hesitance when being invited to bidding rounds for new

Ofshore assets in the South hydrocarbon potential, production-sharing contracts,” she says.

these countries are signif- Increasingly, IOCs seem to be under

China Sea are ripe for further cantly driven to invest in pressure to take sides when expanding in development, but territorial offshore production, tech- the region, and those with strong politi- nology, pipeline networks cal alliance to a particular country would challenges are common. and drilling. Overall, the feel inclined to expand in such country.

Focusing on Vietnam, majority of the countries’ That said, it seems that the territorial dis-

Jeannie Stell talks to oil and gas developments putes are not yet cited as the sole reason are found in shallow water for IOCs to exit a particular country.

Quynh Anh, partner at Mayer basins because the region “In terms of internal political stability,

Brown, for an overview of the has seen limited exploration Vietnam is often cited as a stable politi- of deepwater areas, mostly cal regime with leadership committed to political conditions, contract due to a lack of capabilities. achieving socio-economic development. details and royalty rates that

Yet, more recently, fnds The communist party in Vietnam seems can afect energy development.

such as China’s Liwan 3-1 committed to achieving high gross domes- gas feld, discovered in 2006, tic product growth and aims to achieve demonstrate the potential of this by providing a relatively stable deepwater exploration. As he South China Sea (SCS) offers political environment, especially when a result, some countries potential for signifcant natural compared to its neighbor countries. In

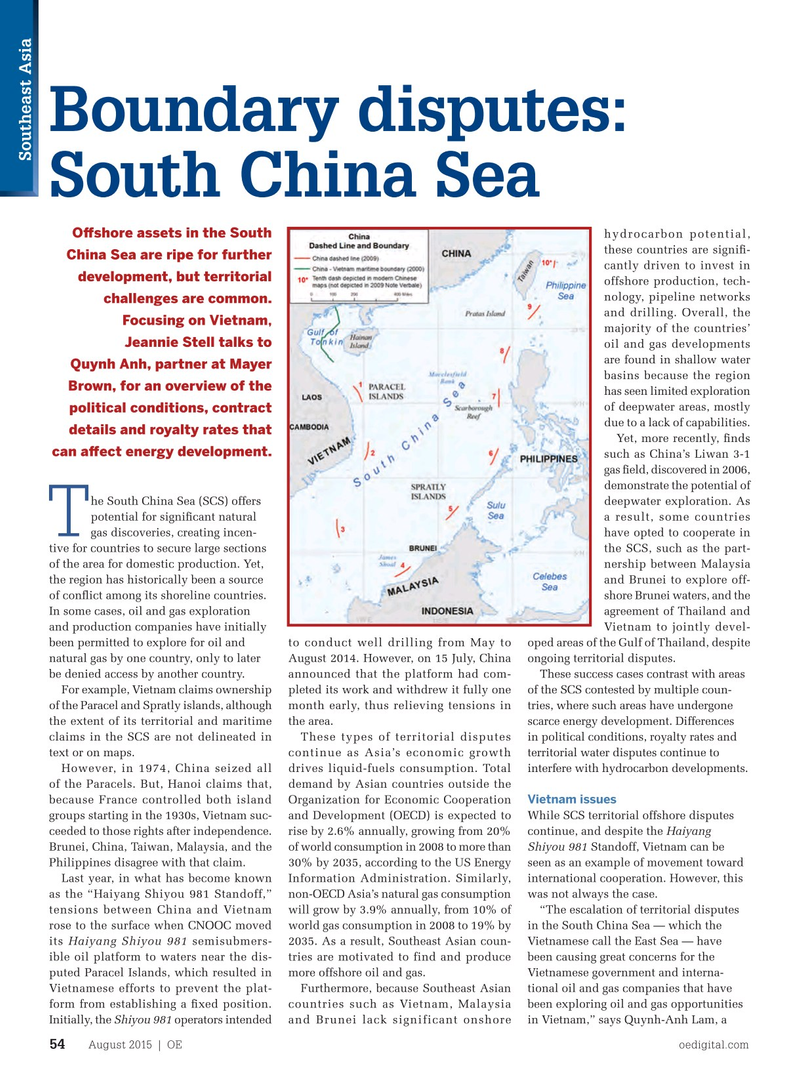

T gas discoveries, creating incen- have opted to cooperate in tive for countries to secure large sections the SCS, such as the part- of the area for domestic production. Yet, nership between Malaysia the region has historically been a source and Brunei to explore off- of confict among its shoreline countries. shore Brunei waters, and the

In some cases, oil and gas exploration agreement of Thailand and and production companies have initially Vietnam to jointly devel- been permitted to explore for oil and to conduct well drilling from May to oped areas of the Gulf of Thailand, despite natural gas by one country, only to later August 2014. However, on 15 July, China ongoing territorial disputes. be denied access by another country. announced that the platform had com- These success cases contrast with areas

For example, Vietnam claims ownership pleted its work and withdrew it fully one of the SCS contested by multiple coun- of the Paracel and Spratly islands, although month early, thus relieving tensions in tries, where such areas have undergone the extent of its territorial and maritime the area. scarce energy development. Differences claims in the SCS are not delineated in These types of territorial disputes in political conditions, royalty rates and text or on maps. continue as Asia’s economic growth territorial water disputes continue to

However, in 1974, China seized all drives liquid-fuels consumption. Total interfere with hydrocarbon developments.

of the Paracels. But, Hanoi claims that, demand by Asian countries outside the

Vietnam issues because France controlled both island Organization for Economic Cooperation groups starting in the 1930s, Vietnam suc- and Development (OECD) is expected to While SCS territorial offshore disputes ceeded to those rights after independence. rise by 2.6% annually, growing from 20% continue, and despite the Haiyang

Brunei, China, Taiwan, Malaysia, and the of world consumption in 2008 to more than Shiyou 981 Standoff, Vietnam can be

Philippines disagree with that claim. 30% by 2035, according to the US Energy seen as an example of movement toward

Last year, in what has become known Information Administration. Similarly, international cooperation. However, this as the “Haiyang Shiyou 981 Standoff,” non-OECD Asia’s natural gas consumption was not always the case.

tensions between China and Vietnam will grow by 3.9% annually, from 10% of “The escalation of territorial disputes rose to the surface when CNOOC moved world gas consumption in 2008 to 19% by in the South China Sea — which the its Haiyang Shiyou 981 semisubmers- 2035. As a result, Southeast Asian coun- Vietnamese call the East Sea — have ible oil platform to waters near the dis- tries are motivated to find and produce been causing great concerns for the puted Paracel Islands, which resulted in more offshore oil and gas. Vietnamese government and interna-

Vietnamese efforts to prevent the plat- Furthermore, because Southeast Asian tional oil and gas companies that have form from establishing a fxed position. countries such as Vietnam, Malaysia been exploring oil and gas opportunities

Initially, the Shiyou 981 operators intended and Brunei lack significant onshore in Vietnam,” says Quynh-Anh Lam, a

August 2015 | OE oedigital.com 54 054_OE0815_Geofocus2_Jeannie.indd 54 7/21/15 10:17 PM

51

51

53

53