Page 40: of Offshore Engineer Magazine (Sep/Oct 2015)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2015 Offshore Engineer Magazine

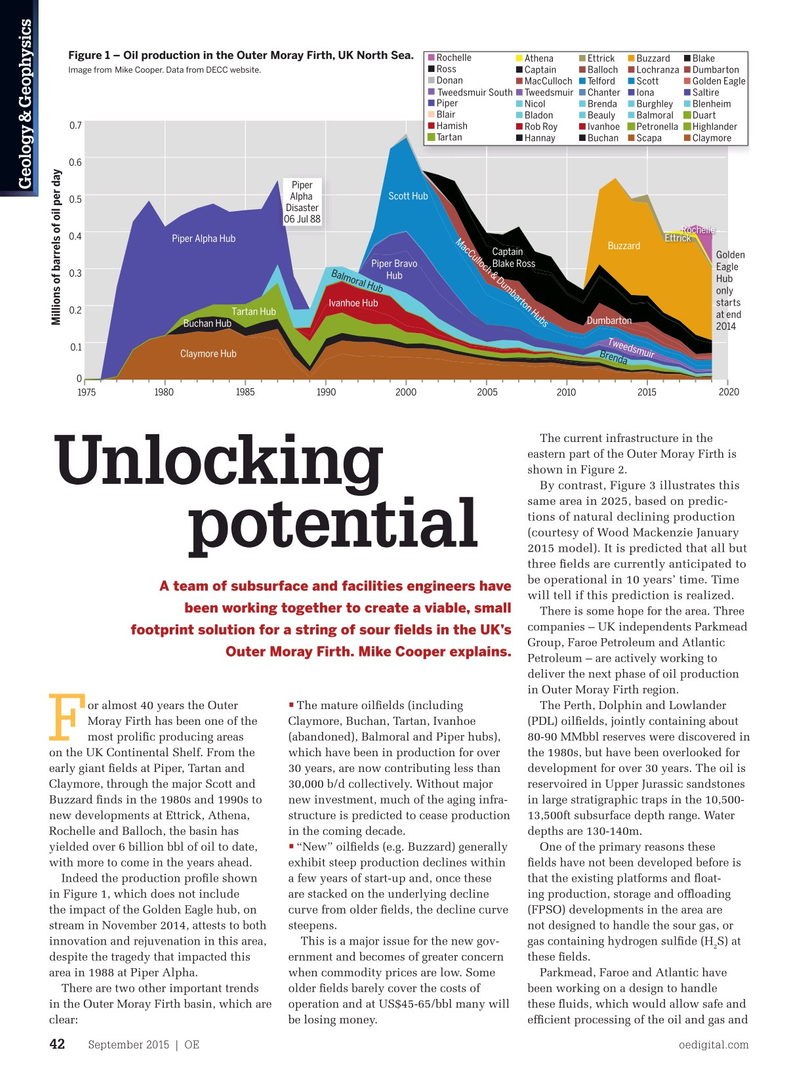

Figure 1 – Oil production in the Outer Moray Firth, UK North Sea.

Rochelle Athena Ettrick Buzzard Blake

Ross Captain Balloch Lochranza Dumbarton

Image from Mike Cooper. Data from DECC website.

Donan MacCulloch Telford Scott Golden Eagle

Tweedsmuir South Tweedsmuir Chanter Iona Saltire

Piper Nicol Brenda Burghley Blenheim

Blair Bladon Beauly Balmoral Duart 0.7

Hamish Rob Roy Ivanhoe Petronella Highlander

Tartan Hannay Buchan Scapa Claymore 0.6

Piper

Geology & Geophysics

Alpha Scott Hub 0.5

Disaster 06 Jul 88

Rochelle 0.4

Piper Alpha Hub EttrickEttrickEttrickEttrick

MacCulloch & Dumbarton Hubs

Buzzard

Captain

Golden

Piper Bravo Blake Ross

Eagle

Balmoral Hub 0.3

Hub

Hub only

Ivanhoe Hub starts 0.2

Tartan Hub at end

Dumbarton

Millions of barrels of oil per day

Buchan Hub 2014

Tweedsmuir 0.1

Brenda

Claymore Hub 0 2010 1975 1980 1985 1990 2000 2005 2015 2020

The current infrastructure in the eastern part of the Outer Moray Firth is shown in Figure 2.

Unlocking

By contrast, Figure 3 illustrates this same area in 2025, based on predic- tions of natural declining production (courtesy of Wood Mackenzie January potential 2015 model). It is predicted that all but three ? elds are currently anticipated to be operational in 10 years’ time. Time

A team of subsurface and facilities engineers have will tell if this prediction is realized. been working together to create a viable, small

There is some hope for the area. Three companies – UK independents Parkmead footprint solution for a string of sour ? elds in the UK’s

Group, Faroe Petroleum and Atlantic

Outer Moray Firth. Mike Cooper explains.

Petroleum – are actively working to deliver the next phase of oil production in Outer Moray Firth region. or almost 40 years the Outer The mature oil? elds (including The Perth, Dolphin and Lowlander •

Moray Firth has been one of the Claymore, Buchan, Tartan, Ivanhoe (PDL) oil? elds, jointly containing about

F most proli? c producing areas (abandoned), Balmoral and Piper hubs), 80-90 MMbbl reserves were discovered in on the UK Continental Shelf. From the which have been in production for over the 1980s, but have been overlooked for early giant ? elds at Piper, Tartan and 30 years, are now contributing less than development for over 30 years. The oil is

Claymore, through the major Scott and 30,000 b/d collectively. Without major reservoired in Upper Jurassic sandstones

Buzzard ? nds in the 1980s and 1990s to new investment, much of the aging infra- in large stratigraphic traps in the 10,500- new developments at Ettrick, Athena, structure is predicted to cease production 13,500ft subsurface depth range. Water

Rochelle and Balloch, the basin has in the coming decade. depths are 130-140m.

• yielded over 6 billion bbl of oil to date, “New” oil? elds (e.g. Buzzard) generally One of the primary reasons these with more to come in the years ahead. exhibit steep production declines within ? elds have not been developed before is

Indeed the production pro? le shown a few years of start-up and, once these that the existing platforms and ? oat- in Figure 1, which does not include are stacked on the underlying decline ing production, storage and of? oading the impact of the Golden Eagle hub, on curve from older ? elds, the decline curve (FPSO) developments in the area are stream in November 2014, attests to both steepens. not designed to handle the sour gas, or innovation and rejuvenation in this area, This is a major issue for the new gov- gas containing hydrogen sul? de (H S) at 2 despite the tragedy that impacted this ernment and becomes of greater concern these ? elds.

area in 1988 at Piper Alpha. when commodity prices are low. Some Parkmead, Faroe and Atlantic have

There are two other important trends older ? elds barely cover the costs of been working on a design to handle in the Outer Moray Firth basin, which are operation and at US$45-65/bbl many will these ? uids, which would allow safe and clear: be losing money. ef? cient processing of the oil and gas and

September 2015 | OE oedigital.com 42 042_OE0815_G&G2_H2S.indd 42 8/19/15 9:20 PM

39

39

41

41