Page 23: of Offshore Engineer Magazine (Jan/Feb 2016)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2016 Offshore Engineer Magazine

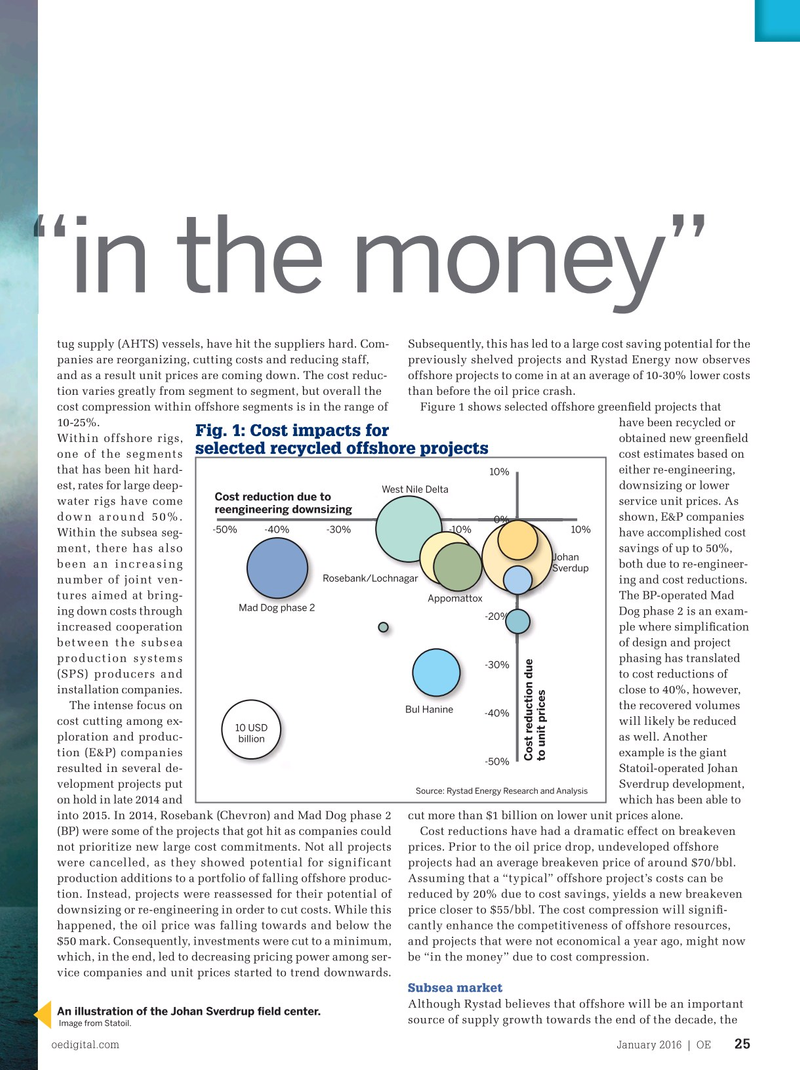

subsea projects “in the money”subsea projects “in the money” tug supply (AHTS) vessels, have hit the suppliers hard. Com- Subsequently, this has led to a large cost saving potential for the panies are reorganizing, cutting costs and reducing staff, previously shelved projects and Rystad Energy now observes and as a result unit prices are coming down. The cost reduc- offshore projects to come in at an average of 10-30% lower costs tion varies greatly from segment to segment, but overall the than before the oil price crash. cost compression within offshore segments is in the range of Figure 1 shows selected offshore green? eld projects that 10-25%. have been recycled or

Fig. 1: Cost impacts for

Within offshore rigs, obtained new green? eld selected recycled offshore projects one of the segments cost estimates based on that has been hit hard- either re-engineering, 10% est, rates for large deep- downsizing or lower

West Nile Delta

Cost reduction due to water rigs have come service unit prices. As reengineering downsizing down around 50%. shown, E&P companies 0% -50% -40% -30% -10% 10%

Within the subsea seg- have accomplished cost ment, there has also savings of up to 50%,

Johan been an increasing both due to re-engineer-

Sverdup

Rosebank/Lochnagar number of joint ven- ing and cost reductions. tures aimed at bring- The BP-operated Mad

Appomattox

Mad Dog phase 2 ing down costs through Dog phase 2 is an exam- -20%-20% increased cooperation ple where simpli? cation between the subsea of design and project production systems phasing has translated -30% (SPS) producers and to cost reductions of installation companies. close to 40%, however,

The intense focus on the recovered volumes

Bul Hanine -40% cost cutting among ex- will likely be reduced 10 USD ploration and produc- as well. Another billion tion (E&P) companies example is the giant

Cost reduction due to unit prices -50% resulted in several de- Statoil-operated Johan velopment projects put Sverdrup development,

Source: Rystad Energy Research and Analysis on hold in late 2014 and which has been able to into 2015. In 2014, Rosebank (Chevron) and Mad Dog phase 2 cut more than $1 billion on lower unit prices alone. (BP) were some of the projects that got hit as companies could Cost reductions have had a dramatic effect on breakeven not prioritize new large cost commitments. Not all projects prices. Prior to the oil price drop, undeveloped offshore were cancelled, as they showed potential for significant projects had an average breakeven price of around $70/bbl. production additions to a portfolio of falling offshore produc- Assuming that a “typical” offshore project’s costs can be tion. Instead, projects were reassessed for their potential of reduced by 20% due to cost savings, yields a new breakeven downsizing or re-engineering in order to cut costs. While this price closer to $55/bbl. The cost compression will signi? - happened, the oil price was falling towards and below the cantly enhance the competitiveness of offshore resources, $50 mark. Consequently, investments were cut to a minimum, and projects that were not economical a year ago, might now which, in the end, led to decreasing pricing power among ser- be “in the money” due to cost compression. vice companies and unit prices started to trend downwards.

Subsea market

Although Rystad believes that offshore will be an important

An illustration of the Johan S verdrup ? eld center.

source of supply growth towards the end of the decade, the Image from Statoil.

oedigital.com January 2016 | OE 25 024_OE0116_Feature1_Rystad.indd 25 12/24/15 12:59 AM

22

22

24

24