Page 85: of Offshore Engineer Magazine (Aug/Sep 2016)

Read this page in Pdf, Flash or Html5 edition of Aug/Sep 2016 Offshore Engineer Magazine

REGIONAL OVERVIEW against a backdrop of effective government subsidy for explo- in Northwest Europe in 2015 the differential expectations of ration drilling, something that is not, and probably will never value between buyer and seller were such that many assets be, available again in the UK, other than for those few compa- in which there was acquisition interest could not secure suf- nies that can offset exploration expenditure against tax. ? cient sale prices to meet hold values and therefore sales did

As a consequence of government incentives, Norway has con- not proceed and assets were removed from the market. tinued to explore at a relatively high level through the start of the Notably, there was Shell’s acquisition of BG Group that downturn and throughout 2015; however, ? scal prudency result- dominated global M&A, which has precipitated a $30 billion ing from the key factors of high sector divestment program from the combined

REGIONAL OVERVIEW

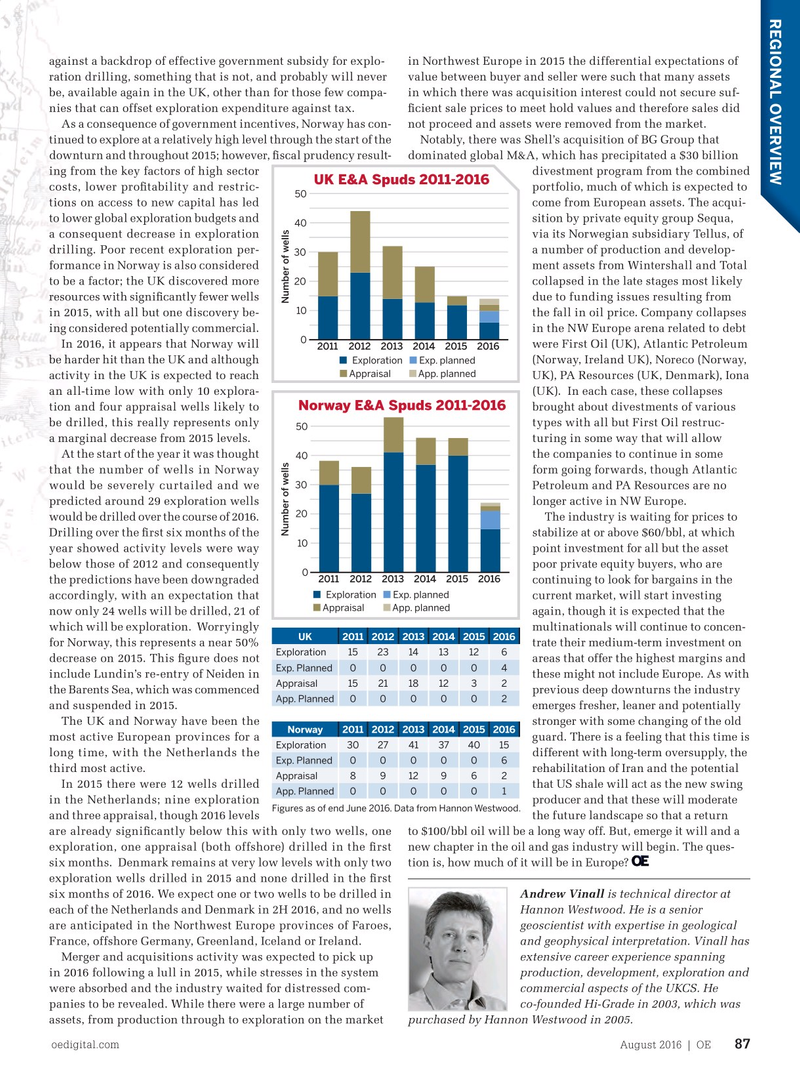

UK E&A Spuds 2011-2016 costs, lower pro? tability and restric- portfolio, much of which is expected to 50 tions on access to new capital has led come from European assets. The acqui- to lower global exploration budgets and sition by private equity group Sequa, 40 a consequent decrease in exploration via its Norwegian subsidiary Tellus, of drilling. Poor recent exploration per- a number of production and develop- 30 formance in Norway is also considered ment assets from Wintershall and Total to be a factor; the UK discovered more collapsed in the late stages most likely 20 resources with signi? cantly fewer wells due to funding issues resulting from 10 in 2015, with all but one discovery be- the fall in oil price. Company collapses ing considered potentially commercial. in the NW Europe arena related to debt 0

In 2016, it appears that Norway will were First Oil (UK), Atlantic Petroleum 2011 2012 2013 2014 2015 2016 be harder hit than the UK and although (Norway, Ireland UK), Noreco (Norway,

ExplorationExp. planned

AppraisalApp. planned activity in the UK is expected to reach UK), PA Resources (UK, Denmark), Iona an all-time low with only 10 explora- (UK). In each case, these collapses

Norway E&A Spuds 2011-2016 tion and four appraisal wells likely to brought about divestments of various be drilled, this really represents only types with all but First Oil restruc- 50 a marginal decrease from 2015 levels. turing in some way that will allow

At the start of the year it was thought the companies to continue in some 40 that the number of wells in Norway form going forwards, though Atlantic 30 would be severely curtailed and we Petroleum and PA Resources are no predicted around 29 exploration wells longer active in NW Europe.

20 would be drilled over the course of 2016. The industry is waiting for prices to

Number of wells Number of wells

Drilling over the ? rst six months of the stabilize at or above $60/bbl, at which 10 year showed activity levels were way point investment for all but the asset below those of 2012 and consequently poor private equity buyers, who are 0 2011 2012 2013 2014 2015 2016 the predictions have been downgraded continuing to look for bargains in the

ExplorationExp. planned accordingly, with an expectation that current market, will start investing

AppraisalApp. planned now only 24 wells will be drilled, 21 of again, though it is expected that the which will be exploration. Worryingly multinationals will continue to concen-

UK 2011 2012 20132014 2015 2016 for Norway, this represents a near 50% trate their medium-term investment on

Exploration15 23 14 13 126 decrease on 2015. This ? gure does not areas that offer the highest margins and

Exp. Planned000004 include Lundin’s re-entry of Neiden in these might not include Europe. As with

Appraisal1521181232 the Barents Sea, which was commenced previous deep downturns the industry

App. Planned000002 and suspended in 2015. emerges fresher, leaner and potentially

The UK and Norway have been the stronger with some changing of the old

Norway 2011 2012 20132014 2015 2016 most active European provinces for a guard. There is a feeling that this time is

Exploration30 27 41 37 4015 long time, with the Netherlands the different with long-term oversupply, the

Exp. Planned000006 third most active. rehabilitation of Iran and the potential

Appraisal8912962

In 2015 there were 12 wells drilled that US shale will act as the new swing

App. Planned000001 in the Netherlands; nine exploration producer and that these will moderate

Figures as of end June 2016. Data from Hannon Westwood.

and three appraisal, though 2016 levels the future landscape so that a return are already signi? cantly below this with only two wells, one to $100/bbl oil will be a long way off. But, emerge it will and a exploration, one appraisal (both offshore) drilled in the ? rst new chapter in the oil and gas industry will begin. The ques- six months. Denmark remains at very low levels with only two tion is, how much of it will be in Europe? exploration wells drilled in 2015 and none drilled in the ? rst six months of 2016. We expect one or two wells to be drilled in Andrew Vinall is technical director at each of the Netherlands and Denmark in 2H 2016, and no wells Hannon Westwood. He is a senior are anticipated in the Northwest Europe provinces of Faroes, geoscientist with expertise in geological

France, offshore Germany, Greenland, Iceland or Ireland. and geophysical interpretation. Vinall has

Merger and acquisitions activity was expected to pick up extensive career experience spanning in 2016 following a lull in 2015, while stresses in the system production, development, exploration and were absorbed and the industry waited for distressed com- commercial aspects of the UKCS. He panies to be revealed. While there were a large number of co-founded Hi-Grade in 2003, which was assets, from production through to exploration on the market purchased by Hannon Westwood in 2005.

oedigital.com August 2016 | OE 87 086_OE0816_Geo2_HannonWestwood.indd 87 7/24/16 10:12 AM

84

84

86

86